|

| |

|---|---|---|

InvestingPro+ | TradingView Premium | |

Price | $300 ($24.99 / month) | $432 ($23.98 / month) |

Best Features | ||

Our Rating |

(4.6/5) |

(4.6/5) |

Read Review | Read Review |

Compare Stock Research & Analysis Features

In this comparison, we’ll provide a detailed comparison of TradingView Premium and InvestingPro+, focusing on their stock research tools, market sentiment analysis, and portfolio management features.

We’ll explain each platform's unique strengths to help you choose the one that best suits your investment strategy.

-

Stock Screening Tools

TradingView Premium offers a powerful stock screener with real-time data, customizable filters, and the ability to screen based on both technical and fundamental factors.

With access to stock market cap, valuation ratios, technical indicators, and more, it provides flexibility for a variety of strategies.

However, InvestingPro+ excels with its advanced screener, featuring over 1,200 metrics, including profitability, growth potential, and even Warren Buffett-style metrics.

While TradingView provides a more technical-oriented screener, InvestingPro+ shines for its depth in fundamental analysis, making it a better fit for those seeking in-depth financial analysis.

-

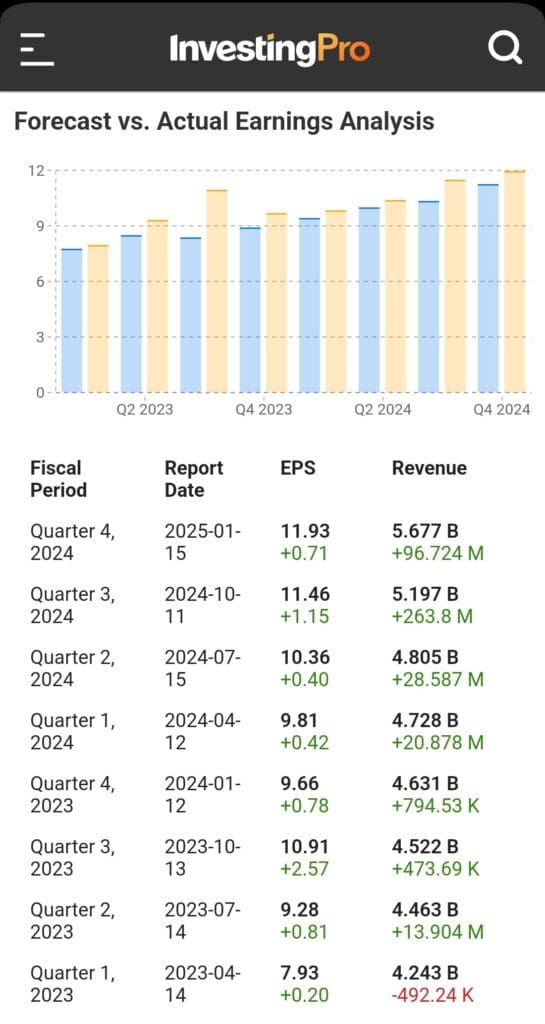

Fundamental Analysis Tools

InvestingPro+ stands out with its 10-year financial history, 14+ valuation models (including DCF and Dividend Discount), AI-driven stock insights, and company health scores.

The platform also provides premium market news, which is essential for tracking developments.

On the other hand, TradingView Premium provides solid tools, including access to financial statements and earnings reports, but it doesn’t offer as in-depth fundamental research as other platforms.

It lacks analyst ratings, fair value estimates, and a full suite of stock analysis reports.

Although both offer strong fundamental data, InvestingPro+ offers more advanced research and insights.

-

Stock Picks & Recommendations

We found that TradingView Premium doesn't provide curated stock picks or investment advice, as it primarily focuses on technical analysis and charting.

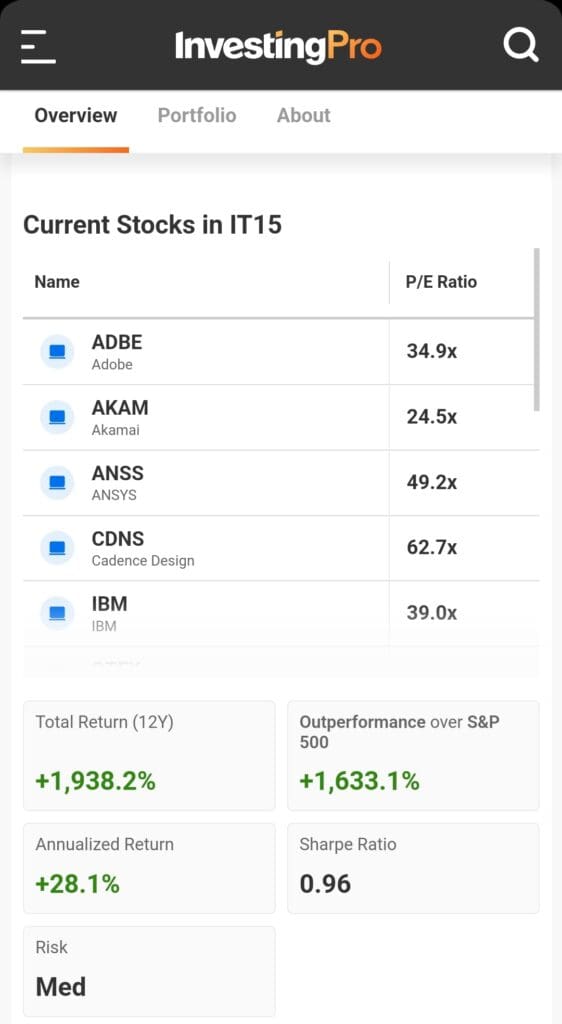

InvestingPro+ includes AI-powered stock picks through its ProPicks tool, which scans stocks likely to outperform based on historical performance and financial data.

This feature provides automated recommendations, giving investors an edge in stock selection.

InvestingPro+ also lacks direct analyst ratings but still offers more actionable stock ideas than TradingView Premium.

-

Market Sentiment Analysis

TradingView Premium includes social trading features that allow users to share ideas, follow other traders, and even access invite-only scripts.

This adds a community element that can influence sentiment, especially for short-term traders.

Additionally, TradingView Premium allows users to get second-based alerts and real-time notifications, making it ideal for reacting quickly to market changes.

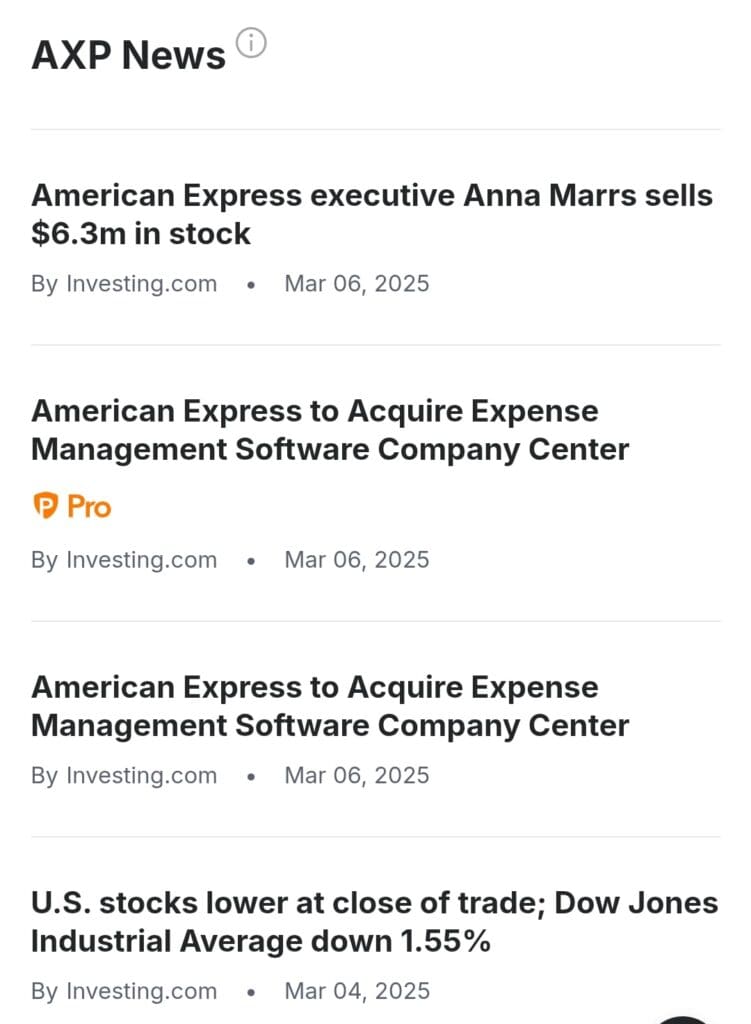

On the other hand, InvestingPro+ provides premium market news and AI-driven insights, offering relevant news articles, earnings reports, and macroeconomic updates.

However, it lacks the social trading aspect seen on TradingView.

Overall, TradingView Premium excels in real-time social features and alerts, while InvestingPro+ offers superior news coverage and market sentiment insights.

-

Portfolio Analysis & Alerts

TradingView Premium excels in alert customization, offering unlimited alerts based on price movements, technical indicators, and custom strategies via Pine Script®.

Its paper trading feature allows users to simulate real trades, adding a risk-free testing element. However, it lacks real-time portfolio sync and management tools.

In contrast, InvestingPro+ offers portfolio analysis, but it doesn’t support direct integration with brokerage accounts for live updates.

It compensates by offering a broader range of stock alerts, including price movements, earnings updates, and dividend changes, but its alert system isn’t as robust or customizable as TradingView’s.

-

Technical Analysis Options

TradingView Premium is one of the top charting tools. It includes Supercharts, over 400 indicators, and advanced chart types like Renko, Kagi, and Point & Figure.

The platform also allows for multi-timeframe analysis, 25 indicators per chart, and auto chart pattern detection. Its Pine Script® automation allows traders to build custom strategies.

In contrast, InvestingPro+ offers basic charting and technical analysis tools, focusing more on fundamental data.

While its technical features are decent, it doesn’t match the extensive charting capabilities and customization that TradingView Premium provides.

-

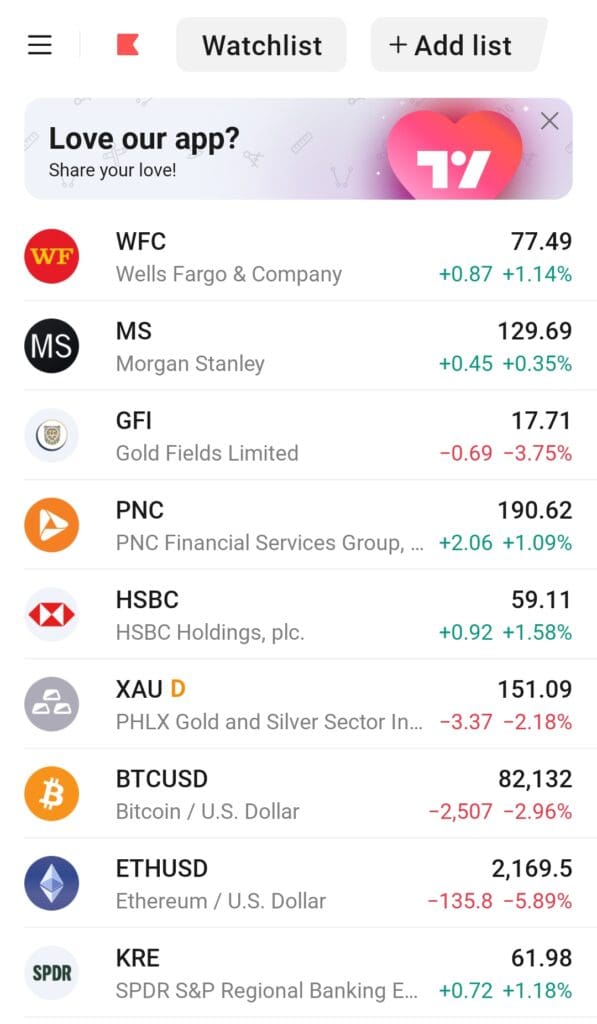

ETF, Bonds & Fund Analysis Tools

TradingView Premium provides more advanced real-time ETF and bond screeners, while InvestingPro+ offers deeper fundamental analysis for ETFs and bonds.

TradingView Premium offers a comprehensive suite of screeners for stocks, ETFs, bonds, and cryptocurrencies, including one of the leading screeners for cryptocurrencies. It features advanced filtering and real-time data for deep analysis.

For ETFs, it provides comparisons of expense ratios, performance, and sector exposure, making it valuable for portfolio diversification.

On the other hand, InvestingPro+ delivers strong ETF and bond analysis with enhanced performance tracking and detailed sector rankings.

It also offers 14+ financial models, which are particularly useful for valuing bonds and ETFs based on their underlying fundamentals.

Which Investors May Prefer InvestingPro+?

InvestingPro+ subscription is worth it for investors who prioritize fundamental analysis and long-term stock evaluations. Here are the key profiles:

Fundamental Analysts: Investors who value in-depth financial data, 10-year histories, and 14+ valuation models for stock selection.

Value Investors: Those who look for undervalued stocks using tools like Fair Value Gap Analysis and advanced stock screeners.

Dividend Investors: Investors focused on dividends will appreciate detailed insights on dividend yields, payout histories, and forecasts.

AI-Driven Investors: Investors seeking automated stock recommendations powered by AI ProPicks for smarter stock selection.

Plan | Monthly Subscription |

|---|---|

InvestingPro | $15.99

$120 ($9.99 / month)

if paid annually |

InvestingPro+ | $39.99

$300 ($24.99 / month) if paid annually |

Which Investors May Prefer TradingView Premium?

A TradingView subscription is worth it for investors focusing on technical analysis and real-time market reactions. These include:

Day Traders: Those who require second-based alerts, ultra-fast execution, and advanced charting for immediate market reactions.

Swing Traders: Investors who use multi-timeframe analysis and unlimited indicators to identify trends and reversal points.

Algorithmic Traders: Traders who build and deploy automated strategies using Pine Script® and webhook alerts.

Technical Investors: Those who rely on technical signals, chart patterns, and advanced chart types for long-term positions.

Plan | Monthly Subscription | Promotion |

|---|---|---|

Trading View Essential | $14.95

$108 ($9 / month) if paid annually | 30-day free trial |

Trading View Plus | $29.95

$180 ($14.95 / month) if paid annually

| 30-day free trial |

Trading View Premium | $59.95

$432 ($23.98 / month) if paid annually | 30-day free trial |

Trading View Expert | $119.95

$1,199 ($99.95 / month) if paid annually | N/A |

Trading View Ultimate | $239.95

$2,399 ($199.95 / month) if paid annually | N/A |

Bottom Line

TradingView Premium is perfect for traders and investors who need advanced technical analysis, real-time alerts, and strategy automation. Its top features include customizable charts, unlimited alerts, and multi-timeframe analysis.

In contrast, InvestingPro+ excels in fundamental analysis with deep stock data, AI-powered stock picks, and financial models, making it ideal for value and dividend investors.