J.P. Morgan Self Directed Investing | Robinhood | |

Monthly Fee | $0

$0 online commission on U.S. listed stocks and ETFs and $0.65 per-contract | $0 – $6.99

$0 for basic account, $6.99 for Robinhood Gold |

Account Types | Brokerage, Retirement | Brokerage, Retirement, Crypto |

Savings APY | 0.01% – 3.99% | 1.00% – 4.50%

You’ll earn 0.01% Annual Percentage Yield (APY) as a Robinhood Gold member on your uninvested brokerage cash that is swept to the banks in our program. |

Minimum Deposit | $0 | $0 |

Best For | Existing Chase Customers, Active Investors Looking To Minimize Fees | Active Traders, Tech Savvy Investors |

Read Review | Read Review |

JPM Self-Directed vs Robinhood: Compare Features

JPM surpasses Robinhood in its more comprehensive research tools and ability to trade a broader range of assets with a focus on long-term growth.

Robinhood | JPM Self-Directed Investing | |

|---|---|---|

Investing Options | Over 5,000 securities, most U.S. stocks and ETFs listed on U.S. exchanges | 800 stocks and ETFs, 8,000+ mutual funds |

Investing Types | Stocks, Options, Futures, ETFs, Crypto, Margin, Fractional Shares | Stocks, Options, ETFs, Fixed Income, Mutual Funds |

Automated Investing | No | No |

Paper Trading | No | No |

IPO Access | Yes | No |

Dedicated Advisor | No | No |

However, Robinhood excels in providing a dynamic and flexible trading environment with better technical analysis tools and the ability to trade around the clock.

-

Self Investing And Fundamental Analysis Options

JP Morgan Self-Directed Investing is our winner when it comes to self-investing due to its better research options and simplicity, while Robinhood has broader investment types, including crypto.

JPM Self-Directed Investing excels in providing a more traditional and comprehensive range of research and fundamental analysis tools.

It offers a robust selection of resources, including proprietary research, portfolio analysis tools, and ESG/SRI research.

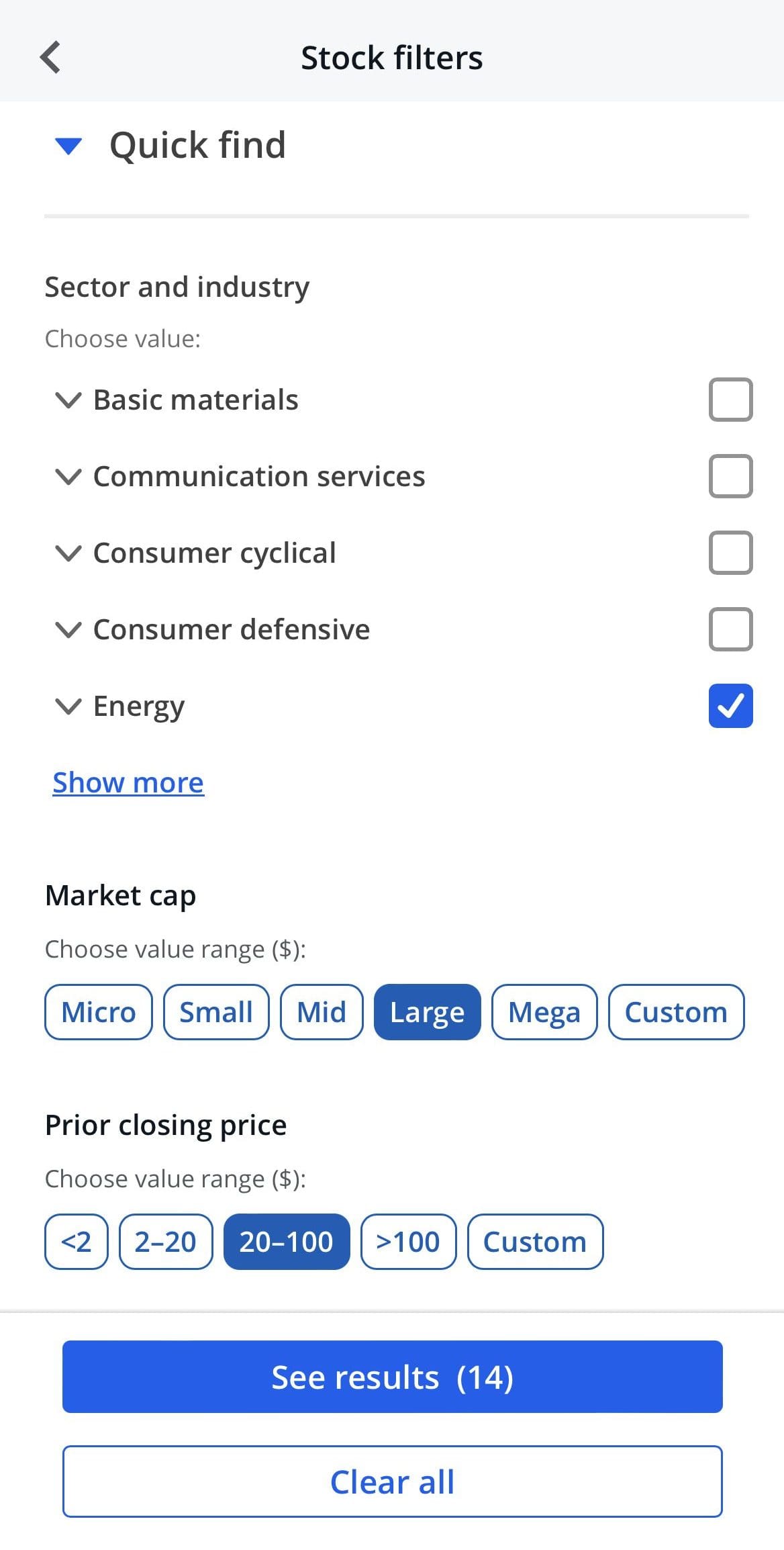

This platform is particularly strong in helping users create and maintain a diversified portfolio through advanced screeners, personalized market alerts, and detailed investment comparison tools.

Robinhood excels in simplicity and ease of use, making it ideal for newer investors who want a straightforward, commission-free trading experience, including for options trading.

Its highly intuitive platform has user-friendly charts and basic fundamental data that are easy to navigate, making stock analysis accessible to everyone.

For example, you can get news and analyst ratings on chosen stocks:

-

Trading Options And Technical Analysis Tools

Robinhood is our winner when it comes to technical analysis features. However, both platforms are definitely good enough for the average trader.

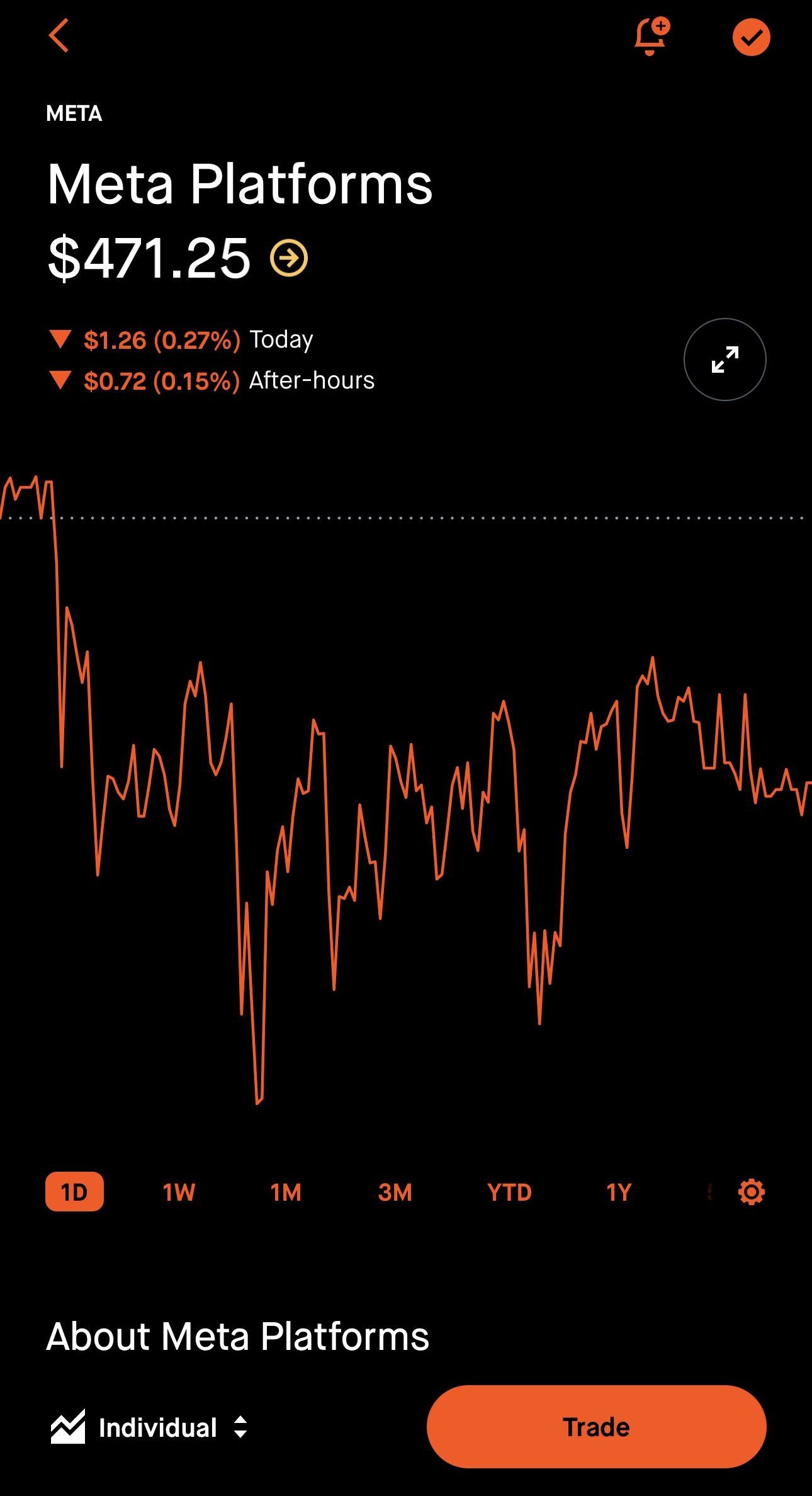

Robinhood lets customers analyze different technical analysis indicators, including charts like moving averages, RSI, MACD, and more:

Its trading interface is clean and straightforward, allowing users to execute trades quickly.

When it comes to technical analysis tools, JPM’s offerings are good for the average trader but don't include advanced options.

The platform offers essential tools like charting and stock screeners. Customers can generate specific graphs based on various indicators such as volume, momentum, and trends.

The platform also allows the use of upper and lower indicators, such as moving averages, linear regression, and high/low ratios, to gain deeper insights and make more informed technical analysis decisions.

-

Robo Advisor And Automated Investing

JPM Self-Directed Investing and Robinhood do not offer traditional robo-advisor or automated investing options.

Robinhood, on the other hand, offers some features that simplify investing. Robinhood’s portfolio-building tools offer recommendations based on your risk tolerance, but they still require manual input to manage and adjust investments.

-

Retirement Accounts

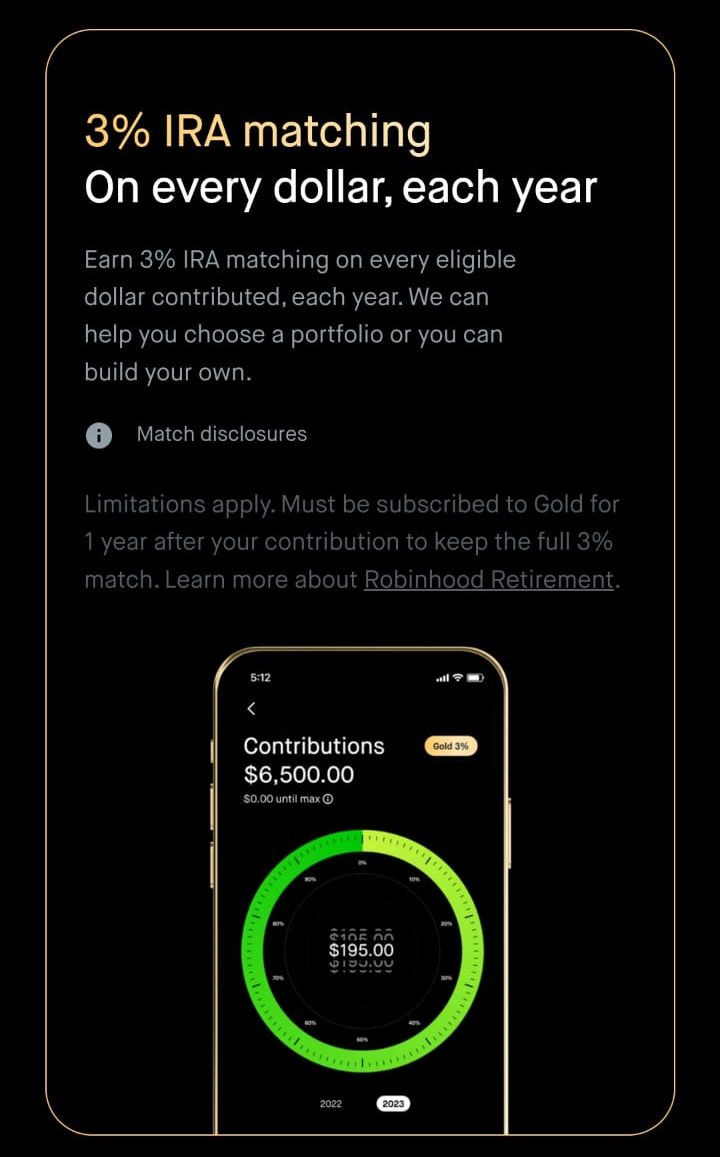

Robinhood offers more options investment options for retirement accounts and also offers great perks, which are not available on JP Morgan Self-Directed Investing.

Robinhood offers a straightforward approach to retirement investing, making it easy for users to open traditional, Roth, or rollover IRAs.

One of Robinhood's standout features is its IRA match, even for non-employer plans. This match, which can go up to 3% for Gold members, is a unique offering that adds extra value to retirement savings, especially for those just getting started.

JP Morgan Self-Directed Investing providing traditional and Roth IRAs without annual fees and offering commission-free trades.

-

Fees

Robinhood is our winner when it comes to platform fees.

JPM charges no commissions on stocks, ETFs, and mutual funds making both platforms appealing for cost-conscious investors.

Robinhood, on the other hand, is known for its completely commission-free trading on stocks, ETFs, options, and even cryptocurrencies.

Robinhood | JPM Self-Directed Investing | |

|---|---|---|

Fees | $0 – $6.99

$0 for basic account, $6.99 for Robinhood Gold | $0

$0 online commission on U.S. listed stocks and ETFs and $0.65 per-contract |

However, JPM has a $0.65 per contract fee for options trades and charges for certain services like broker-assisted trades and account transfers.

Robinhood premium features, known as Robinhood Gold, require a monthly fee.

-

Cash Management And Savings Rates

When it comes to banking options, neither JP Morgan Self-Directed Investing nor Robinhood offer attractive options, but Robinhood Gold's interest rate and credit card are interesting features if you use Gold.

Robinhood | JPM Self-Directed Cash APY | |

|---|---|---|

Savings APY | 1.00% – 4.50%

You’ll earn 0.01% Annual Percentage Yield (APY) as a Robinhood Gold member on your uninvested brokerage cash that is swept to the banks in our program. | 0.01% – 3.99% |

JPM Self-Directed Investing is closely tied to Chase, which gives it an edge for those already using Chase for their banking needs.

However, there is no stand-alone cash management for JPM self-directed customers, and the interest rates on uninvested cash are quite low, typically around 0.01%

Robinhood customers can earn competitive interest rates on uninvested cash, and the funds are FDIC-insured through partner banks. Also here, checking account features are limited.

The Robinhood Cash Card also provides everyday rewards, making it appealing for users who want to earn while they spend, with features like 5% cash back on travel booked through Robinhood's portal.

-

Wealth Management

JP Morgan is our ultimate winner here as Robinhood doesn't offer wealth management.

J.P. Morgan offers two levels of personalized financial advisory services: Personal Advisors and Private Client Advisors, both designed to help you achieve your unique financial goals.

- With Personal Advisors, you get the convenience of virtual financial planning, along with ongoing advice and access to expert-built portfolios that even come with tax-smart technology.

- But if you’re after something more exclusive, the J.P. Morgan Private Client Advisors are perfect for you. Focusing on clients with $100,000 or more in investable assets, they offer a one-on-one relationship, a custom portfolio, and holistic management of your investments and retirement plans.

Bottom Line

JPM is ideal for those who value comprehensive research tools, traditional retirement planning, and seamless integration with Chase banking services.

Robinhood, on the other hand, is best suited for newer or more active traders who prioritize ease of use, mobile accessibility, and low costs.

Compare Robinhood Side By Side

Schwab offers more options for investors, including robo advisors and wealth management, while Robinhood is best for beginners and traders.

Schwab vs. Robinhood: Which Brokerage is Right for You?

Vanguard offers more options for investors, including retirement, robo advisors, and wealth management, while Robinhood is best for traders.

Merrill Edge is best for long-term investments, including retirement, while Robinhood is perfect for active traders who value simplicity.

Merrill Edge vs. Robinhood: Compare Brokerage Account Options

Fidelity is our winner for diversified long-term investing, while Robinhood shines in cost-effective options for active traders and beginners.

Robinhood is an excellent choice for beginner and casual investors, but IBKR is better suited for experienced investors and advanced traders.

Interactive Brokers vs. Robinhood: Compare Brokerage Account Options

Robinhood is best for low-cost platform for various trading needs, including Crypto. Etrade is better for one stop shop, including banking.

Robinhood is best for traders looking for easy, cost-free trading, while Stash is great for beginner investors who need a financial management tool

While Robinhood caters to traders and advanced investors, Acorns focuses on automated investing and banking. Here's our full comparison.

Webull is better suited for experienced traders needing advanced tools, whereas Robinhood caters to beginners and those who prefer simplicity.

How J.P. Morgan Self Directed Compares to Other Online Brokers

Both offer similar tools for the average investor or trader, but Merrill is better at automated investing. Here's our full comparison:

J.P. Morgan Self-Directed Investing vs. Merrill Edge: Compare Brokerage Accounts

If you're an experienced investor or trader, IBKR may be a better option. If you're a Chase customer or prefer simplicity, consider JP Morgan.

Interactive Brokers vs. J.P. Morgan Self-Directed Investing: Which Broker Wins?

Vanguard offers a better approach for serious investors, while JP Morgan's self-directed is better for beginners and advanced traders

Vanguard vs. J.P. Morgan Self-Directed: Which Broker is Best For You?

Schwab surpasses JPM self-directed in most categories, including self-directed investing, robo advisory, and technical analysis.

Schwab vs. J.P. Morgan Self-Directed: Which Brokerage Is Best?

JP Morgan is best for the average investor seeking a simple platform or wealth management, but E-Trade is our overall winner. Here's why.

J.P. Morgan Self-Directed Investing vs. E-Trade: Which Broker Wins?

Fidelity is our winner due to its investment options, research tools, advanced trading features, and excellent retirement planning services.

J.P. Morgan Self-Directed Investing vs. Fidelity : A Side-by-Side Comparison