Table Of Content

Can You Buy Gold Coins Under $1,000?

Yes — buying real gold coins under $1,000 is not only possible, but it’s also a common starting point for investors looking to build wealth gradually.

While a full 1 oz gold coin now costs closer to $3,000, there are fractional gold coins and small gold bars that give you access to physical gold at a lower cost.

These typically come in weights like 1/10 oz, 1/4 oz, or 5 grams and are produced by trusted mints like the U.S. Mint, Royal Canadian Mint, and PAMP Suisse.

Just keep in mind: fractional coins carry higher premiums per ounce than larger ones. Still, they offer excellent flexibility, liquidity, and a low barrier to entry — perfect for stacking gold on a budget.

You can also find bundles or secondary market coins sold at lower premiums from dealers like SD Bullion or JM Bullion. These allow you to buy small quantities without overpaying.

Top Gold Coins You Can Buy for Under $1,000

If you’re working with a $1,000 budget, the best strategy is to look for fractional gold coins or small bars from reputable mints. These are easy to verify, widely recognized, and hold strong resale value.

Here are some of the top options:

Coin or Bar | Weight | Mint / Origin | Notable Features |

|---|---|---|---|

1/4 oz American Gold Eagle | 0.25 troy oz | U.S. Mint | Backed by U.S. government, highly liquid

|

1/10 oz Canadian Gold Maple | 0.10 troy oz | Royal Canadian Mint | 99.99% pure, low premium for fractional gold

|

5g PAMP Suisse Gold Bar | ~0.16 oz | PAMP Suisse (Switzerland) | Tamper-proof packaging, assay included

|

2.5g Valcambi Bar | ~0.08 oz | Valcambi | Good entry point, widely accepted

|

1/4 oz Gold Philharmonic | 0.25 troy oz | Austrian Mint | Elegant design, trusted across Europe

|

Some platforms like SD Bullion let you buy bundles of fractional coins or mixed weights. Here’s how you can select several 1/10 oz and 1/4 oz coins to build your position under $1,000.

Want to understand which coins are the most popular with long-term investors? Check out our guide on Bullion Coins for Investment, where we compare the top choices across sizes and mints.

Where to Find the Best Deals on Cheap Gold Coins

When you’re working with a budget, finding real gold coins under $1,000 comes down to knowing where to look — and who to trust.

Here are the best places to find deals without sacrificing quality or authenticity.

-

Reputable Online Dealers

Online dealers are the easiest and most transparent way to buy fractional gold coins or bars. They often run promotions, offer bundle deals, and let you compare premiums across different products.

APMEX – One of the largest inventories of fractional coins, with price filters that make it easy to stay under budget.

SD Bullion – Known for low premiums, gold bundles, and a clean buying experience. For a deeper look, see our full SD Bullion review.

JM Bullion – Offers frequent sales and deals on fractional gold.

Money Metals Exchange – Great for beginners, often has starter kits and educational content.

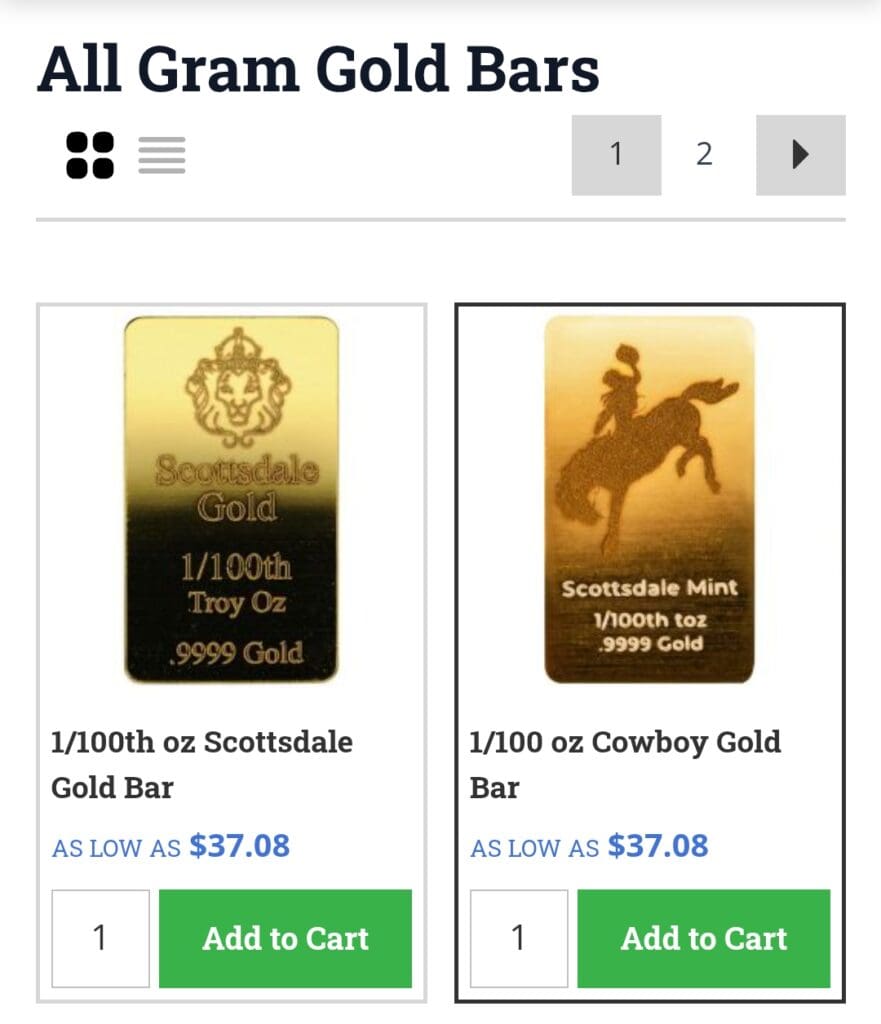

Here you can see how SD Bullion lets you select between gram gold bars, in this example, 1/100 oz.

-

Local Coin Shops (LCS)

Buying from a local coin shop can feel old-school, but for some investors, it offers advantages — especially if you’re paying cash or want to inspect coins before purchasing.

You can see the coin in-hand, check the packaging, and ask questions face-to-face. Some dealers are open to negotiation or cash discounts, especially on older or circulated coins.

That said, local pricing can vary widely. Some shops are competitive with online dealers, while others apply steep markups.

To make the most of a local visit, check the day’s gold spot price before you go. Ask if the coin is buy-back eligible, and consider pulling up dealer websites like SD Bullion to compare premiums on your phone.

Building a relationship with a local dealer can pay off over time — giving you early access to estate sale coins, trade-ins, or exclusive buys.

-

Peer-to-Peer Marketplaces (Use With Caution)

Platforms like eBay, Facebook Marketplace, and Reddit’s r/PreciousMetals occasionally offer lower prices on gold coins — but they also carry far more risk than professional dealers.

You might score deals below dealer premiums, especially from individuals looking to liquidate coins quickly.

However, without authentication or buyback policies, you’re responsible for verifying everything — from weight and purity to packaging.

If you use these platforms, stick with sellers who have a strong track record. On eBay, for example, top-rated sellers with 1,000+ positive reviews are usually a safer bet. Look for listings that include clear photos of the front and back of the coin, assay cards, and packaging.

Key Considerations When Buying Affordable Gold Coins

Buying gold under $1,000 means being extra strategic. With a smaller budget, every choice — from dealer to coin type — matters. Here’s what experienced investors watch for:

Premiums over spot can quickly eat into value. Fractional coins often have higher markups. A 1/10 oz coin might cost more per ounce than a full ounce coin — so always compare the price per gram or ounce, not just the total.

Stick with reputable mints. U.S. Mint, Royal Canadian Mint, Austrian Mint, and Perth Mint coins are easy to resell and widely trusted. Obscure or novelty coins may look cheaper, but they’re harder to verify or liquidate later.

Purity and weight markings are essential. If a coin doesn't clearly show its weight and gold content (e.g., “1/4 oz .9999 Fine Gold”), skip it. This is your best defense against fakes or misleading listings.

Packaging adds long-term value. Coins or bars in sealed assay cards or tamper-proof containers not only protect your gold but make it easier to sell down the line.

Storage should be part of your plan. Even a handful of coins is worth protecting. A basic home safe or lockbox can be a smart, affordable step.

FAQ

No — the total gold content is what matters. A 1 oz 22k coin still contains a full ounce of gold; it’s just alloyed for durability.

Most major online dealers accept credit cards, but expect higher premiums compared to bank wire or ACH payments.

Yes — in the U.S., gold is considered a collectible and subject to capital gains tax when sold at a profit.

Usually not — serial numbers are more common on small gold bars or coins in assay cards.

Stick to coins from trusted mints, look for purity/weight markings, and buy from dealers offering verified packaging like assay cards.

It means the dealer chooses the coin’s year of issue — often from secondary market inventory — which helps keep premiums lower.

Yes — it’s secure, though not insured by the bank. Many investors also use small fireproof safes at home.