| ||

|---|---|---|

Yahoo Finance Gold | Motley Fool Epic | |

Price | $479.40 ($39.95 / month) | $499 (41.60 / month)

No monthly plan

|

Best Features | ||

Our Rating |

(4.6/5) |

(4.4/5) |

Read Review | Read Review |

Compare Stock Research & Analysis Features

In this breakdown, we’re putting Motley Fool Epic and Yahoo Finance Gold head-to-head.

Whether you’re into expert stock picks or proven rankings, we’ll show you which platform gives you more power to level up your investing game.

-

Stock Screening Tools

Yahoo Finance Gold shines with its advanced penny stock screeners, allowing for in-depth filtering based on a range of technical and fundamental criteria.

The platform offers real-time stock quotes, a Smart Money screener, and a Top Holdings screener, which help track hedge fund and institutional activity.

It is also among the top technical stock screeners, features 50+ technical chart patterns, and custom annotations.

However, it's less customizable compared to others, particularly when it comes to creating personalized filters or technical indicators.

On the other hand, Motley Fool Epic provides a solid stock screener with financial metrics but lacks real-time stock data and customization for technical screening.

It’s geared more towards long-term stock picks and fundamental analysis, with fewer tools for day traders.

Overall, Yahoo Finance Gold offers more comprehensive stock screening tools, especially for those focused on technical analysis and institutional insights.

-

Fundamental Analysis Tools

After reviewing both platforms, we found Yahoo Finance Gold provides more robust tools for fundamental analysis.

It offers 40 years of financial data, including income statements, balance sheets, and cash flow reports, which are invaluable for long-term investors.

The platform also integrates Morningstar and Argus stock ratings, giving users expert-backed stock assessments. Additionally, Yahoo Finance Gold provides the ability to export historical data to CSV for custom analysis.

Motley Fool Epic offers deep fundamental research through its stock recommendations and FoolIQ access, which provides detailed financial reports and data.

However, it lacks the depth of historical financial data that Yahoo Finance Gold provides and focuses primarily on stock recommendations.

-

Stock Picks & Recommendations

Motley Fool Epic delivers five stock recommendations per month, backed by detailed research and AI-driven analysis.

These picks are based on strong fundamentals and long-term growth potential, making it a great choice for long-term investors.

Yahoo Finance Gold doesn't focus as heavily on stock picks but does offer personalized trade ideas based on market trends and technical signals.

Overall, Motley Fool Epic provides more consistent and well-researched stock picks, making it the better choice for investors seeking frequent recommendations.

-

Market Sentiment Analysis

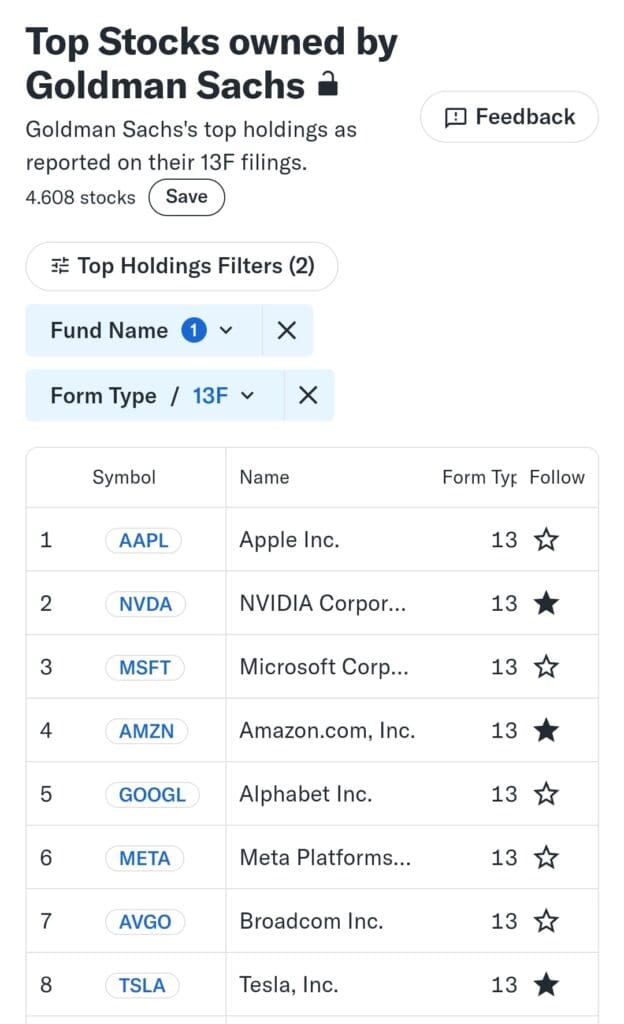

Yahoo Finance Gold provides insightful market sentiment tools, such as the Smart Money and Top Holdings screeners, which allow users to track institutional buying and selling activity.

It also offers premium news from trusted sources like Financial Times and The Information, which helps inform investors of market-moving events.

Motley Fool Epic, on the other hand, integrates the Potential Growth Indicator (PGI), which gauges market sentiment by analyzing cash in taxable money market accounts.

It also includes exclusive analyst coverage and a market sentiment podcast, but it doesn’t offer real-time market news or social features, which limits its effectiveness for traders.

Overall, Yahoo Finance Gold provides a more comprehensive market sentiment analysis, with access to real-time news and institutional tracking.

-

Portfolio Analysis & Alerts

Yahoo Finance Gold is one of the best apps for portfolio performance analysis. It tracks returns, diversification, and volatility and can export data for in-depth analysis.

Motley Fool Epic includes personalized stock tracking via the “My Stocks” tool and access to portfolio strategies, but it lacks portfolio performance analysis or detailed alerts for price movements.

-

Technical Analysis Options

Yahoo Finance Gold to be the stronger option for technical traders. It offers 50+ technical chart patterns, custom annotations, and real-time alerts for key market events.

The platform also includes technical event screeners, helping traders find breakouts, trend reversals, and support/resistance levels.

Motley Fool Epic, by contrast, does not provide technical analysis tools like interactive charts or moving averages.

Its focus is on fundamental analysis and stock recommendations, making it less suitable for traders who rely on technical signals.

-

ETF, Bonds & Fund Analysis Tools

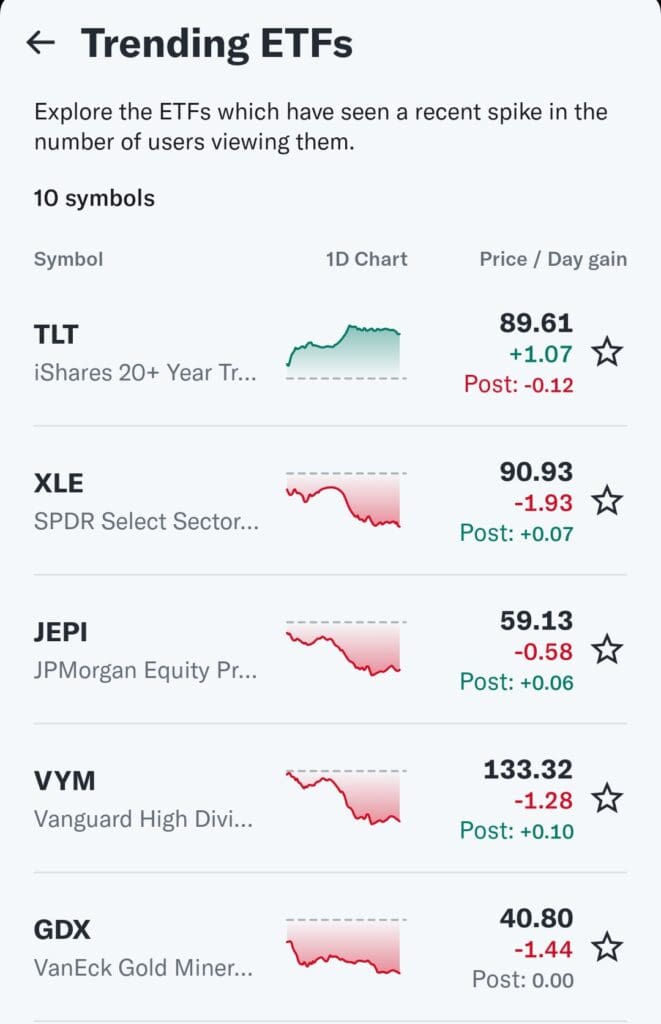

Yahoo Finance Gold includes detailed ETF screening and offers access to key institutional data, helping investors track ETF performance and make informed decisions. However, it focuses more on stocks.

Motley Fool Epic provides portfolio strategies that include ETF rankings and stock recommendations, but it does not offer comprehensive tools for analyzing bonds, commodities, or real estate.

Overall, Yahoo Finance Gold offers better tools for ETF analysis, but both platforms lack in-depth bond and fund analysis features.

Which Investors May Prefer Yahoo Finance Gold?

A Yahoo Finance subscription is worth it for investors seeking deep financial data and advanced technical tools.

Long-Term Investors: Access to 40 years of financial data and Morningstar ratings helps with long-term stock analysis and valuation.

Technical Traders: With 50+ technical chart patterns and real-time alerts, it’s perfect for traders who rely on charting.

Institutional Investors: The Smart Money screener allows tracking of hedge funds and institutional trades, ideal for aligning with big investors.

Data-Driven Analysts: The ability to export historical data and analyze trends makes it a top choice for analysts and backtesters.

Plan | Monthly Subscription |

|---|---|

Yahoo Finance – Bronze | $9.95

$95.40 ($7.95 / month) if paid annually |

Yahoo Finance – Silver | $24.95

$239.40 ($19.95 / month) if paid annually |

Yahoo Finance – Gold | $49.95

$479.40 ($39.95 / month) if paid annually |

Which Investors May Prefer Motley Fool Epic?

Motley Fool Epic is designed for investors looking for in-depth stock recommendations and advanced portfolio strategies based on long-term growth.

Growth-Focused Investors: With five stock recommendations per month, Epic helps investors target high-growth stocks with strong fundamentals.

Retirement Planners: Access to GamePlan+ and portfolio strategies for different risk profiles makes it ideal for retirement-focused investors.

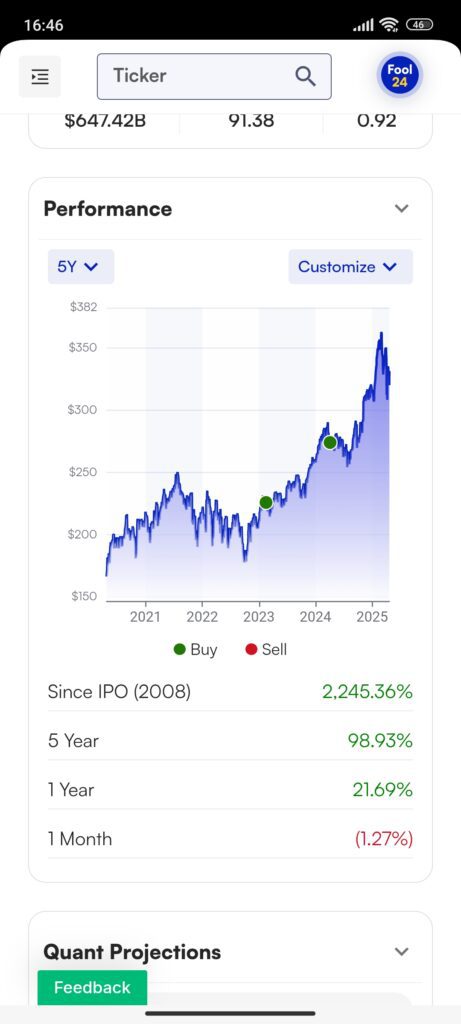

AI-Driven Research Seekers: Tools like the Moneyball Database and Quant: 5Y Scoring offer AI-powered stock analysis for smarter investment decisions.

Stock Pick Enthusiasts: Epic’s consistent stock picks and expanded coverage cater to those focused on building a diversified portfolio.

Plan | Annual Subscription | Promotion |

|---|---|---|

Motley Fool Stock Advisor | $199 (16.60 / month)

No monthly plan

| 30-day money-back guarantee |

Motley Fool Stock Epic | $499 (41.60 / month)

No monthly plan

| 30-day money-back guarantee |

Motley Fool Epic Plus | $1,999 (166.60 / month)

No monthly plan

| 30-day money-back guarantee |

Bottom Line

Yahoo Finance Gold excels with deep financial data, advanced technical analysis tools, and institutional insights, making it ideal for long-term investors and technical traders.

Motley Fool Epic stands out for its consistent stock recommendations, portfolio strategies, and AI-powered research, catering to long-term growth investors and those focused on retirement planning.