Table Of Content

If you're new to gold investing, Silver Gold Bull offers a streamlined and trusted platform with competitive pricing, robust selection, and flexible purchasing options.

This is also reflected in their customer ratings:

Platform | Rating |

|---|---|

Trustpilot

| 4.8 (4,464 reviews) |

Better Business Bureau (BBB) | A+ | Accredited Since 2012 |

Sitejabber | 3.4 (233 reviews) |

Let’s break down how to buy gold from Silver Gold Bull—from setting your goals to tracking your insured delivery.

5 Steps to Buy Gold from Silver Gold Bull

Let’s walk through the process of buying gold with Silver Gold Bull :

1. Set Your Gold Investment Goals

Before you start browsing, it’s worth clarifying your intent. Are you stacking gold for long-term wealth protection? Seeking portfolio diversification? Or just getting started?

Key points to consider:

Budget and Quantity – Whether you want a single 1 oz gold coin or a tube of fractional coins, Silver Gold Bull offers price-based filters and tiered pricing.

Type of Gold – Stick with widely recognized products like sovereign coins and LBMA-approved gold bars for easier resale.

IRA Eligibility – Most U.S. investors can choose IRS-approved gold options if buying through a Gold IRA.

Premium Sensitivity – The platform clearly shows premiums over spot so you can make cost-efficient decisions.

2. Create an Account (Optional, But Worth It)

Silver Gold Bull allows you to checkout as a guest, but creating an account has its perks:

Faster checkout and saved addresses

Access to your order history and tracking

Personalized alerts and bulk pricing visibility

Usually, no documents are required for standard purchases. ID verification is only necessary if you're setting up a Gold IRA or placing very large orders.

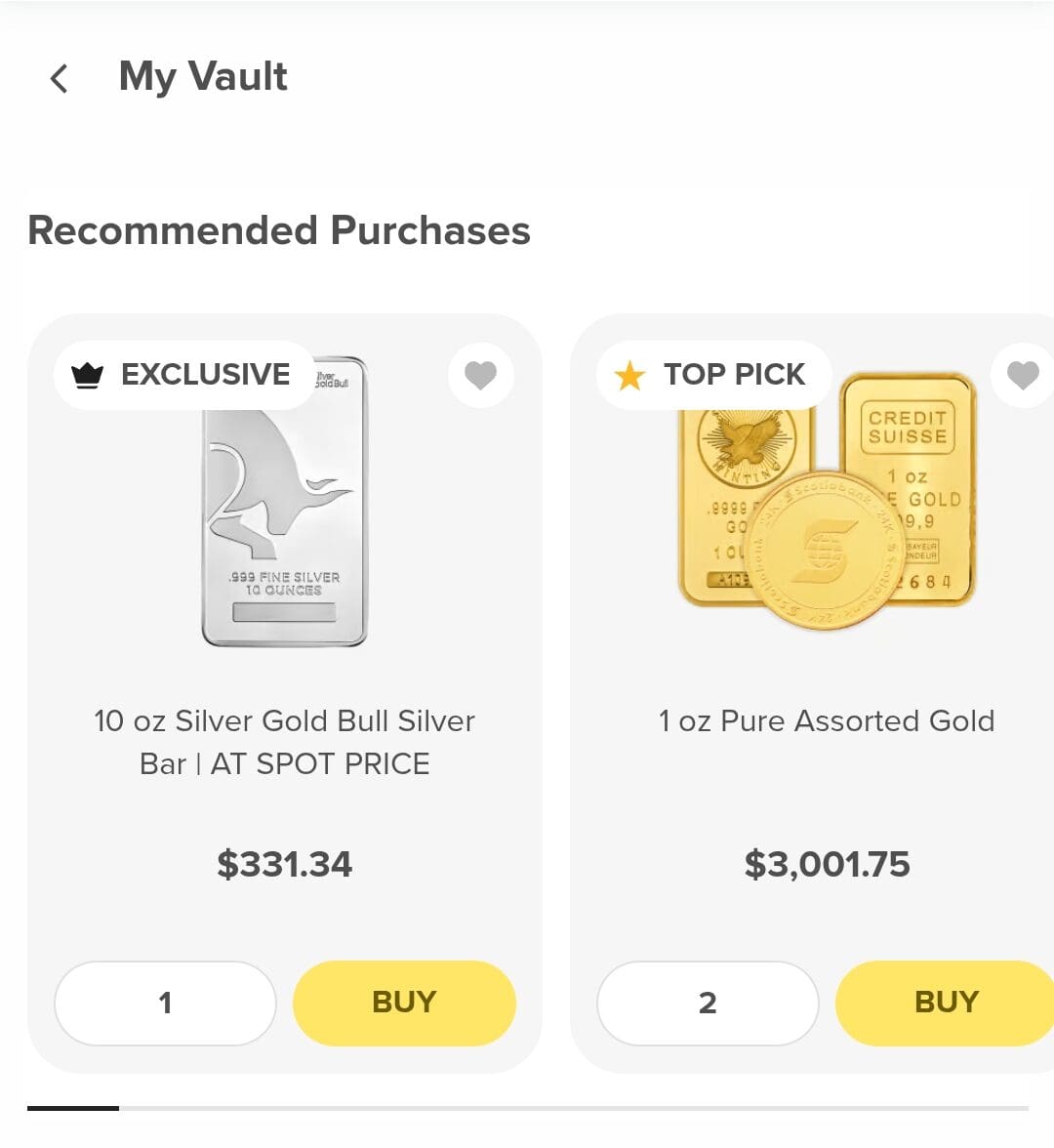

3. Explore Gold Coins and Bars by Category

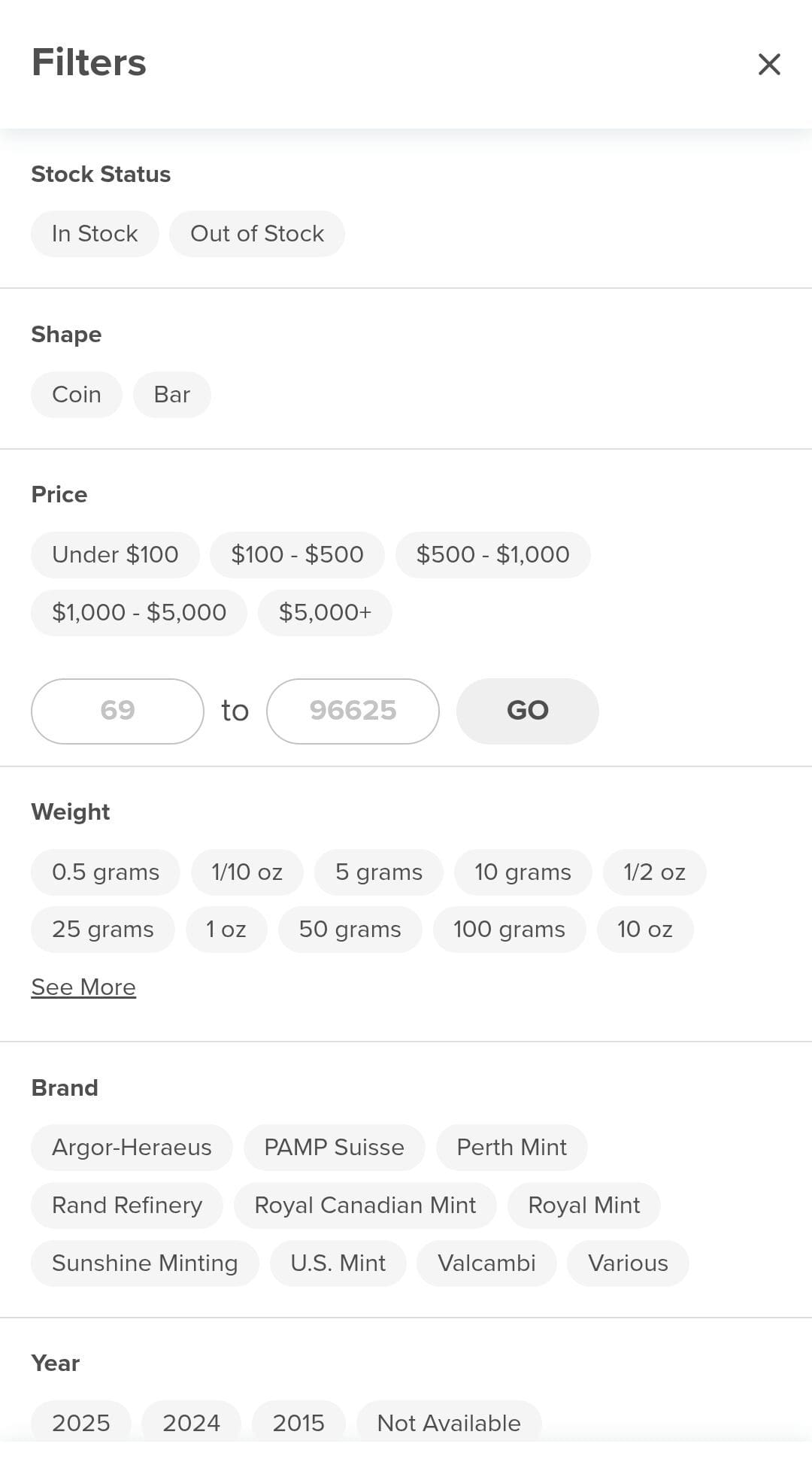

Navigating Silver Gold Bull’s gold catalog is straightforward. Just head to the “Gold” section and use filters like:

Weight – Options include 1 gram, 1/10 oz, 1/4 oz, 1 oz, 100 grams, and 1 kilo.

Product Type – Choose between coins (like Eagles and Maples) or bars (from PAMP, Valcambi, etc.).

Mint – Easily filter by sovereign mints (U.S. Mint, RCM, Perth Mint) or private refineries.

IRA Eligible – Filter only gold that qualifies for tax-advantaged retirement accounts.

Product | Type | Weight | IRA Eligible |

|---|---|---|---|

American Gold Eagle (BU) | Coin | 1 oz | Yes |

Canadian Gold Maple Leaf | Coin | 1 oz | Yes |

PAMP Suisse Gold Bar | Bar | 1 oz | Yes |

Valcambi Gold CombiBar | Bar | 50 grams (divisible) | Yes |

South African Krugerrand | Coin | 1 oz | No (not IRS-approved) |

Royal Canadian Mint Gold Bar | Bar | 1 oz | Yes |

Austrian Philharmonic | Coin | 1 oz | Yes |

Britannia Gold Coin | Coin | 1 oz | Yes |

Product pages include live pricing, volume discounts, customer reviews, and estimated delivery time.

- The Smart Investor Tip

Pay attention to the “pre-sale” and “on sale” tags—Silver Gold Bull regularly offers gold products at discounted premiums or during limited-time promotions.

4. Add to Cart and Lock In Your Price

Gold prices move in real time. When you add an item to your cart and proceed to checkout, your price is locked in once you confirm the order.

Silver Gold Bull offers multiple payment methods:

Bank Wire – Best pricing; ideal for larger orders.

e-Transfer / ACH / Bill Pay – Convenient and fast for U.S. and Canadian buyers.

Credit/Debit Card – Available, but includes higher premiums.

PayPal & Crypto (via BitPay) – Flexible, but check for associated fees.

Check or Money Order – Accepted, though processing takes longer.

After ordering, you’ll receive a confirmation with instructions and payment deadlines.

5. Track Your Gold Shipment — Discreet and Fully Insured

Once payment is confirmed, Silver Gold Bull ships your order discreetly. Packages have no branding and all shipments are insured for the full value.

What you can expect:

1–3 business day processing after payment

Discreet packaging with tracking details sent via email

Signature required for high-value orders

Insurance covers loss or damage during transit

If you live in the U.S. or Canada, delivery is typically fast and reliable, even for bulk orders.

- The Smart Investor Tip

For large purchases, consider shipping to a secure vault location through Silver Gold Bull’s partnership with Brinks or International Depository Services (IDS). It adds a layer of professional-grade security for long-term storage.

Can You Sell Your Gold Back to Silver Gold Bull?

Yes. Silver Gold Bull has an established buyback program that’s straightforward and transparent.

How it works:

Call their trading desk or submit an online form to get a live quote.

Follow the shipping instructions they provide (fully insured).

Once received and verified, payment is issued via wire, ACH, or check.

They buy back both coins and bars—even if you didn’t purchase them from Silver Gold Bull originally.

Tips to Score the Best Gold Prices on Silver Gold Bull

Gold prices fluctuate daily—but there are simple ways to lock in better deals and avoid overpaying on your next order.

Use Bank Wire or ACH – These methods give you access to lower pricing tiers versus card payments.

Watch for Weekly Deals – Check the homepage for rotating discounts on gold coins and bars.

Buy in Bulk – Tiered pricing lets you save more per ounce when you buy multiple coins or bars.

Enable Price Alerts – Be notified the moment your desired price level is reached.

Look for “On Sale” Tags – Silver Gold Bull highlights discounted gold products regularly.

Avoid Credit Card Markups – Credit/debit orders include higher premiums, which eat into your value.

Order During Market Dips – When gold pulls back, lock in before the rebound.

Strategic timing and payment choices make a noticeable difference over time.

FAQ

Yes, you can checkout as a guest, but you’ll miss out on features like saved info, order history, and exclusive deals.

Most gold bullion is tax-exempt in the U.S., but taxes may apply in certain states depending on the product and order size.

There's no set minimum for most orders, but some payment methods (like wire transfers) require higher minimums.

Both are highly liquid, but sovereign coins tend to be easier to sell due to global recognition and IRA eligibility.

Returns are limited. Unless there’s an issue with the item received, bullion orders are usually non-refundable.

You can, but it’s less cost-effective. For large purchases, bank wire or ACH is recommended for lower premiums.