Table Of Content

Is It Safe to Buy Bitcoin on eToro?

Yes, buying Bitcoin on eToro is generally safe because the platform is regulated by top financial authorities like the FCA, CySEC, and ASIC . It also uses advanced encryption, two-factor authentication (2FA), and secure asset storage methods.

However, like any investment, Bitcoin carries market risks you should carefully consider before purchasing.

How to Buy Bitcoin on eToro In 4 Simple Steps

Buying Bitcoin on eToro is straightforward, but making smart choices at each step can improve your experience and investment outcomes.

1. Define Your Bitcoin Investment Approach

Before purchasing, it’s crucial to see where Bitcoin fits within your broader investment goals and risk tolerance.

Bitcoin is volatile, therefore understanding its role can help you avoid impulsive decisions and build a more balanced strategy.

Evaluate your financial goals: Are you aiming for short-term gains or long-term store of value?

Analyze your risk appetite: Bitcoin can swing wildly, so invest amounts you are comfortable holding through volatility.

Plan your holding strategy: Decide if you'll hold Bitcoin long-term, swing trade, or allocate a small percentage for diversification.

Taking a moment to align Bitcoin with your personal goals ensures that you're investing thoughtfully rather than emotionally.

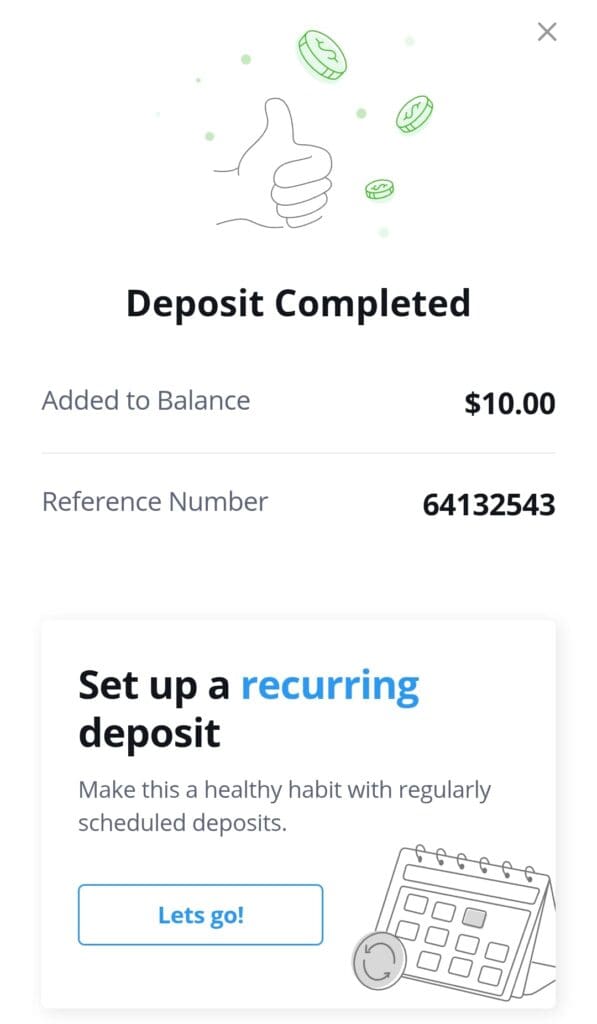

2. Deposit Funds into Your eToro Account

In order to buy Bitcoin, you’ll first need to add funds to your eToro account. eToro offers a variety of payment methods, making the process both quick and flexible for different types of users.

Choose a payment method: Options include bank transfers, credit/debit cards, PayPal, and e-wallets like Skrill.

Consider deposit fees: Some methods may incur small processing fees; reviewing them can save you money.

Ensure sufficient balance: Factor in the Bitcoin amount you plan to buy plus a little extra for possible transaction fees.

Because payment methods differ by region, it’s best to check which options offer the fastest and most cost-effective funding for your needs.

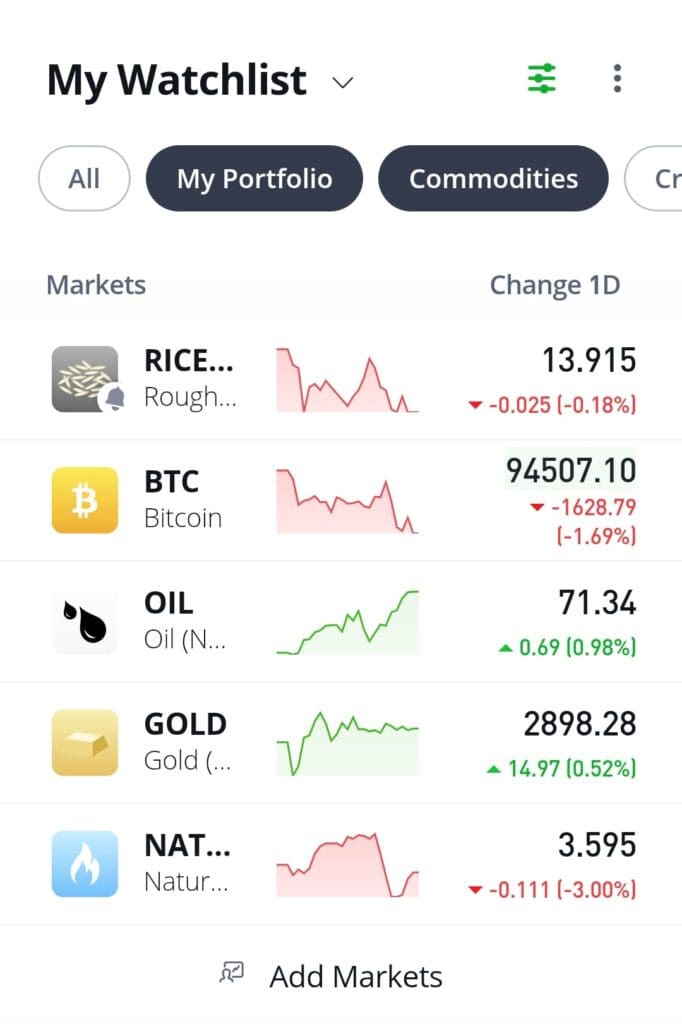

3. Find Bitcoin (BTC) and Analyze Its Current Trends

Once your account is funded, the next step is to locate Bitcoin on eToro and assess market conditions. Analyzing basic metrics can help you make a better-timed purchase.

Search for Bitcoin (BTC): Simply use the search bar at the top of your eToro dashboard.

Review recent price movements: Look at the short-term and long-term charts to identify trends or patterns.

Explore analyst opinions: eToro offers a social feed where investors discuss market sentiment, providing extra insights.

Understanding the current market conditions helps you avoid buying at random and gives you confidence in your investment timing.

4. Place Your Bitcoin Order

After researching, you’re ready to execute your Bitcoin purchase on eToro. The platform offers different order types, allowing you to tailor your purchase to your strategy.

Select ‘Trade’ to begin: You can choose to buy Bitcoin at the current market price.

Set a custom amount or stop-loss/take-profit: Manage your risk by setting predefined sell levels.

Consider a recurring investment: eToro allows setting regular purchases to build your position over time.

By placing a thoughtful order, you create better control over your Bitcoin exposure rather than relying solely on market luck.

Mistakes To Avoid When Buying Bitcoin on eToro

Buying Bitcoin on eToro can be smooth, but overlooking key steps may result in avoidable mistakes that impact your investment results.

Ignoring Bitcoin volatility: Bitcoin’s price can swing significantly within hours, therefore buying without preparation can lead to emotional selling.

Skipping fee awareness: While eToro offers commission-free crypto trading, spreads and withdrawal fees apply and can eat into your profits.

Using leverage unnecessarily: eToro allows crypto trading with leverage, but overusing it increases your risk of liquidation losses.

Neglecting security features: Failing to set up two-factor authentication (2FA) can expose your account to unnecessary risks.

Not planning an exit strategy: Buying without a plan for when to sell may cause you to react poorly during market downturns.

By staying mindful of these pitfalls, you can better protect your capital and make smarter, more confident Bitcoin purchases on eToro.

Alternative Places To Buy Bitcoin

Although eToro is a solid choice, several other platforms also offer secure, user-friendly options to buy Bitcoin based on your needs.

Coinbase: Ideal for beginners because of its intuitive interface, educational resources, and strong regulatory compliance.

Kraken: Offers lower trading fees and advanced security, making it a favorite for serious investors and active traders.

Gemini: Provides a highly regulated environment, plus insurance coverage on crypto holdings for added peace of mind.

Crypto.com: Allows users to earn rewards on Bitcoin holdings through staking features and offers a highly functional mobile app.

Binance.US: Delivers low trading fees and advanced features, but may feel overwhelming for beginners due to its dense dashboard.

Exploring different platforms gives you the flexibility to prioritize what matters most—whether it's low fees, user experience, security, or extra features.

Platform | Coins | Spot Trading Fee | Best For | Crypto.com | +350 | 0.075%

For both maker and taker orders. The more you trade, the lower the fees – can decrease to as low as 0% – 0.050%. Holding and staking CRO tokens, Crypto.com native token, unlocks additional fee discounts. | All-in-One Crypto Services |

|---|---|---|---|

Kraken | +300 | 0.40% – 0.25%

0.40% for taker trades and 0.25% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.10%. Using GT tokens to pay trading fees offers a 10% discount | Advanced Traders |

Coinbase | +250 | $0.99 – 2.00% (Standard), 0.05% – 0.60% (Advanced Trade)

For transactions above $200 (standard account): 1.49% fee for using a bank account or USD wallet, 3.99% fee for using a debit or credit card. For Coinbase Advanced Trade: 0.60% for taker trades and 0.40% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.05%. | Beginners |

Gemini | +150 | $0.99 – 1.49% (Web & Mobile), 0.20% – 0.40% (Active Trader)

For Gemini’s website or mobile app users are charged 0.50% convenience fee For Active Trader, 0.40% for taker trades and 0.20% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.03%. | Compliance & Regulation |

Robinhood | +20 | $0 | Fee-Free Trading |

MEXC | +2,300 | 0% – 0.10%

0.00% for taker trades and 0.10% for maker trades. | Low Fee |

FAQ

You can start buying Bitcoin on eToro with as little as $10, making it accessible for beginners who want to invest small amounts.

Yes, eToro allows transferring Bitcoin to the eToro Money crypto wallet, but you must first meet withdrawal requirements and verify your account.

eToro does not charge custody fees for holding Bitcoin, but if you’re inactive for 12 months, an inactivity fee may apply to your account balance.

Using a limit order can help you control the price you pay for Bitcoin, especially during volatile market conditions where prices move rapidly.

Yes, you can use CopyTrader to automatically mirror Bitcoin trades of experienced investors, but be sure to review their past performance first.

When you buy real Bitcoin on eToro without leverage, you own the actual asset. Leveraged trades, however, are handled as CFDs instead.

During extreme volatility, eToro may temporarily pause Bitcoin trading to protect users from major price slippage, resuming operations once markets stabilize.

eToro does not offer automatic recurring crypto purchases yet, so you need to manually place new Bitcoin buy orders as desired.

While eToro offers staking for some coins like Ethereum and Cardano, Bitcoin staking is not available since Bitcoin uses a proof-of-work model.