Table Of Content

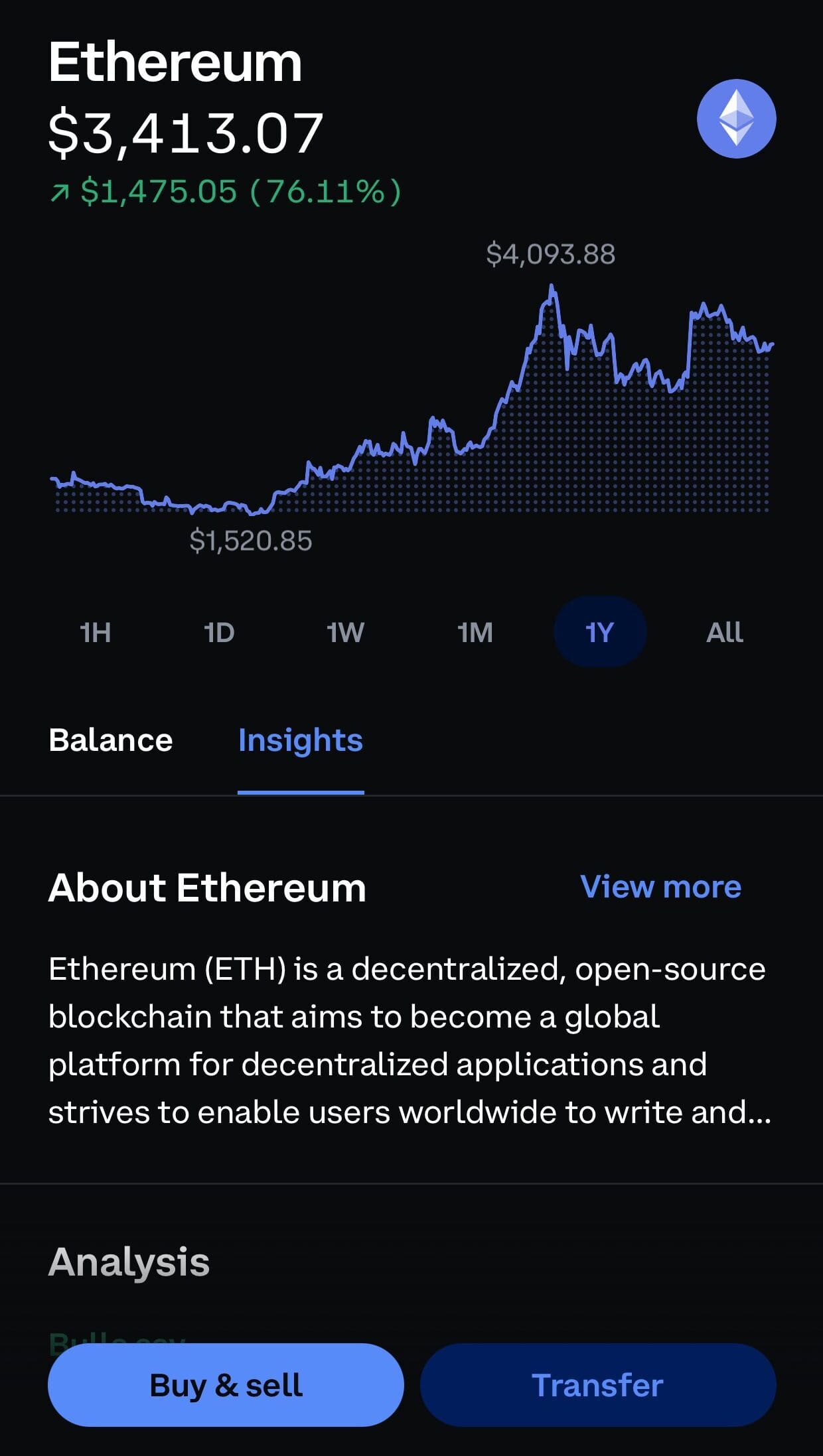

Ethereum is the second-largest cryptocurrency by market cap and the foundation of much of the decentralized finance (DeFi) ecosystem.

Since its transition to a Proof-of-Stake (PoS) model, Ethereum has become more energy-efficient, but is it the right investment for you?

Let’s break down how Ethereum works as an investment, its pros and cons, and how to approach ETH in your portfolio.

Pros and Cons of Investing in Ethereum

Investing in Ethereum offers unique opportunities — but also comes with real risks. Here’s a balanced view:

Pros | Cons |

|---|---|

Strong developer and user base | High gas fees during congestion |

Passive income from staking | Regulatory classification unclear |

Broad dApp ecosystem | Still resolving scalability issues |

Energy-efficient (Post-Merge) | Competition from alternative chains |

- Strong Developer Community

Ethereum has the largest ecosystem of developers and dApps, constantly building innovations across DeFi, NFTs, and Web3.

- Earning Potential Through Staking

After moving to Proof-of-Stake, investors can earn passive income by staking ETH while holding it long-term.

- Long-Term Utility & Adoption

As the go-to network for smart contracts, Ethereum continues to be integrated in financial services, gaming, and decentralized identity systems.

- Improved Sustainability

The switch to PoS reduced Ethereum’s energy consumption by over 99%, making it more ESG-friendly.

- High Transaction Fees (Gas Fees)

Despite Layer 2 solutions, Ethereum is still expensive during high network congestion, especially for retail users.

- Regulatory Uncertainty

Ethereum’s classification as a security vs. commodity remains debated in the U.S., which may impact future adoption.

- Scalability Challenges Remain

Even with upgrades, Ethereum’s speed and cost structure lag behind newer blockchains like Solana or Avalanche.

- Competition From Other Chains

Ethereum faces growing pressure from cheaper and faster Layer 1 alternatives that are rapidly gaining traction.

How Ethereum’s Role in DeFi and NFTs Drives Demand

Ethereum is the backbone of most decentralized finance (DeFi) and NFT activity. Its smart contract capabilities allow developers to build dApps that let users lend, borrow, trade, and earn without banks.

Additionally, the vast majority of NFTs are minted and traded on Ethereum, making it essential for digital art, gaming, and metaverse platforms.

As demand for these applications grows, so does the need for ETH to pay transaction fees and interact with these services — driving long-term demand and value.

When Investing in Ethereum May Be a Good Idea

Ethereum can be a strong addition to your portfolio when certain factors align with your strategy and market outlook.

You Believe in Blockchain Innovation: If you're confident in Ethereum’s role in powering DeFi, NFTs, and Web3 apps, it may offer long-term upside.

You Want Passive Income from Staking: Staking ETH provides a way to earn rewards, making it appealing for those seeking yield from their crypto holdings.

You’re Investing for the Long Term: Ethereum has shown resilience and consistent developer activity, which may benefit patient investors over time.

You’re Comfortable with Moderate Risk: ETH offers higher potential returns than traditional assets, but you should be able to handle short-term volatility.

When Investing in Ethereum May Not Be a Good Idea

Ethereum isn’t the right fit for every investor—especially if your goals or risk profile don’t match crypto’s characteristics.

You Need Liquidity Soon: ETH prices can swing sharply, so it's risky if you plan to withdraw funds in the near future.

You're Unfamiliar with Crypto Storage: If managing wallets, private keys, or exchanges feels overwhelming, you may want to start with simpler investments first.

You’re Uncomfortable with Volatility: Ethereum often experiences double-digit percentage swings in short timeframes — not ideal for conservative investors.

You Expect Guaranteed Income: Staking yields vary and aren't fixed like traditional interest rates, so returns are never guaranteed.

How to Invest in Ethereum

Investing in Ethereum involves several steps, each with varying levels of risk, control, and potential return. Your approach should match your goals and technical comfort.

-

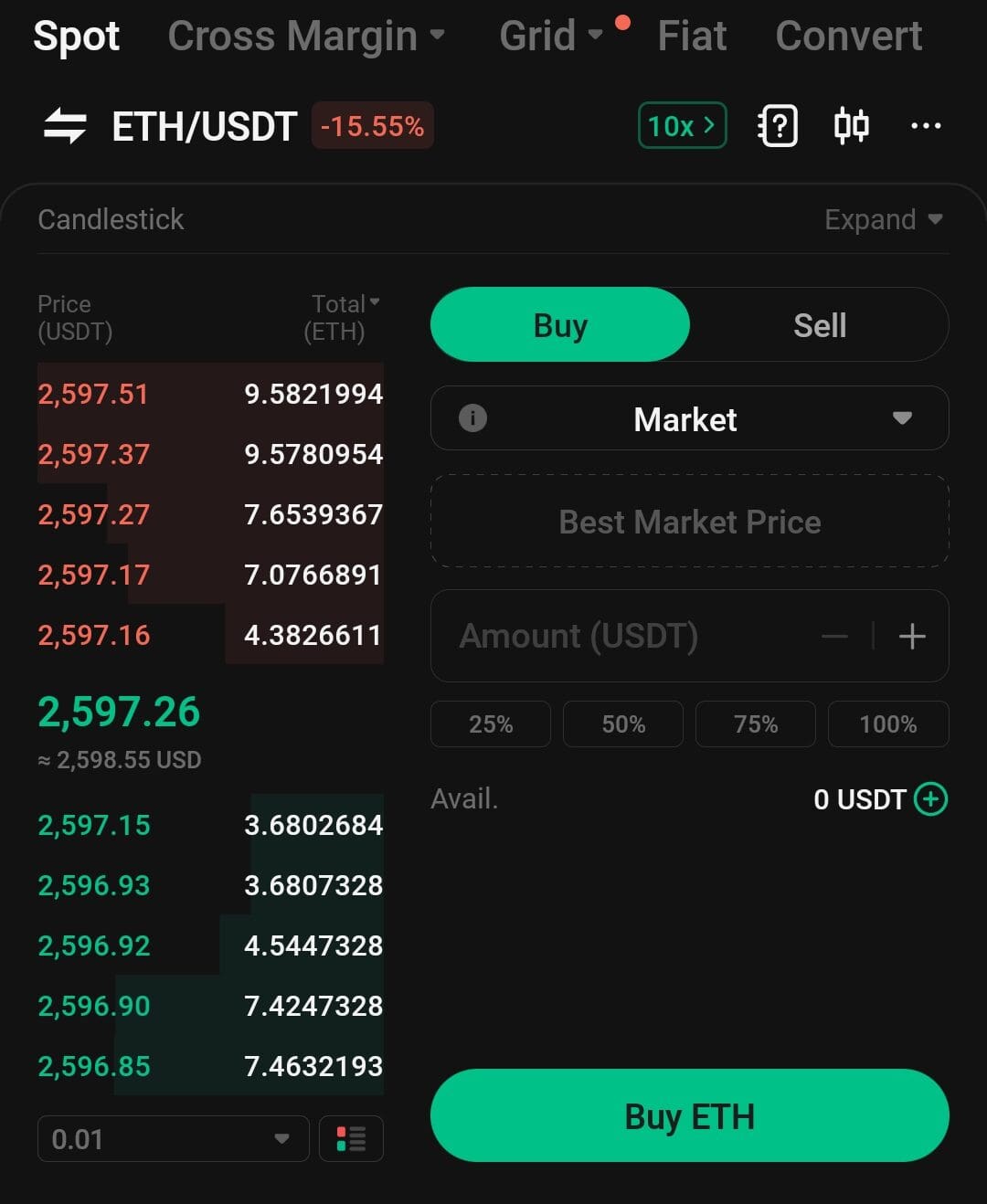

Buy ETH Through a Crypto Exchange

Start by creating an account on trusted platforms like Coinbase, Binance, or Kraken. You can fund your account with a bank transfer, credit card, or even other crypto assets.

-

Secure ETH in a Wallet

For better control, move your ETH off exchanges into a wallet.

Software wallets like MetaMask are good for DeFi use, while hardware wallets like Ledger or Trezor offer stronger protection for long-term storage.

-

Stake ETH to Earn Rewards

If you're holding ETH, consider staking to earn yields.

Platforms like Lido offer liquid staking, while exchanges like Coinbase let you stake directly without setting up validators.

-

Invest via Ethereum ETFs or Funds

In the US, Ethereum ETFs or trusts offer exposure through traditional brokerage accounts — ideal for hands-off investors.

Bottom Line: Should I Buy Ethereum?

Ethereum can be a compelling investment if you believe in the future of decentralized technology and are comfortable with moderate risk.

It offers utility, growth potential, and staking income, but it’s not without volatility or regulatory uncertainty.

As with any investment, it's smart to diversify and avoid allocating more than you're willing to lose. Ethereum fits best as a long-term, high-upside asset in a balanced portfolio.

FAQ

Ethereum has different use cases than Bitcoin, focusing on utility rather than being just a store of value. While it has higher upside potential, it also carries more technological and regulatory risks.

Staking ETH allows you to earn passive income, but it locks your funds for a period and involves added risks like slashing. Holding ETH keeps your liquidity intact, which may be preferable in volatile markets.

Ethereum’s price is influenced by demand for smart contracts, NFT and DeFi activity, gas fees, staking participation, and broader market sentiment.

Ethereum burns a portion of transaction fees, reducing supply over time. This deflationary pressure can support price appreciation, especially when demand rises.

Yes, The Merge has improved Ethereum’s energy efficiency and staking appeal. However, long-term performance still depends on adoption and future upgrades.

Absolutely. ETH is required to interact with dApps, pay for gas fees, and engage with NFTs and DeFi protocols — adding to its functional value.

Layer 2s improve Ethereum’s scalability and user experience. Greater adoption of these solutions can increase ETH usage, driving long-term value.

No, Ethereum does not have a hard cap. However, fee burning and staking incentives may reduce net issuance, potentially making it deflationary.

Yes. Staking yields vary and include risks like slashing, validator downtime, and ETH price drops. Always understand the terms before staking.

It depends on your risk tolerance. Some crypto IRAs support ETH, but due to volatility, it should only be a small part of a diversified retirement strategy.