| ||

|---|---|---|

Morningstar Investor | Motley Fool Epic | |

Price | $249 ($20.75 / month) | $499 (41.60 / month)

No monthly plan

|

Best Features | ||

Our Rating |

(4.5/5) |

(4.4/5) |

Read Review | Read Review |

Compare Stock Research & Analysis Features

In this comparison, we’ll compare Seeking Alpha Premium and Motley Fool Epic, focusing on their stock research, market sentiment analysis, and portfolio management features.

We’ll break down each platform's unique strengths to help you choose the one that suits your strategy.

-

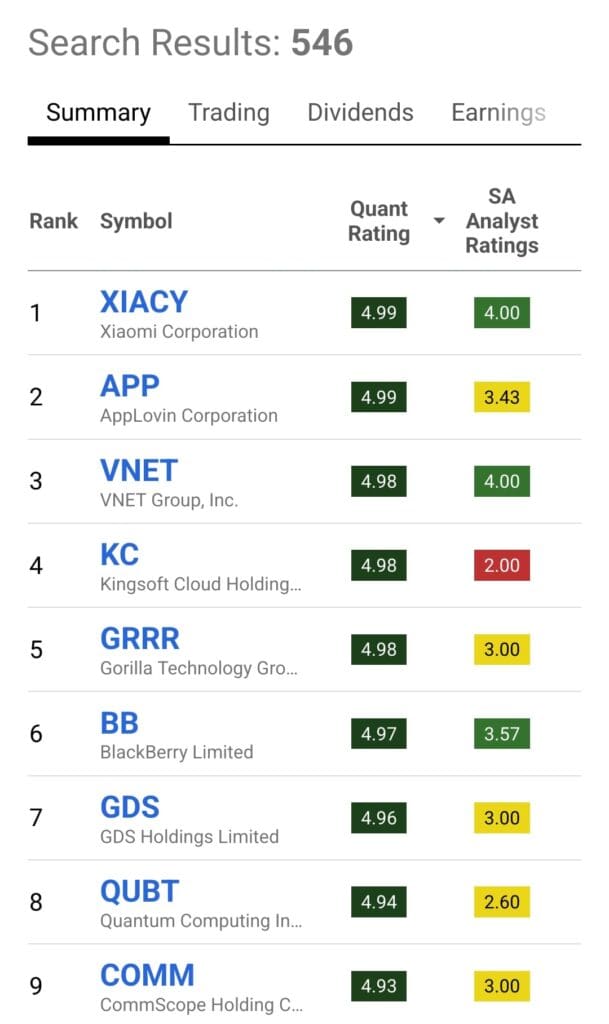

Stock Screening Tools

Seeking Alpha Premium offers a robust, customizable stock screener that allows investors to filter stocks based on valuation, growth, profitability, dividends, and momentum.

It also allows filtering by the proprietary Quant Ratings, helping investors narrow down to top-rated stocks.

On the other hand, Motley Fool Epic provides a stock screener with deeper financial metrics, such as market cap, revenue growth, and competitive positioning.

However, it lacks advanced filtering options like Seeking Alpha’s Quant Ratings.

Overall, Seeking Alpha Premium offers more powerful, customizable stock screening tools, making it the better choice for screening stocks.

-

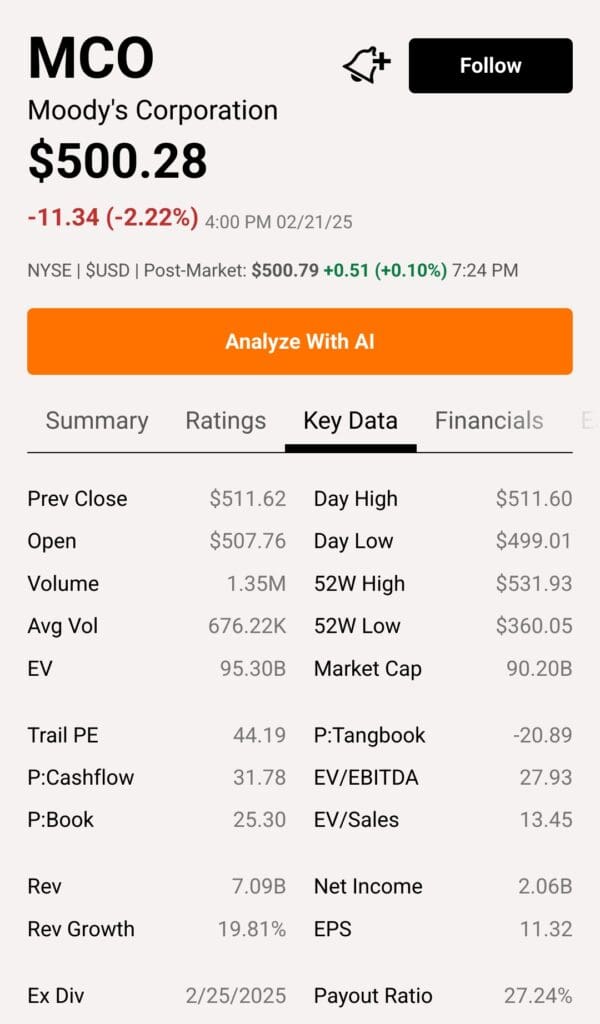

Fundamental Analysis Tools

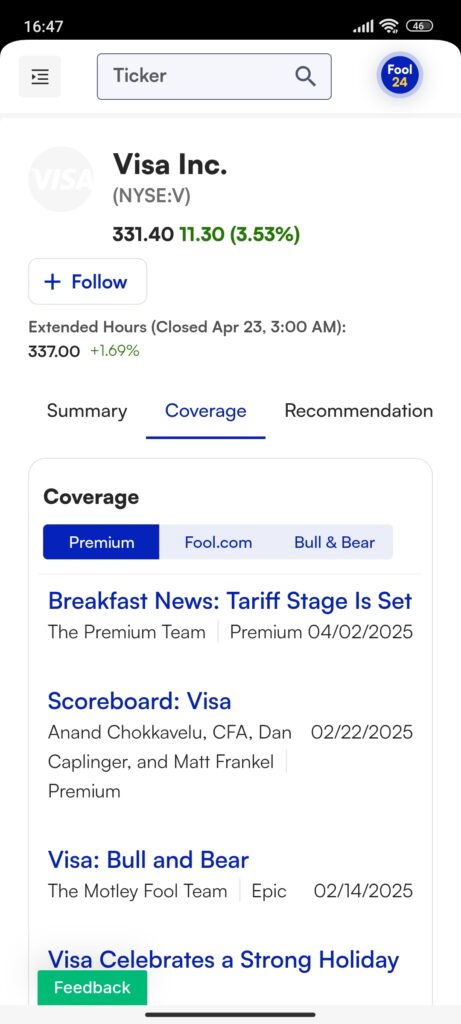

When comparing fundamental analysis, Seeking Alpha Premium stands out with its comprehensive tools. We tested its Quant Ratings, Factor Grades, earnings data, and detailed financial reports.

Premium users have access to a wide range of fundamental analysis, including income statements, balance sheets, and dividend history, as well as in-depth expert articles.

In comparison, Motley Fool Epic offers expanded research reports, including sector-specific insights, FoolIQ access, and its unique Moneyball Database for AI-powered stock evaluation.

While Epic’s research is extensive, Seeking Alpha Premium provides a more detailed and data-driven approach with in-depth analysis across all stock aspects.

-

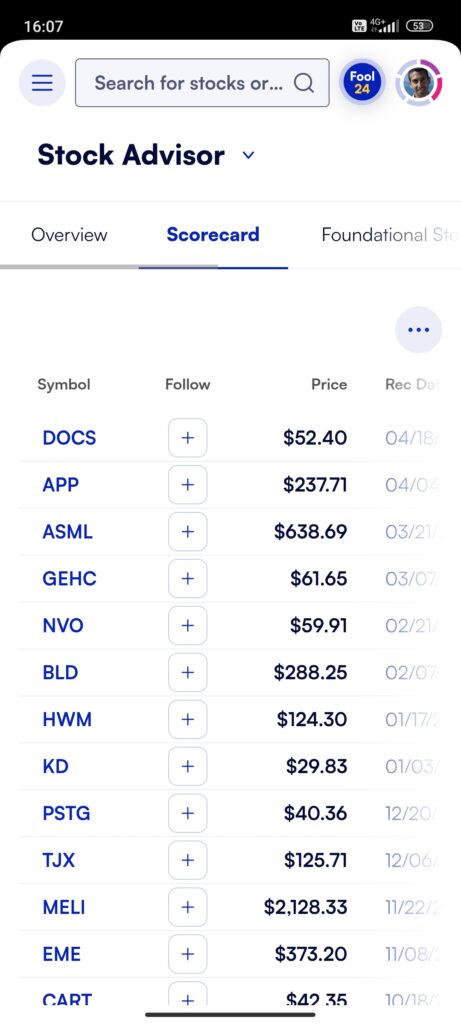

Stock Picks & Recommendations

Seeking Alpha Premium provides access to curated lists like Top Growth Stocks and Top Dividend Stocks, which are driven by Quant Ratings. It also offers handpicked stock recommendations based on data analysis.

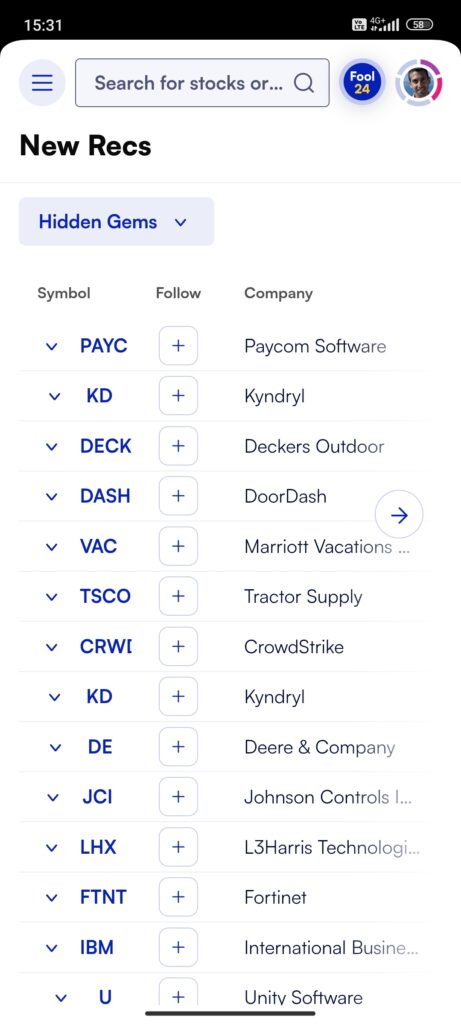

However, Motley Fool Epic goes a step further with five monthly stock recommendations, deeper AI-driven analysis, and sector-specific insights.

Epic's focus on long-term growth potential and its additional scorecards for different market conditions provide more structured guidance on stock selection.

In summary, Motley Fool Epic offers more frequent, diversified, and tailored stock picks, making it better suited for long-term investors looking for broader stock coverage.

-

Market Sentiment Analysis

Seeking Alpha Premium provides a news dashboard, real-time portfolio alerts, earnings call transcripts, and a comprehensive market news section.

This helps users stay updated on stock movements, earnings revisions, and economic events. It also tracks author performance, offering insights into contributors’ stock picks.

Motley Fool Epic, while offering market sentiment tools through its Epic Opportunities Podcast and Fool24’s live coverage, is more focused on sector analysis and long-term growth.

It doesn’t provide real-time breaking news or tickers in the same comprehensive way as Seeking Alpha Premium.

Therefore, Seeking Alpha Premium provides superior market sentiment analysis tools, including real-time updates and breaking news.

-

Portfolio Analysis & Alerts

Seeking Alpha Premium provides detailed portfolio health checks, tracking risk, dividend safety, and fundamental strength.

It offers real-time alerts for stock movements, earnings revisions, and risk warnings, helping investors monitor portfolio performance and take timely action.

Motley Fool Epic, while offering portfolio strategies through its GamePlan tool, lacks real-time alerts and doesn’t offer in-depth portfolio analysis like Seeking Alpha.

Its tracking features are more focused on stock performance rather than portfolio health.

-

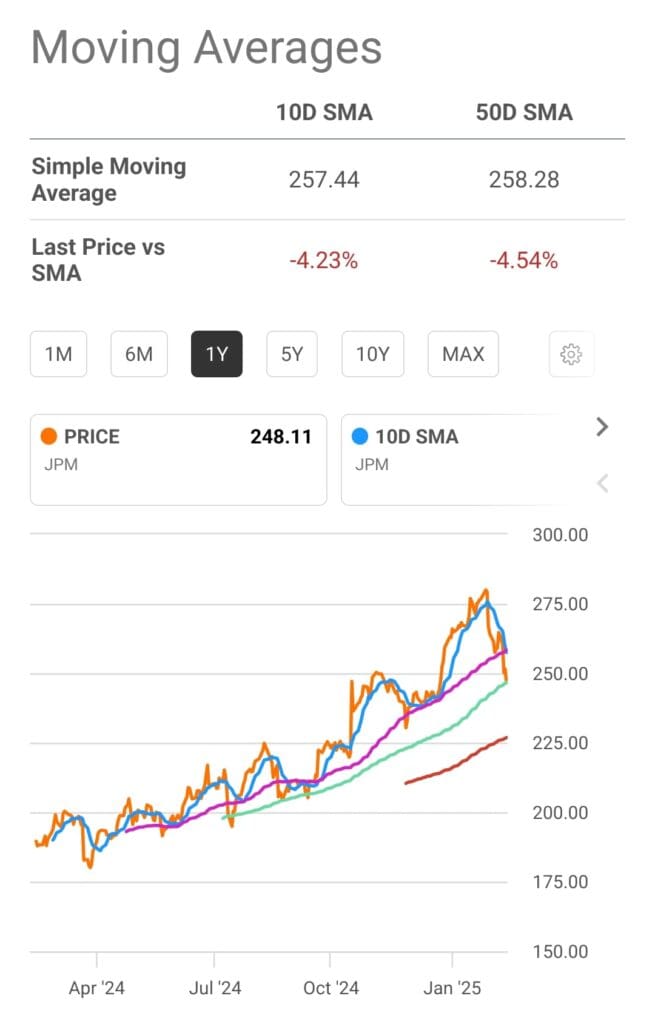

Technical Analysis Options

Neither platform excels in technical analysis, but Seeking Alpha Premium offers slightly more basic charting functionality.

Seeking Alpha Premium focuses primarily on fundamental analysis, offering limited technical analysis tools.

In contrast, Motley Fool Epic also lacks robust technical analysis tools, such as charting or real-time price data.

-

ETF, Bonds & Fund Analysis Tools

In ETF, bonds, and fund analysis, Seeking Alpha Premium provides strong tools for ETF research, including top ETF rankings, performance analysis, and sector exposure. However, it lacks in-depth mutual fund and bond analysis.

Motley Fool Epic, while not focused on bonds or mutual funds, does offer ETF rankings and sector-specific insights.

Both platforms provide useful ETF research, but neither covers mutual funds or bonds extensively.

Which Investors May Prefer Seeking Alpha Premium?

Seeking Alpha Premium is ideal for investors who want data-driven stock research and comprehensive financial insights. This platform excels at providing deep fundamental analysis with tools to track portfolio performance and market trends.

Fundamental Analysts: In-depth stock research, earnings data, and SEC filings.

Dividend Investors: Offers detailed dividend safety scores and payout histories.

Self-Directed Investors: Access to expert articles and Quant Ratings for DIY stock selection.

ETF Investors: Comprehensive ETF rankings based on performance, risk, and sector exposure.

Plan | Annual Subscription | Promotion |

|---|---|---|

Seeking Alpha Premium | $299 ($24.90 / month)

No monthly subscription | $4.95 for 1 month |

Seeking Alpha Pro | $2,400 ($200 / month)

No monthly subscription | $99 for 1 month |

Seeking Alpha – Alpha Picks | $499 ($41.58 / month)

No monthly subscription | N/A |

Which Investors May Prefer Motley Fool Epic?

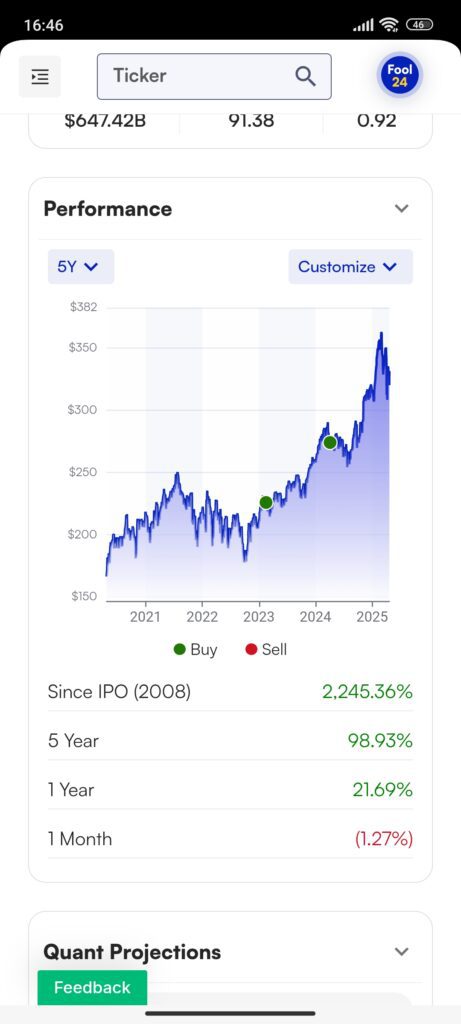

Motley Fool Epic is best suited for long-term growth investors looking for comprehensive stock recommendations and advanced portfolio strategies. It offers expanded coverage, AI-driven stock analysis, and retirement planning tools.

Long-Term Growth Investors: Five monthly stock recommendations with strong growth potential.

Retirement-Focused Investors: GamePlan+ provides portfolio strategies tailored for retirement planning.

Investors Seeking Stock Diversification: Sector-specific insights and additional stock scorecards.

AI-Driven Investors: Access to the Moneyball Database for AI-powered stock evaluations.

Plan | Annual Subscription | Promotion |

|---|---|---|

Motley Fool Stock Advisor | $199 (16.60 / month)

No monthly plan

| 30-day money-back guarantee |

Motley Fool Stock Epic | $499 (41.60 / month)

No monthly plan

| 30-day money-back guarantee |

Motley Fool Epic Plus | $1,999 (166.60 / month)

No monthly plan

| 30-day money-back guarantee |

Bottom Line

Seeking Alpha Premium excels in providing deep fundamental analysis, detailed stock ratings, and comprehensive portfolio management tools, making it a solid choice for long-term investors and dividend seekers.

Meanwhile, Motley Fool Epic stands out with its AI-powered stock recommendations, portfolio strategies, and retirement planning tools, perfect for growth-focused investors.