Motley Fool (Free Plan)

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Pros & Cons

The Motley Fool Free Plan provides a solid starting point for investors looking to stay informed without paying for a subscription.

It offers stock market news, basic stock analysis, educational guides, and curated investment lists, making it useful for long-term investors, beginners, and those interested in passive investing.

The platform covers a range of topics, from how to invest in stocks and ETFs to understanding retirement strategies and Social Security benefits.

For stock insights, Motley Fool includes company overviews, financial health indicators, and earnings transcripts, but stops short of providing direct buy/sell recommendations.

While the Free Plan delivers valuable information, it's very limited. It doesn't include lacks real-time data, advanced stock screening tools, technical analysis, and fundamental analysis tools for investors.

- Stock market news updates

- Basic stock analysis reports

- Financial health indicators

- Company earnings transcripts

- Market movers insights

- Investment guides & tutorials

- Retirement planning resources

- Stock market watchlists

- Dividend stock lists

- IPO & earnings calendars

- Morning financial news updates

- Personal finance comparisons

- Free stock market insights

- Beginner-friendly investment guides

- Covers multiple asset classes

- Includes stock performance data

- Curated investment lists

- No real-time stock data

- Lacks technical analysis tools

- No buy/sell recommendations

- Limited stock screening options

- Some content promotes services

Motley Fool: Explore Higher Tier Options - Worth Upgrading?

Motley Fool’s free plan provides limited investment insights, including market news, educational articles, and occasional stock recommendations.

However, it lacks in-depth research, proprietary stock picks, and advanced tools.

Plan | Annual Subscription | Promotion |

|---|---|---|

Motley Fool Stock Advisor | $199 (16.60 / month)

No monthly plan

| 30-day money-back guarantee |

Motley Fool Stock Epic | $499 (41.60 / month)

No monthly plan

| 30-day money-back guarantee |

Motley Fool Epic Plus | $1,999 (166.60 / month)

No monthly plan

| 30-day money-back guarantee |

In contrast, Stock Advisos offers two monthly stock picks, foundational investing guidance, and historical performance tracking, while Epic and Epic+ Plan expands stock coverage to more stock picks per month, portfolio strategies, and AI-driven analysis.

Is Motley Fool’s Free Plan Useful For Stock Research?

Overall, not so much. We tested Motley Fool’s Free plan for stock research – here’s what it offers and what’s missing:

-

Basic Stock Analysis

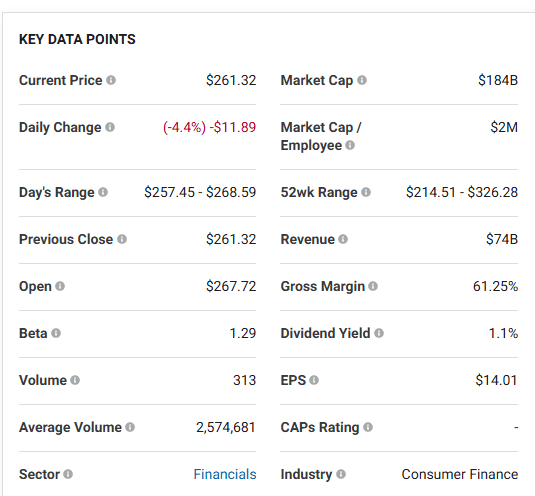

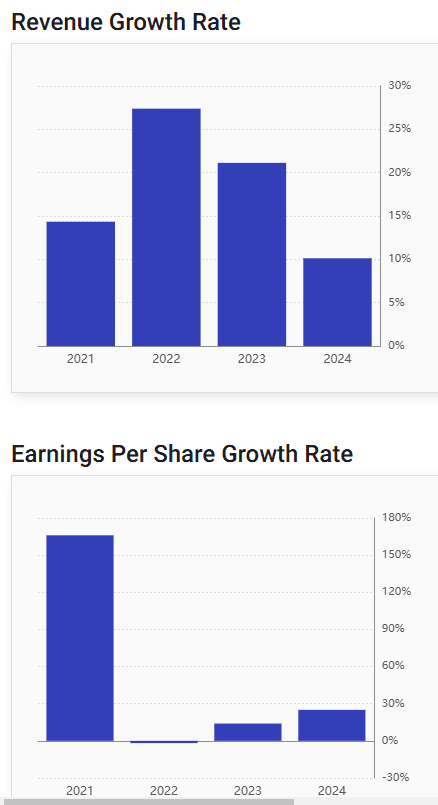

Motley Fool’s free Stock Analysis feature provides insights into individual stocks, covering performance, financials, and market trends.

Each stock page includes a Return vs. S&P 500 comparison, showing whether the stock has outperformed or lagged behind. The company info section offers a quick overview of the business model and key developments.

The news & analysis section compiles Motley Fool’s latest articles and opinions, focusing on industry trends, earnings, and company performance.

The financial health segment highlights revenue growth, profitability, and balance sheet strength in an easy-to-understand format.

The valuation section provides general insights into whether a stock is considered overvalued or undervalued.

For additional insights, Motley Fool includes Podcast Episodes discussing stocks and market trends, as well as earnings transcripts for those wanting firsthand insights from company leadership.

Lastly, the related stocks section suggests similar companies for comparison.

-

Investing Guides & Tutorials

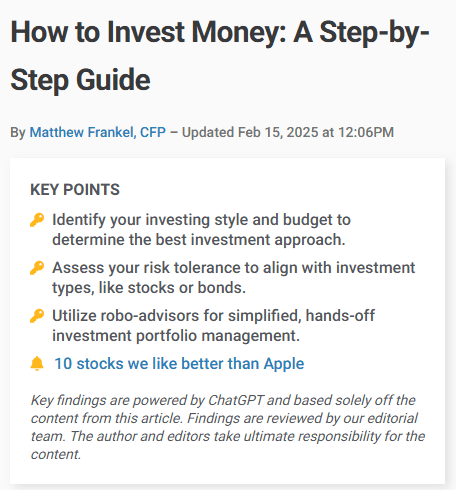

Motley Fool’s free Investing Guides & Tutorials provide beginner-friendly educational content on key investing topics.

The Investing 101 and Stock Market 101 sections introduce fundamental concepts, explaining how markets work and the basics of buying and selling stocks.

For those new to investing, guides like How to Invest Money, What to Invest In, and How to Invest in Stocks break down strategies for getting started.

More specific resources cover different asset classes, including ETFs, index funds, and bonds, helping investors understand their options.

Some guides subtly promote Motley Fool’s services, making them feel less independent.

Additionally, there’s little coverage of technical analysis or short-term trading techniques.

Free Investment Resources: What You Can Find?

We explored Motley Fool’s free investment resource features, including stock news, investing guides, and earnings transcripts – here’s what stands out:

-

Stock Market News

Motley Fool’s free Stock News feature provides updates on major market movements and industry trends.

The Stock Market News section covers broader economic events, such as interest rate changes and corporate earnings, while Market Movers highlights stocks experiencing significant price changes.

For sector-specific updates, Motley Fool offers Tech Stock News, focusing on companies like Apple, Tesla, and Nvidia, and Consumer Stock News, covering brands in retail and e-commerce.

Industrial Stock News provides insights into energy, manufacturing, and transportation, while Crypto News tracks developments in digital assets and blockchain technology.

While useful, the free news lacks real-time updates and in-depth investigative reporting. Coverage leans toward Motley Fool’s long-term investing approach rather than short-term market movements.

-

Retirement Advice

Motley Fool’s free retirement section provides essential guides to help individuals plan for their financial future.

Retirement 101 and retirement essentials cover the basics, including types of retirement accounts, how to contribute to 401(k)s and IRAs, and strategies for long-term savings.

For investment planning, the asset allocation for my age guide helps investors adjust portfolios over time.

The section also explains 401(k) withdrawal rules and strategies for social security benefits, including when to start collecting and how to maximize payouts.

The content lacks personalized planning tools or advanced tax strategies. Some guides subtly promote brokerage services, and there’s limited coverage of non-traditional retirement investments like annuities or real estate.

-

Markets Updates

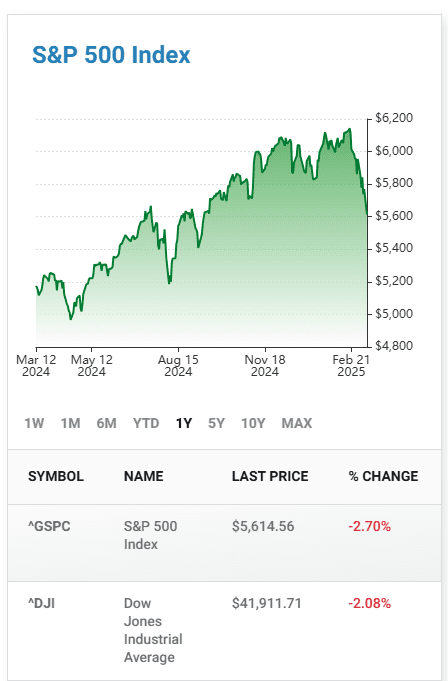

Motley Fool’s free Markets feature provides daily stock market updates and key performance metrics.

Stock market indexes today track major indexes like the S&P 500 and Nasdaq, while most active stocks today highlight stocks with the highest trading volume.

For price movement insights, today's biggest stock gainers and today's biggest stock losers showcase stocks with significant percentage changes.

The Largest Market Cap Companies section ranks leading firms by total valuation, offering a snapshot of the biggest players in the market.

Market Research provides broader investment trends and analysis, while Breakfast News delivers a morning roundup of key financial headlines, helping investors stay informed before trading begins.

While informative, the free market data is basic and lacks in-depth analysis or advanced screening tools. It doesn’t provide real-time updates or interactive charting like professional platforms.

-

Personal Finance

For homebuyers, the Homebuying section includes mortgage lenders, current mortgage rates, and mortgage lender comparisons, helping users navigate loans and financing options.

While informative, the content is general and lacks in-depth rate comparisons or personalized recommendations. Additionally, some rankings may promote affiliate partnerships, so users should cross-check information.

Motley Fool’s free Personal Finance section provides guides, comparisons, and reviews to help users make informed money decisions.

The Credit Cards section covers best credit cards, credit card reviews, and tools for comparing rewards, fees, and benefits.

The bank & loans segment highlights savings accounts, personal loan reviews, and guides on banking products.

Additional Features & Tools

Motley Fool’s Free Plan includes additional tools and features that help investors stay informed and manage their investments more effectively.

Here are ten useful tools available without a subscription:

- Dividend Stock List: Highlights companies with strong dividend histories, helping income-focused investors find reliable stocks for passive income.

- Watchlist Feature: Allows users to save and track their favorite stocks in one place, making it easier to monitor performance over time.

- Earnings Calendar: Displays upcoming earnings reports for major companies, helping investors stay ahead of key financial announcements.

- IPO Calendar: Tracks newly listed and upcoming IPOs, offering insights into potential investment opportunities in the public market.

- Investment Calculators: Includes tools for retirement planning, compound interest projections, and portfolio growth estimations.

Motley Fool Free Plan: Key Drawbacks & Limitations

While Motley Fool’s Free Plan offers valuable insights, it has some clear limitations compared to its premium services and competitors. Here are a few key areas where it falls short:

-

Limited Charting and Technical Analysis

For investors who use technical analysis, the Motley Fool Free Plan is underwhelming.

Unlike platforms like TradingView, Yahoo Finance, or even broker-provided tools, Motley Fool lacks interactive charts, real-time indicators, and historical performance comparisons.

-

No Advanced Stock Screener or Research Tools

Unlike platforms such as Finviz or TradingView, Motley Fool’s Free Plan does not include an advanced stock screener with customizable filters.

Investors looking to analyze stocks based on technical or fundamental metrics won’t find many tools here.

-

Lack of In-Depth Financial Analysis

The Free Plan provides general stock overviews, but deep financial analysis is missing.

Even compared to other free plans on platforms like Yahoo Finance, investing.com and MarketBeat, Motley Fool provide very limited data for fundamental investors.

-

Limited Stock Ratings and Buy/Sell Recommendations

One of the biggest drawbacks is the lack of direct buy/sell recommendations.

While Motley Fool teases top stock picks in free content, the actual names and detailed analysis are locked behind a paywall.

-

Limited Real-Time Market Data

The Free Plan lacks real-time market data and breaking news updates, which can be found on sites like CNBC, Bloomberg, and Yahoo Finance.

Stock prices update regularly, but without real-time insights into major economic events, earnings calls, or company developments, investors may need to rely on other platforms for up-to-the-minute information.

Who Benefits Most From Motley Fool’s Free Plan?

Motley fool’s free plan is best suited for long-term investors and those looking for easy-to-understand investment insights

. here are types of investors and traders who may find it useful:

Beginners: This is great for those just starting out, as it covers investing basics, stock market fundamentals, and how to build a portfolio with simple explanations.

Retirement Planners: Motley fool’s free plan offers useful resources on 401(k)s, iras, and social security, making it a good fit for those planning long-term financial security.

Casual Market Watchers: Motley fool’s free plan is great for investors who like to stay informed about stock market news, trends, and industry insights without diving into complex technical analysis.

Why Motley Fool May Not Suit Every Investor

Motley Fool’s free plan isn’t the best fit for every type of investor or trader. Here are six types who may find it lacking:

Day Traders: The free plan doesn’t provide real-time data, advanced charting, or short-term trade signals, making it unsuitable for those who rely on quick price movements.

Technical Analysts: The free plan lacks in-depth technical analysis tools, indicators, and pattern recognition, which are essential for traders who base decisions on stock charts.

Value Investors: The Motley Fool’s free plan focuses heavily on growth stocks rather than undervalued companies, offering little for those who prioritize deep financial metrics and discounted stock opportunities.

Institutional or Advanced Investors: The Motley Fool’s free plan lacks professional-grade research, earnings projections, and deep financial modeling, which sophisticated investors require for high-stakes decision-making.

FAQ

New articles and market updates are published daily, but they are not real-time like financial news platforms such as CNBC or Bloomberg.

While some stock recommendations are teased in free content, full stock picks with detailed analysis are reserved for premium subscribers.

No, there’s no dedicated portfolio tracking tool, though users can create a watchlist to monitor selected stocks.

Stock prices update periodically but are not in real-time. For instant updates, users need a brokerage platform or financial site like Yahoo Finance.

Not extensively. Most free content focuses on larger, well-established companies rather than high-risk penny stocks.

Motley Fool has a mobile app, but most premium features require a subscription. Free content is available through the website.

No, Motley Fool does not provide a stock screener like Finviz or TradingView. It mainly offers stock lists based on its own research.

Review Free Stock Analysis Tools

Investment Analysis & Research Tools : Review Methodology

At The Smart Investor, we evaluated free investment research platforms based on the quality and depth of their features compared to other free alternatives. Each platform was rated based on the following criteria:

- Fundamental Analysis Tools (25%): We assessed the availability of key financial data, including income statements, balance sheets, cash flow, valuation metrics, and analyst estimates. Platforms with more in-depth historical data, forward-looking projections, and research reports scored higher.

- Technical Analysis Features (20%): We examined the variety and quality of technical indicators, charting tools, and real-time price data. Platforms that offered customizable interactive charts, trend analysis, and multiple timeframes received better ratings.

- Stock Screener & Free Filters (15%): A strong stock screener is crucial for research, so we rated platforms based on the number and depth of filtering options. Higher scores were given to platforms that allowed customized searches using fundamental, technical, and sector-based criteria.

- Portfolio Tracking & Alerts (15%): We reviewed the ability to track multiple portfolios, set up watchlists, and receive alerts on stock movements. Platforms offering real-time updates, dividend tracking, and personalized notifications ranked higher.

- Ease of Use & User Experience (15%): Platforms were rated on their design, navigation, and accessibility across devices. Those with intuitive layouts, easy-to-read data, and smooth user experiences received better scores.

- Additional Perks & Limitations (5%): We considered unique tools, premium research access, and potential feature restrictions. Platforms with added perks like AI analysis or fewer paywalls scored higher, while those with aggressive ads or major limitations were rated lower.

- Community & Social Features (5%): Platforms with investor discussion forums, sentiment tracking, or social trading features were rated higher. Those lacking community-driven insights or engagement tools scored lower.