KuCoin is a global cryptocurrency exchange known for offering a wide variety of coins, low trading fees, and advanced trading tools. It’s designed for both beginners and experienced traders who want access to spot trading, futures, staking, and more.

Users can register quickly, deposit crypto or fiat, and start trading through a simple interface or the more advanced KuCoin Pro.

Because it’s a non-U.S. exchange, KuCoin offers features that some U.S. platforms restrict, making it appealing to international users.

How to Use KuCoin Exchange

You can use KuCoin to buy, sell, and manage crypto through easy tools and advanced features made for all experience levels.

-

Spot Trading: Buy and Sell Crypto Pairs Easily

Spot trading is the core feature on KuCoin and where most investors begin. You can trade hundreds of crypto pairs directly, either instantly or using custom order settings.

Here are a few ways you can use spot trading on KuCoin:

Market and limit orders: Market orders buy/sell instantly, while limit orders let you set your ideal entry or exit price.

Stop-loss and take-profit: These tools help you automate exits when prices hit a trigger, reducing emotional trading.

Instant convert option: If you’re not into chart reading, KuCoin’s convert tool lets you swap assets like USDT to BTC with one click.

Spot trading is great whether you’re making quick moves or holding long-term. And with low fees and high liquidity, it appeals to both casual and active traders.

-

Trading Bots: Automate Your Strategy 24/7

KuCoin’s trading bots allow you to automate your investing strategy, so you don’t need to stare at charts all day. It’s a useful tool for users who want to grow their portfolio passively or based on defined rules.

Below are some key ways traders use bots on KuCoin:

Grid and DCA bots: Grid bots buy low/sell high within a set range; DCA bots let you invest small amounts consistently over time.

Customizable parameters: Set your own buy/sell range, investment size, and bot duration based on your risk tolerance.

Live performance tracking: You can monitor bot profits and make changes or stop it anytime through the mobile or desktop app.

Whether you're averaging into Bitcoin or trading short-term moves, KuCoin bots can make your life easier. And since they're built-in, there’s no extra setup needed.

-

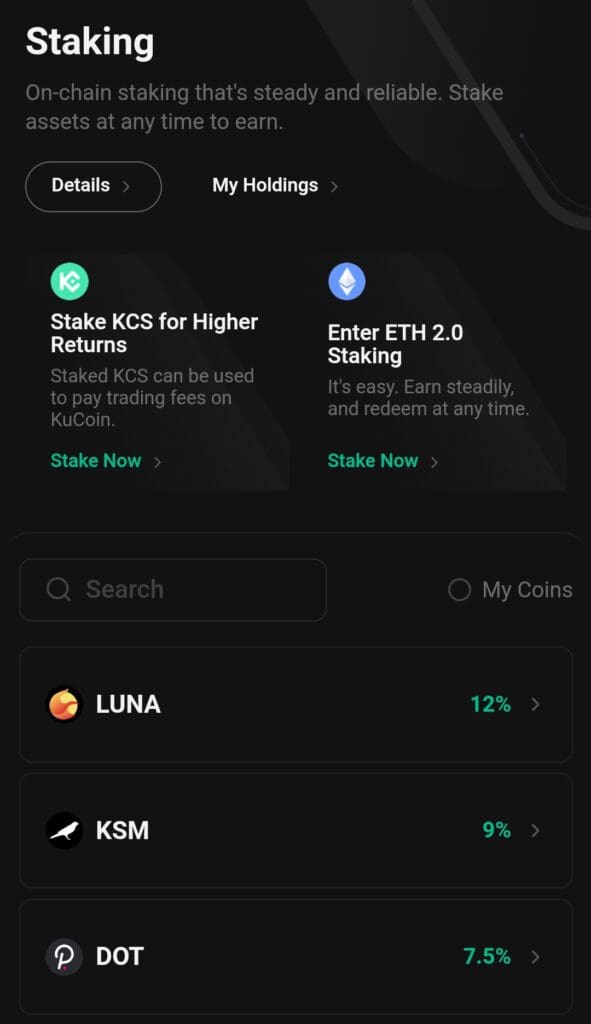

KuCoin Earn: Grow Your Crypto with Passive Income

KuCoin Earn helps you generate passive income from your holdings without having to trade. It’s ideal if you're holding coins and want them to work for you.

Here’s how users commonly leverage KuCoin Earn:

Flexible Savings: Earn interest on coins like USDT or BTC while still having the freedom to withdraw anytime.

Crypto staking: Lock coins such as DOT, ADA, or ETH2 to support blockchain security and earn network rewards.

Dual Investment: A high-risk/high-reward product where returns depend on market outcomes at expiration.

It’s a smart way to let idle assets grow without much effort. But it’s important to understand the risks, especially with fixed-term or advanced products.

-

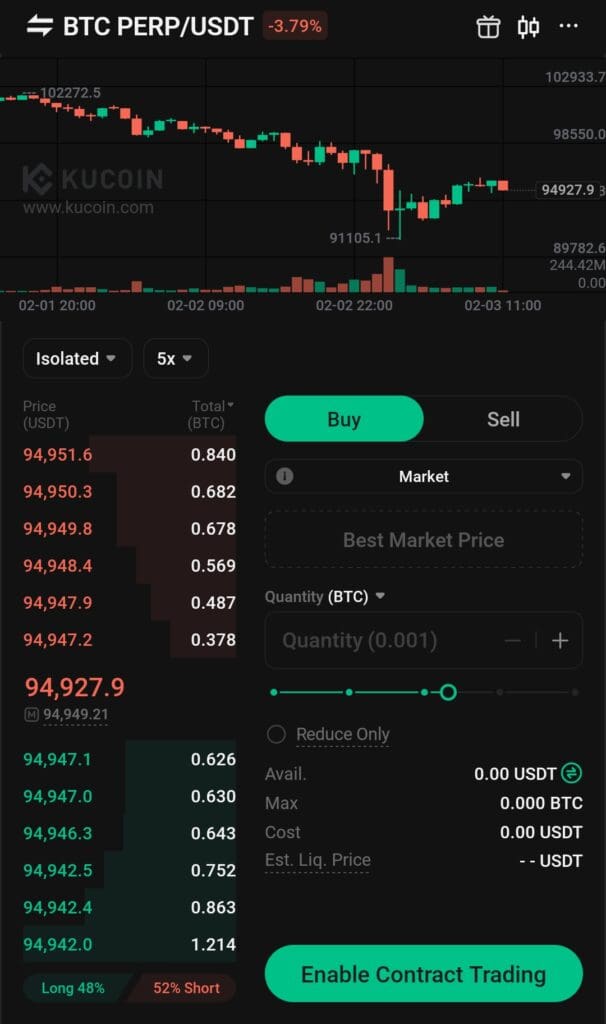

Futures Trading: Use Leverage for Bigger Moves

KuCoin offers futures contracts that let you trade crypto with leverage, aiming for higher gains (but also higher risk). This is more suited for experienced traders who want to profit from both rising and falling prices.

Here are some popular features of KuCoin Futures:

Up to 100x leverage: You can magnify your position — e.g., trade $1,000 with just $10 — but this also increases your risk.

Cross and isolated margin: Choose whether your balance protects all positions (cross) or just individual ones (isolated).

Pro interface and tools: Advanced charts, order book depth, and technical indicators help fine-tune your trading strategy.

Futures trading gives you a powerful way to speculate on market moves. Just be sure to use risk controls like stop-losses, as the leverage can quickly wipe out your capital.

-

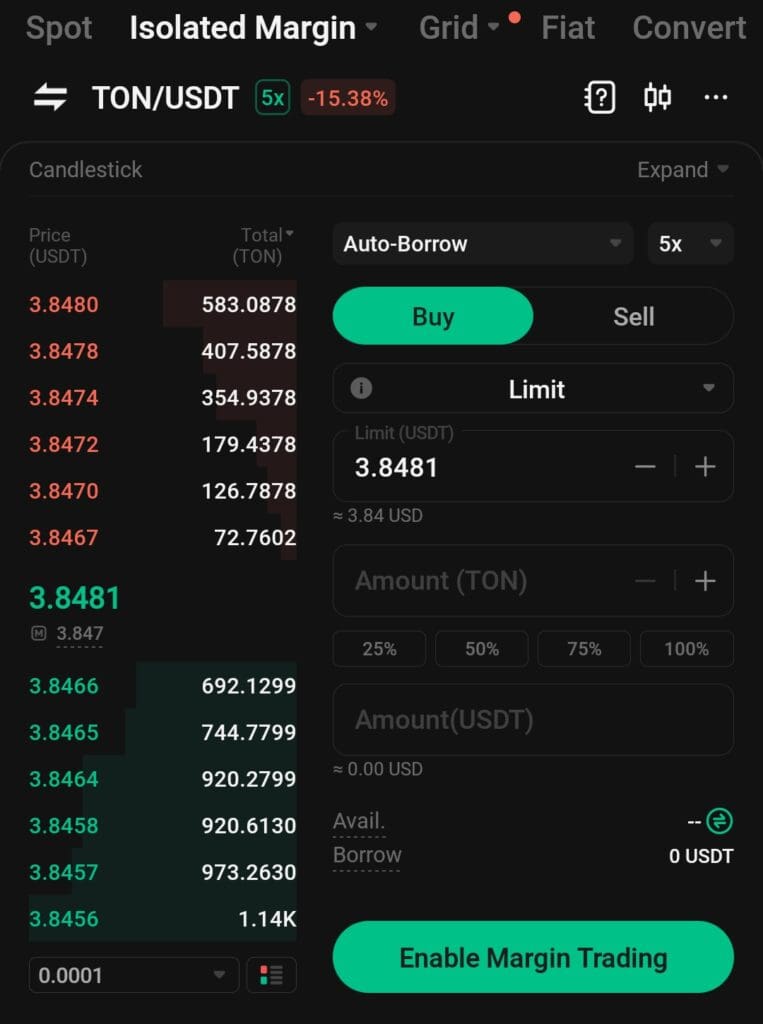

KuCoin Margin Trading: Borrow Funds to Amplify Trades

Margin trading on KuCoin lets you borrow crypto to increase your buying power, which can boost profits—but also losses. It’s a tool for experienced users who want more flexibility than spot trading alone.

Here’s how crypto investors typically use margin trading:

Choose 3x–10x leverage: You can borrow more than you own—e.g., trade $300 worth of ETH using $100 of your own funds.

Isolated vs. cross margin: Isolated limits risk to one position, while cross margin shares risk across your account.

Repay manually or automatically: KuCoin lets you repay interest and borrowed funds when you’re ready or automate it post-trade.

Margin trading can help you make moves in volatile markets with limited capital. Just make sure you understand liquidation thresholds before jumping in.

-

KCS Bonuses & Discounts: Save More with KuCoin Token

Holding KuCoin’s native token (KCS) gives you daily bonuses and fee discounts. It rewards loyal users and encourages long-term participation.

Here’s how KCS holders benefit on the platform:

Trading fee discounts: Get up to 20% off spot trading fees just by paying with KCS.

Daily bonus rewards: KuCoin shares 50% of its trading fee revenue with users holding more than 6 KCS.

Staking opportunities: Lock your KCS in KuCoin Earn to receive steady passive income.

If you use KuCoin frequently, holding KCS can lower costs and boost returns. It also creates a small income stream without active trading.

-

KuCard (Beta): Spend Crypto Like Cash

KuCard is a crypto debit card that lets users spend digital assets like regular money. This bridges the gap between investing and everyday purchases.

Here’s how KuCard works in practice:

Real-time conversion: When you swipe, KuCoin automatically converts crypto (e.g., USDT) into local fiat currency.

Use anywhere Visa is accepted: Whether you’re buying coffee or booking flights, KuCard works globally.

Track expenses in-app: The KuCoin app shows spending history and remaining crypto balance in real time.

KuCard makes crypto usable beyond the exchange, ideal for users who want to spend their gains or live off crypto. Just note, the rollout is still in early phases and region-limited.

-

P2P Marketplace: Buy Crypto with Local Payment Methods

The P2P (peer-to-peer) feature lets you buy or sell crypto directly with other users using local payment options. This is helpful if you're avoiding credit cards or bank wires.

Here’s how users engage with KuCoin’s P2P system:

Use fiat payment methods: Pay via PayPal, Revolut, Wise, or local bank transfers, depending on your region.

Zero trading fees: P2P transactions are free for both buyers and sellers.

Built-in escrow service: KuCoin holds the crypto until payment is confirmed to protect both sides.

P2P is useful in countries with limited banking support for crypto or where credit card usage is restricted. It also gives you more control over price and payment method.

-

KuCoin Learn & News: Stay Updated, In-App Education

KuCoin offers free educational content directly on the platform to help users expand their knowledge. It’s a solid resource for beginners or anyone looking to keep up with market trends.

Here’s how you can learn while using KuCoin:

Beginner tutorials Cover Topics like “how to use leverage” or “what is staking” in bite-sized lessons.

In-app news feed: Market summaries, token listings, and crypto alerts help users stay ahead.

Earn rewards for learning: Some promotions offer free crypto for completing quizzes or reading lessons.

If you're new to crypto, KuCoin Learn gives you an easy entry point. Even if you're experienced, real-time updates are useful for keeping up with market events.

Common KuCoin Mistakes to Avoid: Tips for Smarter Trading

KuCoin makes it easy to trade and invest, but small mistakes can cost you if you're not paying attention. Here are some tips to avoid trouble:

Skipping 2FA security setup: Always enable two-factor authentication and trading passwords to protect your account from unauthorized access.

Using high leverage without experience: Futures and margin trading can wipe out your funds quickly if you don't understand how liquidation works.

Ignoring trading fees: Even though KuCoin fees are low, they can add up fast if you trade constantly without planning.

Staking random coins blindly: Always research the terms, lock-up periods, and risks before staking coins through KuCoin Earn products.

Sending crypto to wrong networks: Always double-check if you're using the correct blockchain (like ERC-20 vs. BEP-20) before making deposits or withdrawals.

Taking a few minutes to set up security and understand each feature can save you a lot of money and stress. KuCoin offers powerful tools — but like any platform, you need to use them carefully.

FAQ

You can deposit fiat via credit card, bank transfer, or third-party services like Simplex and Banxa. However, KuCoin doesn't hold fiat balances directly.

Yes, KuCoin charges withdrawal fees based on the network and coin you're withdrawing. The fee amount is displayed before you confirm the transaction.

Withdrawals usually process within 30 minutes but can vary depending on blockchain congestion. Always check your withdrawal history for status updates.

Yes, KuCoin offers full-featured apps for both iOS and Android. You can trade, earn, withdraw, and use bots directly from your phone.

No, KuCoin is a centralized exchange, meaning it holds custody of your crypto unless you withdraw to an external wallet.

You can reset your trading password through the app or website, but withdrawals will be temporarily locked for security reasons.

Yes, KuCoin has an NFT marketplace called Windvane where you can buy, sell, and mint NFTs on multiple blockchains.

The VIP program rewards high-volume traders with reduced fees, priority support, and special promotions. It’s based on your 30-day trading volume.

Yes, KuCoin allows you to create price alerts for any trading pair. You can receive notifications through the app when prices hit your target.