MarketBeat (Free Plan)

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Pros & Cons

MarketBeat’s free plan is a great starting point for investors who want basic stock research, market news, and analyst ratings without paying for a subscription.

It provides a daily stock market newsletter, real-time stock quotes (not live streaming), and a stock comparison tool that helps investors evaluate companies side by side.

Free users can also track analyst upgrades and downgrades, insider buying and selling activity, and stocks key financial metrics.

The stock screener offers basic filtering options, helping users find stocks based on analyst sentiment, valuation, and fundamental data.

Portfolio tracking is available through My MarketBeat, where users can monitor selected stocks and receive alerts on key updates.

However, the free plan does not provide MarketRank™ stock rankings, advanced technical analysis, or ETF screener .

- Stock research reports

- Analyst forecast ratings

- Dividend and earnings data

- Insider trade tracking

- Short interest insights

- Options chain analysis

- Stock comparison tool

- Market calendars

- Portfolio tracking

- Stock market heatmaps

- Trending stocks data

- MarketBeat mobile app

- Free stock research tools

- Daily market newsletter

- Analyst ratings tracking

- Portfolio monitoring alerts

- Stock comparison tool

- No real-time news

- Limited technical indicators

- No ETF screener

- No stock rankings

- Basic stock screener

How To Research Stocks With MarketBeat?

MarketBeat’s stock research tools, charting options, and portfolio. The platform is very friendly for beginners, easy to use and provides clear data and charts for analysis. Here are our key insights:

-

MarketBeat’s Stock Research Reports and Data Analysis

MarketBeat provides a comprehensive suite of stock research tools that deliver in-depth insights into a company’s financial health, market position, and stock performance.

Investors can access key data sections, including stock analysis, analyst forecasts, dividend reports, earnings history, SEC filings and short interest.

Here's a summary of the main things you can find in the report:

-

Analyst Forecasts

MarketBeat aggregates stock ratings and price targets from top Wall Street analysts, offering a consolidated view of market sentiment.

Investors can see whether a stock has been recently upgraded, downgraded, or maintained as a buy, sell, or hold recommendation.

-

Dividend & Earnings

For income-focused investors, this section displays a stock’s dividend history, payout ratios, yield percentages, and upcoming ex-dividend dates.

The earning section summarizes past earnings reports, including revenue figures, earnings per share (EPS), and whether a company met, beat, or missed analyst expectations.

-

Financials

Investors get access to a company’s key financial statements, including the balance sheet, income statement, and cash flow statement.

This section is essential for fundamental analysis, allowing investors to review revenue growth, debt levels, profit margins, and overall financial health.

-

Insider Trades

Investors can track insider buying and selling activity from company executives and major shareholders.

Insider purchases often signal confidence in a company’s future, while large insider sales may raise caution.

This section provides valuable insights into stock sentiment from those with inside knowledge of the company.

-

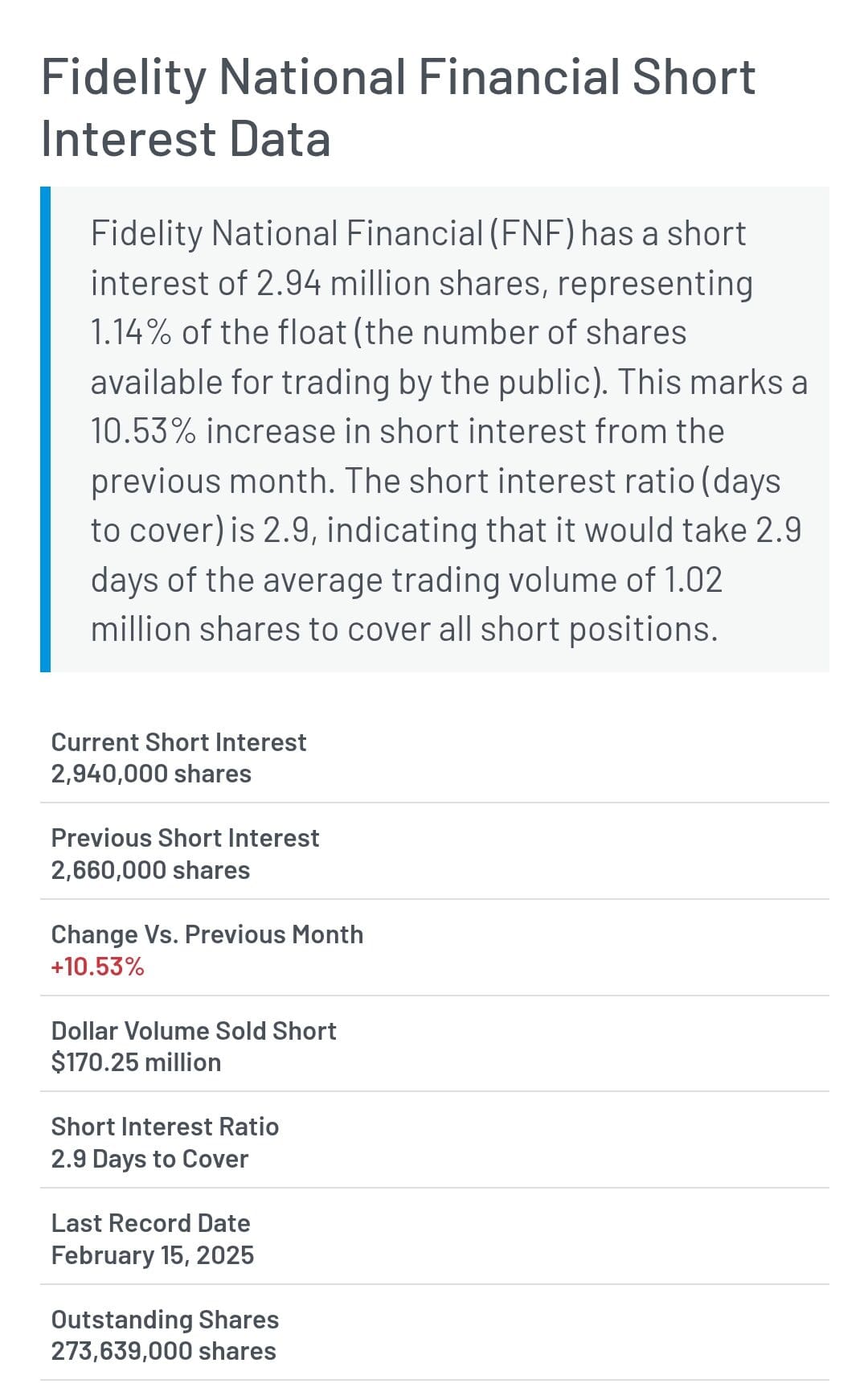

Short Interest

This section tracks the percentage of a company’s shares that have been sold short, providing insight into market sentiment.

A high short interest suggests bearish sentiment, while a sudden decline in short interest could indicate short covering or a potential rally.

-

Options Chain

Options traders can analyze open interest, strike prices, expiration dates, and bid/ask spreads in this section.

It provides data for calls and puts, helping traders evaluate potential strategies such as covered calls or protective puts.

-

Limited Charting and Technical Analysis Tools

MarketBeat’s interactive charts (powered by TradingView) are designed for traders and investors who rely on real-time data and technical indicators.

The charting system includes essential indicators like the Relative Strength Index (RSI) for momentum tracking, Bollinger Bands for volatility assessment, and the Ichimoku Cloud for trend forecasting.

More advanced traders can utilize Parabolic SAR, which signals potential trend reversals, and the Chaikin Money Flow and Chaikin Oscillator, which provide insights into institutional buying and selling pressure.

However, you can explore up to 2 indicators in the chart, while the higher tier plan offers up to 25 indicators, which makes it a bit limited.

-

My MarketBeat (Portfolio Monitoring)

My MarketBeat is a simple yet effective portfolio monitoring tool that lets users track their stocks, receive alerts, and view financial updates in one dashboard.

Setting up a portfolio is straightforward—users can add stocks to track price movements, analyst ratings, and insider transactions.

MarketBeat’s Portfolio Insights feature provides investors with a detailed breakdown of their holdings, performance, risk level, and market comparisons.

Users can track key portfolio metrics such as total returns, cost basis, holdings value, and ROI, helping them measure investment performance over time.

The platform also highlights biggest winners and losers, offering clarity on which stocks are driving returns or underperforming.

Investors can analyze dividend metrics, including yield, payout ratio, and annual dividend income, making it useful for income-focused strategies.

The asset allocation section breaks down portfolio exposure by sector and asset class, allowing users to see how their investments compare to MarketBeat's broader user base.

Additionally, the largest holdings section helps investors assess concentration risks and diversification.

-

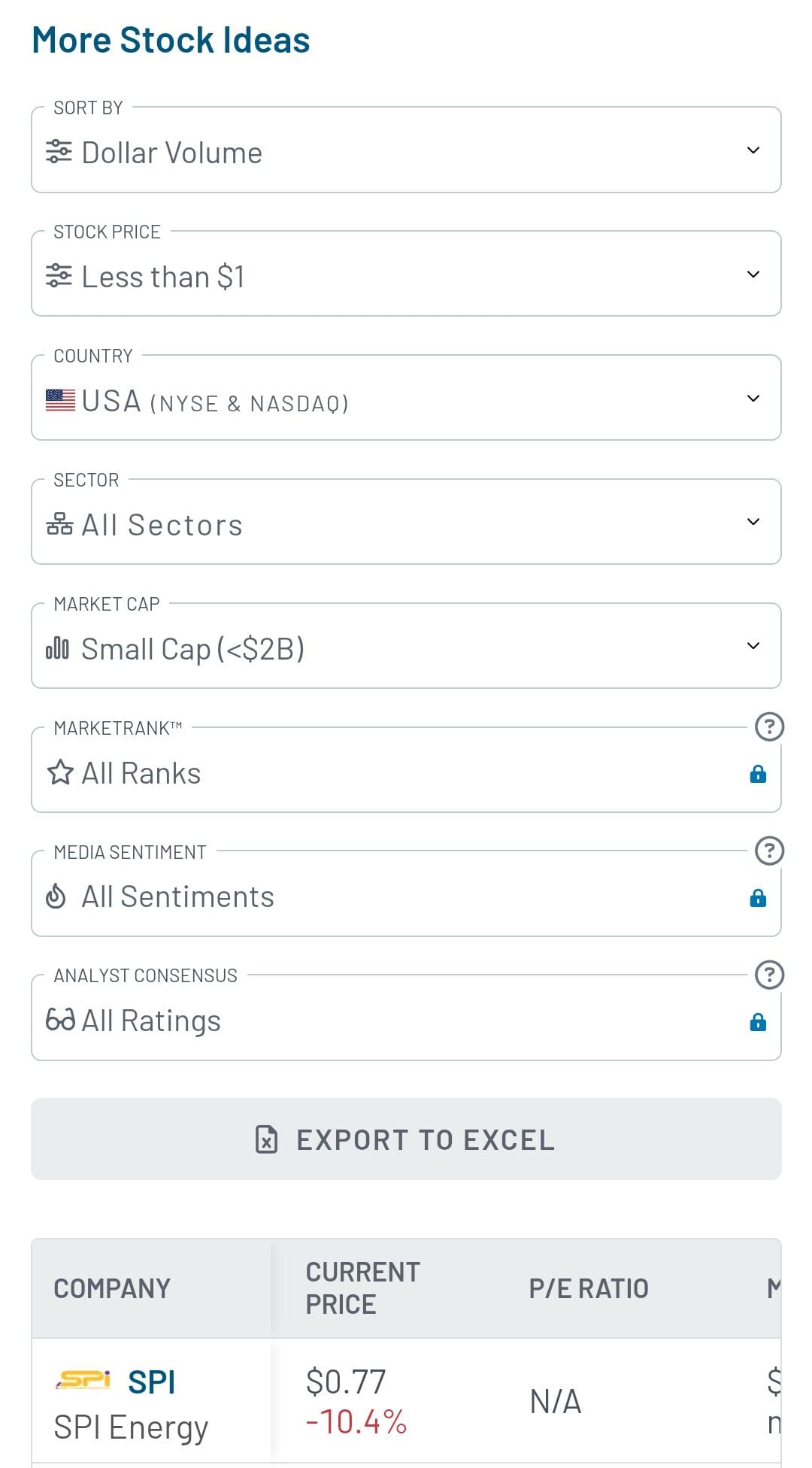

Great Stock Screener

MarketBeat’s Stock Screener is a powerful filtering tool that helps investors and traders identify stocks based on specific financial metrics, technical indicators, and market fundamentals.

The screener includes a wide range of filters, such as analyst ratings, earnings growth, valuation ratios, financial health, ownership, performance trends, and dividend metrics.

Users can refine searches based on consensus price targets, market sentiment, insider trading activity, and key stock advisor ratings.

The ability to filter by fundamentals, technical indicators, and market performance makes it one of the best free research tools for different investment strategies.

However, the ETF screener is not available in the free plan.

-

Market Calendars

MarketBeat’s Market Calendars provide a centralized view of upcoming financial events, including earnings reports, stock splits, IPOs, and dividend payouts.

We found this particularly helpful for planning trades around key announcements, including a calendar for our portfolio:

The layout is easy to navigate, offering a quick way to see which companies are about to report earnings or declare dividends.

Unlike many free calendars, this calendar offers real-time updates, ensuring that investors always have the latest information.

-

Daily Newsletter

The MarketBeat Daily Ratings newsletter provides a concise mid-day summary of key stock market events, including analyst upgrades, downgrades, and top financial headlines.

MarketBeat’s daily stock market newsletter delivers a concise, easy-to-read summary of the latest market news, analyst recommendations, and key stock updates straight to your inbox.

The newsletter also provides relevant news and updates for stocks on your watchlist, ensuring you never miss key developments.

Beyond news updates, the newsletter integrates with MarketBeat’s portfolio monitoring tools (My MarketBeat), allowing users to track their holdings effortlessly. I

The free version is delivered at 1:30 PM ET, offering an overview of market activity as it unfolds. While it helps keep track of important trends, it lacks pre-market insights and deeper analysis tools.

-

Top News Headlines

MarketBeat’s Top News Headlines feature compiles the most relevant stock market and financial news in one place.

The feed updates regularly, pulling news from major sources covering market trends, earnings reports, economic updates, and analyst opinions.

We found this feature useful for staying on top of market movements without needing to browse multiple sites.

The news is sorted by relevance and impact, making it easy to scan for important updates. While it doesn’t provide deep analysis, it helps investors quickly digest what’s moving the markets.

-

Stock Comparison Tool

MarketBeat’s Stock Comparison Tool is designed for investors looking to analyze multiple stocks side by side.

This free tool allows users to compare up to ten stocks at once, evaluating key financial metrics such as price performance, valuation ratios, analyst ratings, market cap, dividend strength, profitability, and technical indicators.

The comparison interface is intuitive, making it easy to assess how different stocks perform against one another.

We found it particularly useful for identifying trends, comparing sector leaders, and evaluating investment opportunities based on historical performance and fundamentals.

More Free Tools Available on MarketBeat

MarketBeat’s free plan offers a variety of tools to help investors stay informed, track stocks, and analyze market trends – here are additional features available at no cost:

- Real-Time Stock Quotes: Provides up-to-the-minute stock prices, allowing investors to track market movements without needing a brokerage account. While real-time data is available, some advanced market depth features require a premium plan.

- Trending Stocks: Highlights stocks gaining attention based on news sentiment, social media discussions, and analyst activity. This feature helps traders identify potential breakout stocks before they make major moves.

- Stock Market Heatmaps: Visualizes market performance across different sectors, showing which industries are leading or lagging. It’s useful for spotting broad market trends and sector rotations.

- Stock Performance Comparisons: Allows users to compare multiple stocks side by side based on price performance, market cap, and analyst sentiment. This feature is helpful for making quick investment decisions.

- Sector Performance Reports: Shows how different sectors are performing relative to the broader market, helping investors identify strong and weak areas of the economy.

- MarketBeat Mobile App: Free users can access MarketBeat features on the go, including watchlists, news alerts, and basic research tools. The app is available for both iOS and Android.

MarketBeat Free Plan Limitations: What You Should Know

MarketBeat’s free plan provides solid stock market insights, but it does have limitations compared to competitors:

-

No Stock Ranking or Recommendations

MarketBeat offers MarketRank™, a proprietary ranking system that evaluates stocks based on various financial metrics, analyst ratings, and performance data.

However, this feature is only available in the paid plan, meaning free users don’t get a clear ranking of top-performing stocks.

-

No ETF Screener

Unlike platforms such as Finviz and Morningstar, MarketBeat does not offer a free ETF screener, meaning investors looking for diversified funds instead of individual stocks have fewer research tools.

This makes it less useful for long-term investors or those focusing on passive investing strategies, as the platform is primarily focused on stocks rather than ETFs.

-

Limited Technical Analysis Tools

MarketBeat provides various technical indicators, but its free plan lacks advanced charting options and deep technical analysis tools.

This can be done only in the paid plan.

-

No Real-Time News Updates

MarketBeat aggregates stock market headlines, but real-time news updates are not available.

Without real-time updates, free users might miss out on time-sensitive stock movements, making it harder to react quickly to market changes.

Who Benefits Most from MarketBeat’s Free Tools?

MarketBeat’s free plan is useful for certain types of investors and traders, depending on their needs and trading style. Here’s who might find it a good fit:

- Long-Term Investors: Investors who focus on buy-and-hold strategies can benefit from MarketBeat’s stock analysis options, dividend insights, and various fundamental data indicators.

- Dividend Investors: Those looking for high-yield stocks will appreciate the dividend calendar, payout history per stock, and stock screener with multiple dividend filter options.

- Stock Market Enthusiasts: Anyone who enjoys following market trends, analyst ratings, and financial news without actively trading will find MarketBeat’s free plan useful.

- New Investors: Beginners who are learning stock market basics can explore stock comparisons, key financials, price performance, and analyst ratings without feeling overwhelmed.

Why Some Investors May Skip MarketBeat

While MarketBeat’s free plan provides great stock research and tools for a free plan, it lacks advanced tools that some traders and investors rely on. Here’s who might find it limiting:

- Active Day Traders: Those who need real-time price data, instant news updates, and advanced technical charts will find the free plan too slow for fast-moving trades.

- Technical Traders: Investors who rely on advanced indicators, interactive stock charts, and custom technical analysis tools may find MarketBeat’s charting features too basic.

- ETF Investors: Since the free plan does not include an ETF screener, investors looking to research funds instead of individual stocks will need to use another platform.

- Institutional or Advanced Investors: Those managing large portfolios or looking for deep financial analysis, historical analyst ratings, and in-depth stock research reports will need a more advanced platform.

MarketBeat Free vs All Access: Worth To Upgrade?

MarketBeat Free provides basic stock ratings, market news, and limited analyst insights, making it useful for casual investors.

However, All Access unlocks advanced stock screeners, real-time alerts, in-depth analyst ratings, proprietary reports, and trending stock analysis, offering a data-driven edge for serious investors and traders.

Plan | Subscription | Promotion | MarketBeat All Access | $39.99

$399 ($33.25 / month) if paid annually | $199/year or $19.99/month

30-day free trial + $19.99/month for the first year (billed monthly) OR $199/year ($16.58/month). New members only. |

|---|

If you rely on detailed stock research, institutional-grade insights, and real-time alerts, upgrading to MarketBeat All Access is worth considering for better-informed investment decisions and faster market reactions.

FAQ

MarketBeat primarily focuses on U.S. and major international stocks, but its coverage of global markets is more limited than some competitors.

Data export to CSV/Excel files is only available in the premium plan, so free users must manually record stock information.

The free plan offers a basic options chain, but it lacks detailed options analysis, implied volatility tracking, and advanced derivatives tools.

Yes, MarketBeat offers earnings calendars and recent earnings results, but detailed financial breakdowns and estimates require a premium plan.

MarketBeat focuses on analyst ratings, stock news, and portfolio tracking, while Yahoo Finance offers more in-depth financial statements, real-time quotes, and ETF data.

Review Free Stock Analysis Tools

Investment Analysis & Research Tools : Review Methodology

At The Smart Investor, we evaluated free investment research platforms based on the quality and depth of their features compared to other free alternatives. Each platform was rated based on the following criteria:

- Fundamental Analysis Tools (25%): We assessed the availability of key financial data, including income statements, balance sheets, cash flow, valuation metrics, and analyst estimates. Platforms with more in-depth historical data, forward-looking projections, and research reports scored higher.

- Technical Analysis Features (20%): We examined the variety and quality of technical indicators, charting tools, and real-time price data. Platforms that offered customizable interactive charts, trend analysis, and multiple timeframes received better ratings.

- Stock Screener & Free Filters (15%): A strong stock screener is crucial for research, so we rated platforms based on the number and depth of filtering options. Higher scores were given to platforms that allowed customized searches using fundamental, technical, and sector-based criteria.

- Portfolio Tracking & Alerts (15%): We reviewed the ability to track multiple portfolios, set up watchlists, and receive alerts on stock movements. Platforms offering real-time updates, dividend tracking, and personalized notifications ranked higher.

- Ease of Use & User Experience (15%): Platforms were rated on their design, navigation, and accessibility across devices. Those with intuitive layouts, easy-to-read data, and smooth user experiences received better scores.

- Additional Perks & Limitations (5%): We considered unique tools, premium research access, and potential feature restrictions. Platforms with added perks like AI analysis or fewer paywalls scored higher, while those with aggressive ads or major limitations were rated lower.

- Community & Social Features (5%): Platforms with investor discussion forums, sentiment tracking, or social trading features were rated higher. Those lacking community-driven insights or engagement tools scored lower.