Staking Ethereum (ETH) means locking up your coins to help secure the Ethereum network and earn passive rewards in return.

Instead of mining, Ethereum now uses a system called “proof of stake,” where validators are randomly chosen to confirm transactions.

In return for staking your ETH, you can earn annual rewards—usually between 3% and 5%—depending on the platform and network conditions.

Staking is popular because it's an easy way to grow your crypto without having to actively trade.

How to Stake Ethereum (ETH): 5 Simple Steps

Getting started with Ethereum staking is easier than you might think. Let’s walk through the basic steps you’ll need to follow.

Step 1: Understand How Ethereum Staking Works

Before you stake ETH, it’s important to understand the basics of staking and what you’re committing to. Ethereum uses proof-of-stake, which means validators (instead of miners) secure the network.

Here’s what you should know first:

Minimum requirement: You usually need 32 ETH to stake directly, but smaller amounts can be staked using pools or exchanges.

Reward system: You earn ETH as a reward for helping validate transactions and securing the network.

Risk factors: Slashing (penalties) can occur if you act maliciously or stay offline too often.

For example, if you don’t have 32 ETH, using a platform like Coinbase or Lido can still allow you to participate easily. As a result, understanding the options early helps you pick the right method.

Step 2: Choose How You Want to Stake

There are multiple ways to stake ETH, each with different levels of control and complexity. Picking the right method depends on your technical skills and goals.

You can choose between:

Solo staking: You run your own validator node (needs 32 ETH and technical knowledge).

Pooled staking: You join a group of users who pool funds together (good for beginners).

Exchange staking: Platforms like Coinbase, Binance, or Kraken handle staking for you.

For example, someone who doesn’t want to manage hardware might prefer staking through an exchange. Therefore, taking the time to evaluate your ideal setup will save you future headaches.

- The Smart Investor Tip

Before choosing a method, write down your goals—like whether you care more about earning yield, having liquidity, or keeping full control. This quick checklist will guide your choice naturally.

Step 3: Pick a Platform or Set Up Your Validator

Once you know how you want to stake, it’s time to pick a platform or prepare your own setup. This decision affects your fees, rewards, and security.

Key actions to take:

If solo staking: Set up a validator client like Prysm or Lighthouse on dedicated hardware.

If using a pool: Sign up on platforms like Rocket Pool or Lido.

If using exchanges: Find a trusted exchange that offers ETH staking services.

For instance, Lido allows you to stake any amount of ETH and still earn daily rewards without managing servers. Because of this flexibility, many everyday users lean toward liquid staking pools.

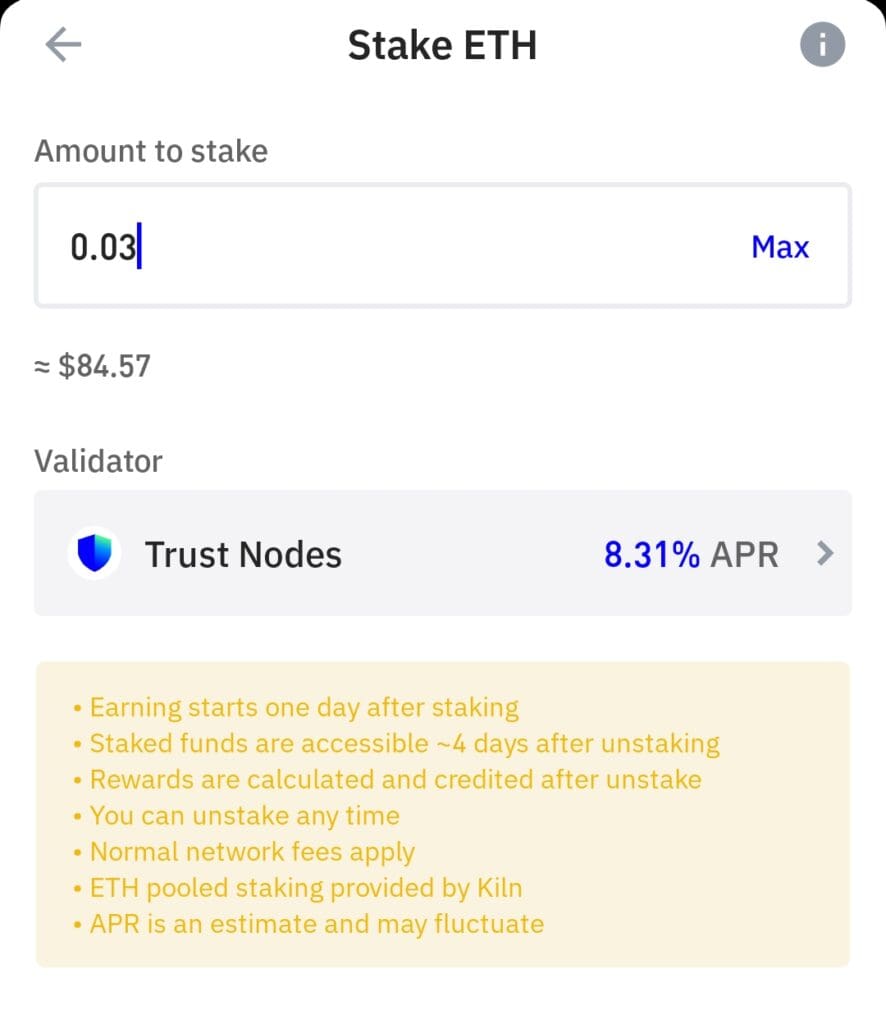

Step 4: Stake Your Ethereum

Now it’s time to actually stake your ETH. Depending on the platform you chose, the staking process can take just a few minutes.

What you’ll need to do:

Connect your wallet: Use wallets like MetaMask to interact with staking pools.

Deposit ETH: Follow your platform’s deposit instructions carefully.

Confirm your staking position: Double-check the staking amount and terms before finalizing.

For example, if you use Coinbase, you simply go to the ETH page and select “Stake”—the platform handles everything else. As a result, you start earning rewards without much technical setup needed.

- The Smart Investor Tip

Triple-check the staking address and platform instructions before confirming any transaction. It’s better to spend an extra 5 minutes verifying than risk sending ETH to the wrong place.

Step 5: Manage and Monitor Your Staked ETH

After staking, it’s important to manage and monitor your ETH to maximize returns and avoid risks like slashing.

Stay on top of your staking by:

Checking rewards: Most platforms show your earned ETH and performance stats in real-time.

Watching lock-up periods: Some staking options (like Coinbase) lock ETH until withdrawals are enabled after protocol upgrades.

Staying informed: Keep up with Ethereum updates to protect your staked funds.

For instance, solo validators must make sure their equipment stays online to avoid downtime penalties. Therefore, regular monitoring helps you keep earning and protect your stake.

Stake Ethereum Rewards & Risks

Staking Ethereum (ETH) offers a simple way to earn passive income by helping secure the network. Rewards typically range from 3% to 5% annually, depending on how you stake and network conditions.

However, staking isn’t risk-free—you could face penalties (called “slashing”) if your validator misbehaves or goes offline.

Also, depending on your platform, your ETH might be locked up and inaccessible for a period. It's important to weigh both the earning potential and the risks before deciding to stake.

How to Choose the Right Ethereum Staking Platform

Choosing the right Ethereum staking platform depends on your goals, technical skills, and risk tolerance. Here’s what you should look at carefully:

Reputation and Security: Always pick platforms with strong reviews and a good security history.

Ease of Use: Platforms like Lido or Coinbase make staking simple even for beginners.

Rewards and Fees: Compare how much reward you’ll actually keep after the platform takes its cut.

Withdrawal Flexibility: Check if you can unstake your ETH easily, or if there’s a lock-up period.

Extra Features: Some platforms offer liquid staking, giving you tokens you can trade while your ETH is locked.

For example, if you want maximum control and no fees, solo staking might suit you. But if you prefer convenience, an exchange or pool could be the smarter route.

Where You Can Stake Ethereum?

Today, there are many places where you can stake Ethereum depending on how hands-on you want to be. Here are your main options:

Centralized Exchanges: Platforms like Coinbase, Binance, and Kraken make staking quick and easy.

Staking Pools: Services like Lido and Rocket Pool let you stake any amount of ETH without running a validator.

Solo Staking: You can run your own validator with software like Prysm, but it requires 32 ETH and technical skills.

DeFi Protocols: Some DeFi apps let you stake ETH and earn extra rewards by lending or farming at the same time.

Validator-as-a-Service: Companies like Blockdaemon help set up and maintain a dedicated validator node for you.

For instance, if you have less than 32 ETH or don’t want technical setup headaches, using a pool like Lido can make staking much more accessible.

FAQ

Yes, there's a small risk. If you're solo staking and your validator acts incorrectly or goes offline, you could be penalized or lose a portion of your staked ETH.

If you're solo staking, you need 32 ETH. But if you use pools or exchanges, you can often stake as little as 0.01 ETH or even less.

In many countries, staking rewards are considered taxable income. Always check your local tax rules or consult a crypto tax professional.

Reward payouts vary by platform. Some centralized exchanges distribute rewards daily or weekly, while direct validators accumulate them continuously on-chain.

Yes, many services let you connect a Ledger or Trezor wallet when staking through a pool, which adds extra security to your assets.

Liquid staking gives you a tradable token (like stETH from Lido) that represents your staked ETH, allowing you to use it while still earning staking rewards.

It’s generally safe on large, reputable exchanges, but you give up direct custody of your coins. If the exchange is hacked or mismanages funds, you could lose access.

It depends. If you're staking directly to the Ethereum network, unstaking may only become available after future network upgrades. Pools and exchanges often have their own terms.

No. When using staking pools or centralized services, you don’t have to maintain any hardware. Only solo validators must stay online consistently.