Table Of Content

Can You Find Penny Stocks Before They Explode?

Yes, it’s possible to spot penny stocks before they surge — but it requires deep research, pattern recognition, and some risk tolerance. Also. many surges are driven by hype or speculation, not strong fundamentals.

According to FINRA, most penny stocks are highly speculative, so even a promising setup doesn’t guarantee success. Investors should also track SEC filings and press releases to confirm legitimacy.

Find Successful Penny Stocks: Key Indicators To Look For

Spotting a penny stock before it takes off often depends on understanding a mix of technical and fundamental signals.

Here are six important indicators that traders use to identify breakout potential:

1. Relative Volume (RVOL)

Relative Volume compares a stock’s current trading volume to its average volume over a selected period.

A sharp rise in RVOL may signal growing interest from traders or institutions.

For instance, if a tech penny stock normally trades 500,000 shares daily and suddenly spikes to 2 million, something is driving that demand — possibly news, rumors, or an upcoming catalyst.

-

Why It May Be A Good Sign?

Sudden volume spikes often precede price breakouts. High volume shows conviction and liquidity, reducing slippage on trades.

However, not all volume spikes lead to sustainable rallies. It could be short-term hype or pump-and-dump activity. Always confirm the reason behind the volume using filings or press releases.

2. Insider Buying and Institutional Holdings

Fundamentally, insider purchases or increased institutional ownership can signal confidence in the company’s future.

If executives are buying their own stock — especially in small, thinly traded companies — it may indicate they expect positive developments.

-

Why It May Be A Good Sign?

Insiders often have a better understanding of the company’s trajectory. Their buying can precede news like partnerships or financial turnarounds.

But, insider buying is not a guarantee — they can also be wrong, or it may be symbolic rather than strategic.

3. Moving Average Convergence Divergence (MACD)

MACD tracks momentum by showing the relationship between two moving averages (typically 12- and 26-day EMAs).

When the MACD line crosses above the signal line, it can signal a bullish reversal. In penny stocks, these crossovers are often early signs of speculative buying.

-

Why It May Be A Good Sign?

MACD helps detect trend shifts early, especially useful in low-volume penny stocks where reversals can be sharp.

However, MACD lags price action and can give false signals in choppy or low-volume environments, which are common with micro-cap stocks.

4. News-Driven Catalysts and Press Releases

Catalyst-driven price moves are common in the penny stock world.

News such as FDA approvals, contract wins, or uplisting announcements can send prices soaring in hours. Traders often monitor PR wires or SEC filings for early signs.

-

Why It May Be A Good Sign?

Penny stocks are especially reactive to news because they’re lightly covered and can move on relatively minor updates.

Keep in mind that not all news is significant — sometimes vague or promotional press releases are issued just to boost prices.

5. Earnings Reports and Forward Guidance

Many investors overlook earnings in penny stocks, but those that report positive surprises or optimistic future outlooks can attract fast attention.

A jump in revenue, reduced losses, or even profitability can shift sentiment dramatically.

-

Why It May Be A Good Sign?

Strong earnings from a microcap company are rare, so they stand out. If paired with optimistic guidance, it can trigger price and volume spikes.

However, earnings in small companies may be volatile or inconsistent. One good quarter doesn’t always mean long-term viability.

6. Social Sentiment and Unusual Mentions

With retail investors driving much of the penny stock action, monitoring online sentiment has become a powerful early indicator.

Unusual spikes in discussion volume on platforms like Reddit, StockTwits, or Twitter can precede major price action.

-

Why It May Be A Good Sign?

A sudden surge in mentions, especially with positive sentiment or due diligence threads, often draws in momentum traders.

On the other hand, hype-based pumps can reverse quickly. Sentiment alone isn’t enough — it needs to be backed by volume or technical confirmation.

What Are the Red Flags?

While searching for promising penny stocks, you should also recognize signs of potential danger that can signal hype, manipulation, or instability.

Frequent reverse stock splits: Often used to artificially inflate stock prices after repeated declines, which may mask long-term performance issues.

No revenue or product: If a company consistently reports zero revenue and vague business goals, it may be more promotional than operational.

Overly optimistic press releases: Excessive announcements about future “potential” without results may be used to attract naive investors.

High dilution or share issuance: A pattern of constantly selling new shares to raise capital can hurt shareholders and signal weak financials.

Pump-and-dump behavior: If you see sudden price spikes followed by equally sharp crashes and no clear reason, it may indicate manipulation.

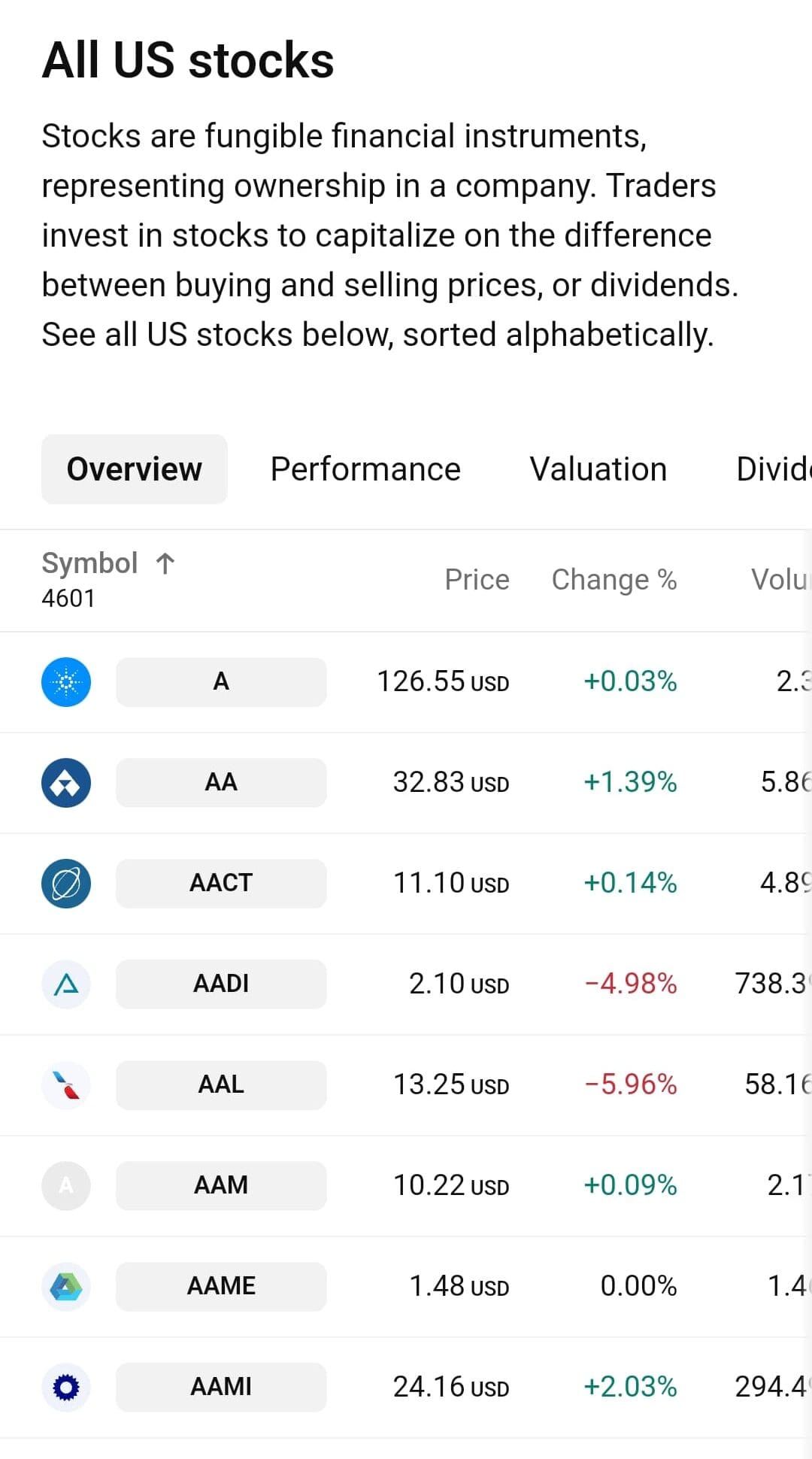

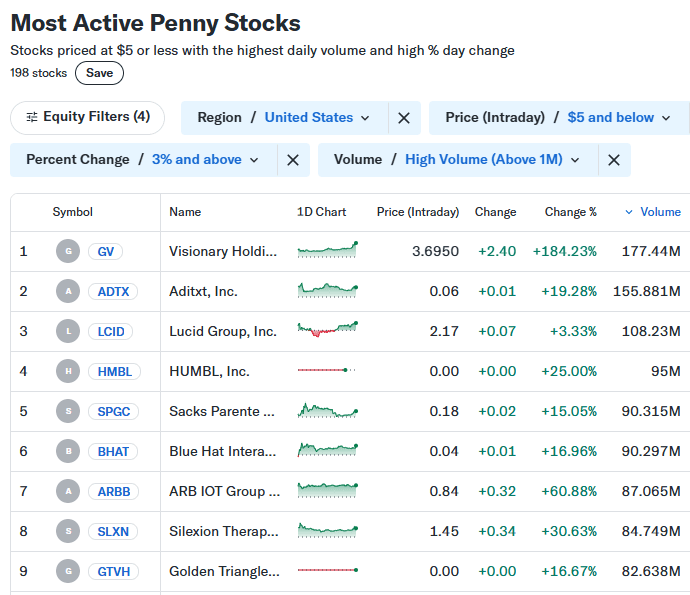

What Are the Best Stock Screeners for Penny Stocks?

Finding quality penny stocks starts with the right penny stock screener. These platforms help filter by volume, price, sector, and technical signals for better targeting.

-

Finviz

Finviz is a popular and easy-to-use screener that offers a clean interface with filters for price, volume, fundamentals, and technicals. It also provides heatmaps, charts, and news integration.

For penny stock traders, it’s helpful because you can filter stocks under $5, add criteria like high volume or low float, and quickly spot potential breakout setups. Many use it to catch momentum trades early.

You can use Finviz for free, though the Elite version gives you real-time data, advanced filters, and alerts.

-

TradingView Stock Screener

TradingView combines powerful charting with a built-in screener that lets you filter stocks by technical indicators, price levels, fundamentals, and even custom scripts.

It’s great for penny stocks because you can screen for oversold setups, unusual volume, or bullish MACD patterns and view the chart instantly to confirm. That visual workflow makes it ideal for technical traders.

There’s a free version with delayed data, while Pro plans unlock real-time quotes and more filters.

-

Yahoo Finance Screener

Yahoo Finance offers a straightforward screener that links directly to company profiles, charts, and recent news. Filters include price, market cap, volume, earnings, and insider activity.

If you're tracking penny stocks, it’s useful for finding companies under $2 with recent insider buying, rising earnings, or above-average trading volume. You can dive into financials or news right from the screener.

Most features are free to use.

-

Zacks Screener

Zacks is known for its research and earnings-based ratings. The screener lets you filter by broker ratings, earnings revisions, growth forecasts, and valuation metrics.

It’s a great tool if you’re looking for penny stocks with improving fundamentals, such as upgraded analyst forecasts or earnings beats, which can be hard to find in the space.

Basic filters are free, but the full Zacks Premium screener includes proprietary rank-based picks.

FAQ

Many traders prefer the first hour after market open and the last hour before close due to increased volatility and liquidity. These windows often offer sharper price moves and volume spikes.

Yes, some penny stocks can be traded after hours, but liquidity is usually low, and prices can be more volatile. Be cautious, as spreads tend to widen.

Using margin on penny stocks is risky because of their volatility and potential for rapid losses. Most brokers also restrict margin trading on low-priced securities.

Some penny stocks are listed on major exchanges, especially those between $1–$5. However, many trade on OTC markets, which carry higher risk and less regulation.

It’s possible but difficult, as most brokers restrict shorting stocks under a certain price due to risk and limited borrow availability. Even if allowed, losses can be unlimited.

These involve artificially inflating a stock's price through false or exaggerated claims, then selling at the peak. Unsuspecting investors are left with sharp losses once the price crashes.

Some newsletters offer insights, but many are promotional or biased. Always cross-check recommendations with your own research and independent sources like SEC filings.

Yes, though rare, some penny stocks have grown into large-cap companies. Monster Beverage and Sirius XM are often cited as historic examples of such transitions.

You can start with a few hundred dollars, but risk management is key. Only invest what you can afford to lose and avoid going all-in on a single pick.

Absolutely. Paper trading allows you to test strategies in real time without risking real money. It’s useful for learning how fast these stocks can move.

They’re usually better for short-term speculation due to high risk. However, a few high-potential microcaps with solid fundamentals may grow over time with patience.

Social platforms like Reddit, Twitter, and StockTwits can spotlight penny stocks early. But sentiment is often hype-driven, so always verify with news and data.