| ||

|---|---|---|

MEXC | OKX | |

Supported Coins | +2,300 | +300 |

Spot Trading Fees | 0% – 0.10%

0.00% for taker trades and 0.10% for maker trades. | 0.08% – 0.10%

0.10% for taker trades and 0.08% for maker trades. As you trade more or hold more OKB, your fees decrease, potentially reaching as low as 0.02% for high-volume traders |

Future Trading Fees | 0% – 0.01%

0.00% for taker trades and 0.01% for maker trades. | 0.02% – 0.05%

0.05% for taker trades and 0.02% for maker trades. Like spot trading, the more you trade or the more OKB you hold, the lower your fees can become. |

Our Rating |

(3.8/5) |

(4/5) |

Read Review | Read Review |

MEXC vs. OKX: Compare The Best Features

Choosing the right crypto platform depends on what you value most — whether it’s ease of use, crypto selection, or advanced trading tools.

Let's break down how MEXC and OKX stack up side-by-side across key areas, so you can quickly find the best fit for your trading goals.

-

Ease of Use & Mobile App Experience

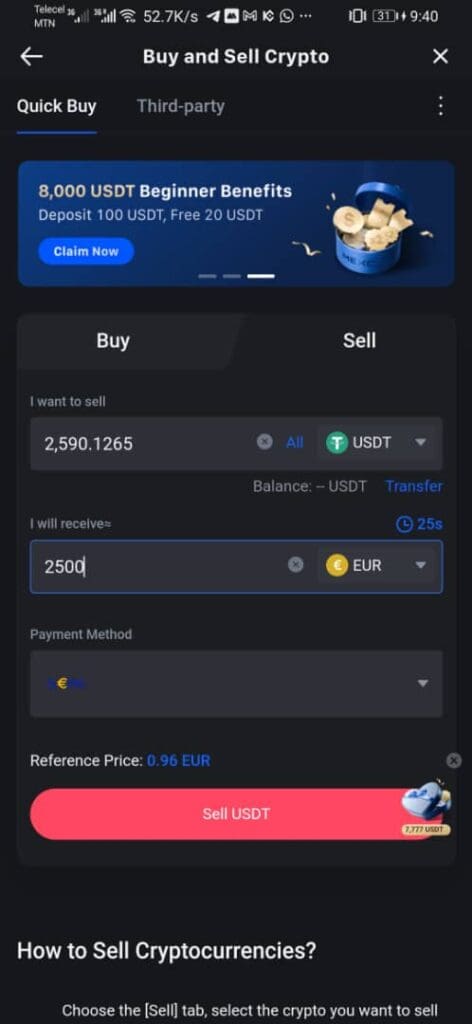

MEXC offers a beginner-friendly platform, with clear navigation, a quick-buy feature for crypto, and a mobile app that mirrors the desktop experience.

New users can easily buy Bitcoin or altcoins without being overwhelmed by complex tools.

OKX also delivers a smooth mobile and desktop experience, but because it targets more advanced traders, its interface can feel crowded.

For example, its app integrates DeFi, NFT trading, and multiple order types, which may be overwhelming for beginners.

Overall, MEXC is better for ease of use and mobile simplicity, while OKX is suited for traders who want all features in one app.

-

Cryptocurrency Selection

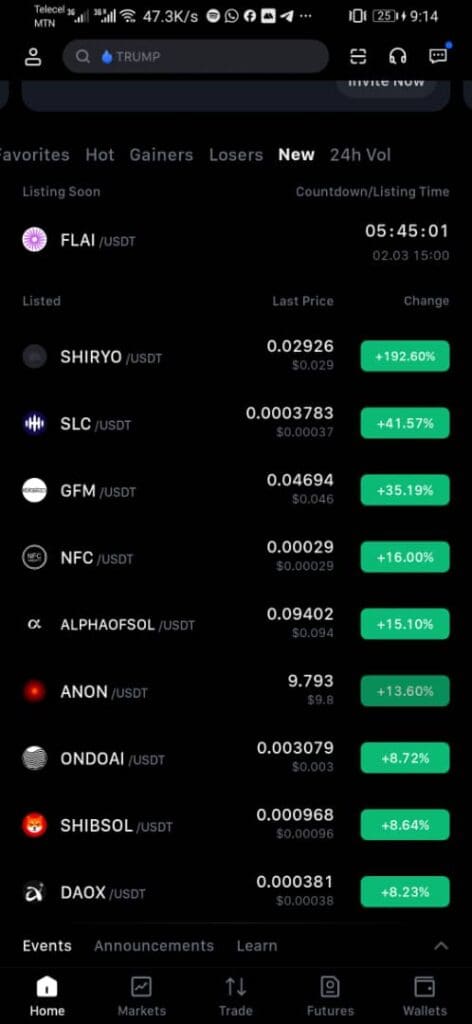

MEXC shines with access to +2,300 cryptocurrencies and trading pairs. Traders can easily find niche coins in trending sectors like AI, DeFi, and Metaverse.

Finding a newly launched token often happens faster on MEXC than elsewhere.

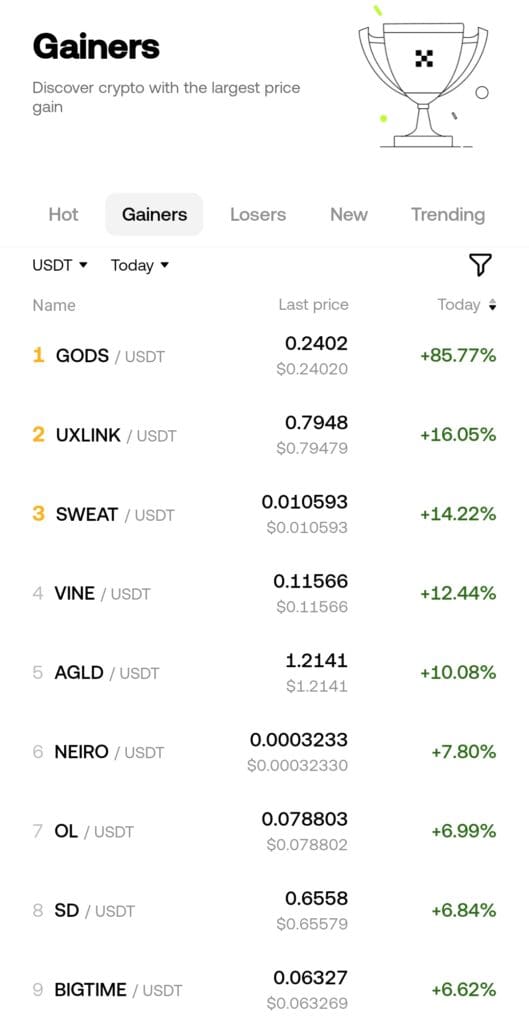

OKX supports +300 major cryptocurrencies, including Bitcoin, Ethereum, and popular stablecoins.

Although its selection is smaller, OKX focuses more on liquidity and reliable assets, plus it offers direct NFT marketplace integration.

-

Trading Crypto Features & Experience

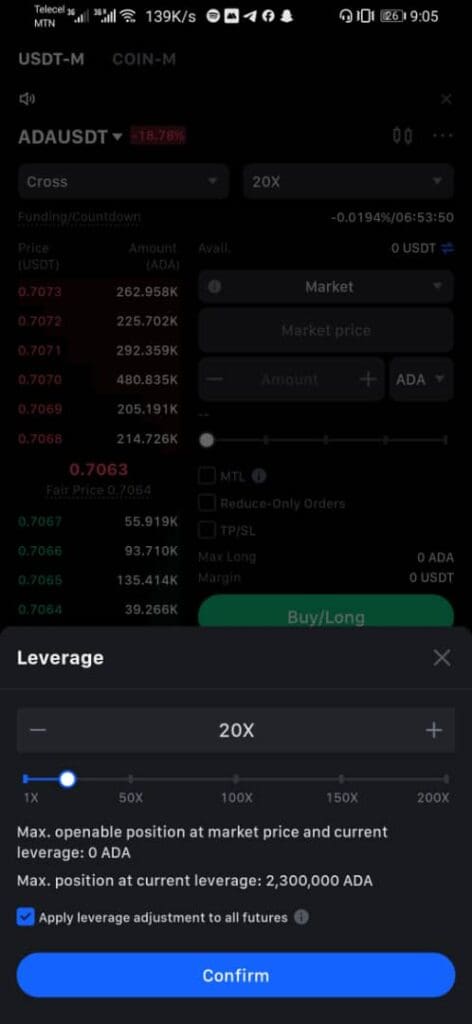

MEXC offers spot trading, futures with up to 200x leverage, copy trading, and a demo trading mode.

Beginners can practice futures strategies without risk, while more experienced users can follow top traders automatically using performance metrics like win rate and ROI.

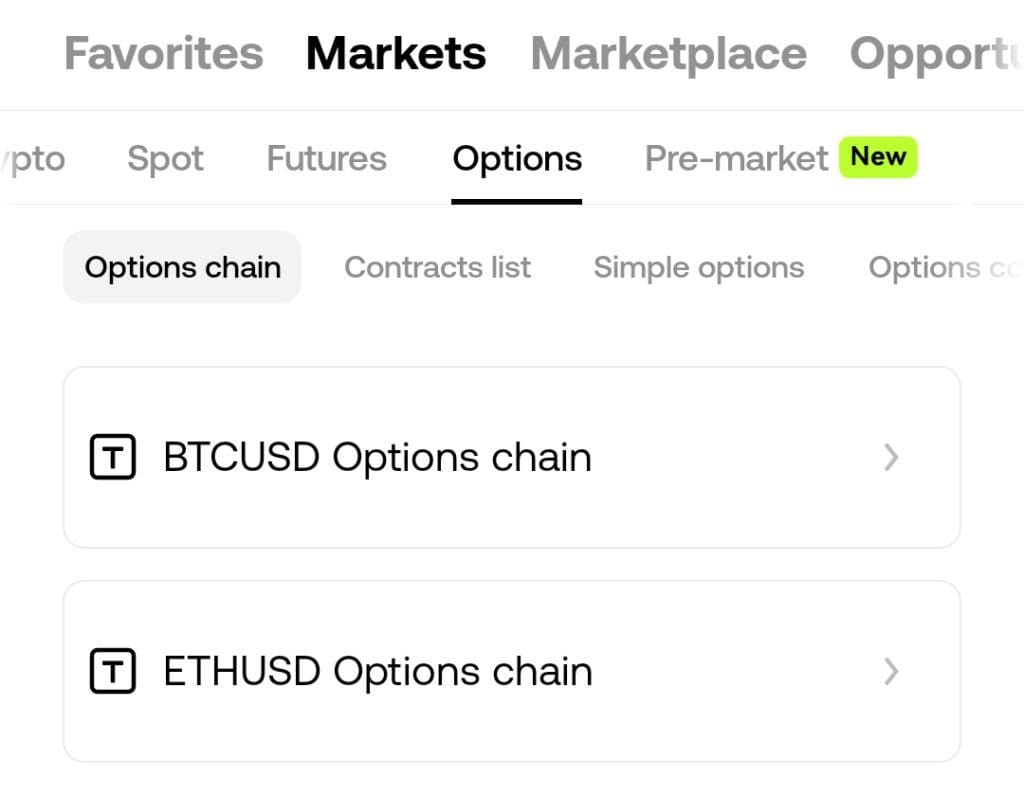

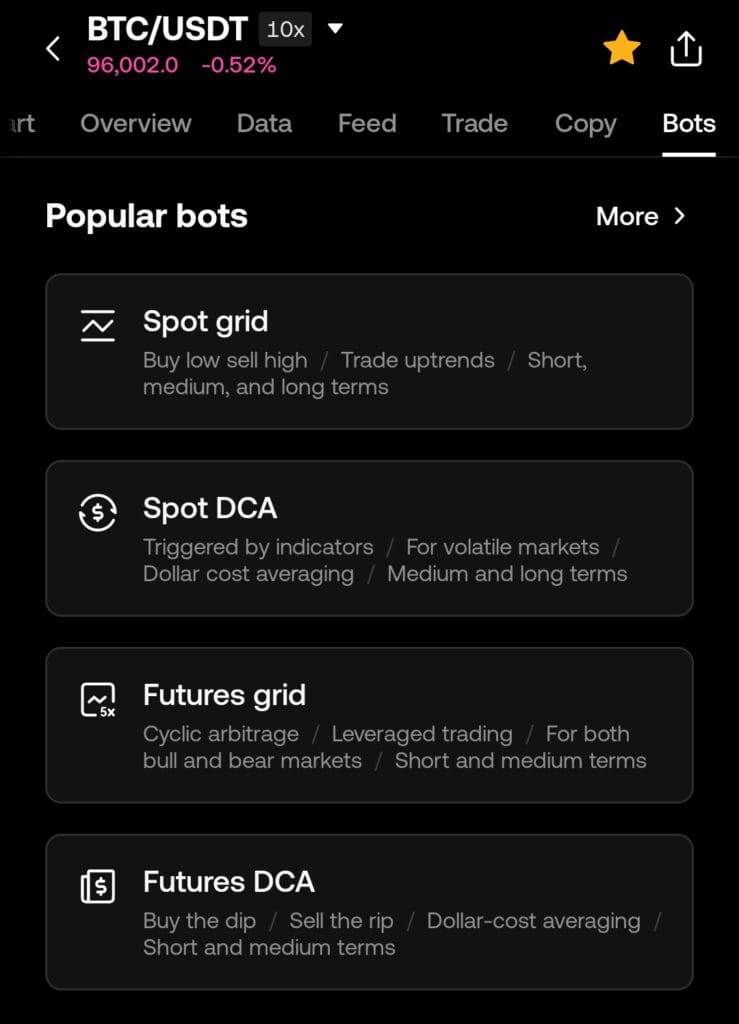

OKX provides advanced trading too, including spot, futures, options, and perpetual swaps. It also offers customizable trading bots, such as grid bots, for automated trading strategies.

For example, users can set bots to automatically buy Bitcoin if the price dips below a specific level.

Overall, both platforms are strong, but OKX edges ahead for traders needing bots, options, and more complex automation.

-

Staking Options and Rewards

MEXC offers both flexible and fixed staking options, allowing users to earn passive income on their crypto holdings.

Flexible staking provides the freedom to withdraw at any time, while fixed staking offers higher rewards for locking assets over set periods (e.g., 30, 60, or 120 days).

OKX provides a comprehensive staking platform through its “Earn” feature, encompassing Simple Earn, Structured Products, and On-chain Earn.

Users can stake a variety of cryptocurrencies, including Ethereum (ETH) and Solana (SOL), with flexible redemption options.

-

DApps and Web3 Integration

MEXC primarily focuses on traditional crypto trading and does not directly support Web3 DApps. While it once offered NFT indices, it lacks a full NFT marketplace or DeFi app integration, limiting its Web3 capabilities.

OKX fully embraces Web3 with a built-in NFT marketplace, DeFi access, and a multi-chain wallet.

For example, users can buy NFTs or interact with blockchain games without leaving the OKX app, making it highly versatile.

Overall,OKX dominates Web3 and DApps integration, whereas MEXC remains focused only on core trading.

-

Wallet Options

OKX provides a versatile wallet ecosystem, including a non-custodial, multi-chain wallet that supports a wide range of cryptocurrencies and NFTs.

Users can manage their private keys, interact with decentralized applications (DApps), and access DeFi services directly through the wallet.

MEXC primarily offers custodial wallets, where the platform manages users' private keys. While this simplifies the user experience, it may raise concerns for those seeking full control over their assets.

-

Trading Bots and Automation

MEXC supports third-party trading bots through integrations with platforms like 3Commas and TradersPost.

Users can automate trading strategies, including grid and dollar-cost averaging (DCA) approaches, to enhance trading efficiency.

OKX offers built-in trading bots, including spot grid, futures grid, and recurring buy bots.

These tools allow users to automate trades based on predefined strategies, helping to manage risks and capitalize on market movements.

-

Security Measures And Past Hacks

OKX has maintained a strong security record, with no major hacks reported. The platform utilizes 2FA, cold storage, and regular Proof of Reserves audits.

In 2025, OKX temporarily suspended its DEX aggregator services to implement new security measures following attempted exploits by the Lazarus Group.

MEXC employs robust security measures, including two-factor authentication (2FA), cold storage for funds, and real-time risk monitoring.

In 2025, MEXC partnered with cybersecurity firm Hacken to enhance its security infrastructure, focusing on audits and user protection.

Which Investors & Traders May Prefer OKX Exchange?

OKX is better suited for investors who want deeper DeFi, NFT, and automation capabilities alongside strong security. Here’s who will benefit most:

DeFi and Web3 Users: Those looking to access DApps, NFTs, and multi-chain wallets directly from an exchange.

Advanced Traders: Investors who need futures, options, perpetual swaps, and customizable trading bots.

Global Traders Seeking Security: Users who value 2FA, cold storage, Proof of Reserves, and active cybersecurity partnerships.

Yield Hunters: Investors who want structured earning options, flexible staking, and high-interest products through OKX Earn.

In short, OKX caters to experienced, security-conscious traders who want more than just basic crypto buying and selling.

Which Investors & Traders May Prefer MEXC Exchange?

MEXC is a strong choice for traders who prioritize a massive selection of cryptocurrencies, low fees, and simple navigation. Its flexibility appeals to a wide range of investors:

Altcoin Hunters: Those looking for rare or trending coins will appreciate MEXC’s 2,300+ supported assets.

Beginner Traders: The user-friendly interface and demo trading features help newcomers practice and build confidence.

Copy Trading Enthusiasts: Investors who want to mirror experienced traders can use MEXC’s copy trading system.

Low-Fee Seekers: With 0%–0.10% spot trading fees, MEXC is ideal for frequent traders aiming to reduce costs.

In short, MEXC suits investors who want broad access to crypto markets without getting bogged down by complex tools or high fees.

Bottom Line

Both MEXC and OKX offer excellent features, but each excels in different areas.

MEXC shines with its massive altcoin selection, easy-to-use platform, and attractive low trading fees, making it perfect for beginners and altcoin enthusiasts.

OKX, on the other hand, offers a rich ecosystem with DeFi, NFTs, trading bots, and structured earning options — ideal for more advanced users who want an all-in-one crypto experience with strong security.