Table Of Content

Key Features of eToro for Crypto Trading

eToro offers several unique features tailored for crypto traders — from its secure wallet to automated copy trading. Here's what stands out:

-

User-Friendly Interface for Beginners

eToro’s platform is designed for ease of use — perfect for beginner crypto traders. You can view real-time prices, community discussions, and market charts all from one dashboard.

The process of buying, setting stop-losses, or tracking open trades is simplified with just a few clicks. Also, eToro’s mobile app syncs seamlessly with your web account, enabling 24/7 access to your portfolio.

For those just entering the crypto space, this clean, intuitive layout reduces the friction of managing a volatile asset class.

-

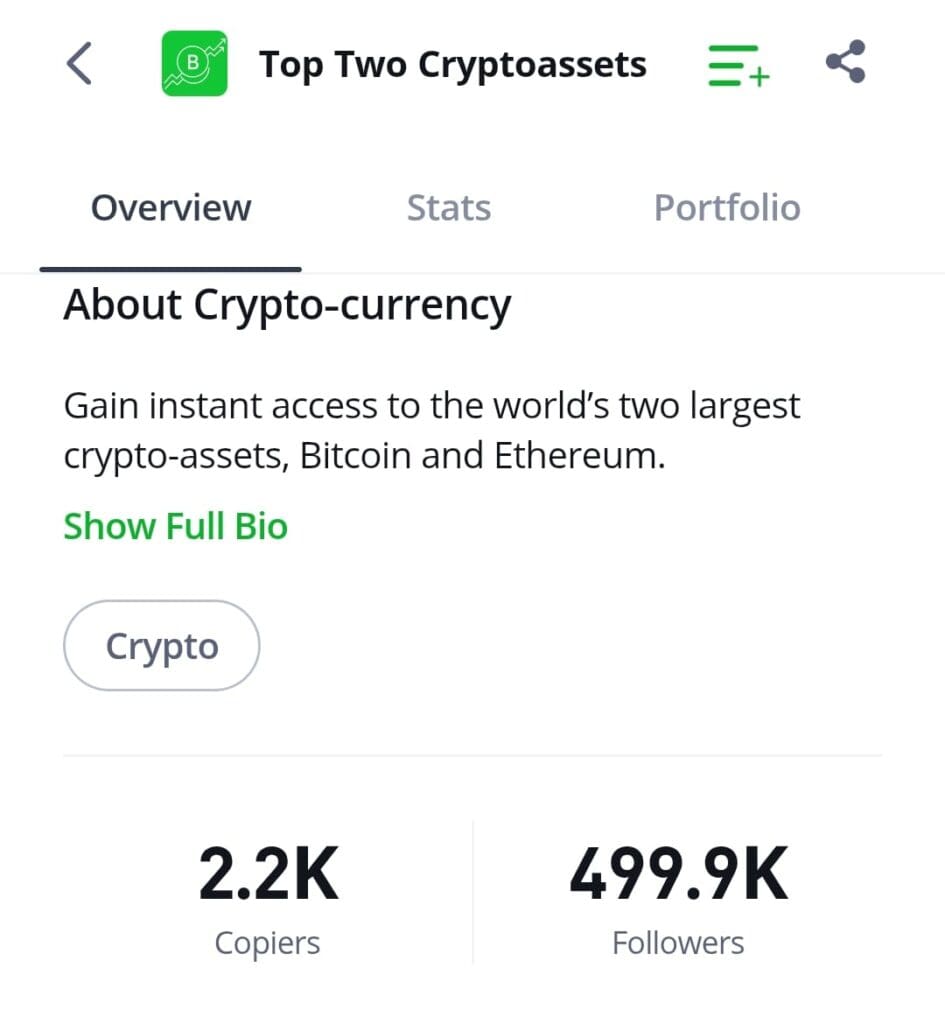

eToro’s Copy Trading Works for Crypto Investors

One of eToro’s standout features is its CopyTrader, which allows users to mirror the trades of experienced investors—even in crypto. Before choosing whom to copy, you can view performance history, portfolio allocation, and risk metrics.

For example, if a trader actively invests in Bitcoin, Ethereum, and Solana, you can automatically replicate those trades proportionally.

This is especially useful if you want crypto exposure but lack time or confidence to trade actively. However, you should still monitor overall portfolio performance and set limits.

-

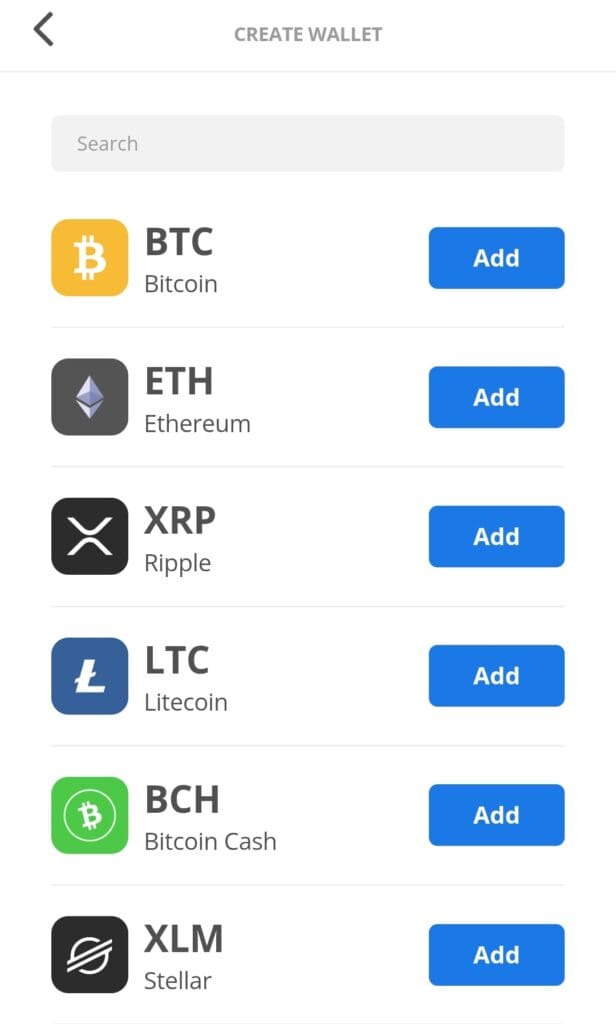

eToro’s Crypto Wallet for On-Chain Transfers

eToro offers a multi-crypto wallet app that supports over 120 coins and provides the ability to send, receive, and convert assets. This feature is ideal if you want to move crypto off-platform for personal storage or DeFi use.

Unlike the main trading account — which is custodial — the eToro Money wallet gives you full control of your crypto keys.

-

Staking Rewards on Select Cryptos

eToro offers staking rewards on eligible proof-of-stake (PoS) coins such as Cardano (ADA), Ethereum (ETH), and Tron (TRX).

When you hold these assets, eToro automatically stakes them on your behalf and distributes rewards monthly.

This means you can earn passive income just by holding crypto — no need to manually stake or use external wallets.

How to Buy and Sell Cryptocurrencies on eToro

If you want to trade cryptocurrencies on eToro, it's essential to go beyond clicking “Buy” and understand the full process — from asset research to post-trade steps. Here's a structured way to do it right:

1. Choose and Explore the Asset

Before trading, dig into the details of the crypto asset to avoid blind bets.

Understand the project’s purpose: For example, Bitcoin aims to be decentralized digital money, while Ethereum enables smart contracts. This helps align with your investment thesis.

Study historical performance: Look at past volatility and major turning points. Did it react to regulation? News? Adoption spikes?

Evaluate liquidity and market cap: A token with low daily volume may be hard to exit quickly.

Check broader sentiment: Use resources like CoinGecko to track fundamentals and tokenomics.

This research is especially important in crypto, where hype often outweighs value.

2. Consider Personal Fit and Risk Factors

Crypto may be trending, but that doesn’t mean it fits your portfolio or goals.

Why are you buying? Are you trading short-term hype or betting on long-term adoption?

How long can you hold? If you're not ready to stomach wild volatility or a two-year downturn, plan your timing carefully.

Set clear limits: Define your budget, entry points, stop losses, and when to take profits — don’t wing it.

Understand tax consequences: In the U.S., for example, crypto gains are taxable. Tools like CoinTracker help track and calculate.

Account for sensitivity: Crypto reacts sharply to tweets, global regulation, and even platform outages. Be emotionally and technically prepared.

Always tie your crypto trades to a broader strategy — not just FOMO.

3. Start the Buying Process on eToro

Once you’ve done your homework, it’s time to place the trade — but don’t rush.

Search the crypto asset by name or ticker: e.g., BTC, ETH, ADA. Confirm you’re selecting the correct asset, especially with lookalike names.

Review fees: eToro charges a spread (e.g., ~1%) instead of trading commissions. You can review current fees on their crypto fees page.

Understand order type: You’ll typically use market orders, but limit orders help control price. eToro may restrict limit orders for some crypto.

Check platform insights: Look at charts, sentiment, and analyst news within the platform before confirming your buy.

These steps ensure you’re not just buying — but buying wisely.

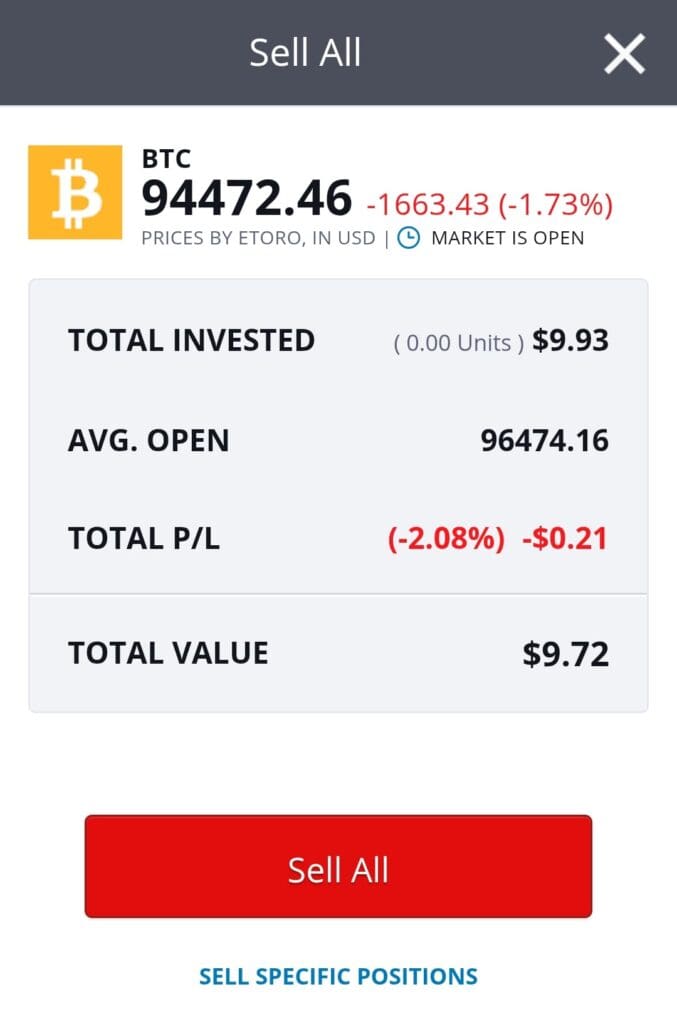

4. Execute the Trade and Track It

Buying is just the beginning — what you do after matters just as much.

Monitor performance and set alerts: Use eToro’s “Watchlist” and “Price Alerts” to stay updated.

Consider dollar-cost averaging: If you’re investing long term, consider buying in small chunks over time to manage volatility.

Review trade notes and strategy: Add a memo explaining your rationale — it’s a habit of disciplined traders.

Be ready to exit: Whether taking profit or cutting losses, use the “Close Trade” feature on eToro. You can close partially or fully.

Finally, reflect on what worked and what didn’t. Every trade is a lesson if you review it.