What Is an ETF Screener and How Does It Work?

An ETF screener is a research tool that helps investors filter and identify exchange-traded funds based on specific criteria like asset class, sector, expense ratio, performance, and more.

Because there are thousands of ETFs available—including those tracking stocks, bonds, commodities, and global indexes—using a screener allows you to narrow your search and focus only on funds that match your investment goals.

The best ETF screeners let you combine filters across fundamentals, strategy types, and risk metrics. For example:

Filter by Asset Class and Category: Identify sector-specific ETFs (like tech or energy) or asset-based categories (such as equity, bond, or commodity ETFs).

Sort by Expense Ratio and AUM: To find cost-efficient ETFs with strong liquidity, filter for low expense ratios and high assets under management.

Use Performance Metrics: Narrow funds by 1-year or 5-year total return, or screen for consistent performance against category peers.

Plan | Subscription | Best For |

|---|---|---|

Morningstar Investor | $34.95

$249 ($20.75 / month) if paid annually | Retirement Planners |

Zacks Premium | $249 ($20.75/month)

No monthly plan | Research-Driven Investors |

Motley Fool Stock Advisor | $199 (16.60 / month)

No monthly plan

| Stock Picks |

Yahoo Finance Gold | $49.95

$479.40 ($39.95 / month) if paid annually | Casual Investors |

InvestingPro | $15.99

$120 ($9.99 / month)

if paid annually | Global Market Investors |

TipRanks Premium | $359 ($30 / month)

No monthly plan | Analysts Followers |

Seeking Alpha Premium | $299 ($24.90 / month)

No monthly subscription | Research-Oriented Investors |

Best Strategies to Screen for High-Quality ETFs

ETF screeners are especially helpful in identifying top-performing, low-cost, or thematic funds. Below are our main strategies you can use to uncover smart ETF picks for your portfolio.

-

Find Low-Cost ETFs with Strong Returns

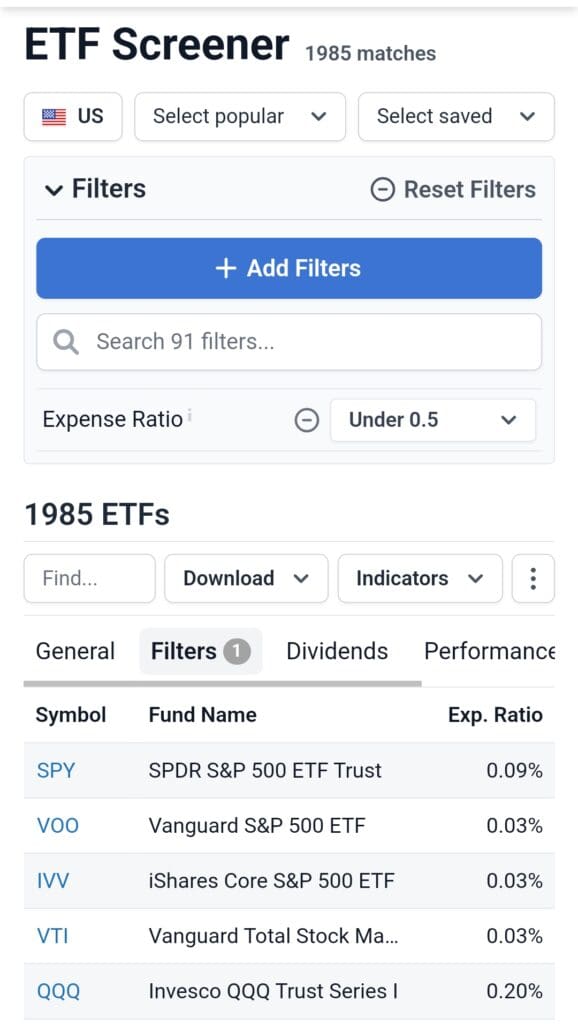

Low fees don't always mean low quality. A good ETF screener can help you find low-cost funds with solid historical performance.

Expense Ratio Filter: Focus on ETFs with fees under 0.20% to minimize cost drag.

Performance Filter: Screen for top-quartile performers in the past 3–5 years within their category.

Issuer and Size: To ensure liquidity, choose funds from reputable issuers like Vanguard or iShares with assets over $1 billion.

This setup is ideal for long-term investors aiming to build a core portfolio with broad market exposure and minimal fees.

-

Find Thematic or Sector ETFs Based on Trends

If you're looking to play a trend—like AI, clean energy, or cybersecurity—ETF screeners can help you zero in on niche funds aligned with that theme.

Sector or Theme Filter: Use keywords like “robotics,” “green energy,” or “blockchain” to identify relevant funds.

Top Holdings Review: Check whether the ETF has concentrated exposure to leaders in the space (e.g., Nvidia for AI or Tesla for EVs).

Performance & Volatility Metrics: Review past returns and standard deviation to assess risk-reward.

This approach is best suited for investors seeking focused exposure to emerging industries, but it’s wise to check the fund’s turnover rate and liquidity before committing.

-

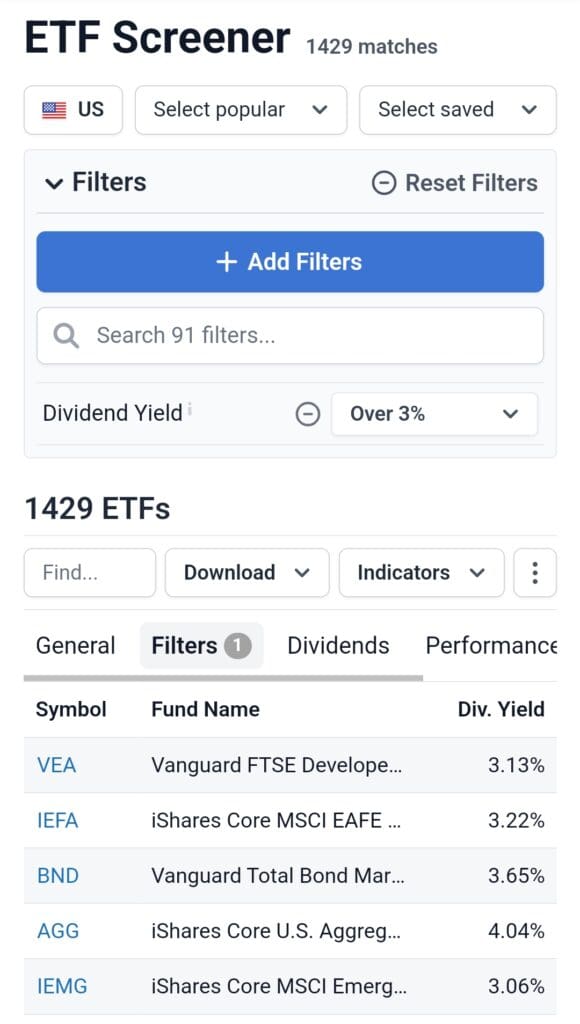

Find Dividend-Focused ETFs for Income

For income-seeking investors, a screener can help you find ETFs with reliable dividend payouts and stable track records.

Dividend Yield Filter: Look for ETFs with yields over 3%, but verify the payout sustainability.

Dividend Growth Strategy: Use screeners with a “dividend aristocrats” or “dividend growth” category filter.

Fund Type & Holdings: Favor ETFs holding high-quality large-cap stocks or dividend-focused REITs.

This strategy works well for retirement portfolios or investors seeking a regular income stream while still participating in equity market gains.

-

Find Defensive ETFs During Market Uncertainty

During periods of volatility, ETF screeners can help you shift toward more conservative or hedged strategies.

Risk Rating or Beta Filter: Filter for ETFs with a beta below 1 to reduce market correlation.

Bond or Multi-Asset Category: Focus on fixed-income ETFs or balanced allocation strategies.

Historical Drawdown Data: Check the maximum drawdown over the past few years to evaluate downside protection.

This filtering method is especially helpful for capital preservation and reducing portfolio volatility during uncertain market cycles.

-

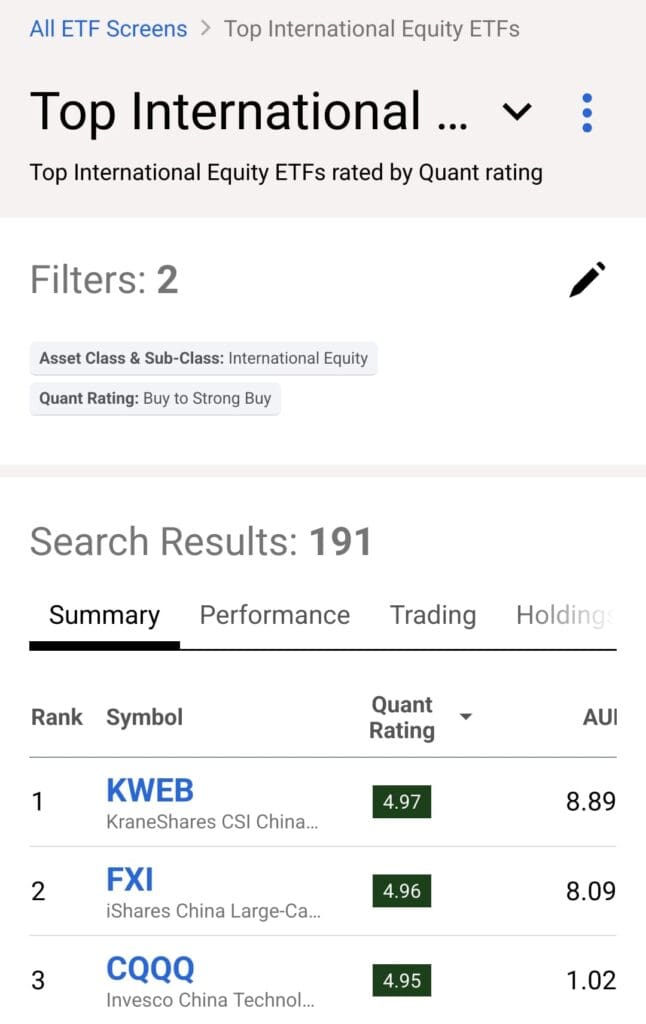

Screen for International or Emerging Market Exposure

Diversifying geographically can reduce home country bias and improve long-term returns. ETF screeners make it easy to identify regional or country-specific funds.

Region or Country Filter: Choose specific markets like “Asia Pacific,” “Latin America,” or “India.”

Currency Exposure: Look for ETFs that hedge currency risk if you're concerned about forex volatility.

Market Cap Allocation: Prioritize funds focused on large-cap companies in emerging economies for more stability.

This strategy helps investors broaden exposure beyond U.S. markets and participate in global growth opportunities.

-

Identify Actively Managed ETFs for Tactical Plays

While most ETFs are passive, active ETFs are growing in popularity for those seeking professional management with flexibility.

Management Style Filter: Select “active” ETFs to find funds that do not follow a static index.

Manager Track Record: Look for consistent alpha generation over 3–5 years.

Holdings Turnover: Review fund turnover to understand the manager’s activity and responsiveness to market shifts.

This is suitable for investors who want manager-driven strategies but still value the liquidity and tax advantages of ETFs.

-

Screen for Tax-Efficient ETFs for Brokerage Accounts

If you’re investing in a taxable account, screeners can help you find ETFs that minimize capital gains distributions.

Turnover Ratio & Distributions: Use filters to find funds with low internal turnover and minimal annual distributions.

ETF Structure: Prioritize ETFs structured as C-Corps or using in-kind redemption (e.g., many Vanguard and iShares funds).

Tax Cost Ratio: Morningstar offers a “tax cost ratio” filter that shows how much returns were reduced due to taxes.

This strategy works best for high-income investors or those planning to hold ETFs for the long term in taxable accounts.

How to Choose the Right ETF Screener

Not all ETF screeners offer the same features, so it's important to choose one that aligns with your investment goals.

Filter Customization: Look for screeners that let you combine metrics like expense ratio, sector, and performance.

User Interface: Choose a platform with a clean layout and easy navigation for quicker comparisons.

Data Quality: Ensure the screener pulls from reliable sources with up-to-date fund data and historical performance.

Comparison Tools: Side-by-side ETF comparison features are helpful for evaluating multiple options at once.

Screener Focus: Some tools are better for thematic investing (e.g., ETF.com), while others excel in portfolio building (e.g., Morningstar).

The best ETF screener depends on whether you prioritize research depth, usability, or niche exposure. Try a few tools to see which one fits your style and portfolio needs.

Common Mistakes To Avoid When Using an ETF Screener

Even with powerful tools, it's easy to make missteps when filtering ETFs. Here are key mistakes to avoid.

Focusing Only on Performance: Past returns don’t guarantee future results. Also consider risk metrics, fees, and fund strategy.

Ignoring Liquidity: Low-volume ETFs can have wide bid-ask spreads, which may increase trading costs or limit execution.

Overlooking Expense Ratios: A fund with strong returns but high fees may underperform cheaper alternatives in the long run.

Skipping Holdings Review: Two ETFs may sound similar but have completely different top holdings and sector weightings.

Not Using Enough Filters: Relying on just one or two metrics often yields broad, unfocused results.

To get the most value from an ETF screener, balance filters across performance, cost, structure, and underlying strategy—not just returns.