Table Of Content

Where to Buy Bitcoin Online?

Buying Bitcoin online has become more accessible than ever, thanks to a wide range of user-friendly platforms catering to all experience levels.

Crypto Exchanges: These platforms allow you to buy, sell, and store Bitcoin in one place. Coinbase, crypto.com, Gemini, and Kraken are among the most widely used for Americans.

Brokerage Apps (e.g., Robinhood, eToro): You can buy Bitcoin through investment apps. However, some platforms don’t let you withdraw your crypto directly.

Bitcoin ATMs and P2P Platforms: You can also buy Bitcoin in person through a Bitcoin ATM or via peer-to-peer platforms like Paxful, which connect you with other buyers and sellers.

How to Buy Bitcoin on Major Exchanges

Buying Bitcoin on major exchanges like Coinbase, Gemini, or Kraken is straightforward once you understand the process. Here’s a step-by-step guide to help you through it:

1. Create and Verify Your Account

First, choose a reputable exchange such as Coinbase, Kraken, or Binance. You’ll need to sign up with your email and create a strong password. These platforms will ask you to verify your identity to comply with regulations.

Upload a government-issued ID (passport or driver’s license)

Submit a selfie or complete a live verification

Provide proof of residence if required (utility bill, bank statement)

This step helps ensure account security and is required under KYC (Know Your Customer) laws. Without verification, you won’t be able to deposit money or make large transactions.

Platform | Coins | Spot Trading Fee | Best For | Crypto.com | +350 | 0.075%

For both maker and taker orders. The more you trade, the lower the fees – can decrease to as low as 0% – 0.050%. Holding and staking CRO tokens, Crypto.com native token, unlocks additional fee discounts. | All-in-One Crypto Services |

|---|---|---|---|

Kraken | +300 | 0.40% – 0.25%

0.40% for taker trades and 0.25% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.10%. Using GT tokens to pay trading fees offers a 10% discount | Advanced Traders |

Coinbase | +250 | $0.99 – 2.00% (Standard), 0.05% – 0.60% (Advanced Trade)

For transactions above $200 (standard account): 1.49% fee for using a bank account or USD wallet, 3.99% fee for using a debit or credit card. For Coinbase Advanced Trade: 0.60% for taker trades and 0.40% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.05%. | Beginners |

Gemini | +150 | $0.99 – 1.49% (Web & Mobile), 0.20% – 0.40% (Active Trader)

For Gemini’s website or mobile app users are charged 0.50% convenience fee For Active Trader, 0.40% for taker trades and 0.20% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.03%. | Compliance & Regulation |

Robinhood | +20 | $0 | Fee-Free Trading |

MEXC | +2,300 | 0% – 0.10%

0.00% for taker trades and 0.10% for maker trades. | Low Fee |

- The Smart Investor Tip

Set up 2-factor authentication (2FA) right after creating your account. This provides an extra layer of protection, especially if your email gets compromised.

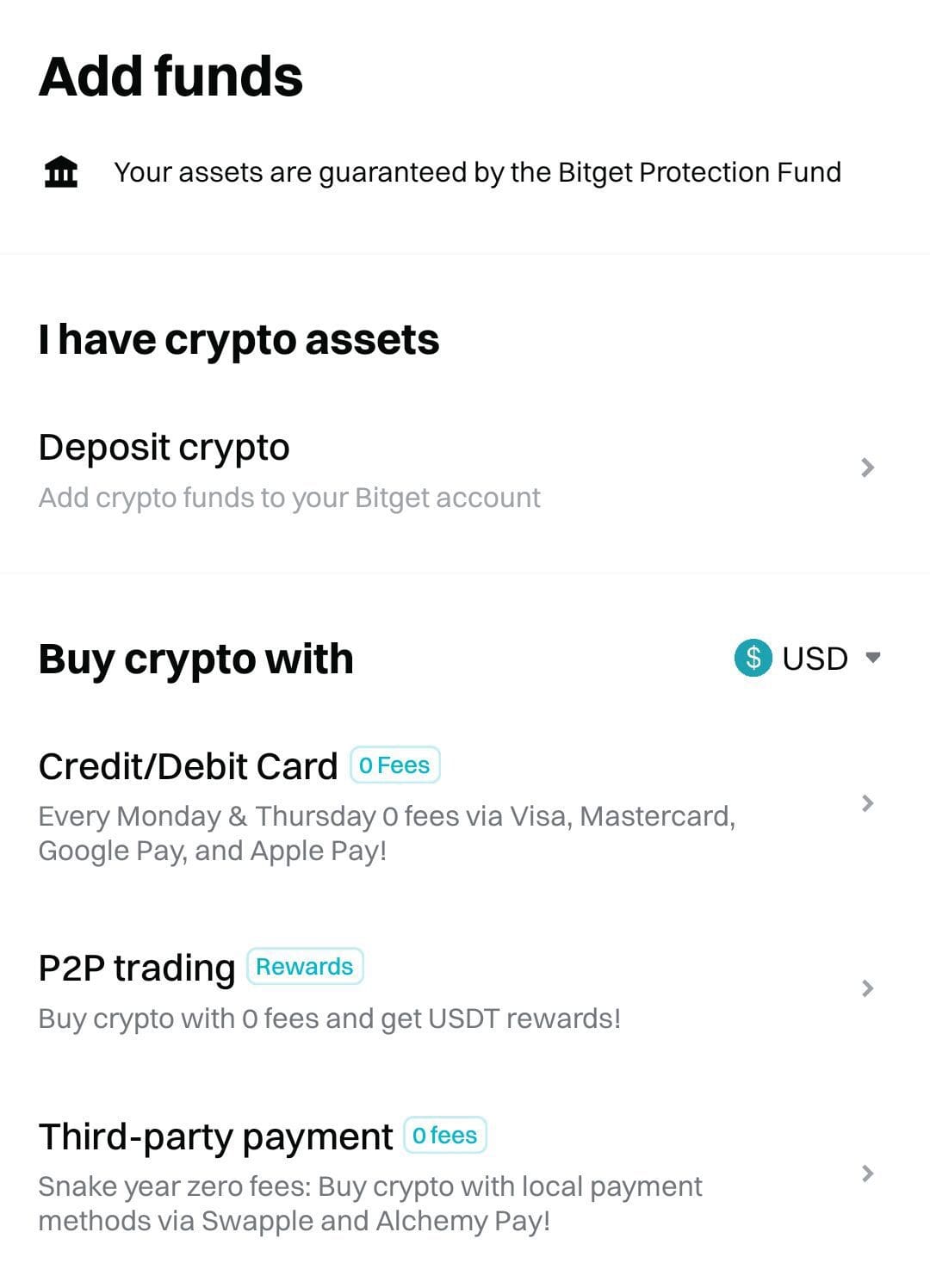

2. Fund Your Account

Once verified, you can deposit funds into your account. Most exchanges accept a range of payment methods, including:

Bank transfer (ACH or wire): Ideal for larger amounts, though slower (1–3 business days)

Credit/debit cards: Faster, but usually comes with higher fees

Third-party apps: Some exchanges integrate with PayPal or Apple Pay for quick deposits

For example, if you're in the U.S., using ACH transfers through Coinbase is usually free and efficient, but someone needing instant access might choose a debit card, despite the extra fees.

- The Smart Investor Tip

Link your bank account in advance, even if you plan to use a card. ACH transfers often have higher limits and lower fees, which can be useful as you scale up.

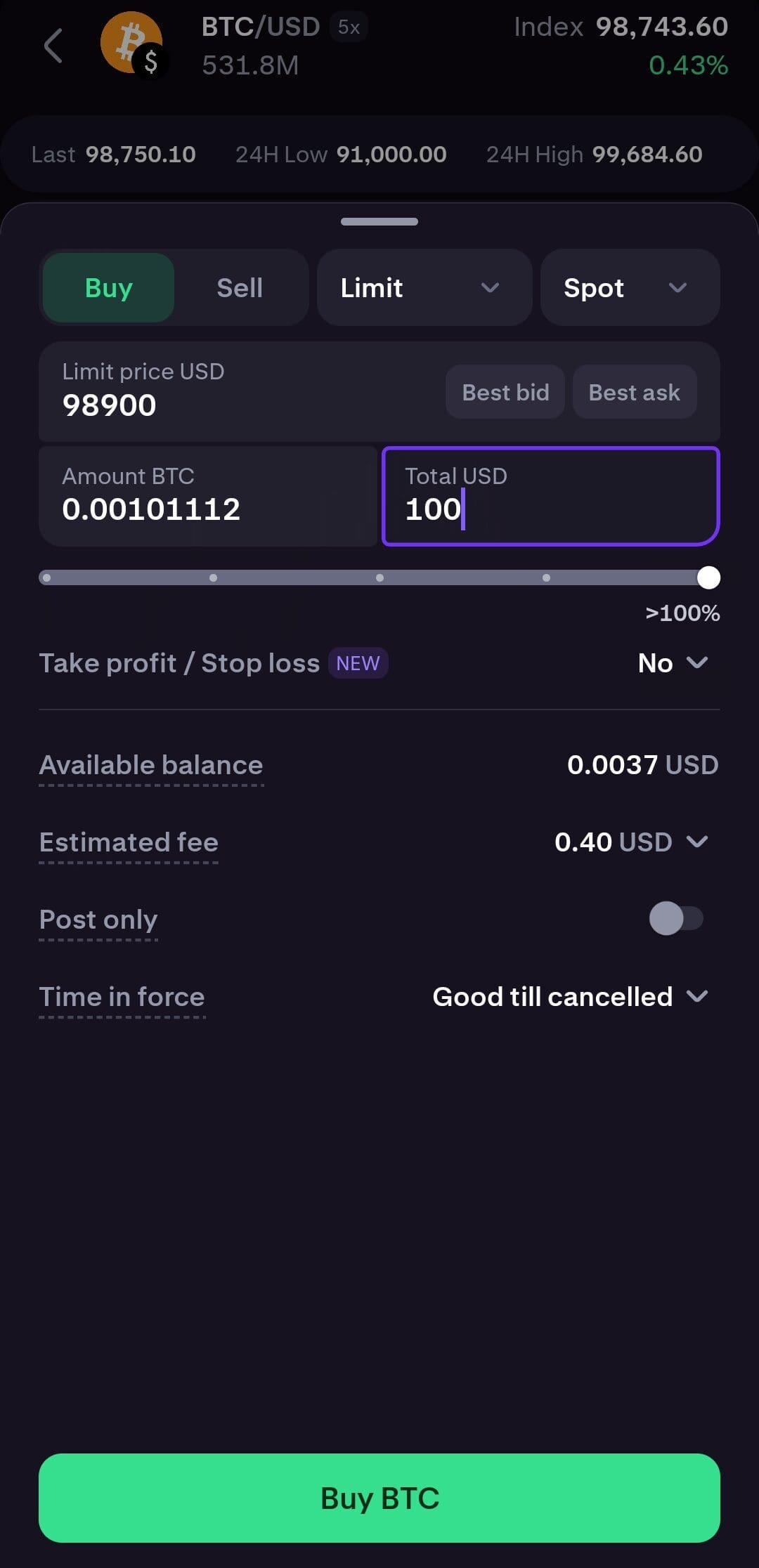

3. Choose Bitcoin (BTC) and Enter Order Details

After funding your account, search for Bitcoin (BTC) in the trading section. You’ll usually see two types of orders:

Market Order: Instantly buys Bitcoin at the current price

Limit Order: Lets you set a target price; your order executes when the market reaches it

For instance, a first-time buyer might use a market order for simplicity, while an experienced user could place a limit order to wait for a price dip.

- The Smart Investor Tip

Use a price alert tool (available on most exchanges) to get notified when Bitcoin hits your target price—this helps avoid emotionally driven buys.

4. Confirm and Execute Your Purchase

Before placing your order, review the total cost, including fees. Exchanges often show a preview screen breaking down:

Purchase amount

Network and platform fees

Final BTC amount you’ll receive

This transparency helps you avoid surprises. For example, buying $100 worth of BTC might leave you with only $97 in crypto after fees. Once you confirm, your order is executed, and Bitcoin will appear in your account's wallet section.

5. Store Your Bitcoin Safely

After purchase, you can either leave your Bitcoin on the exchange or transfer it to a private wallet for added security. While exchanges like Coinbase offer insured custodial wallets, keeping your crypto in a personal hardware wallet reduces exposure to hacks.

Hot wallets (e.g., Trust Wallet, MetaMask): Convenient for frequent access but online

Cold wallets (e.g., Ledger, Trezor): More secure for long-term storage

As a result, many users transfer large amounts off exchanges to cold wallets. Ledger and Trezor are two trusted hardware wallet providers known for security.

How to Buy Bitcoin Directly From Brokerage Apps

Buying Bitcoin through brokerage apps is designed to be simple and user-friendly. These platforms are ideal if you're already investing in stocks or ETFs and want to add Bitcoin easily.

The overall process is very similar across platforms like Robinhood, SoFi, Webull, and eToro, though some features vary:

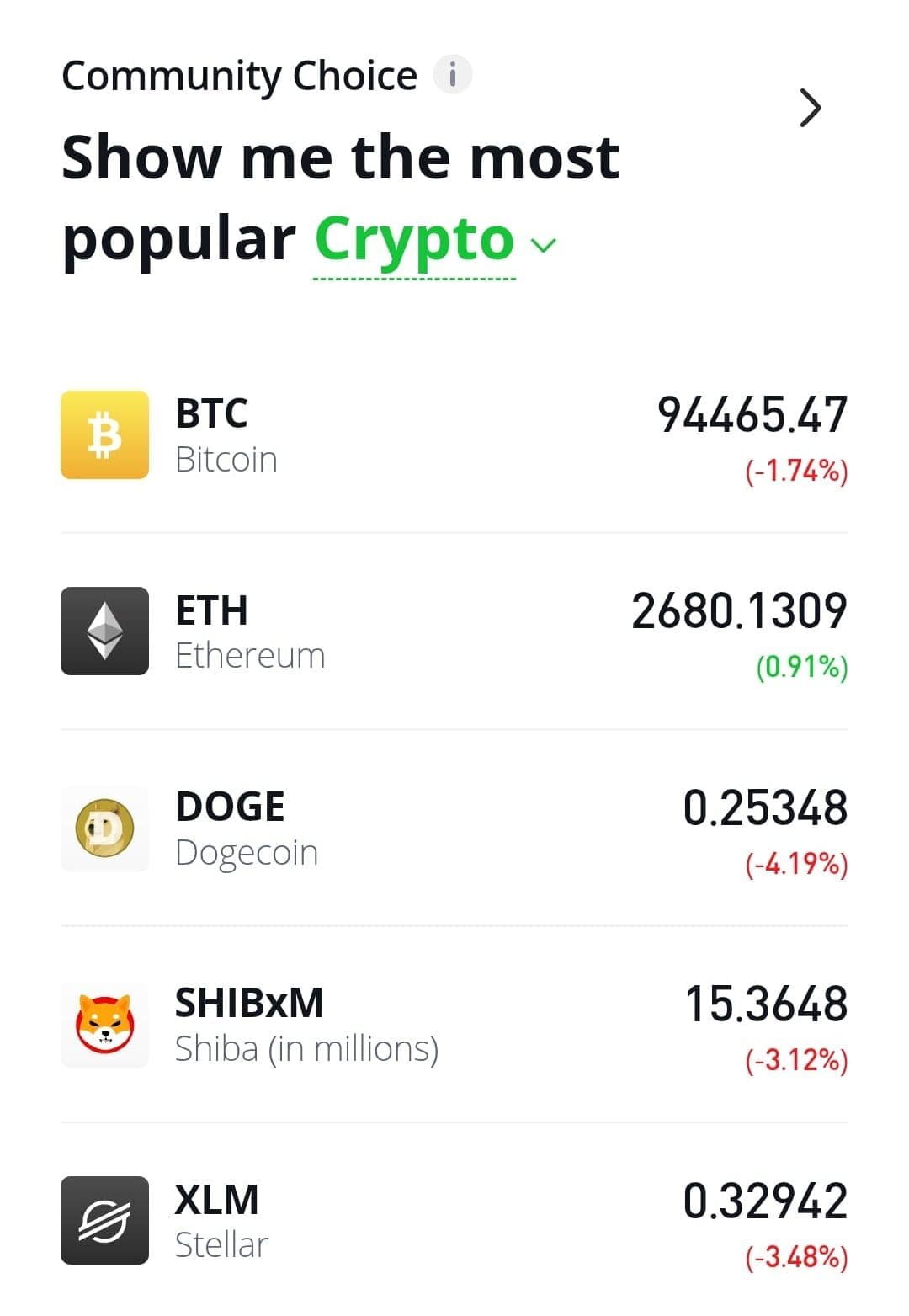

Search for Bitcoin (BTC): Navigate to the crypto section or search for Bitcoin just like you would a stock. You’ll usually see real-time price data, charts, and a basic overview of the asset.

Choose an Amount to Buy: You can typically buy fractional Bitcoin—meaning you don’t need to buy a whole BTC. Enter the amount in dollars (e.g., $10 or $100), and the platform will calculate how much BTC you’ll get.

However, because these are not dedicated crypto exchanges, they may lack advanced features but are excellent for casual or beginner investors.

How to Buy Bitcoin Directly From a Friend or Local Meetup

Buying Bitcoin from a friend or at a local crypto meetup offers more privacy, but it requires trust and caution. This method is often used by those who want to avoid exchange fees or prefer peer-to-peer (P2P) transactions.

Agree on a price: Use a site like CoinMarketCap or CoinGecko to check the current market rate and negotiate accordingly.

Choose a payment method: You can pay in cash, Venmo, Zelle, or bank transfer. Always confirm receipt before releasing the Bitcoin.

Use a crypto wallet: You’ll need a wallet like Trust Wallet or BlueWallet to receive Bitcoin. Your friend can scan your wallet QR code to send BTC directly.

Consider meeting in public: For safety, meet in a coffee shop or bank lobby—and if large amounts are involved, bring a trusted third party.

As a result, this method gives more control, but always take security precautions to avoid scams or disputes.

Common Mistakes To Avoid When Buying Bitcoin

Many new investors make avoidable errors when buying Bitcoin, which can result in higher fees, lost funds, or security risks.

Skipping wallet setup: Buying Bitcoin without a proper wallet means you may leave it vulnerable on an exchange. Use a wallet like Trust Wallet or Ledger for safer storage.

Ignoring fees: Platforms often charge different deposit and trading fees. For example, buying via credit card on Coinbase can cost up to 3.99%.

Falling for scams: Avoid Telegram “giveaways,” suspicious websites, or unsolicited DMs claiming to offer BTC. If it sounds too good to be true, it usually is.

Buying based on hype: FOMO (fear of missing out) can lead to bad timing. Instead, dollar-cost averaging (DCA) spreads out risk.

Using weak security: Not enabling two-factor authentication (2FA) leaves your account open to hacks.

Avoiding these mistakes can protect both your Bitcoin and your peace of mind.

FAQ

Most platforms allow you to buy Bitcoin in small fractions, sometimes as little as $1. This makes it easy to get started without needing to purchase a whole coin.

Not always—most exchanges and apps provide a built-in wallet. However, using a personal wallet gives you more control and security over your assets.

Regulated platforms require identity verification, so anonymous purchases are generally not possible unless you're using decentralized peer-to-peer methods, which carry more risk.

On most platforms, Bitcoin is credited to your account immediately after purchase, but blockchain confirmations may take several minutes to finalize the transaction.

It’s possible but usually comes with higher fees and risk of chargebacks. Many exchanges recommend using bank transfers for security and lower cost.

Buying Bitcoin itself isn’t taxable, but selling, spending, or converting it into another asset can trigger a taxable event depending on your location.

Yes, many platforms offer recurring buys or dollar-cost averaging tools. This helps you invest consistently over time, regardless of short-term price changes.

You can send Bitcoin to someone else’s wallet after buying, but buying directly in their name may not be allowed unless using a shared or custodial account.

A private key is your digital password to access Bitcoin in a personal wallet. You don’t need one to buy Bitcoin on an exchange, but you will if you transfer it to a private wallet.

Once a Bitcoin transaction is broadcast to the blockchain, it cannot be canceled or reversed. Always double-check wallet addresses before sending.