|

| |

|---|---|---|

Seeking Alpha Premium | InvestingPro | |

Price | $299 ($24.90 / month)

No monthly subscription | $120 ($9.99 / month)

|

Best Features | ||

Our Rating |

(4.6/5) |

(4.5/5) |

Read Review | Read Review |

Compare Stock Research & Analysis Features

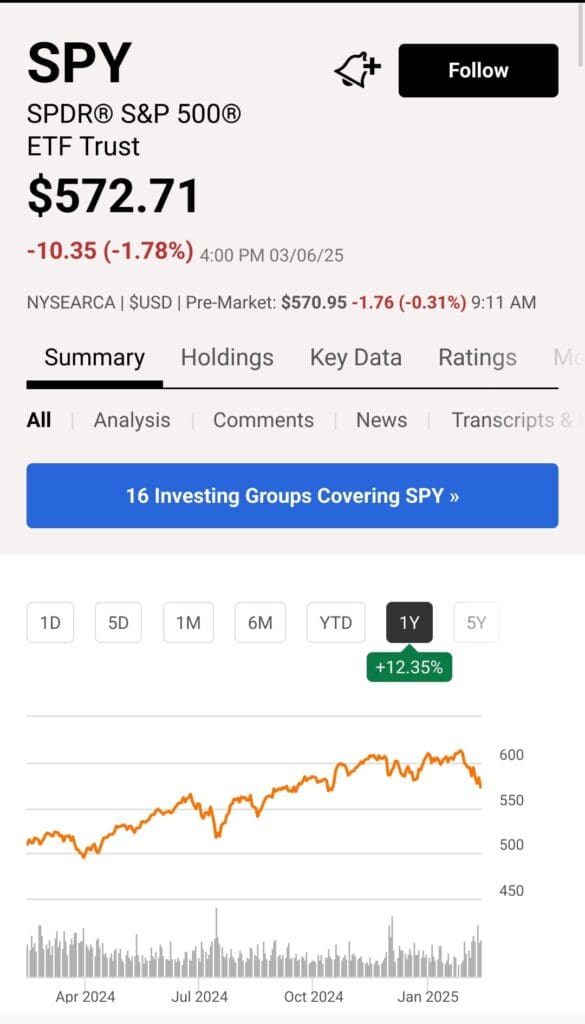

In this article, we’ll compare Seeking Alpha Premium and InvestingPro, two of the best apps for stock research and analysis.

We’ll walk you through their screening capabilities, fundamental analysis tools, portfolio insights, and stock recommendation features to help you decide which platform aligns better with your investing goals.

-

Stock Screening Tools

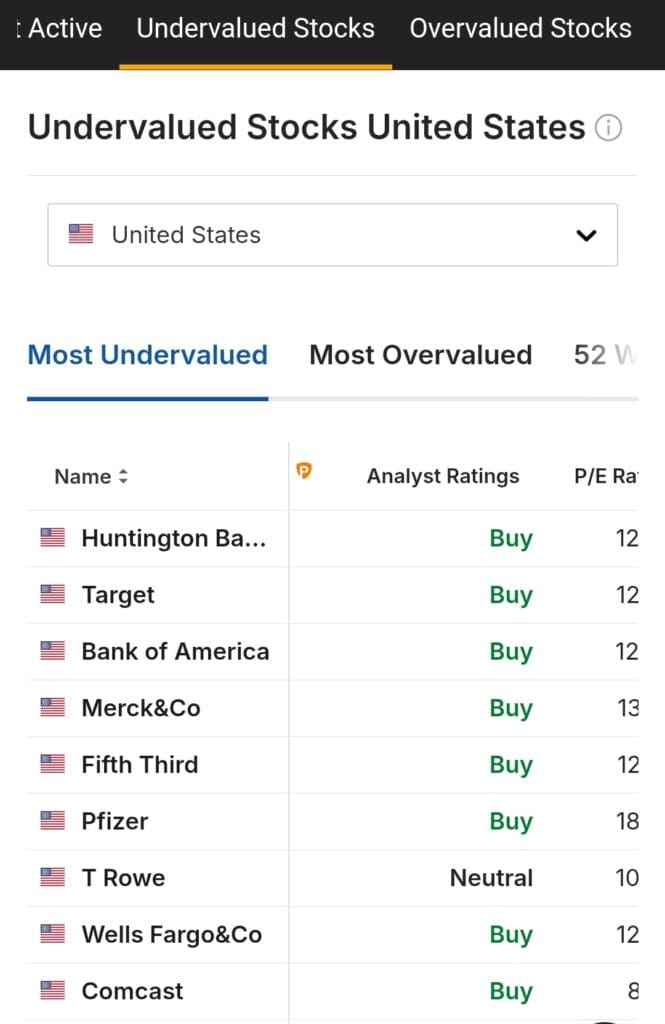

InvestingPro’s screener is more powerful in terms of customization, allowing filters across 1,000+ metrics including financial ratios, valuation metrics, and sector data.

It's designed for broad and granular research, giving users more control and data points than Seeking Alpha.

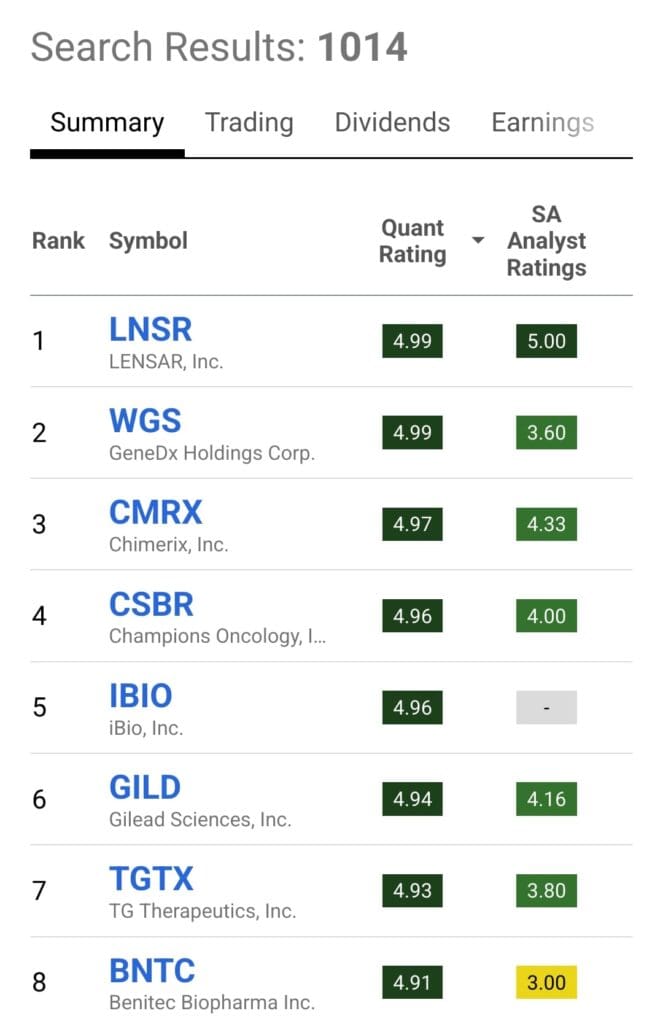

Seeking Alpha Premium offers an advanced stock and ETF screener with filters for valuation, growth, profitability, dividends, and momentum.

Its standout feature is the ability to filter by Quant Ratings and Factor Grades, which simplify finding high-rated stocks across categories like value or dividend yield. However, it lacks deep customization and data exporting.

-

Fundamental Analysis Tools

Seeking Alpha Premium shines in stock research with full financials, earnings data, dividend safety analysis, and proprietary tools like Quant Ratings and Factor Grades.

It also includes unlimited access to premium articles and earnings call transcripts, which add a qualitative layer to the research.

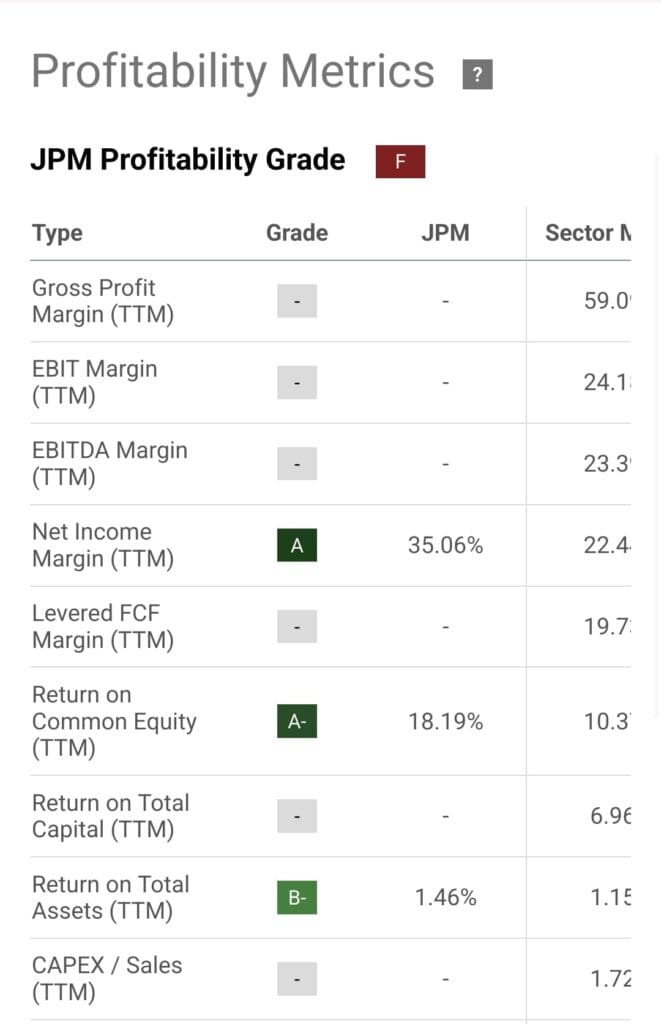

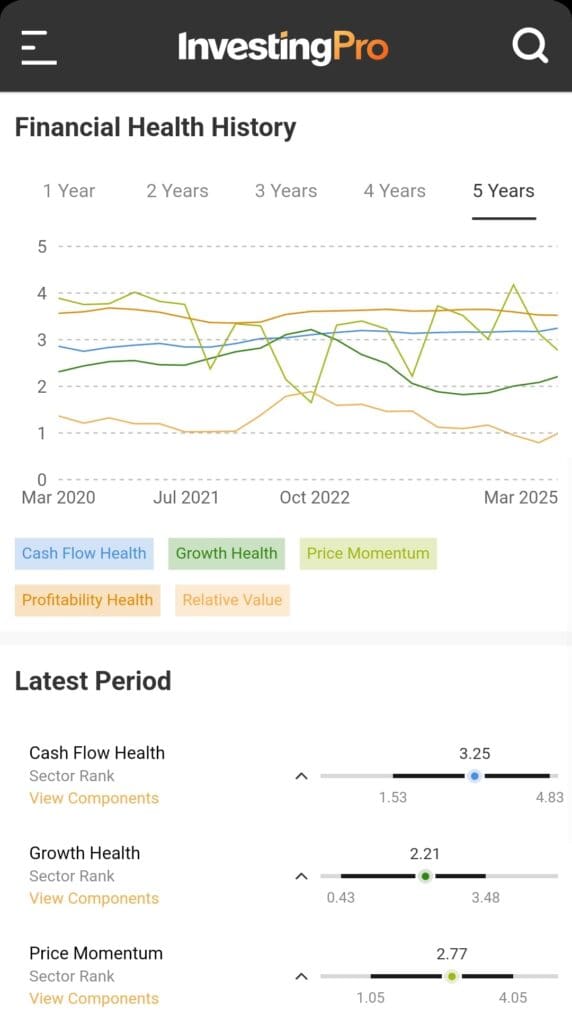

InvestingPro focuses heavily on data, offering over 1,000 metrics, company health scores, sector rankings, and fair value gap analysis.

However, it lacks Wall Street analyst ratings and doesn’t include premium articles or earnings call transcripts.

-

Stock Picks & Recommendations

InvestingPro includes AI-powered ProPicks, which use algorithms to identify stocks expected to outperform the S&P 500.

These recommendations are updated automatically and based on financial modeling and market patterns.

Seeking Alpha Premium itself doesn’t offer formal stock picks, but its Alpha Picks service does, using Quant Ratings to deliver handpicked ideas.

Within Premium, users can still leverage Top Rated Stock lists (e.g., Growth, Dividend) and access contributor recommendations.

-

Market Sentiment Analysis

InvestingPro offers exclusive news, economic updates, and real-time market data, but focuses more on curated headlines than interactive sentiment tools. It doesn’t provide social engagement or ticker-level discussions either.

Seeking Alpha Premium users can track news on portfolio holdings and search for ticker-specific insights, but it lacks real-time social sentiment or user commentary features.

-

Portfolio Analysis & Alerts

Seeking Alpha Premium includes a Portfolio Health Check that flags overvalued or weak stocks, evaluates diversification, and offers real-time alerts on earnings revisions and dividend risks. It's especially helpful for long-term and income-focused investors.

InvestingPro offers custom watchlists and real-time price alerts but lacks in-depth portfolio risk tools or warnings. It focuses more on individual stock metrics than full portfolio diagnostics.

-

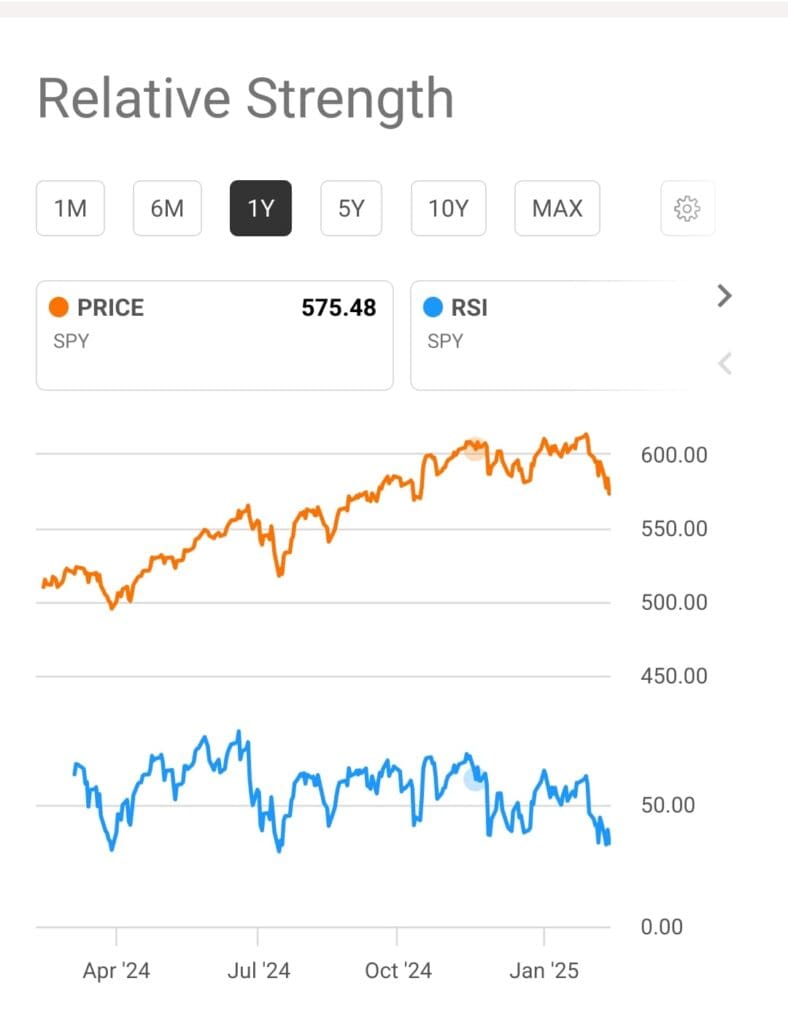

Technical Analysis Options

Seeking Alpha Premium focuses on fundamentals and offers only basic charts with no advanced indicators or price action tools.

InvestingPro provides customizable stock charts with technical indicators and overlays for trend and pattern analysis, including price alerts. However, it still lacks the depth of a dedicated charting platform.

-

ETF, Bonds & Fund Analysis Tools

Seeking Alpha Premium provides curated ETF rankings by performance, risk, and sector, along with in-depth financial data. However, it lacks bond and mutual fund coverage.

InvestingPro allows ETF analysis through its screener and data filters but also doesn’t support mutual fund or bond research.

Which Investors May Prefer Seeking Alpha Premium?

Ideal for data-driven investors seeking expert insights and in-depth stock research tools. It offers both quantitative metrics and qualitative perspectives.

DIY investors who enjoy reading expert articles and earnings breakdowns.

Dividend investors need payout safety scores and growth screens.

Long-term investors looking to track portfolio risk, diversification, and financial strength.

ETF-focused investors who want curated top fund rankings.A

Seeking Alpha paid subscription is best for those who want both comprehensive financial data and detailed commentary on U.S. stocks.

Plan | Annual Subscription | Promotion |

|---|---|---|

Seeking Alpha Premium | $299 ($24.90 / month)

No monthly subscription | $4.95 for 1 month |

Seeking Alpha Pro | $2,400 ($200 / month)

No monthly subscription | $99 for 1 month |

Seeking Alpha – Alpha Picks | $499 ($41.58 / month)

No monthly subscription | N/A |

Which Investors May Prefer InvestingPro?

Designed for investors who prioritize customizable data tools, AI-generated picks, and real-time financial metrics to power stock decisions.

Value investors looking for undervalued stocks using fair value gap analysis.

Fundamental analysts needing access to 1,000+ metrics and sector-level insights.

Long-term investors who want clean dashboards for tracking financial health scores.

Traders or analysts seeking real-time alerts and flexible charting tools.

InvestingPro subscription is ideal for hands-on investors who want fast, metrics-based decision support without relying on article-based research.

Plan | Monthly Subscription |

|---|---|

InvestingPro | $15.99

$120 ($9.99 / month)

if paid annually |

InvestingPro+ | $39.99

$300 ($24.99 / month) if paid annually |

Bottom Line

Both Seeking Alpha Premium and InvestingPro offer powerful tools for stock research, but they cater to slightly different investor styles.

Seeking Alpha excels in deep fundamental analysis, dividend insights, and expert-driven content. In contrast, InvestingPro shines with customizable data filters, real-time market data, and AI-powered stock picks.

If you want curated articles and portfolio health tools, go with Seeking Alpha. If you prefer data-rich screeners and smart automation, InvestingPro is a top contender.