Table Of Content

How Crypto Staking Generates Passive Income

Staking allows crypto holders to earn rewards by participating in blockchain validation, especially in Proof-of-Stake (PoS) networks like Ethereum or Cardano.

Instead of mining, users “lock” their tokens to support network security and operations — and in return, they receive staking rewards.

Earn Rewards Over Time: By staking your crypto, you receive regular payouts in the form of additional coins, often ranging from 4% to 20% APY depending on the asset and platform.

Contribute to Network Security: Stakers help validate transactions and maintain the blockchain's integrity, making the ecosystem more secure and decentralized.

No Need for Expensive Hardware: Unlike mining, staking doesn’t require complex setups — you can stake via exchanges or directly through wallets.

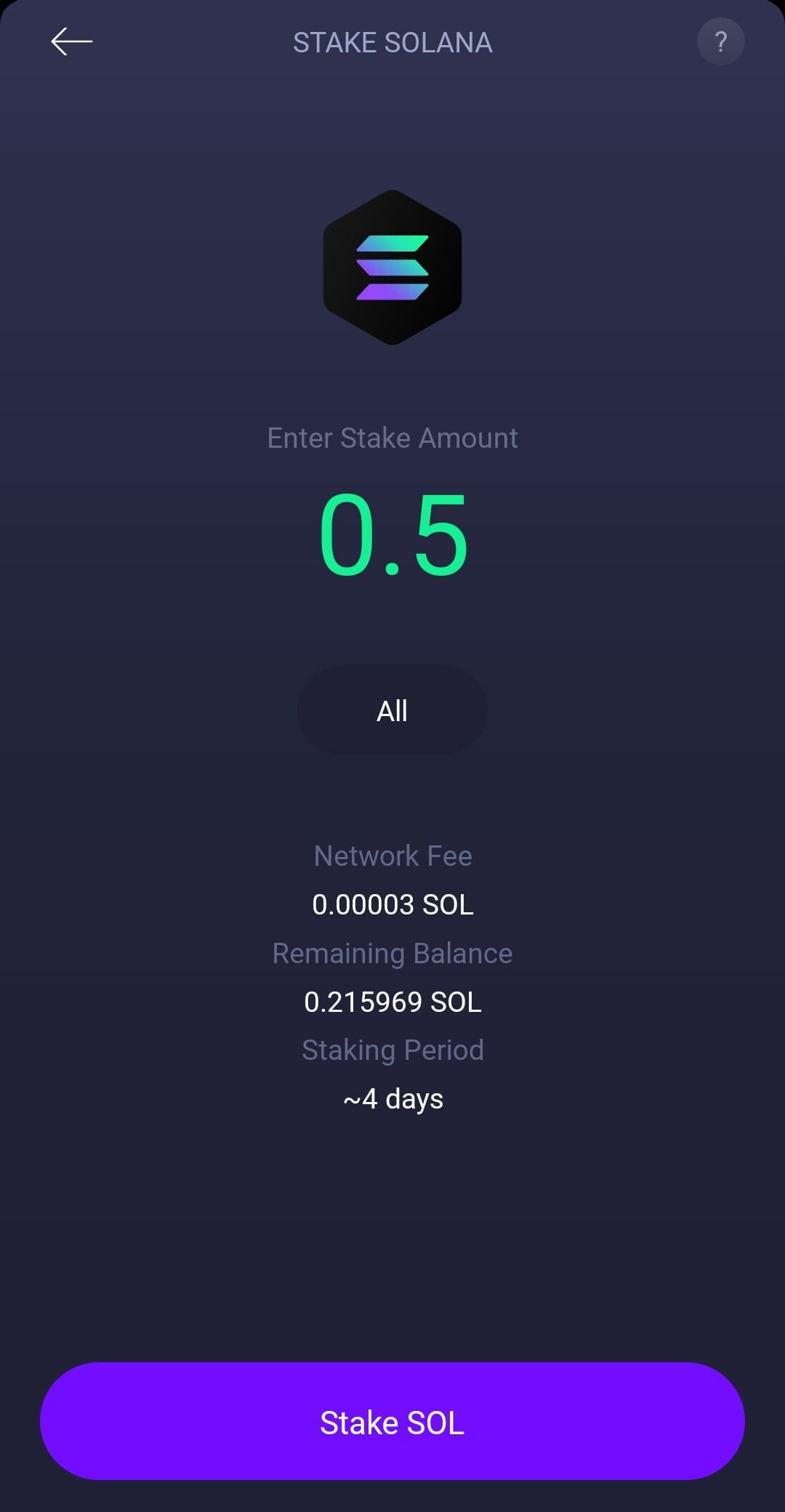

For example, if you stake Solana on Kraken, you could earn rewards daily without needing to trade actively. Coinbase and Kraken both offer staking guides and explain yields for supported coins.

Pros and Cons of Staking Crypto

Staking can be an appealing passive income strategy, but it's not without risks. Here's a balanced look at both sides:

Pros | Cons |

|---|---|

Generates passive crypto income | Locked assets during staking period |

Enhances blockchain security | Returns may vary or drop |

Energy-efficient method | Risk of slashing on validator failure |

Easy to get started | May reduce liquidity in volatile times |

Flexible staking terms offered | Risk if staking through third parties |

- Generates Passive Income

Staking provides a steady income stream in the form of native token rewards, which can compound over time.

- Supports Blockchain Networks

By staking, you're actively helping validate transactions, which improves decentralization and security.

- Eco-Friendly Compared to Mining

Because it doesn’t require energy-hungry machines, PoS staking is far more sustainable than traditional crypto mining.

- Low Entry Barriers

Platforms like Binance or Coinbase make it easy to stake with just a few clicks, often starting with as little as $10.

- Flexible Options Available

Some platforms offer both fixed and flexible staking — giving you more control over when to withdraw.

- Asset Lock-Up Periods

You might not be able to access your crypto for days or weeks, which can be risky if prices fall suddenly.

- Reward Volatility

Staking returns aren’t guaranteed — they depend on network performance and can fluctuate unexpectedly.

- Slashing Risks

If the validator misbehaves or has downtime, a portion of your staked funds could be penalized (slashed).

- Limited Liquidity

Because staked assets can’t be sold instantly, you lose flexibility, especially in fast-moving markets.

- Platform Risk

When staking through centralized exchanges, you rely on them to manage your funds, which adds counterparty risk.

Best Cryptocurrencies for Staking

Some cryptocurrencies are designed specifically for staking and offer better returns or lower risk than others. Here are some popular options:

Ethereum (ETH): After the shift to Proof-of-Stake, ETH staking offers competitive yields and is available on most major exchanges.

Cardano (ADA): ADA is known for its secure staking system and low minimums, often accessible through native wallets like Daedalus or Yoroi.

Solana (SOL): SOL staking is popular due to its fast transactions and attractive APY on platforms like Kraken and Ledger.

Polkadot (DOT): DOT offers governance participation and rewards, but some platforms require a higher minimum to get started.

How to Choose a Staking Platform: Exchange vs. Wallet vs. DeFi

Choosing where to stake your crypto depends on how much control and flexibility you want.

Centralized exchanges are beginner-friendly, while wallets and DeFi platforms offer more transparency and control — but come with technical demands.

Platform Type | Control Over Funds | Ease of Use | Risk Level |

|---|---|---|---|

Exchange | Low | High | Medium |

Wallet | High | Medium | Low–Medium |

DeFi | High | Low–Medium | High |

-

Exchanges (e.g., Binance, Coinbase)

Great for beginners — easy setup, daily rewards, and no validator setup needed. But they control your private keys and charge fees.

-

Wallets (e.g., Ledger, Trust Wallet)

These allow self-custody while staking through integrated services. While safer than exchanges, they may require more effort and knowledge.

-

DeFi Platforms (e.g., Lido, Rocket Pool)

Offer innovative staking with added liquidity (liquid staking), but involve smart contract risks and require experience with Web3 wallets.

How to Avoid Staking Scams and Risky Platforms

With the rise of staking, many fraudulent or poorly secured platforms have emerged. Use these tips to stay safe:

Research the Platform: Look for reviews, audits, and regulatory status. If a platform lacks transparency or has poor feedback, it’s a red flag.

Avoid Unrealistic Yields: If a platform promises extremely high returns (like 100%+ APY), it's likely unsustainable or a scam.

Stick to Reputable Validators: If staking through wallets or DeFi, choose validators with strong uptime, good reviews, and no slashing history.

Use Hardware Wallets When Possible: Staking directly through devices like Ledger adds an extra security layer, especially when using self-custody.

Verify Smart Contract Audits: When using DeFi staking, ensure the protocol has undergone third-party security audits and is open source.

Bottom Line: Is Staking Crypto Worth It?

Staking crypto can be a smart way to earn passive income while supporting blockchain networks, especially if you choose secure platforms and reliable assets.

However, it's not risk-free — factors like asset volatility, lock-up periods, and platform security must be considered.

For long-term holders comfortable with temporary illiquidity, staking can be a valuable addition to your crypto strategy.

FAQ

Yes, even if you earn staking rewards, a significant price drop in the crypto you're staking could result in an overall loss.

Staking rewards come from network participation, while interest is usually earned through lending platforms. Both generate passive income but through different methods.

In most jurisdictions, staking rewards are considered taxable income at the time they’re received. Always consult local tax regulations.

Yes, many platforms support multi-asset staking. This allows you to diversify and reduce dependency on a single token's performance.

If you stake through a centralized exchange and it fails, you may lose access to your funds. Self-custody is often safer for long-term staking.

No, yields fluctuate based on network conditions, validator performance, and overall staking participation. They can change without notice.

On-chain staking offers more control and often better security, but exchanges are more user-friendly for beginners. Each has trade-offs.

Liquid staking lets you earn rewards while still having access to a tradable token that represents your staked asset, adding flexibility.

Staking rewards can help offset inflation by growing your holdings over time, but only if the crypto itself holds its value.

Yes, some networks require a minimum number of coins or tokens. Others, especially exchanges, allow small-scale staking with no minimum.

While unlikely if using trusted platforms, risks like slashing, scams, or platform failure can lead to partial or full losses.