E-Trade | Merrill Edge | |

Monthly Fee | 0% – 0.35%

0% on stocks and ETFs in self directed brokrage, 0.35% for Core Portfolio Robo Advisor

| 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor |

Account Types | Brokerage, Retirement | Brokerage, Retirement, Wealth Management |

Savings APY | 4.00% | 0.01 – 4.18%

0.01% interest on uninvested USD for accounts up to $100,000, 3.67% interest on uninvested USD for accounts over $100,000, 4.18% interest on uninvested USD for accounts over for eligible accounts enrolled in the following investment advisory programs: (1) Assigned to eligible accounts enrolled in the following investment advisory programs: (1) the Merrill Lynch Investment Advisory Program, (2) the Merrill Lynch Strategic Portfolio Advisor Service; (3) the Merrill Lynch Managed Account Service; (4) the BlackRock Private Investors Service; (5) the Merrill Guided Investing Program (6) the Merrill Guided Investing with Advisor Program; and (7) the Merrill Edge Advisory Account program. |

Minimum Deposit | $0 | $0 – $50,000

Merrill Edge Self-Directed Trading: $0 Merrill Guided Investing – Robo Advisor: $1,000 for growth-focused strategies OR $50,000 for income-focused strategies Merrill Guided Investing – Online Advisor : $20,000 for growth-focused strategies OR $50,000 for income-focused strategies |

Best For | Beginners, Traders | Bank of America Customers, Advanced Traders |

Read Review | Read Review |

Merrill Edge vs E-Trade: Compare Investing Features

Both E-trade and Merrill Edge are among the top brokerage options for investors and traders, with a lot of tools and options for both active and passive investors.

ETRADE surpasses Merrill Edge with its broader selection of investment options, including fractional shares. It also offers features such as tax loss harvesting, paper trading and IPO access.

E-Trade | Merrill Edge | |

|---|---|---|

Investing Options | Full Access To Almost Any Asset | Full Access To Almost Any Asset |

Investing Types | Stocks, Options, Futures, ETFs, Crypto, Bonds & CDs, Margin, Fractional Shares | Stocks, Options, Margin, ETFs, Bonds & CDs, Mutual Funds, Margin |

Automated Investing | Yes | Yes |

Paper Trading | Yes | No |

Tax Loss Harvesting | Yes | No |

IPO Access | Yes | No |

Dedicated Advisor | Yes (Through Morgan Stanley) | Yes |

Merrill Edge, on the other hand, excels in its integration with Bank of America, offering seamless management of both banking and investment accounts.

Merrill Edge’s Guided Investing feature provides a more personalized robo-advisor experience, with the added option of working directly with a human advisor, making it ideal for those who prefer a blend of automated and human guidance.

-

Self Investing And Trading Options

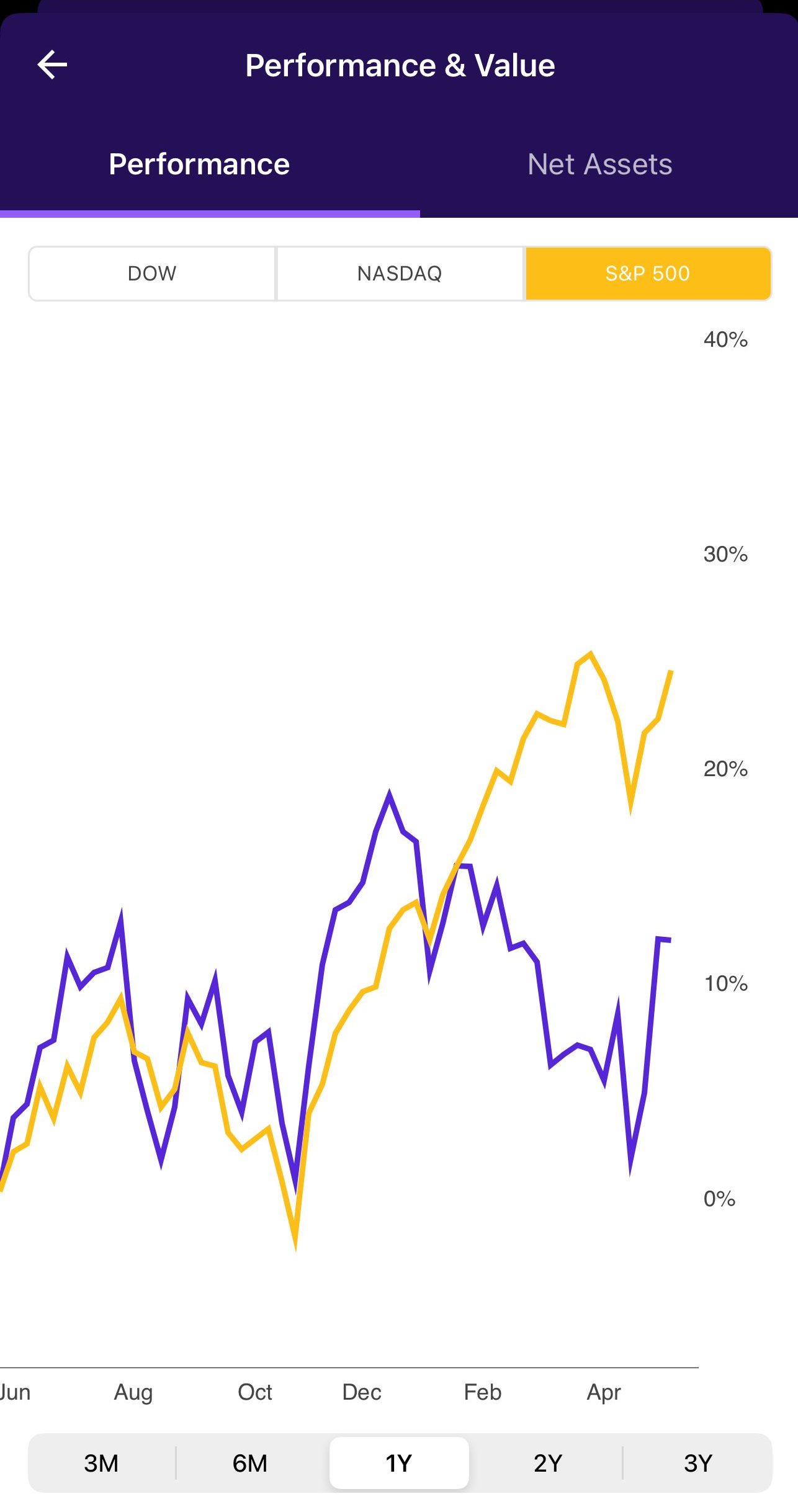

E-Trade is our winner for traders and short-term investors, while Merrill is our preferred brokerage for long-term investors, including beginners.

E-Trade stands out with its advanced trading tools and platform flexibility, making it an excellent choice for active traders and short term investors.

Its powerful research tools, including in-depth technical analysis, extensive charting capabilities, and customizable watchlists, provide a comprehensive trading experience that appeals to those who want detailed control over their investments.

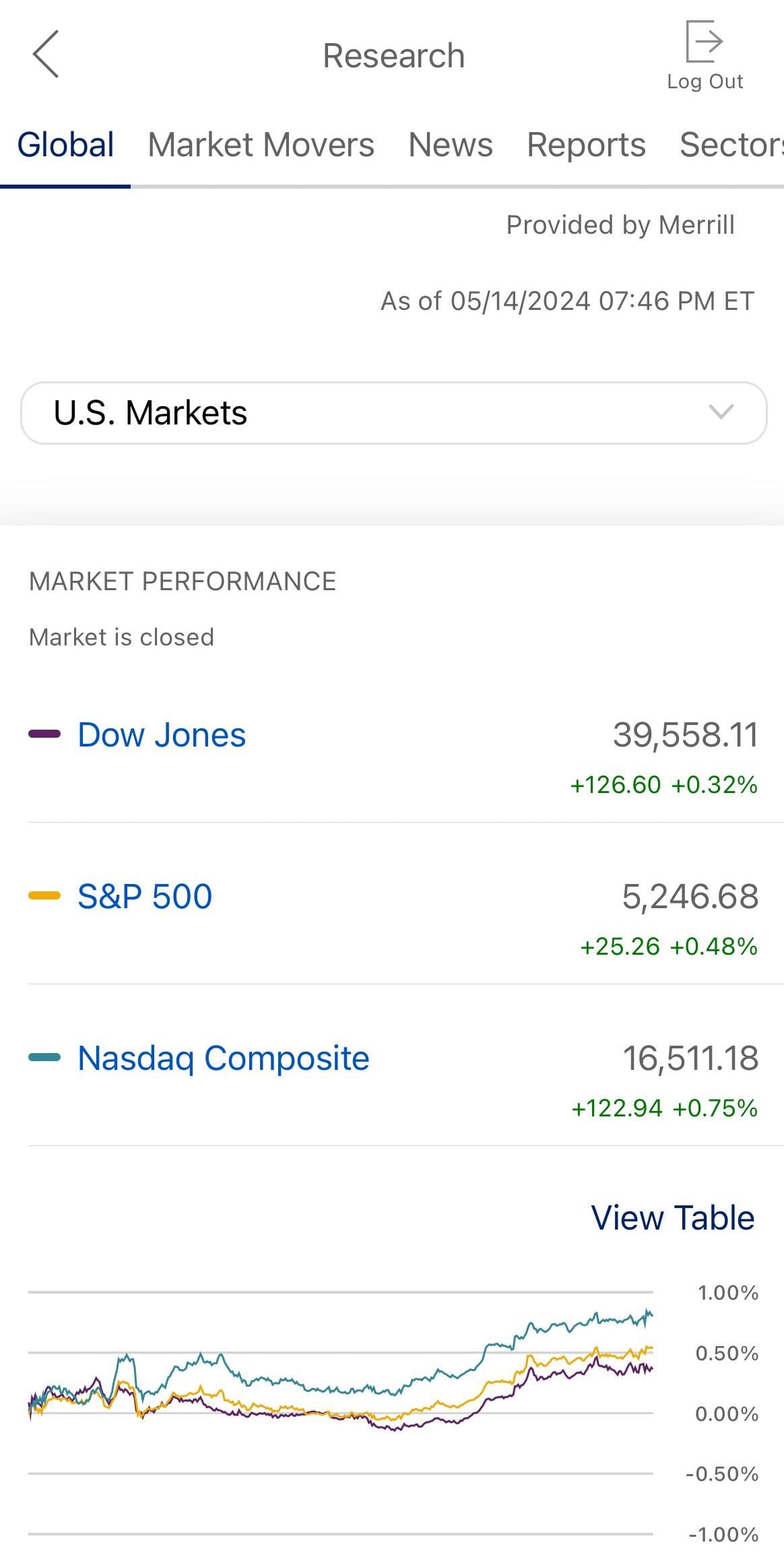

Merrill Edge’s MarketPro platform is also noteworthy, providing advanced charting and analytical tools such as real-time quotes, Level II data, and market depth that are particularly appealing to traders who value deep market insights.

However, where Merrill Edge truly surpasses E-Trade is in its ease of use and the overall user experience, especially for those who are newer to investing.

The platform’s intuitive order screens and educational resources, combined with fee-free mutual funds and personalized insights, make it a strong option for investors.

-

Automated Investing

While E-Trade excels in offering a low-cost, flexible, and user-friendly automated investing service through its Core Portfolios, Merrill Edge provides a more personalized approach with professional oversight and the convenience of integration with broader financial services.

Both robo advisors are stands out for its flexibility and ease of use, allow users to set up a diversified portfolio based on their risk tolerance and investment goals, with automated rebalancing and adjustment features.

E-trade also offers tax-loss harvesting which is not available with Merrill Automated Investing.

On the other side, Merrill Edge offers the option to add human advice to the robo-advisor service for an additional fee, which can be beneficial for investors who want occasional professional input without fully committing to a traditional financial advisor.

-

Fees

E-Trade wins when it comes to fees.

Merrill Edge | E-Trade | |

|---|---|---|

Fees | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor | 0% – 0.35%

0% on stocks and ETFs in self directed brokrage, 0.35% for Core Portfolio Robo Advisor

|

Merrill Edge and E-Trade offer $0 commissions on online stock, ETF, and mutual fund trades, with options contracts costing $0.65 per contract.

When it comes to Robo Advisory, E-Trade is a bit cheaper than Merrill Edge

-

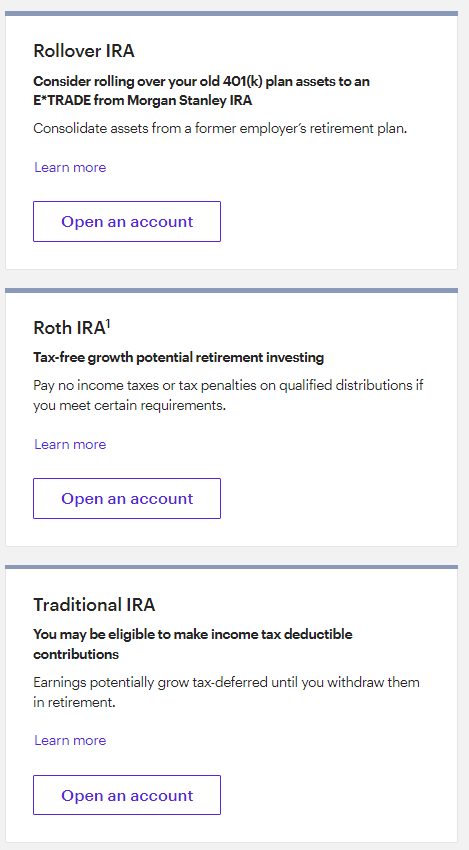

Retirement Accounts And Planning

Both E-trade and Merrill Edge excels with its diverse range of retirement accounts, making it particularly appealing for individuals with unique retirement planning needs.

They offers not only traditional and Roth IRAs but also more specialized accounts such as SEP IRAs, SIMPLE IRAs, and even Beneficiary IRAs.

Additionally, ETRADE’s Complete IRA stands out for investors over 59½, offering easy access to funds without delays or forms, along with a free debit card, checks and online bill payment options, which add convenience in managing retirement savings.

Merrill Edge, on the other hand, shines in its integration with Bank of America.

This integration allows Merrill Edge to offer a streamlined experience, particularly for BoA customers, where their retirement accounts contribute to their overall Preferred Rewards status.

Merrill Edge’s strength lies in its integration with broader banking services and its personalized, professional guidance through Merrill Guided Investing

-

Wealth Management Options

Merrill Edge and E-trade Wealth Management offer personalized services tailored to clients with specific financial needs, allowing them to work closely with a dedicated advisor.

To access these services, clients usually need at least $250,000 in investable assets. With this, they can choose from a variety of investment options like stocks, ETFs, mutual funds, options, and bonds, all managed by Merrill’s expert team.

E-Trade, through its relationship with Morgan Stanley, provides access to a broad range of wealth management services, including personalized financial planning, investment strategies, and access to a variety of investment products.

-

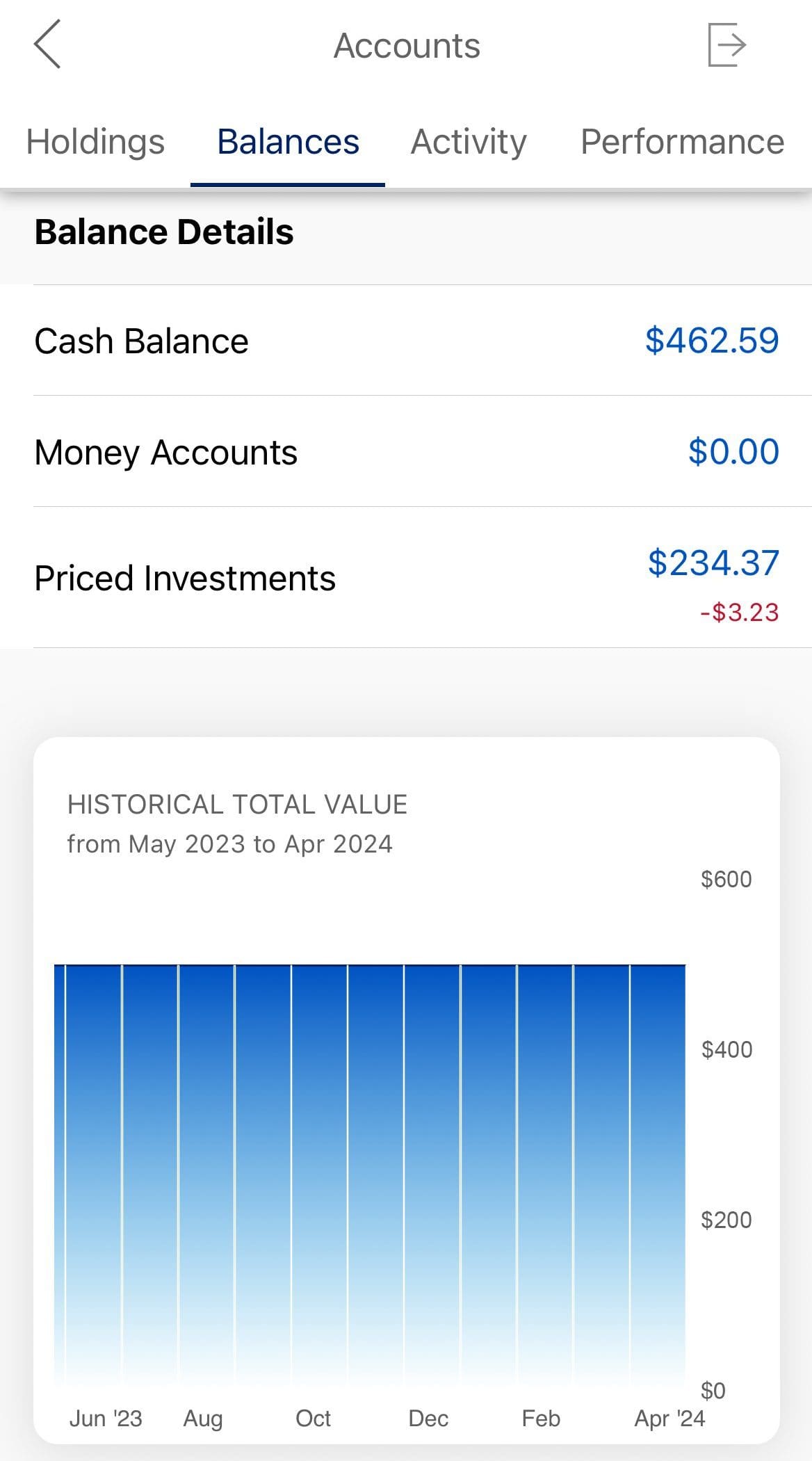

Cash Management And Savings Rates

When it comes to banking options, E-Trade is our winner – unless you're an existing Bank Of America customer.

E-Trade (through Morgan Stanley Private Bank) offers comprehensive cash management through its Max-Rate Checking and Premium Savings accounts, both managed by Morgan Stanley Private Bank.

The Premium Savings Account provides a competitive interest rate with no minimum deposit. Merrill doesn't offer an attractive option when it comes to savings, as customers should have over $100,00 in their account to get high interest on uninvested cash.

Merrill Cash Account | E-Trade Premium Savings | |

|---|---|---|

Savings APY | 0.01 – 4.18%

0.01% interest on uninvested USD for accounts up to $100,000, 3.67% interest on uninvested USD for accounts over $100,000, 4.18% interest on uninvested USD for accounts over for eligible accounts enrolled in the following investment advisory programs: (1) Assigned to eligible accounts enrolled in the following investment advisory programs: (1) the Merrill Lynch Investment Advisory Program, (2) the Merrill Lynch Strategic Portfolio Advisor Service; (3) the Merrill Lynch Managed Account Service; (4) the BlackRock Private Investors Service; (5) the Merrill Guided Investing Program (6) the Merrill Guided Investing with Advisor Program; and (7) the Merrill Edge Advisory Account program. | 4.00% |

E-trade checking accounts feature unlimited online wire transfers, no monthly fees mobile check deposits, and nationwide ATM fee refunds. Merrill Edge doesn't have its own checking account, but offers easy access and management if you are an exisintg BofA customer.

Bottom Line

Merrill Edge and E-trade are great for investors who want a well-rounded, research-focused platform for long-term and short-term investments, including retirement.

Both also offer robo-advisor options as well as wealth management for high-net-worth individuals.

E-trade may be a better option for those who also need banking services.

How Merrill Edge Compares to Other Online Brokers

Vanguard may be a better option for value, long-term investors, while Merrill offers better trading options. Here's a side-by-side comparison

Vanguard vs. Merrill Edge: Which Brokerage is Right for You?

Both offer similar tools for the average investor or trader, but Merrill is better at automated investing. Here's our full comparison:

J.P. Morgan Self-Directed Investing vs. Merrill Edge: Compare Brokerage Accounts

Merrill Edge is best for long-term investments, including retirement, while Robinhood is perfect for active traders who value simplicity.

Merrill Edge vs. Robinhood: Compare Brokerage Account Options

Merrill Edge stands out for its interface and integration with BofA, but IBKR is the ultimate winner for trading and investing. Here's why:

Interactive Brokers vs. Merrill Edge: Compare Brokerage Account Options

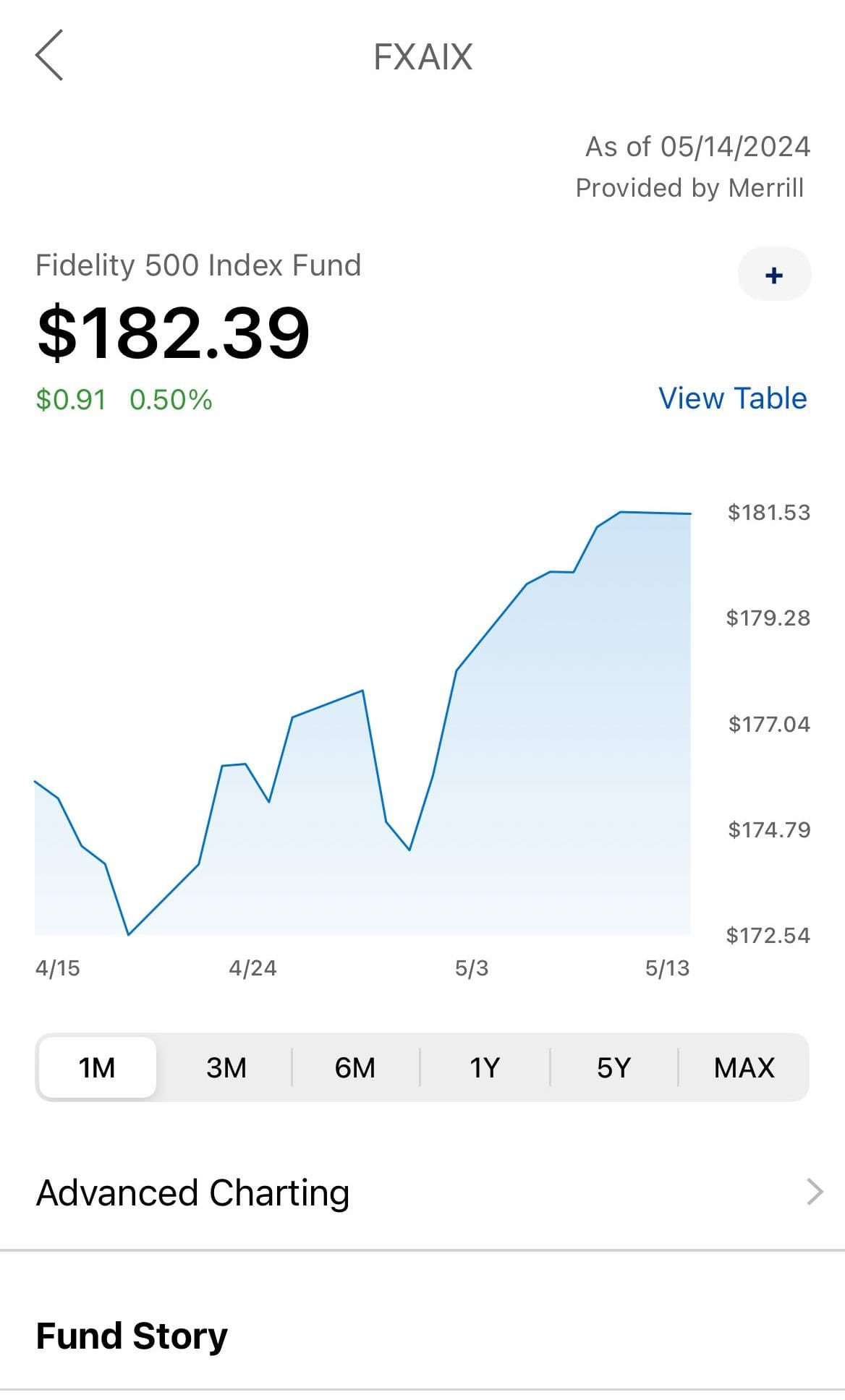

Fidelity has more investing options, cheaper robo-advisor, and more banking options. Merrill is better for Bank of America customers.

Schwab is our winner for investors and traders. However, the differences between brokerages are not significant. Here's our comparison: