Table Of Content

Can You Buy Walmart Stock?

Yes, you can buy Walmart stock just like you would with any other publicly traded company. Walmart trades on the New York Stock Exchange (NYSE) under the ticker symbol WMT.

It’s a popular choice for investors seeking long-term growth, stable dividends, and exposure to the consumer staples sector.

Walmart has a history of steady performance, thanks to its massive retail footprint across the U.S. and international markets.

It's known for its grocery dominance, e-commerce expansion, and consistent dividend payments — making it appealing to both growth and income-focused investors.

How to Buy Walmart Stock

Buying Walmart stock is a simple process when you use a reputable online brokerage. Here's how to start:

-

1. Choose a Brokerage Platform

First, pick an online broker that provides access to U.S. stocks. Platforms like Fidelity, Charles Schwab, Robinhood, and Interactive Brokers all support Walmart stock trading.

These brokers usually offer commission-free trades and tools to research Walmart’s financials, analyst ratings, and earnings reports.

Broker | Annual Fees | Best For |

|---|---|---|

E-Trade | 0% – 0.35%

0% on stocks and ETFs in self directed brokrage, 0.35% for Core Portfolio Robo Advisor

| Options & Futures Trading |

Interactive Brokers | 0% – 0.75%

$0 online commission on U.S. listed stocks and ETFs, Options: $0.15 – $0.65 per-contract, Futures: $0.25 – $0.85 per-contract. For Interactive Advisors: asset-based management fees of 0.10% to 0.75% | Professional Trading Tools |

Fidelity | 0% – 1.04%

Fidelity Go® Robo advisor: $0: under $25,000, 0.35%/yr: $25,000 and above

Fidelity® Wealth Management dedicated advisor: 0.50%–1.50%

Fidelity Private Wealth Management® advisor-led team: 0.20%–1.04%

| Retirement Account Investing |

Vanguard | Up to 0.30%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Vanguard Digital Advisor – 0.015%, Vanguard Personal Advisor: 0.03%, Vanguard Personal Advisor Select: up to 0.03%, Vanguard Wealth Management: up to 0.03% | Low-Cost ETF Investors |

J.P. Morgan Self Investing | $0

$0 online commission on U.S. listed stocks and ETFs and $0.65 per-contract | Chase Bank Customers |

Charles Schwab | Up to 0.80%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Schwab Intelligent Portfolio – 0%, Schwab Intelligent Portfolios Premium – One-time planning fee: $300 + Monthly advisory fee: $30, Schwab Wealth Advisory: up to 0.80% | Advanced Trading Tools |

Merrill Edge | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor | Bank of America Clients |

If you're new to investing, Robinhood or SoFi might offer a more user-friendly experience. If you prefer deeper analytics, Schwab or Fidelity may be better suited.

- The Smart Investor Tip

Pick a brokerage that supports fractional shares if you're starting small.

This allows you to invest in Walmart even if you don’t have enough for a full share — great for building a position gradually while staying diversified.

-

2. Open and Fund Your Account

Once you’ve selected a brokerage, complete the sign-up process. This involves verifying your identity and linking a bank account. After funding your account, you’re ready to place an order.

For example, if WMT is trading at $60 per share and you want to purchase 5 shares, you’ll need at least $300 available in your account.

-

3. Understand Walmart’s Business and Stock Performance

Before investing, review Walmart’s recent earnings, revenue trends, and strategy. Walmart has been growing its online sales and delivery services in recent years to compete with Amazon. They’ve also been increasing automation in their warehouses and investing in private-label products.

Explore key areas such as:

Historical dividend payments and payout ratio

E-commerce vs. in-store growth

Performance of Sam’s Club and Walmart International

Operating margins and inflation-related challenges

Websites like Morningstar and Yahoo Finance provide in-depth financial snapshots and analyst opinions to help evaluate Walmart's long-term value.

-

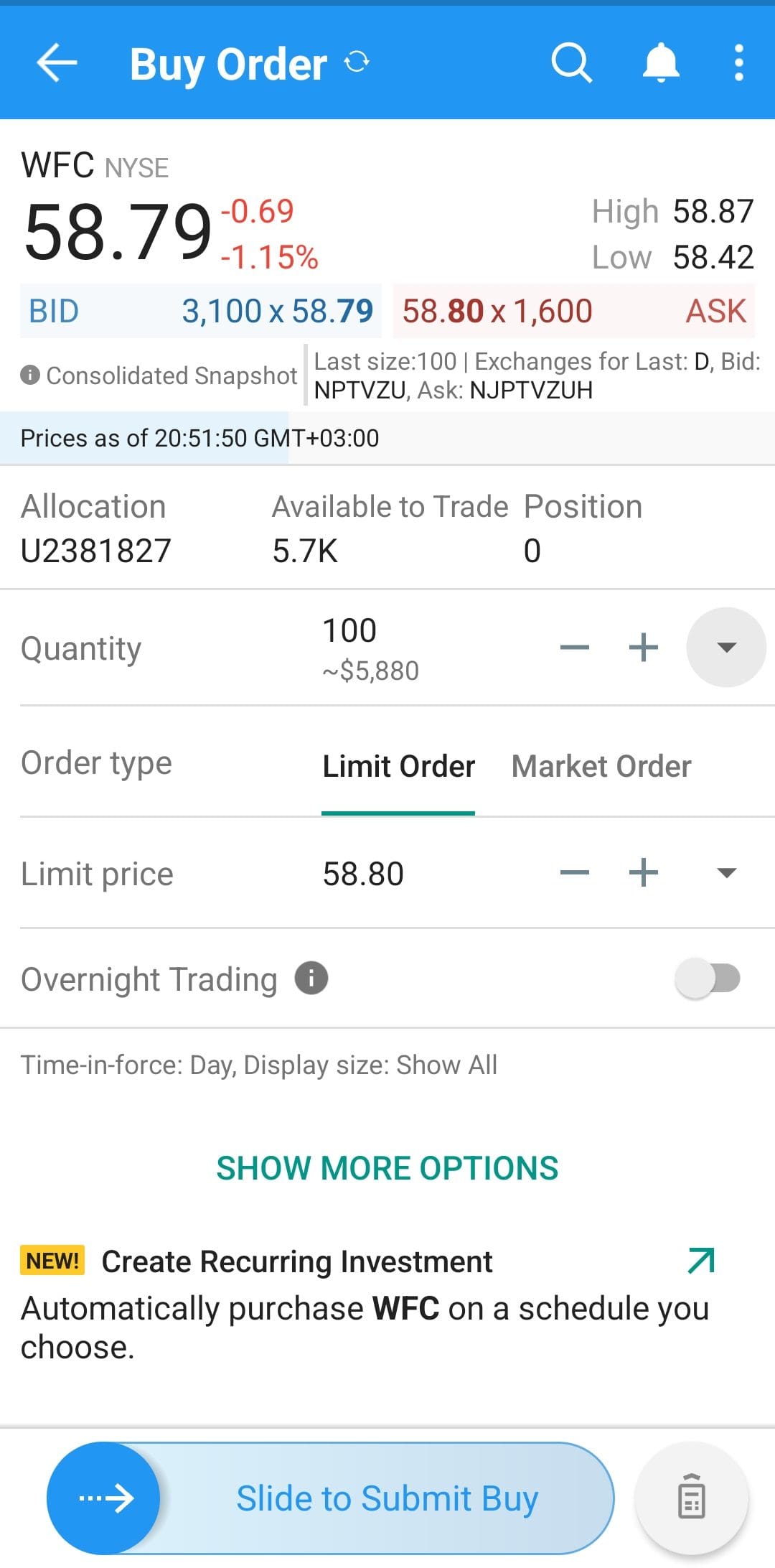

4. Place a Buy Order

Search for WMT in your brokerage account and place a buy order. You'll need to choose the type of order:

Market Order: Executes immediately at the current market price.

Limit Order: Only executes when WMT reaches a specific price you set.

If Walmart is trading at $62 but you’re only willing to pay $60, placing a limit order allows you to wait for your target price without having to monitor the stock constantly.

- The Smart Investor Tip

If you’re watching for dips, set a limit order slightly below the current price. This can help you avoid overpaying during short-term spikes, especially around earnings or retail sales data releases.

-

5. Track Your Investment Over Time

After buying Walmart stock, monitor its performance by checking quarterly earnings reports, retail sales updates, and broader consumer spending trends.

Many brokers allow you to set alerts for earnings calls or breaking news. Keep an eye on key developments like wage increases, store renovations, and competition from Amazon and Target, as they can affect Walmart’s stock price.

- The Smart Investor Tip

Set up custom alerts in your brokerage app for key Walmart events — like dividend declarations, earnings calls, or major partnerships — so you can stay informed without constantly checking the stock.

How to Get Walmart Exposure Indirectly

If you're not ready to buy Walmart stock directly, or if you'd prefer a more diversified approach, there are several indirect ways to gain exposure to Walmart’s performance through funds, portfolios, and similar strategies.

-

Invest in ETFs That Hold Walmart

A popular way to invest in Walmart indirectly is by purchasing exchange-traded funds (ETFs) that include WMT as part of their portfolio.

These ETFs provide diversification while still allowing you to benefit from Walmart’s role in the retail sector.

Many major ETFs hold Walmart as a top-10 component due to its large market capitalization and consistent financials. For instance:

Vanguard Consumer Staples ETF (VDC) includes Walmart alongside Procter & Gamble and Costco.

SPDR S&P 500 ETF Trust (SPY) allocates a portion of its holdings to Walmart, reflecting its weight in the overall U.S. stock market.

For example, an investor focused on defensive stocks might choose VDC to gain exposure to Walmart and other household staples. This approach spreads out risk while still capturing upside from retail performance.

ETF Name | Ticker | Walmart Holding % | Other Top Holdings |

|---|---|---|---|

Vanguard Consumer Staples ETF | VDC | ~7–9% | Procter & Gamble, Coca-Cola, Costco |

SPDR S&P 500 ETF Trust | SPY | ~0.5–1% | Apple, Microsoft, Amazon |

iShares U.S. Consumer Services ETF | IYC | ~3–4% | Amazon, Home Depot, McDonald’s |

Schwab U.S. Dividend Equity ETF | SCHD | ~2–3% | PepsiCo, Johnson & Johnson, Cisco Systems |

Note: Data may vary depending on the date and rebalancing. Always verify via ETF providers

-

Use Mutual Funds or Robo-Advisors with Walmart Exposure

Another strategy is to invest through mutual funds or robo-advisors that hold Walmart as part of a larger portfolio. This is ideal if you prefer professional management or want to set it and forget it.

For instance:

The Fidelity Contrafund (FCNTX) has historically held Walmart among its top holdings as part of its growth-oriented strategy.

Robo-advisors like Betterment and Wealthfront typically allocate client funds to ETFs that include Walmart, depending on your risk profile.

Let’s say you’re saving for retirement and prefer an automated solution — a robo-advisor might allocate 3–5% of your portfolio to Walmart through a broader consumer ETF, giving you exposure without individual stock picking.

Rovo Advisor | Annual Fees | Minimum Deposit |

|---|---|---|

Wealthfront | 0.25% | $500 |

Betterment | 0.25%

$4 monthly for $0 – $20K balance, 0.25% annually for $20K – $1M balance, 0.15% annually for $1M – $2M balance, 0.10% annually for +$2M balance | $10 |

Acorns | Monthly: $3 – $12

$3 for Bronze, $6 for Silver and $12 for Gold

| $0 |

Schwab Intelligent Portfolios | Up to 0.80%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Schwab Intelligent Portfolio – 0%, Schwab Intelligent Portfolios Premium – One-time planning fee: $300 + Monthly advisory fee: $30, Schwab Wealth Advisory: up to 0.80% | $5,000 |

Vanguard Digital Advisor® | Up to 0.30%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Vanguard Digital Advisor – 0.015%, Vanguard Personal Advisor: 0.03%, Vanguard Personal Advisor Select: up to 0.03%, Vanguard Wealth Management: up to 0.03% | $100 |

E*TRADE Core Portfolios | 0% – 0.35%

0% on stocks and ETFs in self directed brokrage, 0.35% for Core Portfolio Robo Advisor

| $500 |

Merrill Guided Investing | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor | $1,000 |

-

Invest in Competitor or Sector Peers

If you’re interested in Walmart’s retail strength but want a broader retail play, consider investing in other big-box retailers or e-commerce peers that operate in the same space.

Walmart competes with companies like:

Target (TGT) – Known for strong branding and customer loyalty.

Costco (COST) – Offers a membership-based model with a focus on bulk sales.

Amazon (AMZN) – Walmart’s biggest rival in online retail and logistics innovation.

Investing in these stocks alongside Walmart can help you build a balanced retail sector portfolio.

For example, an investor bullish on U.S. consumer spending might buy both Walmart and Costco to diversify across business models.

Which Type of Investors May Buy Walmart Stock?

Walmart stock appeals to a wide range of investors due to its stability, dividends, and strong position in the retail sector.

Dividend Seekers: Walmart has paid regular dividends for decades, making it attractive to income-focused investors who want dependable payouts.

Defensive Investors: During economic downturns, Walmart often performs well as consumers shift toward value-oriented shopping, offering downside protection.

ESG-Conscious Investors: Walmart has made strides in sustainability and labor practices, which may appeal to investors focused on corporate responsibility.

Conservative Investors: With relatively low volatility and strong cash flow, Walmart suits those who prefer stability over high-risk, high-reward plays.

For example, a retiree might invest in Walmart to receive dividend income, while a younger investor may include it as a defensive anchor in a diversified portfolio.

FAQ

No, you’ll need to use a broker to purchase Walmart shares. However, you can use online brokerages or investing apps that are simple to set up and use.

Walmart no longer offers a direct stock purchase plan. Investors must go through brokerage platforms to buy WMT shares.

Yes, Walmart is often recommended for beginners due to its financial stability, consistent dividends, and familiar business model.

You can buy fractional shares of Walmart using brokers like Robinhood, Fidelity, or Schwab, which allow you to invest with smaller amounts.

Yes, Walmart pays a quarterly dividend and has a long history of increasing its dividend payout over time.

Yes, you can purchase Walmart stock through IRAs or 401(k) accounts, depending on what your retirement plan allows.

There’s no required minimum if your broker allows fractional shares. You can start with as little as $5 or $10 on platforms that support it.

That depends on your investing strategy. Some investors use dollar-cost averaging and invest in Walmart on a regular monthly or quarterly schedule.

Walmart’s stock trades under the ticker symbol WMT on the New York Stock Exchange (NYSE).

Walmart is more commonly held for long-term investing due to its stable price movement. It’s less volatile than stocks typically favored by day traders.

Timing depends on your financial goals and market conditions. Some investors wait for pullbacks or buy after earnings announcements.

You can track Walmart stock on financial sites like Yahoo Finance, Morningstar, or your brokerage’s dashboard.

Yes, many brokerages allow you to set up dividend reinvestment plans (DRIPs), so your Walmart dividends are used to buy more shares.