Benzinga (Free Plan)

Subscription/month

Promotion

Our Rating

Best For

- Overview

- Features

- Pros & Cons

The Benzinga Free Plan is a no-cost option designed for investors and traders who want access to market news, stock quotes, and financial updates without committing to a paid subscription.

It offers stock prices, analyst ratings, earnings calendars, stock movers, and a watchlist and portfolio tracking tool. Users can also monitor major indices, sector performance, and cryptocurrency prices, providing a well-rounded market overview.

One of the most useful features is the market news section, which delivers stock updates, analyst upgrades and downgrades, and earnings reports. The watchlist and portfolio tracking tool allows users to follow stocks, ETFs, and crypto in one place, making it easy to track price movements.

Despite these useful features, the free plan has notable limitations. There is no stock screener or custom stock alerts and charting tools are basic, lacking advanced indicators and customization options.

- Real-time stock quotes

- Market news updates

- Analyst ratings & reports

- Stock price tracking

- Portfolio monitoring tool

- Earnings calendar access

- Basic technical indicators

- Crypto market data

- Stock movers insights

- ETF data & trends

- IPO calendar updates

- Insider trading activity

- Free access to market news

- Basic stock charts included

- Analyst ratings available

- Crypto price tracking

- Watchlist & portfolio tracking

- No stock screener feature

- Limited fundamental analysis

- Basic charting & indicators

- No custom stock alerts

- No real-time market signals

Benzinga: Basic Tools For Fundamental Analysis

We examined Benzinga’s free charting tools, analyst indicators, and stock price data to see how investors can analyze stocks effectively.

-

Stock Charts: Basic Technical Analysis

Benzinga’s Stock Charts & Quotes provide traders and investors with an easy way to track price movements and analyze stocks.

The free version includes many technical analysis indicators such as momentum, stochastic, gaps, and volatility, but each graph can contain a maximum of 2 indicators – if you want more, you'll need the pro plan.

The charts display live stock quotes, allowing users to monitor price changes, volume, and historical trends. Traders can quickly spot price fluctuations, recent highs/lows, and overall market sentiment.

The interactive charts help visualize stock performance over different time frames, making it easier to analyze trends before making a trade.

What Investors Can Do With It?

- Check real-time stock prices and market movements.

- Analyze short-term and long-term trends using historical price data.

- Use advanced technical indicators, up to 2 indicators in the chart.

- Get a quick snapshot of stock performance before executing trades.

-

Key Financial For Multiple Stocks

Benzinga includes several fundamental analysis tools that help investors assess a company’s financial health and market outlook.

These features provide insights beyond just price movements, allowing for a more complete stock analysis.

- Forecast & Guidance: Investors can review future earnings projections and company guidance to understand growth expectations.

- Insider & Government Trades: Investors can track executive trades and government transactions, offering insights into how key stakeholders view the company.

- Dividends: Investors can check dividend yields and payment history, making it easier to evaluate income-generating stocks.

- Analyst Ratings: Stock ratings from Wall Street analysts provide buy, sell, and hold recommendations.

- News & Earnings: The platform integrates latest stock news and earnings reports, helping traders assess how financial results impact price trends.

- Options & Short Interest: Options activity and short interest data give clues about market sentiment and potential volatility.

-

Watchlist & Portfolio Tracking Tool

Benzinga’s watchlist and portfolio tracking tool allows users to monitor stocks, ETFs, and cryptocurrencies in one place.

It provides a basic way to track stock prices and performance, but it lacks the advanced features found in premium platforms.

The watchlist lets users add stocks and ETFs to track their real-time price movements. It’s helpful for keeping an eye on potential investments or following market trends.

However, unlike platforms such as Yahoo Finance or Seeking Alpha, Benzinga’s free watchlist does not include detailed portfolio analytics, gain/loss tracking, or dividend monitoring.

-

Analyst Ratings & Price Targets

Benzinga’s Analyst Ratings & Price Targets feature provides investors and traders with expert opinions from Wall Street analysts.

This tool is useful for those looking to understand how professionals view a stock, whether it’s a strong buy, hold, or sell.

While the free version doesn’t include deep research reports, it offers a snapshot of analyst sentiment, making it easier to spot potential opportunities.

The tool aggregates analyst upgrades, downgrades, and price target adjustments, helping investors see where the market might be headed.

How It Can Help Investors?

- See analyst ratings for individual stocks, including buy, hold, or sell recommendations.

- Track price target changes to compare current stock prices with projections.

- Identify stocks with upgrades and downgrades from top analysts.

- Use analyst insights to support long-term investment or trading strategies.

-

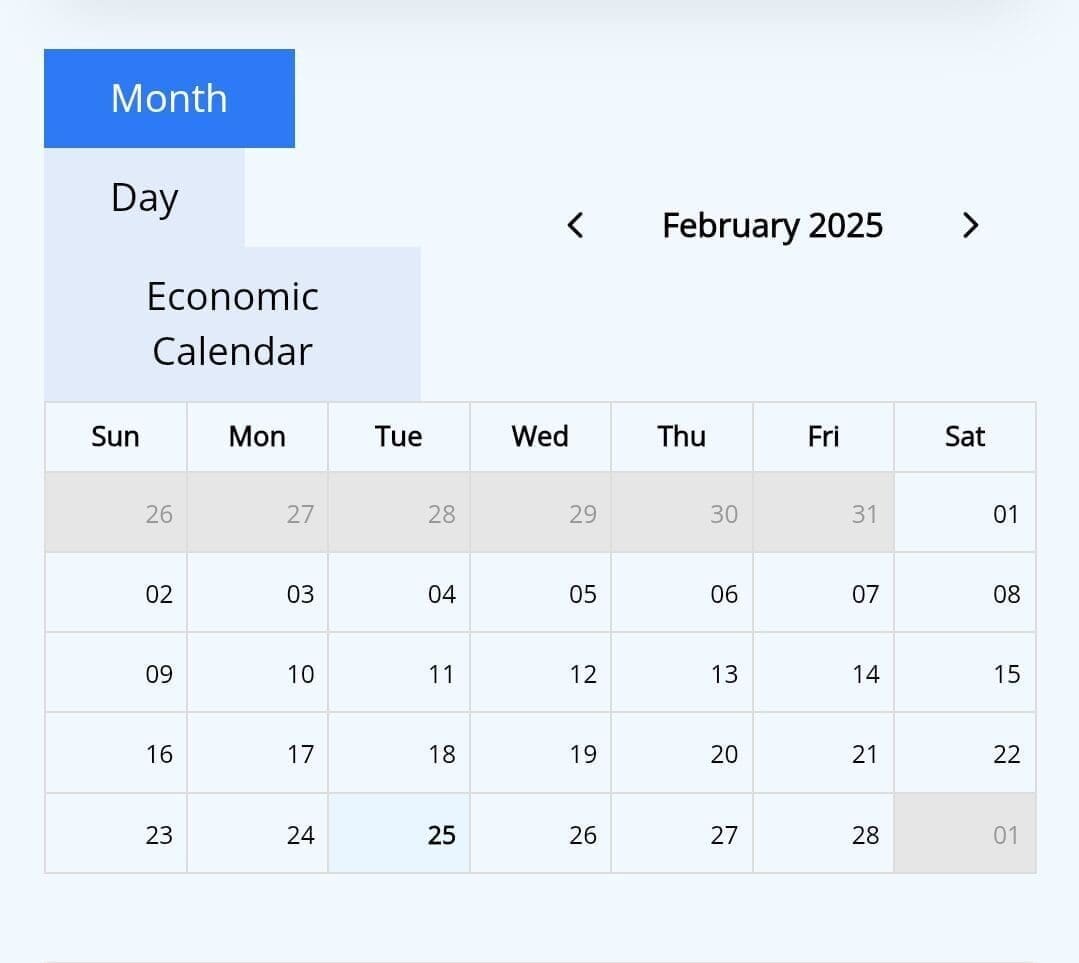

Economic Calendar & Key Events

Benzinga’s economic calendar is an essential tool for traders who want to stay ahead of major economic events.

It covers Federal Reserve decisions, job reports, inflation data, and GDP updates—all crucial for understanding market direction.

How It Can Help Investors?

- Track important economic events affecting stocks.

- Prepare for market reactions to inflation reports, rate hikes, and GDP data.

- Use macroeconomic data for fundamental analysis.

- Plan trades around key financial events that move markets.

-

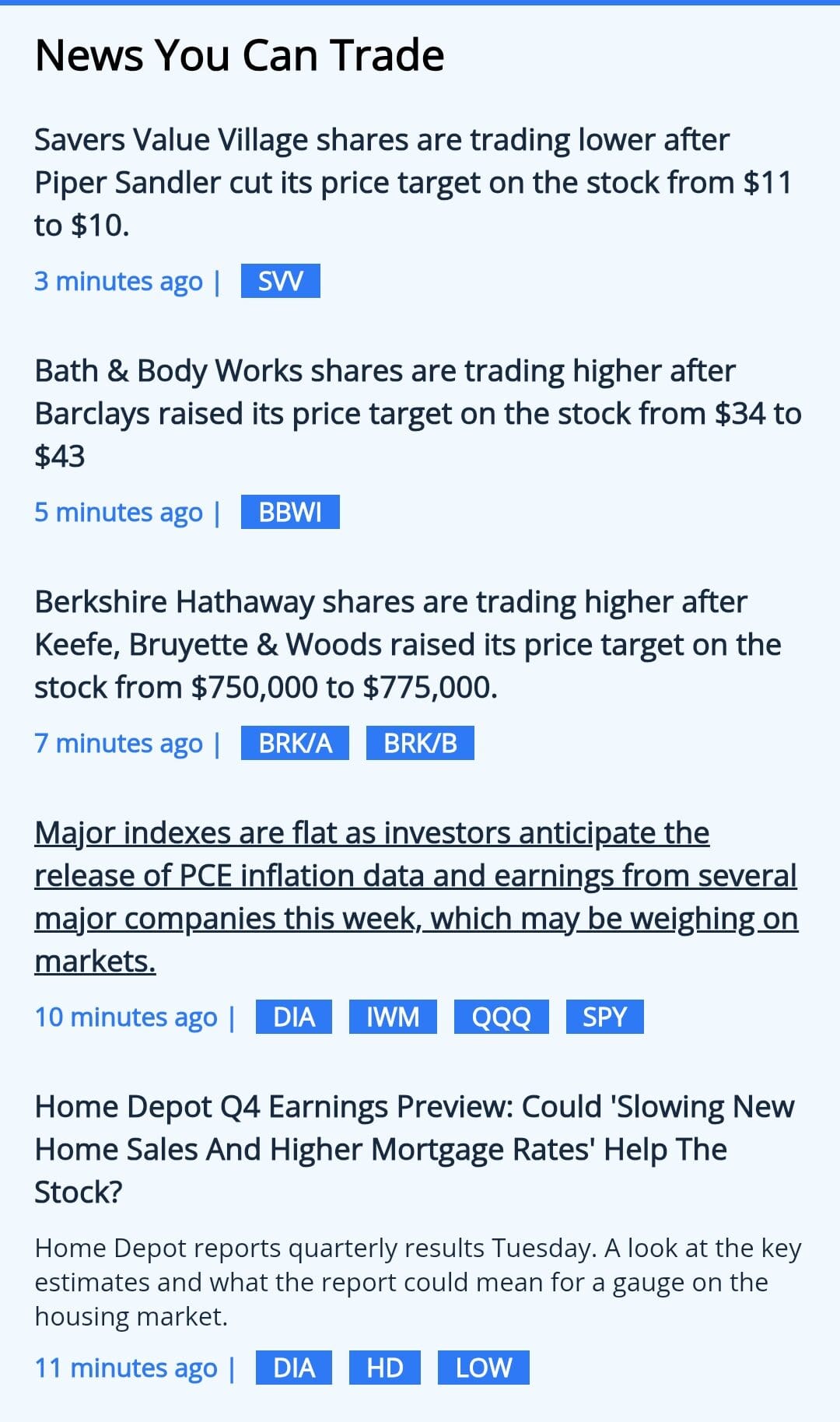

Market News & Analysis

We found Benzinga’s free market news feature an excellent tool for staying on top of real-time stock market updates.

The news feed is well-organized, covering everything from breaking stock news to earnings reports and analyst ratings.

While it doesn’t include Benzinga Pro’s faster updates or audio squawk, the free version still provides timely insights for traders and investors.

What Investors Can Do With It?

- Read real-time news on stocks, crypto, and commodities.

- Stay updated with analyst ratings and price target changes.

- Monitor market-moving events, including earnings reports and economic data.

- Use news-driven stock analysis to make informed trades.

Additional Features & Tools

Benzinga’s Free Plan offers more than just market new. Here are some additional tools available in the free plan:

Crypto Market Data: Benzinga provides cryptocurrency price tracking for Bitcoin, Ethereum, and other altcoins. Users can monitor price movements, market trends, and news related to digital assets.

Stock Movers & Most Active Stocks: This tool highlights stocks with the largest gains, losses, and unusual volume activity. It helps traders identify momentum plays and potential breakout opportunities.

Dividends & Earnings Calendar: The free plan provides upcoming earnings reports and dividend payouts for publicly traded companies. This helps investors plan around key financial events that may impact stock prices.

Insider Trading Activity: Users can view limited recent insider buying and selling activity, which may indicate confidence or caution from company executives.

ETF Data & Trends: Benzinga provides information on exchange-traded funds (ETFs), including performance trends and holdings. This is helpful for investors looking to diversify their portfolios.

IPO Calendar: This tool tracks upcoming IPOs, recent debuts, and performance data for newly listed companies. It helps investors stay informed about new opportunities in the stock market.

Is Benzinga Free Plan Too Limited?

As with any other tool, especially a free one, there are gaps and limitations to consider:

-

No Stock Screener & Weak Fundamental Analysis Tools

One of the biggest limitations of the Benzinga Free Plan is the lack of a stock screener and the weak fundamental analysis tools available.

Unfortunately, Benzinga does not offer a free stock screener, which puts it at a disadvantage compared to competitors like Finviz, TradingView, and GuruFocus, all of which provide powerful screening tools at no cost.

Without a stock screener, users must manually search for stocks, making it harder to identify potential investment opportunities.

Additionally, free fundamental analysis tools are very limited. While users can see basic financial data like stock price and market cap, Benzinga lacks access to detailed balance sheets, income statements, and financial ratios.

-

Basic Stock Charting & Technical Tools

Benzinga’s Free Plan offers stock charts that display real-time stock prices and basic technical indicators, but they are quite limited compared to competitors.

One of the biggest drawbacks is the lack of customizable indicators, trend analysis, and pattern recognition.

Additionally, Benzinga doesn’t provide real-time technical signals or alerts, which can make it difficult for traders to react quickly to breakout patterns, support/resistance levels, or momentum shifts.

For day traders or swing traders who use technical analysis to make fast decisions, this limitation can be a dealbreaker.

Benzinga Free Plan: Who It’s For

Benzinga’s Free Plan is best suited for investors and traders who need quick market insights, stock quotes, and financial news without committing to a paid subscription:

Here’s who might benefit the most:

- Beginner Investors: Those who are just starting out and want to follow stock trends, read expert insights, and track basic stock movements without advanced stock research softwares.

Crypto Enthusiasts: Those looking for basic crypto market data, price tracking, and news but don’t require deep blockchain analysis or trading signals.

- Casual Market Watchers: Anyone who enjoys following market trends, checking stock prices, and reading financial news without actively trading.

For more active traders, options traders, or technical analysts, the free plan may feel too limited, and they may need a more advanced platform.

Why Active Traders May Skip Benzinga Free

While Benzinga’s Free Plan is useful for casual investors and market followers, it lacks many advanced features needed by active traders and serious investors.

Here are the types of investors and traders who may not be the best fit:

- Day Traders & High-Frequency Traders: Without real-time news updates, advanced charting tools, and custom alerts, the free plan is not ideal for traders who need split-second decisions and fast execution.

- Fundamental Investors & Deep Researchers: The plan does not provide detailed financial statements, valuation metrics, or stock screeners, making it unsuitable for those conducting deep fundamental analysis.

- Technical Analysts: The free stock charts lack advanced indicators, custom settings, and multi-timeframe analysis, which are essential for traders using chart patterns and technical strategies.

Benzinga: Exploring Higher-Tier Plans - Worth To Upgrade?

The Benzinga Free Plan offers basic market news, stock quotes, and earnings calendars, but its Pro plans provide more advanced tools.

Plan | Monthly Subscription | Promotion |

|---|---|---|

Benzinga Pro – Basic | $37

$367 ($30.58 / month) if paid annually | 14-day free trial |

Benzinga Pro – Streamlined | $147

$1,497 ($124.75 / month) if paid annually | 14-day free trial |

Benzinga Pro – Essential | $197

$1,997 ($166.42 / month) if paid annually | 14-day free trial |

Benzinga Edge | $19

$228 if paid annually

| $129

$129 for new member’s annual price ($11/month), including 7-day money-back guarantee

|

Benzinga Pro Basic, Streamline and Essential plans offer progressively more real-time data, advanced scanning, news filtering, and market insights, catering to active traders and investors who need faster updates, premium alerts, and more profound stock analysis tools.

FAQ

No, Benzinga’s mobile app requires a Benzinga Pro subscription. However, free users can access the platform through their mobile browser.

No, the Benzinga Free Plan does not include price or news alerts. Users who need custom stock alerts must upgrade to a paid plan or use an alternative platform.

No, users can not create a basic watchlist to track stock prices, it's available only with the pro plan or Benzinga Edge.

The free plan provides timely market news, but updates are slightly delayed compared to real-time news feeds in Benzinga Pro.

Yes, Benzinga allows users to track ETF prices and trends, but it lacks in-depth research on ETF holdings, expense ratios, and comparative analysis.

No, Benzinga does not offer a built-in community or discussion forum, unlike some investing platforms that allow user-generated discussions.

Review Free Stock Analysis Tools

Investment Analysis & Research Tools : Review Methodology

At The Smart Investor, we evaluated free investment research platforms based on the quality and depth of their features compared to other free alternatives. Each platform was rated based on the following criteria:

- Fundamental Analysis Tools (25%): We assessed the availability of key financial data, including income statements, balance sheets, cash flow, valuation metrics, and analyst estimates. Platforms with more in-depth historical data, forward-looking projections, and research reports scored higher.

- Technical Analysis Features (20%): We examined the variety and quality of technical indicators, charting tools, and real-time price data. Platforms that offered customizable interactive charts, trend analysis, and multiple timeframes received better ratings.

- Stock Screener & Free Filters (15%): A strong stock screener is crucial for research, so we rated platforms based on the number and depth of filtering options. Higher scores were given to platforms that allowed customized searches using fundamental, technical, and sector-based criteria.

- Portfolio Tracking & Alerts (15%): We reviewed the ability to track multiple portfolios, set up watchlists, and receive alerts on stock movements. Platforms offering real-time updates, dividend tracking, and personalized notifications ranked higher.

- Ease of Use & User Experience (15%): Platforms were rated on their design, navigation, and accessibility across devices. Those with intuitive layouts, easy-to-read data, and smooth user experiences received better scores.

- Additional Perks & Limitations (5%): We considered unique tools, premium research access, and potential feature restrictions. Platforms with added perks like AI analysis or fewer paywalls scored higher, while those with aggressive ads or major limitations were rated lower.

- Community & Social Features (5%): Platforms with investor discussion forums, sentiment tracking, or social trading features were rated higher. Those lacking community-driven insights or engagement tools scored lower.