The Yahoo Finance Stock Screener is a powerful tool that helps investors filter and find stocks based on specific criteria such as market cap, price, sector, and performance.

It’s ideal for discovering investment opportunities without needing a premium Yahoo Finance subscription.

Plan | Monthly Subscription |

|---|---|

Yahoo Finance – Bronze | $9.95

$95.40 ($7.95 / month) if paid annually |

Yahoo Finance – Silver | $24.95

$239.40 ($19.95 / month) if paid annually |

Yahoo Finance – Gold | $49.95

$479.40 ($39.95 / month) if paid annually |

Best Free Yahoo Finance Screener Features

The Yahoo Finance Stock Screener allows users to filter stocks based on various criteria, helping investors find opportunities that meet their investment goals.

Key features include customizable filters and real-time data updates.

1. Dividend Screening

Yahoo Finance’s screener allows users to filter for dividend-paying stocks, helping income investors build portfolios with reliable yield and long-term growth potential.

Dividend Yield: Filter for companies offering higher-than-average dividend yields to generate income from your holdings.

Payout Ratio: Use this to assess dividend sustainability; lower payout ratios often suggest room for growth or protection during downturns.

Dividend Growth: Target companies with a multi-year history of increasing dividends—an indicator of financial health and shareholder focus.

-

Dividend Screening - Example

A retiree seeks dependable income stocks with moderate risk. They set:

Dividend Yield: 3%+

Payout Ratio: <70%

Dividend Growth: Positive over 5 years

This helps income-focused investors identify financially healthy companies with reliable and sustainable dividend payouts.

2. Sector and Industry Screening

Yahoo Finance’s screener includes filters for both sectors and industries, helping investors focus on specific market areas or diversify across them.

Sector Filter: Narrow your search to broad sectors like Technology, Healthcare, or Financials.

Industry Filter: Drill down to specific industries (e.g., semiconductors, biotech, banks) for more targeted exposure.

Diversification Strategy: Use sector spread to balance your portfolio across defensive and cyclical areas.

-

Sector and Industry Screening - Example

An investor wants exposure to U.S. defense stocks. They set:

Sector: Industrials

Industry: Aerospace & Defense

Market Cap: Over $10B

This allows investors to focus their analysis on specific market segments with strong potential or strategic importance.

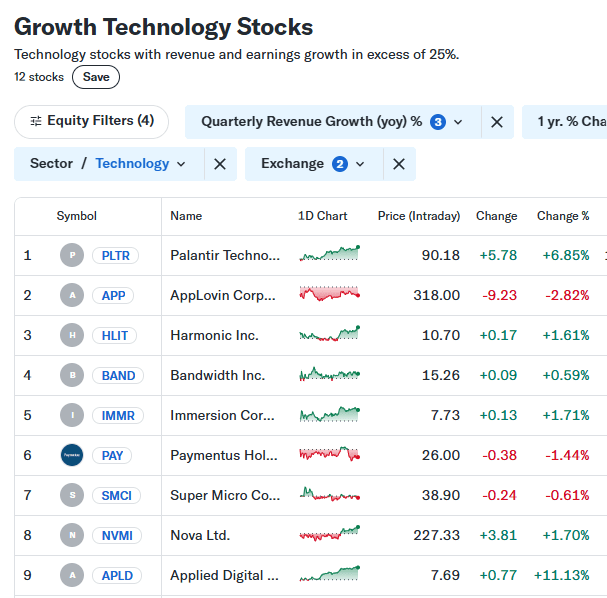

3. Growth and Value Investing Screening

Yahoo Finance allows users to screen based on fundamental metrics tied to either growth or value strategies, making it ideal for strategy-driven investing.

Growth Filters: Use EPS growth, revenue growth, and high forward P/E to find expanding companies.

Value Filters: Target low P/E, P/B, and undervalued stocks trading below intrinsic worth.

Hybrid Strategy (GARP): Combine growth and value metrics to find “growth at a reasonable price” stocks.

-

Growth and Value Investing - Example

A value investor wants to find financially strong bargains. They set:

P/E Ratio: Under 15

Revenue Growth: Positive

Market Cap: Over $5B

This approach helps identify companies that align with either deep value or high-growth investment strategies.

4. Debt and Liquidity Screening

Yahoo Finance’s screener includes financial health metrics that help investors evaluate companies’ debt loads and liquidity, important for both risk management and stability.

Debt-to-Equity Ratio: Filter for companies with low leverage to reduce exposure to financially risky businesses.

Current Ratio: Screen for companies that can easily cover short-term obligations, signaling operational strength.

Quick Ratio: A more conservative measure of liquidity, ideal for evaluating emergency cash handling.

-

Debt and Liquidity Screening - Example

A cautious investor wants financially stable companies in volatile sectors. They set:

Debt-to-Equity: Under 0.5

Current Ratio: Above 2

Sector: Technology

This helps reduce portfolio risk by filtering for financially stable businesses with solid balance sheets.

5. Technical Indicator Screening

For technically minded traders who need a technical screener, Yahoo Finance offers filters based on basic indicators like moving averages and RSI, which are useful for identifying momentum or reversal signals.

RSI Filter: Spot oversold (RSI <30) or overbought (RSI >70) conditions for potential entry or exit points.

Moving Averages: Filter stocks trading above their 50-day or 200-day moving averages—common trend-following signals.

MACD: Detect momentum shifts and potential breakouts using MACD crossovers.

-

Technical Indicator Screening - Example

A trader wants to find bullish setups. They screen for:

RSI: Between 40 and 60

Price: Above 50-day moving average

Volume: Over 500K shares

This could surface mid-cap momentum plays preparing for a breakout.

6. Customizable Filters

Yahoo Finance’s screener lets users fully customize screens using dozens of metrics—across valuation, performance, dividends, technicals, and more—tailored to any investing strategy.

Build by Investment Goal: Choose filters aligned with income, growth, or safety preferences.

Layered Screening: Add multiple filters (e.g., P/E, sector, analyst rating) for highly specific results.

Reusability: Save screens to monitor ongoing opportunities or adjust for new strategies.

-

Customizable Filters - Example

An investor seeks high-quality small-cap growth stocks. They set:

Market Cap: Under $2B

Revenue Growth: >20%

Sector: Consumer Discretionary

This highlights fast-growing companies often missed in larger indexes.

Best Paid Yahoo Finance Screener Features

Yahoo Finance's paid plans unlock advanced screener tools designed for serious investors and active traders.

These premium features offer deeper insights, expert research, and smarter stock filtering capabilities:

7. Analyst Ratings Screener

The Yahoo Finance Screener in Silver and Gold plans includes an Analyst Ratings filter, allowing investors to find stocks based on expert opinions from Morningstar and Argus.

Buy/Hold/Sell Filter: Investors can screen for stocks with a “Buy” or “Strong Buy” consensus to target companies favored by analysts.

Rating Changes: Focus on stocks recently upgraded or downgraded, which often experience short-term price momentum.

Fair Value Estimates: In Silver and Gold, Morningstar fair value data helps investors determine if a stock is undervalued based on comprehensive research.

-

Analyst Ratings Screener - Example

A fundamental investor wants to find undervalued large-cap U.S. stocks with bullish analyst sentiment. They set:

Market Cap: Over $10B

Analyst Rating: Buy

Morningstar Fair Value: Undervalued

This returns quality stocks trading below fair value with strong institutional backing—ideal for long-term investing.

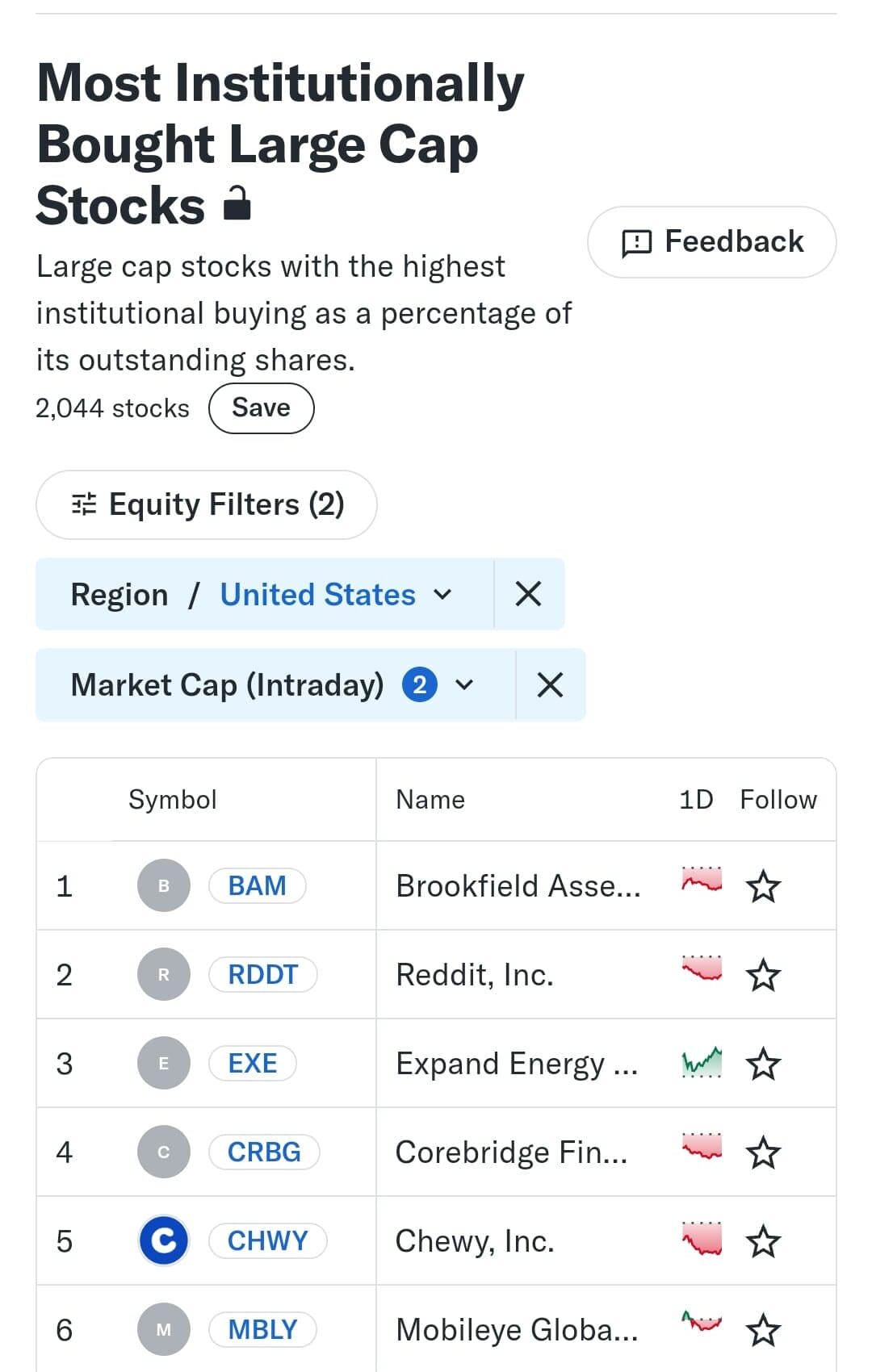

8. Smart Money Screener

The Smart Money Screener (Gold only) tracks institutional investor activity, letting users filter for stocks with high hedge fund or mutual fund ownership.

Institutional Accumulation: Identify stocks being bought heavily by hedge funds or large asset managers.

Recent Institutional Buys: Filter for companies that saw new institutional purchases in the last quarter.

Ownership % Filter: Target stocks where institutional investors hold a large percentage of total shares, indicating strong conviction.

-

Smart Money Screener - Example

An investor wants to align with hedge fund positions. They screen for:

Institutional Ownership: Over 70%

Recent Buys: Yes

Sector: Financials

This returns stocks being actively bought by large funds—ideal for investors following smart money signals.

9. Technical Events Screener

Available only in Yahoo Finance Gold, this screener filters stocks based on advanced technical patterns like breakouts, trend reversals, and support/resistance levels.

Pattern Recognition: Scan for 50+ technical setups including head & shoulders, double bottoms, and flag patterns.

Moving Average Crossovers: Filter for bullish or bearish crossovers, signaling momentum changes.

Breakout Alerts: Identify stocks breaking above resistance levels, often indicating strong upward moves.

-

Technical Events Screener - Example

A swing trader wants to catch breakouts in the tech sector. They screen for:

Technical Pattern: Breakout

Sector: Technology

Volume: Above 1M

This highlights tech stocks experiencing high-volume technical breakouts—ideal for short-term trade setups.

10. Top Holdings Screener

Exclusively in the Gold plan, the Top Holdings Screener shows stocks most commonly held by institutional investors, allowing users to build portfolios aligned with professional funds.

Most Held Stocks: View stocks widely held by hedge funds and mutual funds.

High Conviction Picks: Filter by stocks that appear in the top 10 holdings of major institutions.

Fund Ownership Trends: Spot changes in institutional confidence based on ownership shifts.

-

Top Holdings Screener - Example

A long-term investor wants to build a portfolio mirroring institutional holdings. They screen for:

Common Holdings: In top 25% of mutual fund portfolios

Market Cap: Over $50B

Sector: Healthcare

This pulls up blue-chip stocks that institutions rely on—ideal for conservative or retirement-focused portfolios.

Free vs Paid Screener: Compare Yahoo Finance Plans

Yahoo Finance offers both free and paid stock screener tools to suit different investor needs.

- The free version includes customizable filters, sector and industry screening, dividend filters, and basic technical indicators—ideal for beginners and long-term investors.

- Paid plans (Bronze, Silver, and Gold) unlock advanced features like analyst ratings, fair value estimates, institutional activity screeners, and technical pattern recognition.

These tools are designed for more active or professional investors who need deeper insights, real-time alerts, and strategic research capabilities.

Plan | Monthly Subscription |

|---|---|

Yahoo Finance – Bronze | $9.95

$95.40 ($7.95 / month) if paid annually |

Yahoo Finance – Silver | $24.95

$239.40 ($19.95 / month) if paid annually |

Yahoo Finance – Gold | $49.95

$479.40 ($39.95 / month) if paid annually |

FAQ

The screener is primarily focused on stocks and ETFs. While Yahoo Finance provides data on mutual funds and bonds, there's no dedicated screener for them.

Yes, the Yahoo Finance app includes a simplified free stock screener, allowing users to apply basic filters on mobile devices for on-the-go research.

Yes, Yahoo Finance allows combining multiple filter types—such as valuation ratios and moving average conditions—to refine results under one screener setup.

Most filters use real-time or end-of-day data for U.S. stocks, depending on the feature and plan level. Free users may experience slight delays in quotes.

Only Yahoo Finance Gold users can export historical and screener data to CSV for offline analysis. This feature isn't available in the free plan.

The platform does not currently offer automatic alerts for newly matching stocks in saved screeners. Users must re-run saved screens manually.

Insider trading trends and earnings estimate revisions are available in Silver and Gold plans, not in the free version of the screener.

Yes, users can filter by region or country, and in some cases by specific international exchanges, although real-time data may not always be available.