Table Of Content

What Are the Key Features of the eToro App?

eToro app offers a wide range of tools and features designed for both beginners and experienced investors.

Below are the most popular standout features that make the platform unique:

1. Zero-Commission Stocks and Fractional Shares

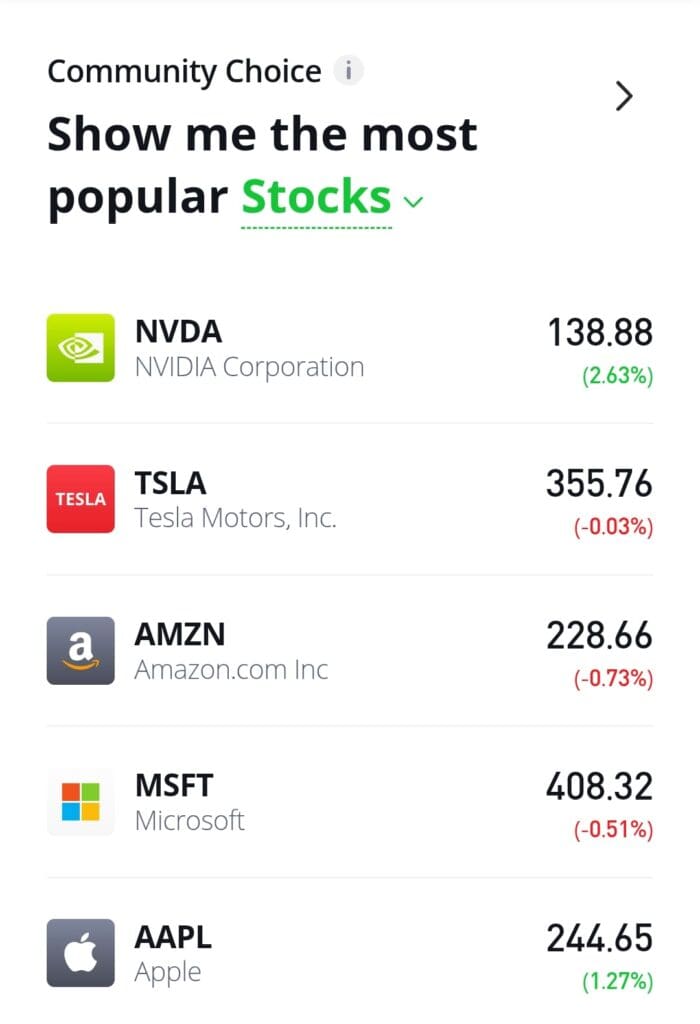

eToro allows you to invest in over 3,500 stocks and 290+ ETFs without paying commission fees.

In order to make investing more accessible, the platform also offers fractional shares, letting you buy part of high-priced stocks like Tesla or Amazon starting from just $10.

This is especially useful for younger or budget-conscious investors who want exposure to top companies without needing large sums of money.

While stock and ETF trading is free, you should still account for currency conversion fees if your account is not in USD.

2. Smart Portfolios: Theme-Based Investing Made Simple

Instead of choosing individual stocks or cryptos, users can invest in Smart Portfolios (formerly CopyPortfolios), which bundle assets around specific themes like clean energy or artificial intelligence.

These portfolios are curated by eToro’s investment team and automatically rebalanced to optimize performance.

For instance, a tech-themed portfolio may include top U.S. software companies and is adjusted quarterly based on market trends.

Because of their managed nature, Smart Portfolios are ideal for those seeking diversification without micromanagemen

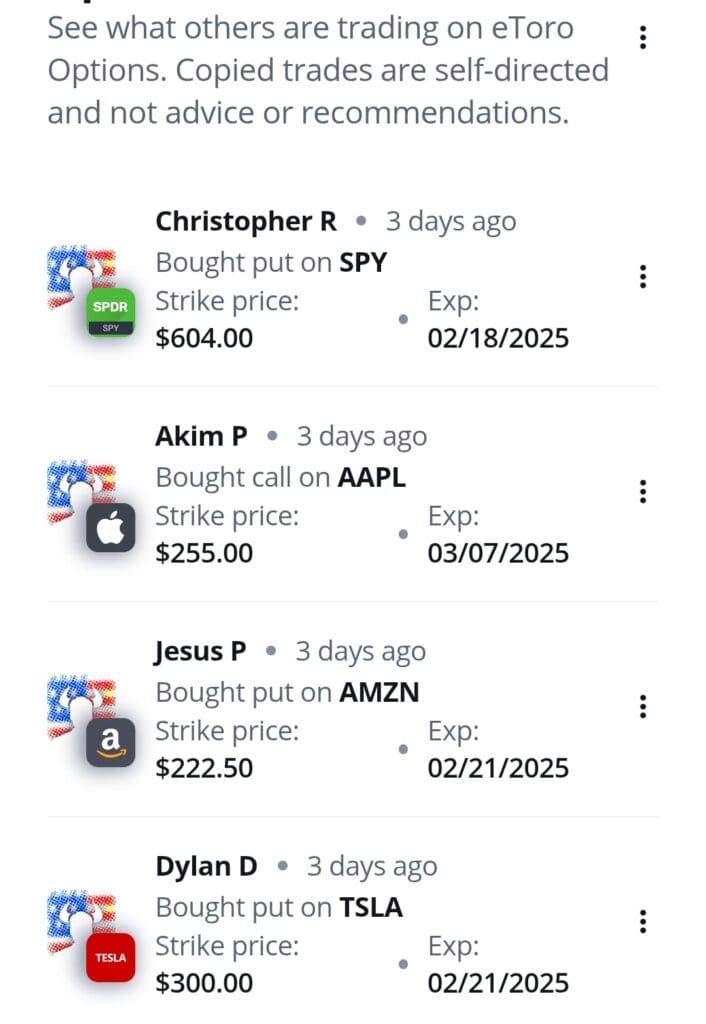

3. CopyTrader: Mimic Top Investors in Real Time

eToro’s CopyTrader lets users automatically copy the trades of seasoned investors, making it ideal for those new to the markets or too busy to manage trades manually.

For example, a beginner can browse trader profiles, review their past performance, and start copying with a minimum of $200. As a result, your portfolio will mirror their positions and adjust in real time whenever they trade.

You can pause or stop copying at any point. This makes CopyTrader not only educational but also a hands-off investing solution.

4. $100K Virtual Trading Account for Practice

eToro offers every user a $100,000 demo account, which simulates real market conditions so you can test strategies and get comfortable with the app’s interface.

This is particularly helpful if you're starting out or experimenting with new trading ideas.

You can switch between your real and virtual portfolio with a single tap, allowing you to try out the CopyTrader feature or simulate day trading with no risk.

As a result, you’ll gain confidence before transitioning to real money. This also helps users avoid costly beginner mistakes.

5. Set Price Alerts to Stay Ahead of Market Moves

If you’re trading on the go, price alerts are a must. eToro’s app allows you to set custom alerts on any stock, ETF, crypto, or forex pair so you can react quickly.

For example, if you're watching Ethereum and want to buy only if it dips below $2,500, just set that alert. You’ll get a push notification when the price hits your threshold, allowing you to act without monitoring charts all day.

You can also use alerts to notify you when assets hit profit-taking levels or trigger entry signals based on your technical setup. This feature turns your phone into a mobile trading command center.

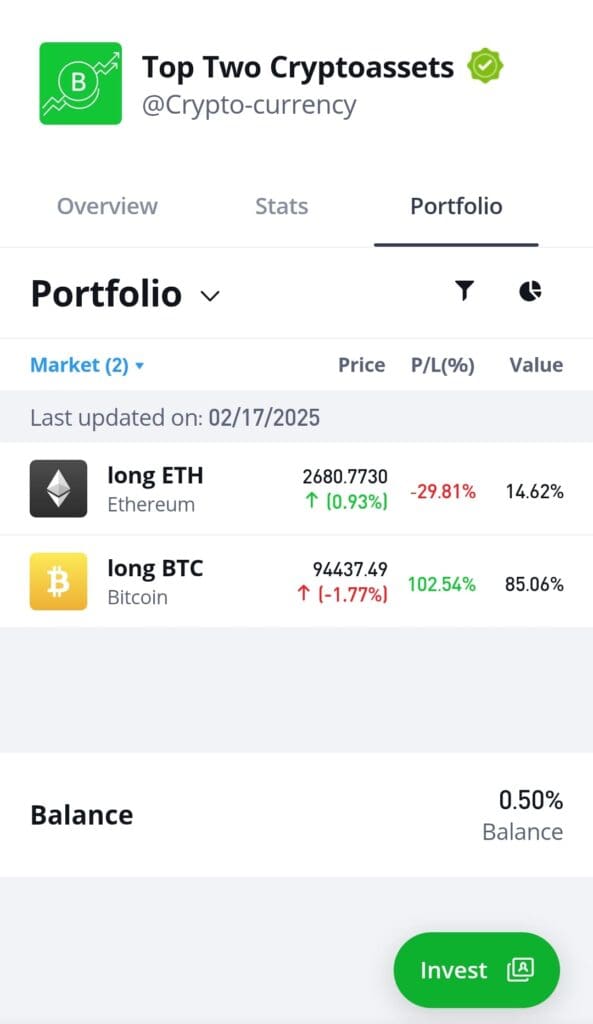

6. Track Portfolio Performance and Allocation Breakdown

Understanding how your money is distributed across assets is key to risk management. eToro’s app lets you see a visual breakdown of your holdings by asset class, sector, and geography.

You can also track portfolio performance in real time, view individual trade history, and see unrealized gains or losses. For instance, if you’re heavily allocated to U.S. tech stocks, you might decide to diversify into commodities or ETFs.

What's Missing On eToro Mobile Trading App?

While the eToro mobile app covers most essentials, it lacks several advanced features that seasoned traders may find limiting.

Limited Technical Analysis Tools: The app offers basic charting but lacks robust indicators, drawing tools, and multi-timeframe support found on desktop platforms like TradingView.

No Margin or Options Trading in the U.S.: U.S. users cannot access margin for crypto or trade options through the app, reducing flexibility for more active traders.

No Crypto-to-Crypto Swaps: You can’t swap one cryptocurrency for another directly on the app, which is a common feature on dedicated crypto platforms.

Fewer Custom Alerts: While basic price alerts are available, the app doesn’t support condition-based or multi-criteria alerts (e.g., volume spikes or RSI crossovers).

Research and News Are Light: The mobile app offers minimal analyst commentary or deep market research compared to web-based platforms or competitors like Fidelity and TD Ameritrade.

How to Place Trades on eToro’s Mobile App

eToro’s app allows you to research assets, place trades, and manage positions directly from your smartphone with just a few taps.

Search and Select an Asset: Tap the search bar to find a stock, ETF, crypto, or currency pair. You can also browse by category or market movers.

Tap “Trade” to Enter the Order Screen: Once on the asset page, tap “Trade.” You’ll be taken to a screen where you can specify your investment amount.

Choose Between Buy or Sell: If the market is open, select whether you want to open a “Buy” or “Sell” position depending on your market outlook.

Set Order Details: Input the amount (you can trade fractional shares), adjust leverage (if available), set stop-loss or take-profit levels.

Swipe to Confirm: Once everything looks good, swipe to place your order. You’ll receive a confirmation and can track the position in your portfolio.