The MarketBeat Stock Screener is a powerful free tool that helps investors filter stocks using key financial metrics, analyst ratings, dividend data, and performance trends.

While it lacks the customization of premium tools, it offers meaningful insights for long-term investors, dividend seekers, and those exploring analyst sentiment.

Whether you're looking for undervalued stocks, consistent dividend payers, or equities with bullish ratings, MarketBeat allows users to combine multiple filters to narrow down their list based on real data — all without a paid MarketBeat subscription.

Best MarketBeat Screener Features

MarketBeat’s screener emphasizes fundamentals, valuation, sentiment, and dividend metrics, making it ideal for building a quality stock watchlist.

Below are some key filtering capabilities, along with use cases to demonstrate how to apply them:

1. Use Valuation Metrics to Find Undervalued Stocks

These filters help value investors target companies that are trading at a discount relative to earnings, growth, or peer benchmarks.

Low P/E Ratio: Filter for stocks with price-to-earnings ratios below 15 or industry average, often a starting point for value plays.

Earnings Growth: Include stocks with positive year-over-year EPS growth to avoid value traps and focus on companies with improving profitability.

Debt-to-Equity: Screen for companies with low debt levels (e.g., under 0.5), suggesting stronger balance sheets and lower financial risk.

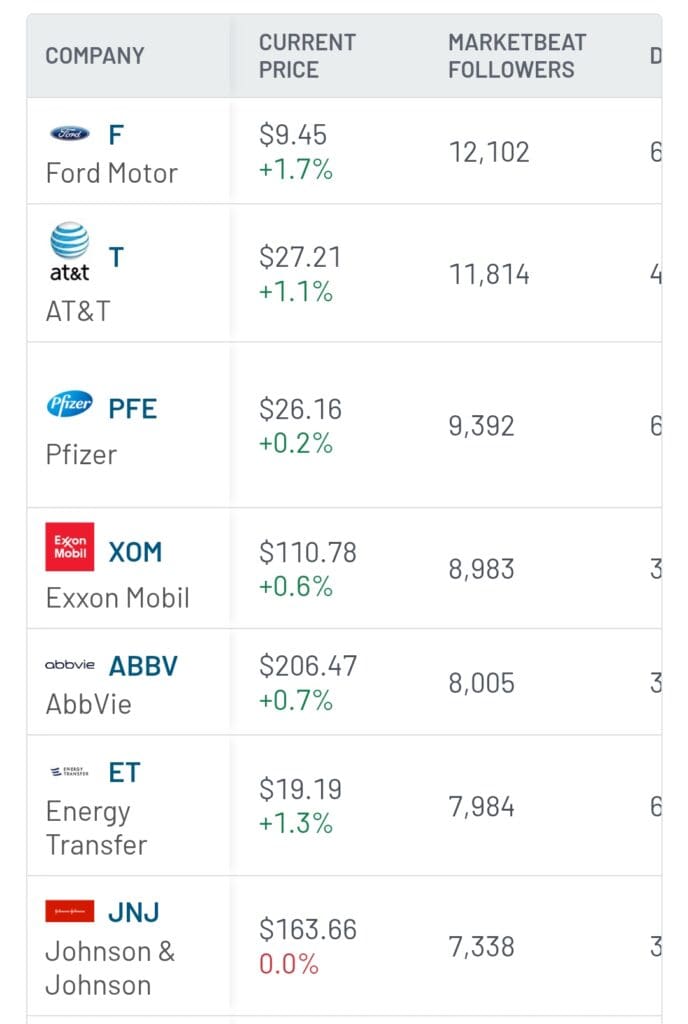

2. Screen by Dividend Yield and Payment History

The screener is ideal for dividend-focused investors, helping you identify consistent income-generating stocks while avoiding yield traps.

High Dividend Yield: Spot stocks with dividend yields over a customizable threshold (e.g., 4% or 5%), suitable for building income portfolios.

Sustainable Payout Ratio: Focus on stocks with moderate payout ratios (e.g., under 60%), indicating the dividend is well-supported by earnings.

Ex-Dividend Calendar Integration: Find companies with upcoming ex-dividend dates, helping time purchases to qualify for the next payout.

3. Filter by Analyst Ratings and Price Targets

MarketBeat aggregates buy/hold/sell ratings and price targets from top analysts, offering insight into overall market sentiment and institutional forecasts.

Analyst Consensus: Filter for stocks with a majority of analysts issuing “Strong Buy” or “Buy” ratings to focus on high-conviction ideas.

Target Price Upside: Highlight stocks trading below their average analyst price target, signaling potential for price appreciation.

Recent Upgrades/Downgrades: Identify stocks that have been recently upgraded or reaffirmed by analysts, often leading to increased interest and trading volume.

4. Track Insider Activity and Ownership Sentiment

MarketBeat offers insight into how insiders and institutions view a company’s prospects — a valuable indicator of market confidence or caution.

Recent Insider Buying: Highlight companies where executives or directors are purchasing shares, often signaling internal optimism.

Institutional Ownership: Filter for stocks with high institutional holdings (e.g., over 70%), suggesting strong backing from major funds.

Ownership Changes: Spot increasing or decreasing institutional positions, which may indicate shifts in sentiment or portfolio rebalancing.

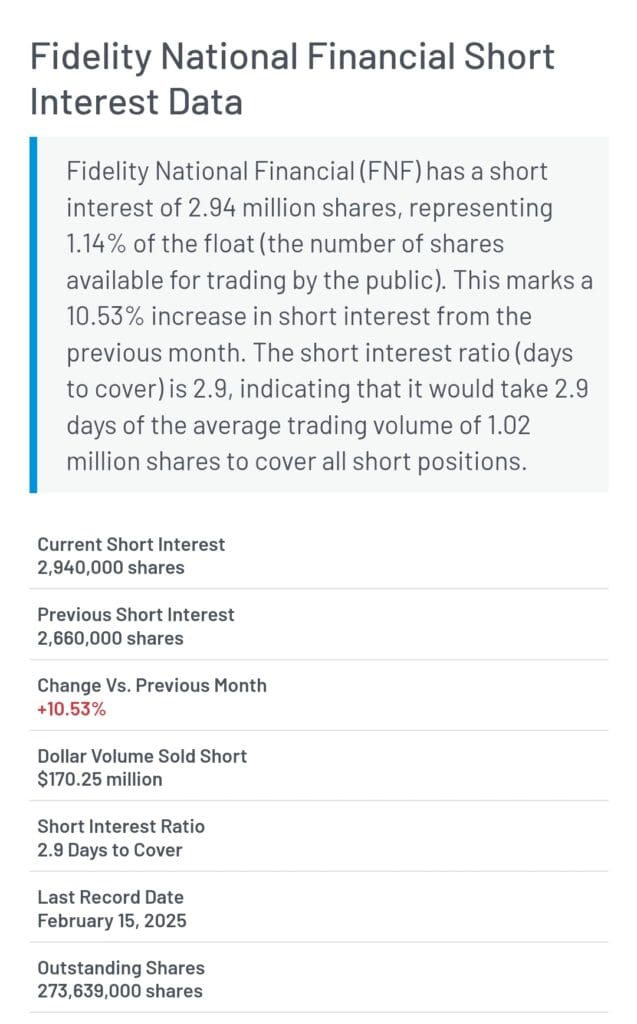

5. Analyze Short Interest for Sentiment Shifts

MarketBeat’s screener includes short interest data, allowing traders to gauge bearish sentiment or identify short squeeze potential.

High Short Interest: Filter for stocks where a significant percentage of shares are sold short, indicating widespread bearish sentiment or risk of a squeeze.

Short Interest Decline: Spot stocks where short interest has recently dropped, which may suggest growing investor confidence or recent covering.

Days to Cover Ratio: Use this metric to identify stocks with high short interest relative to average daily volume, often linked to volatility during rallies.

6. Identify Momentum Stocks Using Performance Metrics

Performance-based filters let users focus on stocks gaining price momentum, ideal for swing traders and breakout investors.

Price Performance (1-Week to 1-Year): Filter by strong short-term or long-term performance to identify trends.

Relative Performance: Compare a stock’s performance to sector or index benchmarks to spot outperformers.

Volatility Metrics: Use volatility filters to find stocks with price swings suited for active trading strategies.

7. Filter by Financial Strength and Balance Sheet Health

Fundamental investors can use MarketBeat’s screener to find companies with solid financial foundations.

Revenue Growth: Filter for companies growing top-line revenue year-over-year, a key sign of business expansion.

Profit Margins: Look for firms with high or improving profit margins, suggesting operational efficiency.

Cash Flow Strength: Target companies with strong free cash flow to ensure they can reinvest, pay dividends, or reduce debt.

8. Use Sentiment and Media Metrics to Spot Trends Early

MarketBeat includes tools to evaluate market sentiment, drawing from news coverage and analyst behavior.

Positive Media Sentiment: Filter for stocks with a high percentage of favorable headlines over the past week or month.

Analyst Activity Volume: Identify companies with a surge in analyst ratings or commentary, indicating renewed attention.

News Volume Spikes: Spot stocks receiving unusually high news coverage, which may precede large moves.

9. Find Stocks With Strong Earnings Momentum

MarketBeat’s screener allows users to track earnings-related metrics to find companies consistently beating expectations or showing positive earnings growth.

EPS Surprise History: Filter for stocks that have beaten analyst earnings estimates in recent quarters, which can drive strong price movement.

Earnings Growth YoY: Identify companies growing their bottom line year-over-year — a core indicator of profitability trends.

Upcoming Earnings Reports: Focus on stocks set to report soon using MarketBeat’s earnings calendar, combined with screen filters.

10. Use Fundamental Ratios to Spot Value or Growth Plays

The screener includes access to valuation and profitability ratios that help distinguish between undervalued stocks and fast growers.

- Price-to-Sales (P/S) Ratio: Screen for stocks trading at a low multiple of revenue, often used for growth stocks without strong earnings yet.

- Return on Equity (ROE): Target companies with strong capital efficiency, showing how well management reinvests shareholder funds.

- Operating Margin: Look for high-margin businesses with strong pricing power or cost advantages.

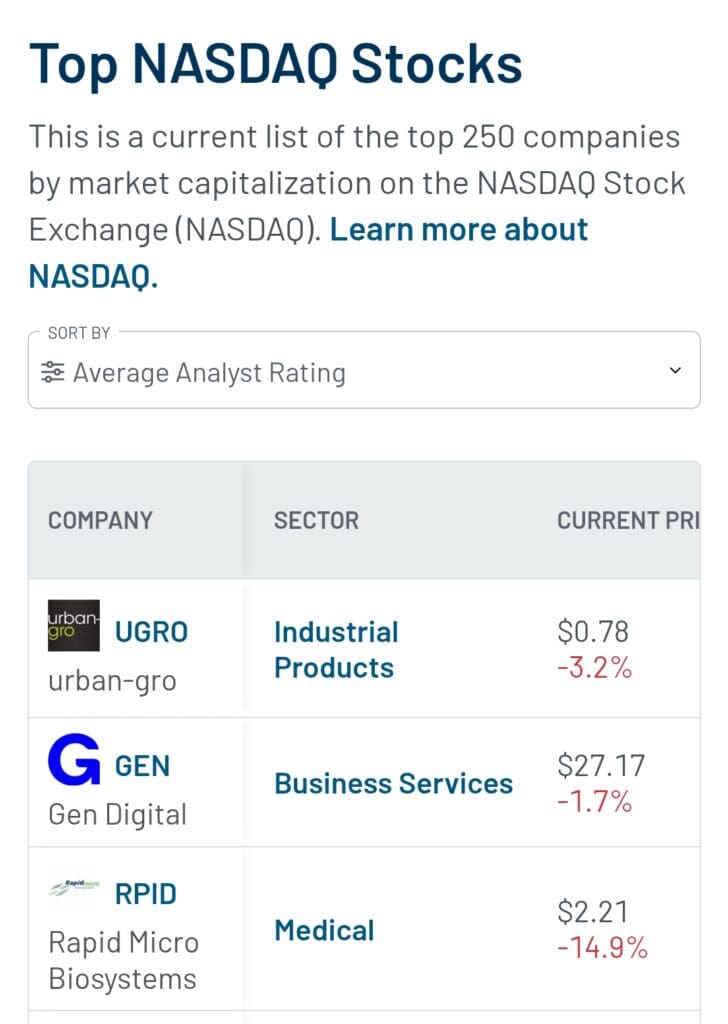

11. Filter Stocks by Market Capitalization and Sector

To refine results based on company size and industry focus, MarketBeat includes filters by market cap and sector, which helps with portfolio diversification.

Market Cap Range: Choose from micro-cap to mega-cap stocks based on your risk preference or diversification needs.

Sector Selection: Limit results to specific industries like tech, healthcare, or energy to focus on targeted investment themes.

Sector Performance: Use supplemental sector data to prioritize sectors outperforming the broader market.

FAQ

No, the free version of MarketBeat does not allow users to save custom screener setups. You’ll need to re-enter filters each time unless you upgrade to a premium plan.

MarketBeat provides real-time price quotes, but screener results are updated on a delayed basis. For true live data or streaming updates, a different platform or paid tier is required.

Only basic technical indicators like RSI and MACD are available, and users are limited to a couple indicators at once. Advanced technical analysis is only offered in the All Access plan.

Yes, MarketBeat’s screener is accessible via the mobile app for both Android and iOS. However, the experience is more streamlined on desktop for advanced screening.

No, the free MarketBeat screener does not support ESG, governance, or sustainability-related filters. Those looking for socially responsible investing filters will need to use other platforms.

You can compare up to ten stocks using MarketBeat’s Stock Comparison Tool after generating a list from the screener, which is useful for side-by-side analysis.

Yes, recent IPOs may appear in screener results, but filters specific to IPO dates or SPAC status are not currently available in the free plan.