Table Of Content

What Is an Earnings Calendar?

An earnings calendar is a financial tool that tracks the scheduled release dates of quarterly or annual earnings reports for publicly traded companies.

These calendars help investors stay informed about upcoming announcements that could impact stock prices and trading volume.

Traders often use earnings calendars to plan short-term strategies, while long-term investors may use them to gauge business performance trends.

By knowing when key companies report earnings, investors can better anticipate market volatility and adjust their portfolios accordingly.

Best Websites And Tools for Tracking Earnings Reports

Several platforms offer reliable earnings calendars, but each serves slightly different needs—some focus on data depth, others on user interface or speed.

-

Nasdaq Earnings Calendar

The Nasdaq site offers a clean, easy-to-filter calendar showing upcoming earnings by date, symbol, or sector.

It's especially useful for quickly finding major tech companies’ announcements. You can also access historical data and preview consensus EPS forecasts.

-

Yahoo Finance

Yahoo provides a detailed earnings calendar that includes time of release (pre-market, after hours), EPS expectations, and revenue estimates.

It also links directly to recent company news, which helps investors put the earnings in context.

-

Zacks Investment Research

Zacks includes a well-organized calendar that highlights key companies and includes surprise history, analyst revisions, and Zacks Rank scores.

It’s great for blending technical and fundamental analysis ahead of earnings.

-

TradingView Earnings Calendar

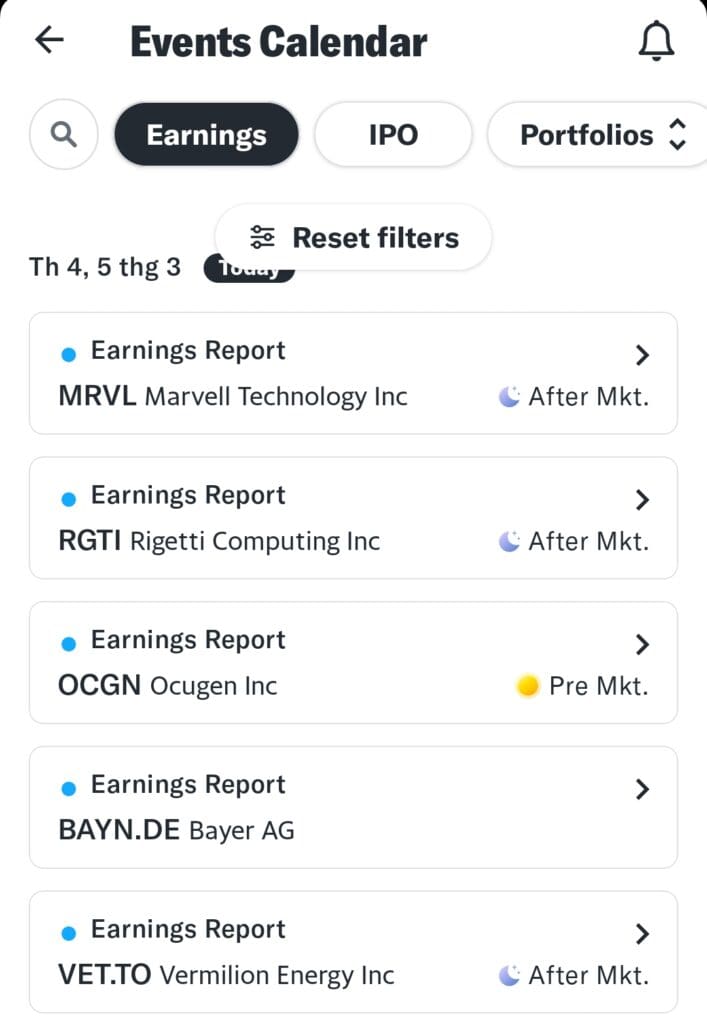

In addition to offering technical charting, TradingView’s earnings calendar is ideal for traders who want real-time updates integrated into their watchlists.

It’s also highly customizable, helping users stay on top of announcements for specific sectors or portfolios.

-

Benzinga Earnings Calendar

Benzinga provides a trader-friendly calendar that includes earnings time, EPS estimates, revenue expectations, and whether the company is expected to report before or after the bell.

It’s popular among day traders due to its integration with breaking news and alerts.

-

MarketBeat Earnings Calendar

MarketBeat offers a clean layout with filters by date, sector, and market cap.

It also shows EPS surprise history and links to analyst commentary, making it great for both research and tracking expectations.

-

Seeking Alpha Earnings Calendar

Seeking Alpha features a robust calendar with company previews, contributor earnings insights, and links to earnings call transcripts.

It’s ideal for investors who want deeper commentary beyond numbers.

How to Use an Earnings Calendar?

An earnings calendar isn’t just a schedule—it’s a powerful planning tool for retail investors, swing traders, and analysts alike.

1. Plan Swing Trades Around Volatility Events

Earnings announcements often trigger sharp price movements, making them ideal setups for short-term swing traders.

By identifying companies that report earnings within the week, traders can prepare entry and exit strategies in advance.

For instance, a trader might buy call options on a stock expected to beat earnings, or set stop-loss orders to hedge against a downside miss.

It’s also useful to review past earnings reactions using platforms like Earnings Whispers or TradingView to anticipate potential volatility.

2. Time Long-Term Buys After Earnings Announcements

Long-term investors often wait until earnings are released to reduce uncertainty and avoid buying into hype-driven price spikes.

For instance, if a stock disappoints but its long-term outlook remains intact, the post-earnings dip can offer a more attractive entry.

This approach reduces the risk of buying just before negative earnings surprises. You can track earnings misses and analyst revisions on Yahoo Finance or MarketBeat.

It’s also helpful to listen to earnings calls or read transcripts to understand management’s tone and forward guidance—available through Seeking Alpha. This context can offer clues about the company’s longer-term strategy and resilience.

3. Track Sector-Wide Trends with Clustered Reports

When many companies in a sector report in the same week, it can signal broader industry momentum—or trouble.

If you’re investing in ETFs like XLF (financials) or XLK (tech), it’s smart to monitor top holdings’ earnings for clues.

For example, JPMorgan, Bank of America, and Wells Fargo reporting strong results in the same week may lift the entire financials sector. Use Nasdaq or TradingView to filter earnings calendars by sector and date.

This approach also helps with rotational strategies—moving capital between sectors based on earnings trends. It’s especially useful during earnings season, when industry themes can dominate headlines and market behavior.

4. Watch for Pre-Market and After-Hours Reports

Many earnings reports are released outside of regular trading hours. Traders who monitor pre-market (8:00–9:30 AM ET) and after-hours (4:00–8:00 PM ET) sessions can react to news before the broader market opens.

For example, if Tesla releases earnings at 4:05 PM, investors can act immediately in extended hours via platforms like Nasdaq or TradingView.

It’s also wise to use limit orders during these volatile periods to control risk.