Coinbase | Gemini | |

Supported Coins | +250 | +150 |

Spot Trading Fees | $0.99 – 2.00% (Standard), 0.05% – 0.60% (Advanced Trade)

For transactions above $200 (standard account): 1.49% fee for using a bank account or USD wallet, 3.99% fee for using a debit or credit card. For Coinbase Advanced Trade: 0.60% for taker trades and 0.40% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.05%. | $0.99 – 1.49% (Web & Mobile), 0.20% – 0.40% (Active Trader)

For Gemini’s website or mobile app users are charged 0.50% convenience fee For Active Trader, 0.40% for taker trades and 0.20% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.03%. |

Future Trading Fees | 0.40% – 0.60%

0.60% for taker trades and 0.40% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.04%.

| |

Our Rating |

(4.5/5) |

(4.2/5) |

Read Review | Read Review |

Coinbase vs Gemini: Compare Main Features

Choosing the right crypto exchange can be challenging. In this guide, we compare Coinbase and Gemini, breaking down key features, fees, and security to help you make an informed decision.

-

Ease of Use & Mobile App Experience

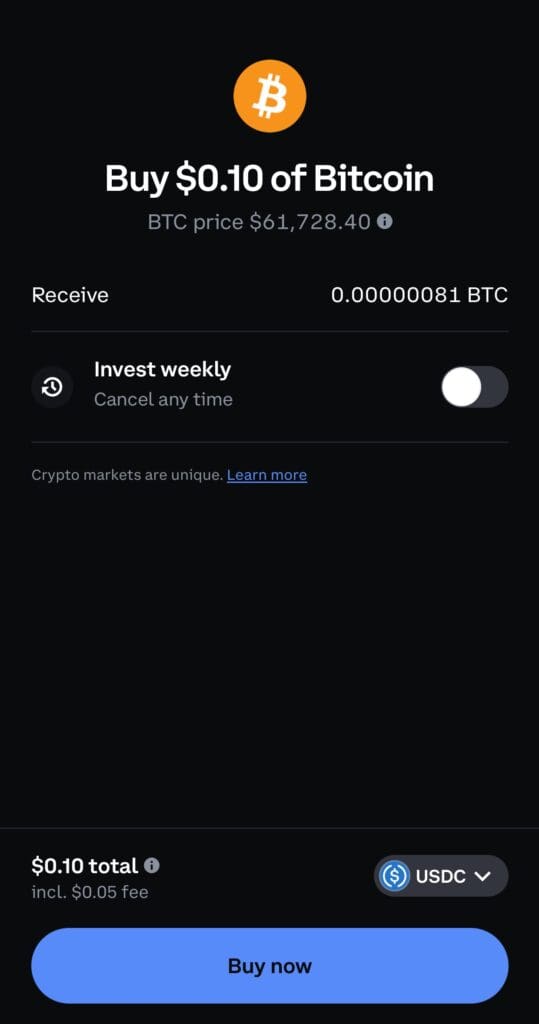

Coinbase offers a clean, straightforward app where users can buy Bitcoin or Ethereum within minutes using a debit card.

Gemini, however, combines simplicity with slightly more detailed screens, which can feel slower for fast purchases but are useful for setting recurring buys.

Coinbase’s mobile app mirrors its desktop platform closely, while Gemini may require switching screens to access advanced tools.

Overall, Coinbase wins for the easiest mobile and web experience, especially for quick first-time crypto buyers.

-

Cryptocurrency Selection

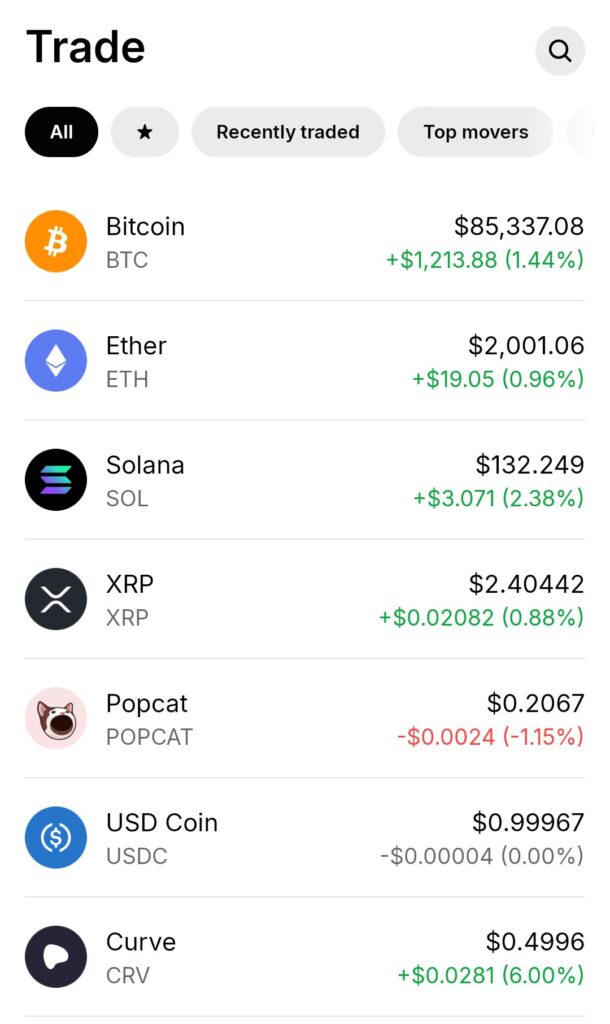

Coinbase supports +250 cryptocurrencies, ranging from Bitcoin and Ethereum to smaller DeFi tokens and NFTs, allowing users to explore niche altcoins easily.

Gemini, on the other hand, offers a more curated list of +150 coins, focusing on major projects and stablecoins, such as GUSD.

Therefore, if you are looking for very new coins or experimental assets, Coinbase provides broader access, while Gemini leans toward established and vetted assets.

-

Trading Crypto Features & Experience

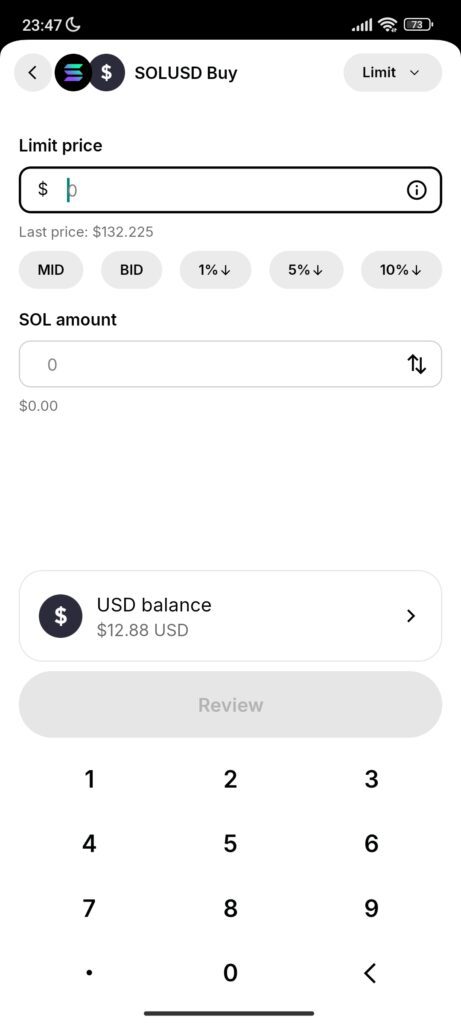

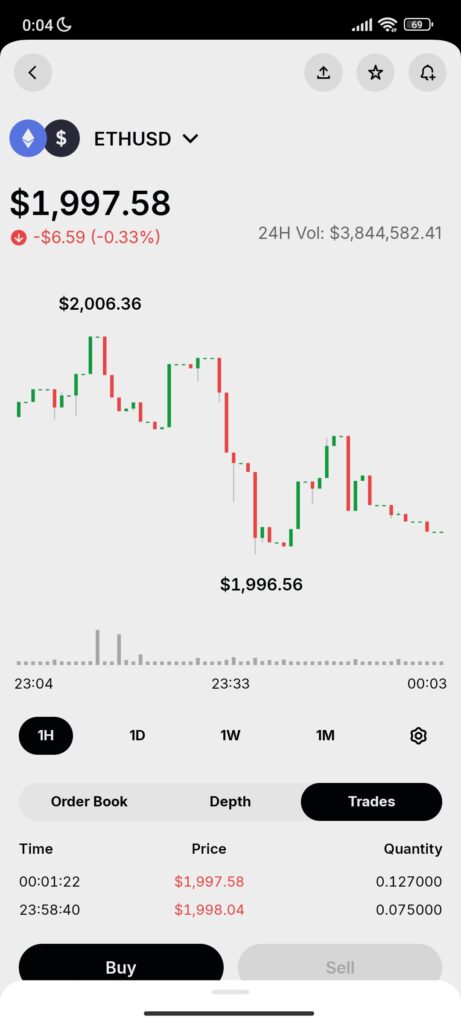

For professional traders, Coinbase Advanced Trade offers lower fees, real-time TradingView charts, and complex order types like stop-limits, designed for active market participants.

Gemini ActiveTrader, however, offers even faster execution speeds and slightly lower maker-taker fees, making it a better fit for high-frequency traders.

Coinbase compensates by offering margin trading and access to crypto futures, features that Gemini restricts for U.S. users because of regulatory limits.

Overall, Gemini is slightly better for pure active spot trading, but Coinbase offers more diverse advanced trading products overall.

-

Staking Options and Rewards

Gemini offers more favorable staking fees, but Coinbase provides a broader selection of staking assets.

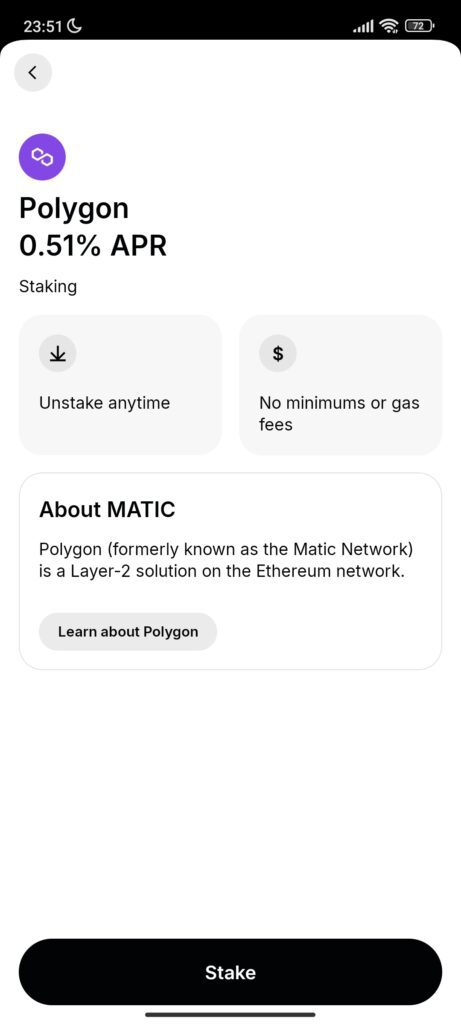

Gemini provides staking for Ethereum (ETH), Polygon (MATIC), and Solana (SOL), with a 15% reward fee. However, U.S. users are limited to staking ETH and MATIC, as SOL staking is unavailable in the U.S.

Coinbase offers staking for several cryptocurrencies, including Ethereum (ETH), Solana (SOL), and Cosmos (ATOM), with variable rewards up to 14%.

However, it charges a 35% commission on staking rewards, which is higher than many competitors. Keep in mind that staking is restricted in certain U.S. states.

-

Security Measures And Past Hacks

Coinbase emphasizes security by storing 97% of user funds in offline cold storage and implementing two-factor authentication (2FA). It has not experienced any major hacks to date .

Gemini is regulated by the New York State Department of Financial Services and offers $200 million in insurance for digital assets.

It also employs strong security measures, including 2FA and cold storage.

-

DApps and Web3 Integration

Coinbase clearly leads for full Web3 and decentralized app integration.

Coinbase takes Web3 integration further by offering its own Coinbase Wallet for accessing DeFi apps, NFT marketplaces, and blockchain games, supporting blockchains like Ethereum and Solana.

In contrast, Gemini connects users to Web3 mainly through its Nifty Gateway NFT platform, without full DeFi app browsing.

As a result, Coinbase users can participate in staking, liquidity pools, and gaming more easily within a single app environment.

-

Wallet Options

Coinbase Wallet offers greater flexibility and access to the decentralized ecosystem, while Gemini focuses on secure custodial services.

Coinbase offers the Coinbase Wallet, a self-custody wallet supporting a wide range of cryptocurrencies and NFTs. It allows users to buy, swap, stake, and interact with decentralized applications (dApps) across various blockchains

Gemini provides a custodial wallet with institutional-grade security, supporting all listed assets. While it ensures high security, it lacks support for custom tokens and broader DeFi integrations .

-

Trading Bots and Automation

Both platforms support trading automation, but Coinbase offers more user-friendly integrations for retail traders.

Coinbase allows users to connect with automated trading platforms and bots through its Advanced Trade API, enabling strategies like grid trading and integration with tools like TradingView.

Gemini supports algorithmic trading via robust APIs, allowing users to implement custom trading bots and integrate with third-party software for automated trading strategies.

Which Investors May Prefer Coinbase Exchange?

Coinbase is one of the top exchanges for beginners who want simplicity without giving up growth opportunities in crypto and Web3.

Beginner Investors: Easy account setup, intuitive mobile app, and clear options for buying, selling, and storing 250+ cryptocurrencies.

NFT and Web3 Enthusiasts: Access to a native NFT marketplace and seamless connections to decentralized apps (dApps) through Coinbase Wallet.

Passive Income Seekers: Simple staking options for Ethereum, Solana, Cardano, and more, with easy one-click activation.

Busy Users Needing Convenience: Fast ACH deposits, PayPal options, and instant credit card purchases for on-the-go investing.

Coinbase also suits users who want the flexibility to scale from casual to more advanced trading without needing to leave the platform.

Which Investors May Prefer Gemini Exchange?

Gemini is ideal for investors who prioritize security, regulatory compliance, and a polished experience from the start.

Security-Focused Investors: Institutional-grade cold storage, strong compliance measures, and insurance coverage for added peace of mind.

Serious Traders: Gemini ActiveTrader offers professional tools, advanced order types, and lower maker-taker fees than Coinbase.

Long-Term Holders: Gemini’s simple storage solutions and limited free crypto withdrawals make it a strong fit for buy-and-hold strategies.

NFT Collectors: Through Nifty Gateway, users can easily purchase high-profile NFTs using both crypto and traditional payment methods.

For users who value trust, structure, and serious protection over chasing every new token, Gemini feels like a safer, well-governed choice.

Bottom Line

Coinbase excels with beginner-friendly features, a vast selection of cryptocurrencies, Web3 integration, and straightforward staking options, making it ideal for casual investors and NFT enthusiasts.

Gemini, meanwhile, shines with tight security, lower spot trading fees for pros, and strong regulatory compliance.

If you want the easiest on-ramp into crypto, Coinbase wins. But if you’re all about serious storage, trading efficiency, and maximum safety, Gemini deserves your attention.