Table Of Content

What Is a Custodial Wallet?

A custodial wallet is a type of crypto wallet where a third party—typically an exchange like Coinbase or Binance—manages your private keys. This means you don’t have full control of your crypto, but it’s easier to recover your funds if you forget your login.

Custodial wallets are ideal for beginners or casual users who prioritize convenience and don't want to manage technical details like backup phrases.

However, because another party holds your keys, you must trust them with the security and availability of your assets.

Pros | Cons |

|---|---|

Easy To Recover Funds | No Full Control Of Assets |

User-Friendly Interface | Relies On Third-Party Trust |

Ideal For Beginners | Risk Of Centralized Hacks |

Often Supports Fiat Onramps | Limited Privacy |

What Is a Non-Custodial Wallet?

A non-custodial wallet gives you full control over your crypto assets because only you hold the private keys.

Examples include MetaMask, Trust Wallet, and Ledger (hardware wallets). These wallets are favored by experienced users who prioritize privacy and security.

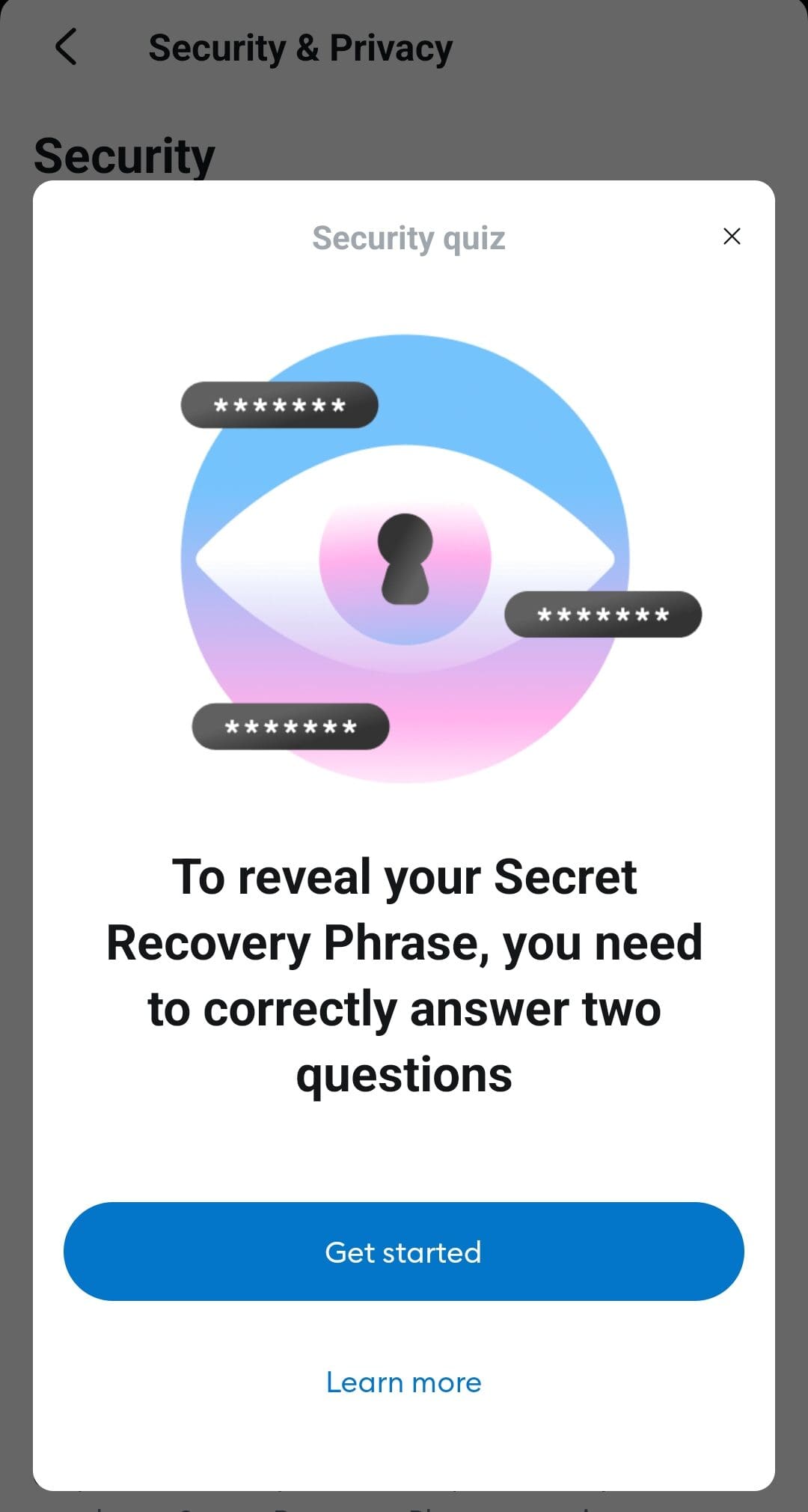

However, losing access to your seed phrase can result in the permanent loss of funds, as there is no third-party recovery option.

As a result, non-custodial wallets require more responsibility, but they also offer greater sovereignty and decentralization.

Pros | Cons |

|---|---|

Full Control Of Your Funds | Hard To Recover If Lost |

Greater Privacy And Freedom | User Responsible For Security |

No Third-Party Risk | Learning Curve For Beginners |

Works With DeFi Platforms | Requires Secure Backup System |

Custodial vs. Non-Custodial Wallets: Key Differences

Choosing between custodial and non-custodial wallets depends on your crypto experience, risk tolerance, and how much control you want over your assets.

-

Control Over Private Keys

The most fundamental difference is who controls the private keys that authorize crypto transactions. In custodial wallets, the provider holds the keys; in non-custodial wallets, you do.

Custodial Wallets: Platforms like Binance or Coinbase hold your private keys, so they handle all the technical operations for you.

Non-Custodial Wallets: Apps like MetaMask or Ledger require you to secure and manage your own keys.

Security Risk: If you lose your non-custodial recovery phrase, your crypto is gone. In contrast, custodial services can help with recovery.

Because of this, custodial wallets are convenient for beginners, while non-custodial wallets are better suited for users who understand the importance—and burden—of self-custody.

-

Recovery and Backup

When it comes to losing access, your recovery options differ greatly. This impacts both the safety and responsibility involved in managing crypto.

Custodial Wallets: You can usually reset your password or contact support, as the platform retains access to your wallet.

Non-Custodial Wallets: If you lose your recovery phrase, there’s no way to regain access—no password reset or customer support can help.

Responsibility Trade-Off: Non-custodial wallets offer greater freedom, but they shift all recovery responsibility to the user.

As a result, users with larger holdings or frequent trades may lean on custodial services for ease, but long-term holders often choose non-custodial solutions for independence.

-

Platform Accessibility and Features

Your wallet choice affects what features and platforms you can access, especially in the fast-moving world of decentralized finance (DeFi).

Custodial Wallets: Often don’t support direct DeFi access or token swaps without using the platform’s interface.

Non-Custodial Wallets: Allow you to connect to DeFi platforms like Uniswap, Aave, or Curve directly for swapping, staking, or lending.

Feature Limitations: Custodial wallets prioritize simplicity but restrict more advanced or decentralized functions.

Therefore, if you want to explore blockchain-based services beyond just holding crypto—such as participating in DAOs or staking—you’ll need a non-custodial wallet that integrates directly with those protocols.

-

Security and Regulatory Risks

Both wallet types come with their own security models and regulatory risks, depending on where and how they’re used.

Custodial Wallets: Are vulnerable to centralized hacks (e.g., exchange breaches) and may freeze assets due to regulations or investigations.

Non-Custodial Wallets: Reduce the risk of third-party hacks, but you’re responsible for keeping your device and keys safe from malware.

Compliance Risks: Custodial wallets may be subject to government tracking, while non-custodial users retain greater anonymity.

Because custodial services operate under financial regulations, your account might be frozen or monitored. Non-custodial users have more privacy, but at the cost of self-managed security and no support fallback.

When a Custodial Wallet May Be a Good Idea

Custodial wallets are ideal for users who prefer simplicity, support, and security managed by a trusted third-party service.

For Crypto Beginners: New users benefit from easy setup, no key management, and intuitive wallet apps like Coinbase or Binance.

If You Forget Passwords Easily: Custodial wallets often let you reset your password and restore access, which isn’t possible with self-custody.

When Using Centralized Exchanges: If you trade actively on platforms like Kraken or Gemini, using their custodial wallet ensures faster transactions.

For Small, Everyday Holdings: Keeping limited crypto in a custodial wallet helps manage risk while allowing quick access for payments.

These wallets simplify the crypto experience because users don’t need to handle private keys. However, your funds depend on the provider’s reliability and regulatory environment.

When a Non-Custodial Wallet May Be a Good Idea

Non-custodial wallets are ideal for crypto users who value privacy, long-term control, and direct access to decentralized platforms.

For Long-Term Investors: If you're holding assets like BTC or ETH for years, a wallet like Ledger or MetaMask gives full ownership.

When Using DeFi or DApps: Non-custodial wallets allow you to connect to DeFi tools like Aave, Uniswap, and NFT platforms directly.

To Maintain Financial Privacy: Because there’s no KYC or data sharing, non-custodial wallets like Trust Wallet offer more anonymity.

In High-Risk Jurisdictions: People in unstable regions often use self-custody to avoid government control or asset freezes.

As a result, non-custodial wallets offer freedom and decentralization, but you must safeguard your recovery phrase to avoid permanent loss.

FAQ

Yes, you can transfer your crypto from a custodial exchange to a non-custodial wallet. Just make sure to verify the wallet address carefully and confirm network compatibility.

Some custodial wallets offer insurance on assets held, but it's limited and usually doesn’t cover losses from personal account breaches or market drops.

Non-custodial wallets typically don’t charge for holding crypto, but you’ll still pay blockchain transaction fees for sending or swapping assets.

Non-custodial wallets, especially hardware ones, are considered safer for long-term storage because they reduce exposure to centralized hacks.

For software wallets, yes—but hardware wallets can stay offline until connected for a transaction, offering extra protection from cyber threats.

Yes, custodial providers can freeze accounts due to legal orders, suspicious activity, or platform policies since they control the private keys.

No, many are specific to certain blockchains. For example, MetaMask supports Ethereum and compatible chains but not Bitcoin natively.

In some cases, yes—especially if the platform has insurance or a fraud response team. Still, recovery isn't always guaranteed.