Thinking of leveling up your stock game? Whether you're just getting started or already deep into the markets, MarketBeat gives you tools to research, track, and react.

But is the paid plan worth the upgrade — or is the free version enough?

In this breakdown, we’ll help you figure out which MarketBeat plan actually fits your investing vibe and goals.

What You'll Get On Both Plans?

Here’s a comparison of features included in both MarketBeat Free and MarketBeat All Access plans. While the premium tier often enhances these tools, this comparison only covers what both tiers provide.

These features are especially useful for retail investors seeking actionable insights and practical stock research.

-

Basic Stock Screener

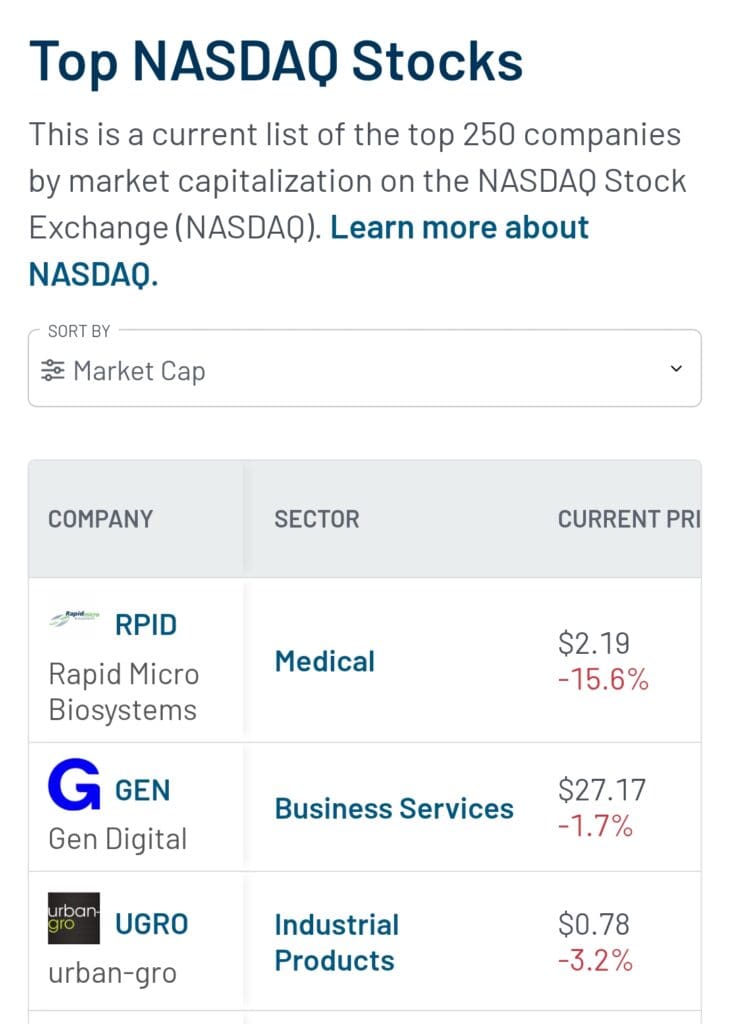

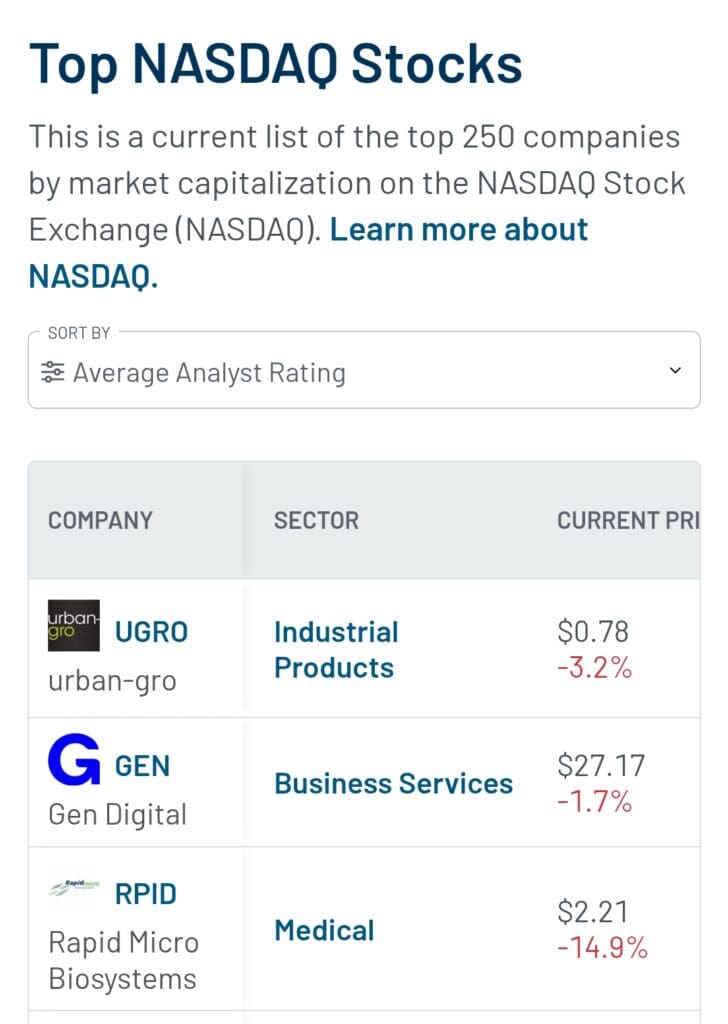

The free plan includes a limited version of MarketBeat’s stock screener.

Investors can filter by dividend yield, P/E ratio, and analyst rating to find candidates that meet specific criteria — such as filtering for stocks with strong buy consensus and high earnings growth.

This is ideal for building watchlists or running quick screens.

-

Dividend and Earnings Insights

MarketBeat offers detailed dividend history and earnings results in both plans. This includes payout ratios, dividend yield, and whether a company beat or missed expectations.

A dividend investor might track Coca-Cola’s yield and ex-dividend dates, while growth investors may review Tesla’s quarterly EPS trends.

-

Stock Comparison Tool

The free and premium plans both include the stock comparison tool, letting users evaluate up to 10 companies side by side.

This is ideal when comparing competitors like Microsoft vs. Google based on valuation ratios, analyst sentiment, or profit margins.

It's especially useful for new investors making sector-level decisions or identifying better-positioned companies.

-

Insider Trading Data

Both plans allow investors to monitor insider buying and selling activity. For instance, if a CEO of a mid-cap biotech stock buys a significant number of shares, that might suggest internal confidence.

These reports help retail traders align with insider sentiment, even if they don’t have institutional-level tools.

-

Analyst Ratings and Forecasts

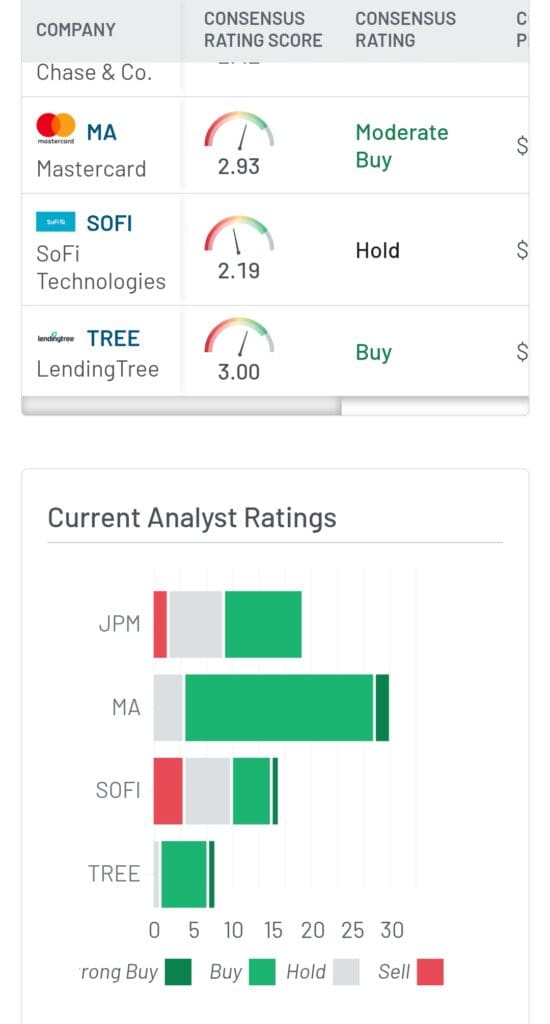

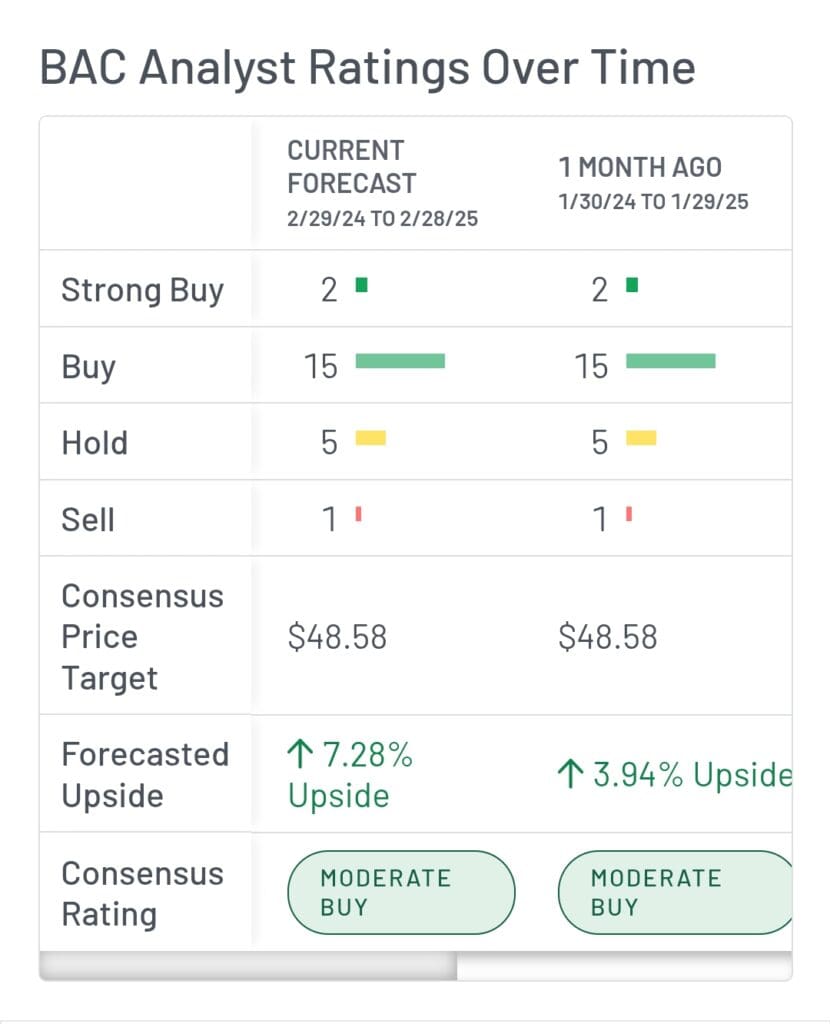

Both plans include access to MarketBeat’s analyst rating data, which shows whether Wall Street analysts rate a stock as a buy, hold, or sell.

For example, investors can see if Apple has more recent upgrades or downgrades and view its price target range. This helps users gauge market sentiment based on expert opinions.

-

My MarketBeat Portfolio Tracker

Investors can manually build a portfolio in both plans and receive alerts for changes in analyst ratings, dividend events, or insider trades.

For example, users tracking 10 stocks will receive an email if any company reports earnings or is upgraded by a major firm. It’s a practical tool for monitoring investments without needing brokerage integration.

-

Additional Free Features & Tools

In addition to its core research tools, MarketBeat includes several smaller features available in both the Free and All Access plans:

Real-Time Stock Quotes: Both tiers offer up-to-date (though not streaming) stock prices, useful for tracking performance during market hours without a brokerage account.

- Daily Market News and Ratings Newsletter: MarketBeat sends out a daily newsletter with analyst upgrades, market headlines, and stock performance summaries to both free and All Access users.

Market Calendars: Users get access to calendars for earnings reports, IPOs, dividends, and stock splits — helpful for planning trades around key events.

Trending Stocks Dashboard: This feature highlights stocks gaining attention based on analyst activity and news sentiment, helping users spot momentum early.

Stock Market Heatmaps: Both plans offer heatmaps showing sector performance and market trends, great for identifying rotation or broad market shifts at a glance.

Mobile App Access: MarketBeat’s mobile app supports watchlists, news updates, and stock data on the go, ensuring investors stay connected from anywhere.

Why You’d Want to Go With MarketBeat All Access?

MarketBeat All Access includes several premium-only features that go beyond the basics, offering deeper analysis, faster alerts, and exclusive tools:

-

Advanced Stock & ETF Screener

The premium screener includes filters like MarketRank™ score, P/E ratios, earnings growth, sector allocation, and technical indicators. ETF filters include category, AUM, and regional focus.

Compared to the free version’s basic filters, this offers much more precision for targeting high-conviction investments and diversifying across funds.

-

The Idea Engine™

This proprietary tool generates weekly stock ideas using 24+ indicators like momentum, analyst sentiment, and social media buzz.

It’s ideal for investors who want actionable recommendations without spending hours researching. This feature is completely exclusive to All Access and doesn’t exist in the free version.

-

Real-Time Portfolio Alerts

All Access subscribers receive instant alerts for analyst upgrades, earnings releases, and insider trades via email or SMS.

While free users receive delayed notifications, premium users can react to market-moving news immediately—a key advantage for swing traders or active investors managing multiple holdings.

-

Top-Rated Stocks Lists

Premium users get curated lists of stocks rated highest by top-performing analysts based on historical accuracy and price target success. This simplifies stock picking and narrows choices to quality ideas.

Free users can only view individual analyst ratings without knowing their long-term success rate.

-

Performance Ratings for Analysts

This feature shows detailed performance histories for each Wall Street analyst, including win rates and average returns on recommendations.

It allows users to follow only analysts with proven track records. Free users can see ratings, but not how reliable the analyst has been over time.

-

Additional Premium Features Investors Love

Beyond major tools, MarketBeat All Access also includes several smaller premium-only features designed to enhance research, alerts, and market awareness:

Priority Newsletter Delivery: Subscribers receive morning and afternoon newsletters at 8:50 AM and 4:30 PM ET, offering pre-market insights and session recaps earlier than free users.

Momentum Alerts: Get notified when stocks experience sharp price swings or trading volume spikes — ideal for spotting breakout opportunities or volatility-based trades.

Stocks to Short List: This exclusive list highlights weak stocks based on bearish sentiment, declining fundamentals, or recent downgrades — helpful for contrarians or risk-hedging.

CSV/Excel Data Export: Premium users can export screener results, ratings, and performance data for custom analysis — useful for building models or tracking strategies offline.

Premium Support Access: All Access includes priority customer support with faster response times, helping users resolve technical or research questions more efficiently.

Who May Want to Upgrade to MarketBeat All Access?

MarketBeat All Access is ideal for investors who need advanced research tools, real-time alerts, and deeper analyst insights to act fast.

Swing and Momentum Traders: Benefit from real-time alerts, trending stock tools, and momentum signals to capture short-term price moves.

Fundamental Analysts: Access advanced screeners, analyst performance ratings, and detailed reports for deeper company evaluation and long-term thesis building.

ETF-Focused Investors: Use the ETF screener to analyze fund characteristics, sector exposure, and costs to build diversified portfolios.

Active Portfolio Managers: Real-time updates on earnings, insider trades, and stock ratings help optimize timing and stay ahead of market shifts.

Which Investor Types Prefer MarketBeat Free Plan?

The MarketBeat free plan suits casual investors and beginners who want market insights, analyst ratings, and stock tools without paying for extras.

New Investors: Offers a simple interface with basic data, making it easy to learn stock research and portfolio tracking.

Dividend Seekers: Track dividend histories, ex-dates, and yields to manage income strategies without needing premium filters.

Long-Term Holders: Use fundamental analysis, insider activity, and stock comparisons to evaluate buy-and-hold candidates.

News-Focused Traders: Daily newsletters and trending stock updates provide a solid overview of key market movements and analyst sentiment.

Bottom Line: Is MarketBeat Subscription Worth It?

MarketBeat Free is solid for new and long-term investors who want basic research and tracking tools without spending a dime.

But if you're a more active investor, upgrading to All Access gives you real-time alerts, premium screeners, analyst rankings, and exclusive insights — offering serious value for data-driven decision-making.

Choose based on how hands-on you are with your portfolio.