Table Of Content

Bitcoin, the first and most recognized cryptocurrency, offers a decentralized way to invest, store value, and transact globally.

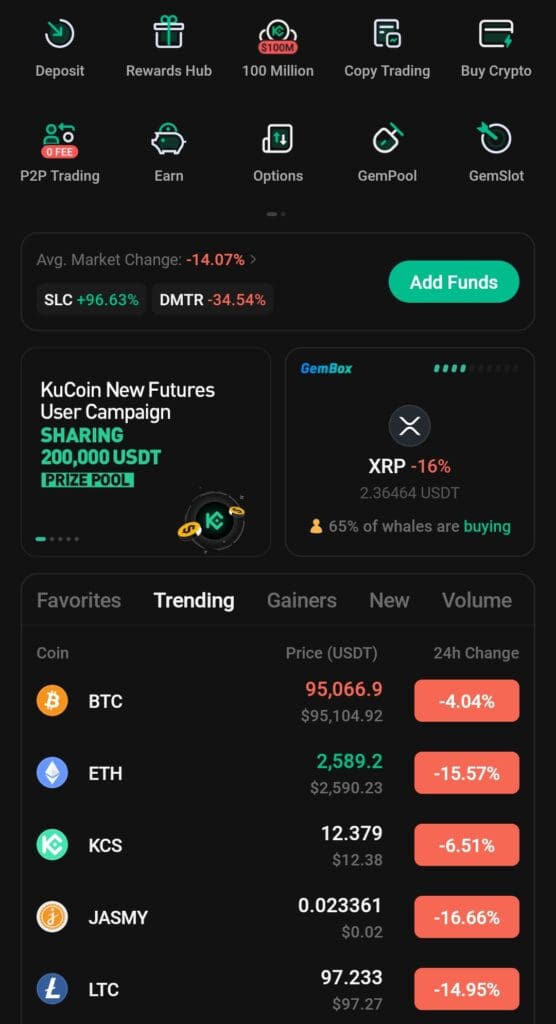

KuCoin, a popular exchange launched in 2017, has gained trust for its wide range of cryptocurrencies, low trading fees, and user-friendly interface. Many investors prefer KuCoin because it offers spot, margin, and futures trading under one platform.

Is It Safe to Buy Bitcoin on KuCoin?

Yes, KuCoin is generally considered safe for buying Bitcoin. However, U.S. residents can't use it as the platform does not comply with U.S. regulations.

The platform uses advanced security measures, including multi-layered encryption, two-factor authentication, and a dedicated risk control department.

However, because KuCoin is a centralized exchange, it’s important to move large holdings to a private wallet for maximum protection after purchase.

How to Buy Bitcoin on KuCoin in 4 Simple Steps

Buying Bitcoin on KuCoin is fast once you understand the key steps to follow safely and strategically.

Step 1: Explore Bitcoin Investing & Match It to Your Strategy

Before buying, it’s important to match Bitcoin’s potential with your financial goals and risk tolerance. KuCoin offers both long-term storage and active trading features, making it flexible for different investors.

Understand Bitcoin’s Volatility: Bitcoin’s price can rise or fall sharply within hours, so be prepared for sudden changes.

Choose Your Investment Style: Decide whether you aim to trade Bitcoin actively or hold it for the long term based on your strategy.

Allocate Responsibly: Limit your Bitcoin exposure to an amount that fits your broader portfolio goals.

As a result, spending a little extra time evaluating your approach will help you avoid common mistakes, such as panic selling during market dips.

- The Smart Investor Tip

Before buying, take time to define whether you want to trade actively or hold Bitcoin long term. Matching your approach to Bitcoin’s volatility can protect you from emotional decision-making during price swings.

Step 2: Fund Your KuCoin Account

In order to buy Bitcoin, you need to ensure your KuCoin account is properly funded with fiat or crypto. KuCoin supports several payment methods like bank cards, peer-to-peer (P2P) transfers, and third-party gateways.

Use a Bank Card or Third-Party Payment: You can buy USDT or other stablecoins directly via credit/debit cards through trusted providers like Simplex.

Deposit Crypto: If you already hold crypto like USDT or ETH elsewhere, transferring it into KuCoin is often faster and cheaper.

P2P Market: KuCoin’s P2P marketplace allows you to buy crypto from verified sellers using PayPal, bank transfer, or other methods.

Therefore, selecting the right funding method depends on your budget, speed needs, and payment preferences.

Step 3: Find Bitcoin on KuCoin and Choose Purchase Method

KuCoin provides multiple ways to buy Bitcoin, including spot trading, quick buy options, and trading bots, depending on your experience level.

Quick Buy/Sell: If you want instant purchases, use KuCoin’s ‘Fast Buy' feature to exchange fiat or stablecoins into Bitcoin quickly.

Spot Market: For better rates, place a limit order in the spot market, where you can specify your desired purchase price.

KuCoin Trading Bot: You can automate purchases based on specific price targets using KuCoin’s free trading bot.

Because KuCoin caters to both beginners and advanced users, you have flexibility to choose a method that matches your comfort level and goals.

Step 4: Secure Your Bitcoin After Purchase

After purchasing Bitcoin, securing it properly is essential. KuCoin lets you store coins in your exchange wallet, but for maximum safety, consider external options.

Withdraw to a Private Wallet: Move your Bitcoin to a hardware or software wallet where you control the private keys.

Set Up Two-Factor Authentication (2FA): If you plan to keep some Bitcoin in your KuCoin account, strengthen your KuCoin account security to reduce risk.

Use KuCoin’s Cold Wallet Service: If you hold Bitcoin on KuCoin, use their cold wallet features for enhanced internal storage protection.

In conclusion, the safest practice is to combine KuCoin’s security tools with your own self-custody strategies to fully protect your Bitcoin investment.

- The Smart Investor Tip

After buying, move your Bitcoin to a wallet where you control the private keys. Using a hardware wallet ensures that even if an exchange is hacked, your Bitcoin remains safe and accessible.

Mistakes to Avoid When Buying Bitcoin on KuCoin

Buying Bitcoin is exciting, but mistakes can be costly if you're not careful. KuCoin provides a smooth experience, but personal choices still matter.

Skipping Research: Jumping in without understanding Bitcoin’s volatility can lead to panic selling during normal price swings.

Using Market Orders Blindly: Buying with market orders during low liquidity times may cause you to pay a significantly higher price.

Ignoring Security Practices: Not setting up two-factor authentication (2FA) makes your account vulnerable even if KuCoin’s platform is secure.

Overfunding an Exchange Wallet: Keeping too much Bitcoin on the exchange exposes you to unnecessary custodial risk.

Missing P2P Advantages: You might find better prices through KuCoin’s P2P platform, especially during high-demand periods.

Therefore, planning your Bitcoin purchase smartly can help you avoid common traps and build a stronger crypto portfolio.

Alternative Places to Buy Bitcoin for U.S. Residents

While KuCoin is restricted in the United States, U.S. residents also have access to several strong Bitcoin purchasing platforms, each offering different benefits.

Coinbase offers an easy-to-use interface and FDIC-insured USD balances, but it also has relatively higher fees than others.

Kraken: Known for strong security measures and a wide range of trading pairs, making it ideal for active traders.

Gemini: Provides regulatory compliance and insured hot wallets, which may appeal to cautious, first-time Bitcoin buyers.

Cash App: Good for beginners who want a fast and simple way to buy Bitcoin without needing a separate exchange account.

As a result, depending on your priorities—such as regulation, fees, or ease of use—you may prefer different platforms over KuCoin for your Bitcoin needs.

FAQ

No, U.S. residents are no longer be able to open an account on KuCoin. Users should seek alternative platforms that operate legally within the United States.

No, you can buy and trade smaller amounts of Bitcoin without completing KYC. However, KYC verification increases withdrawal limits and security.

KuCoin does not allow direct USD deposits, but you can use credit cards, third-party services, or P2P platforms to purchase Bitcoin with USD.

KuCoin caters to both; beginners benefit from quick buy features, while advanced traders appreciate margin trading, futures, and trading bots.

KuCoin charges trading fees starting at 0.1% per transaction, but buying via third-party services like Simplex may involve extra processing fees.

KuCoin does not currently offer automated recurring buys like Coinbase, but you can manually schedule buys at regular intervals.

Purchases through Quick Buy are usually instant, but spot market trades may take longer depending on liquidity and order type.

Yes, KuCoin provides an internal wallet, but it’s safer to transfer your Bitcoin to a personal hardware or software wallet after buying.