Curious if Seeking Alpha Premium is worth the cash? Whether you're tracking Tesla or hunting dividend gems, this platform levels up your stock game.

The free plan gives you the basics, but Premium unlocks pro tools like quant scores and stock screeners.

Let’s break it down so you can invest smarter, not harder.

What Both Seeking Alpha Free and Premium Include?

Here are the main features available on both the Seeking Alpha Free (Basic) and Premium plans.

While Premium includes additional functionality, this comparison focuses only on what you get with both plans, showing how free users can still benefit from Seeking Alpha’s research tools.

-

Basic Stock Screener Tools

Both plans give users access to Seeking Alpha’s stock screener to filter equities based on basic criteria such as market cap, sector, and dividend yield.

This is helpful for beginners and long-term investors who want to shortlist dividend-paying stocks or growth companies without needing advanced filters.

However, advanced screening using Quant Ratings and valuation filters is locked behind the Premium paywall.

-

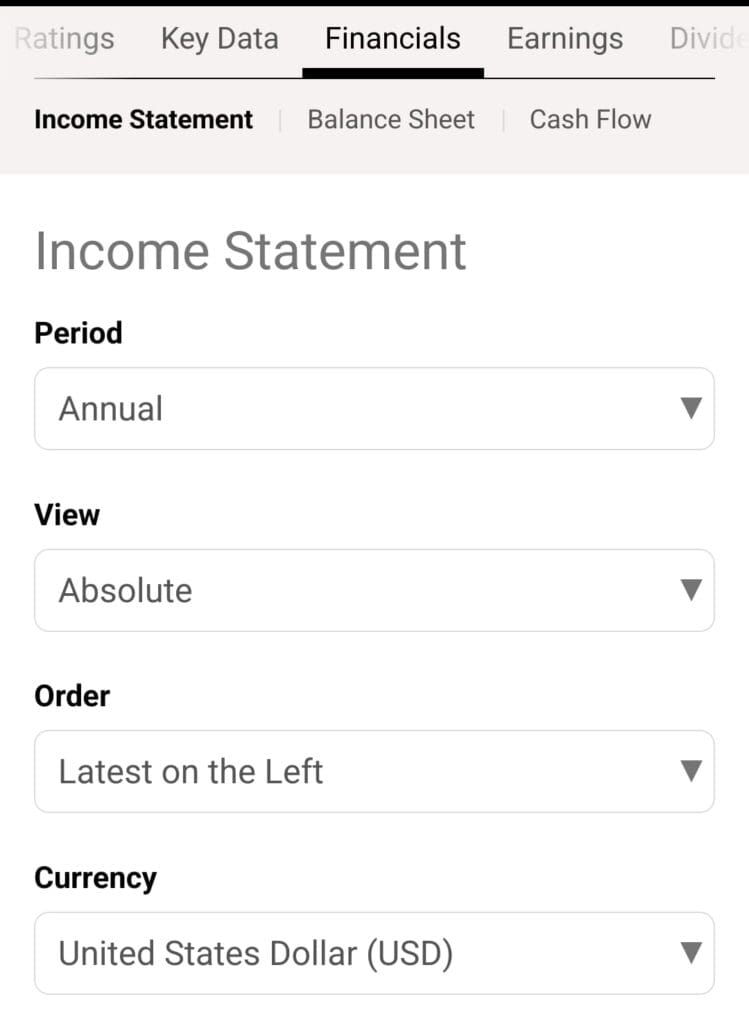

Fundamental Stock Analysis Tools

Both plans allow access to company financials such as income statements, balance sheets, and cash flow reports.

This enables investors to evaluate revenue trends, profit margins, debt levels, and dividend payouts over time.

Because of this, value investors and DIY researchers can conduct foundational stock analysis using historical data.

-

Basic Portfolio Watchlist Tools

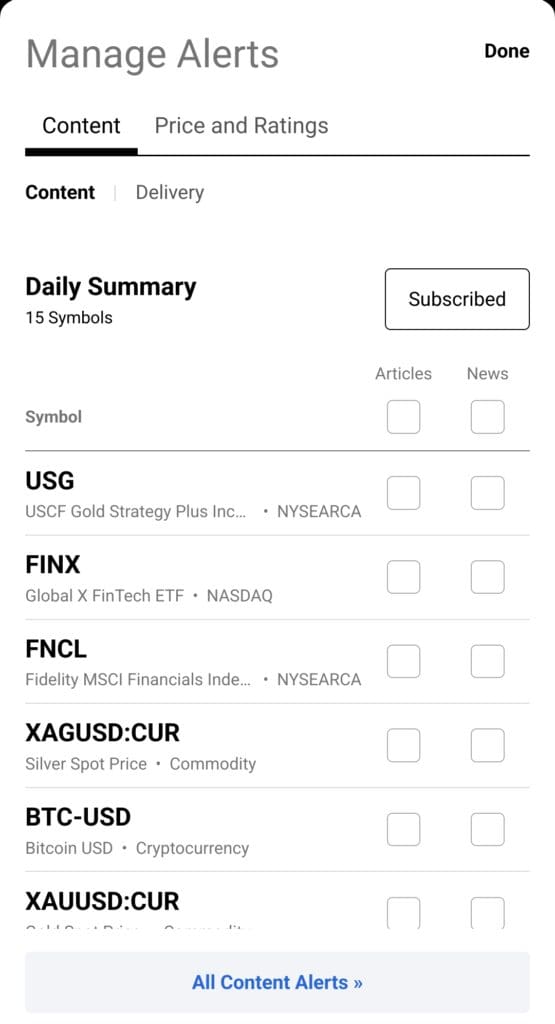

Users can create stock watchlists and receive limited notifications related to price movements and news headlines.

While real-time alerts and full portfolio analytics are Premium-only, Basic users can still track portfolio health and monitor stock updates.

-

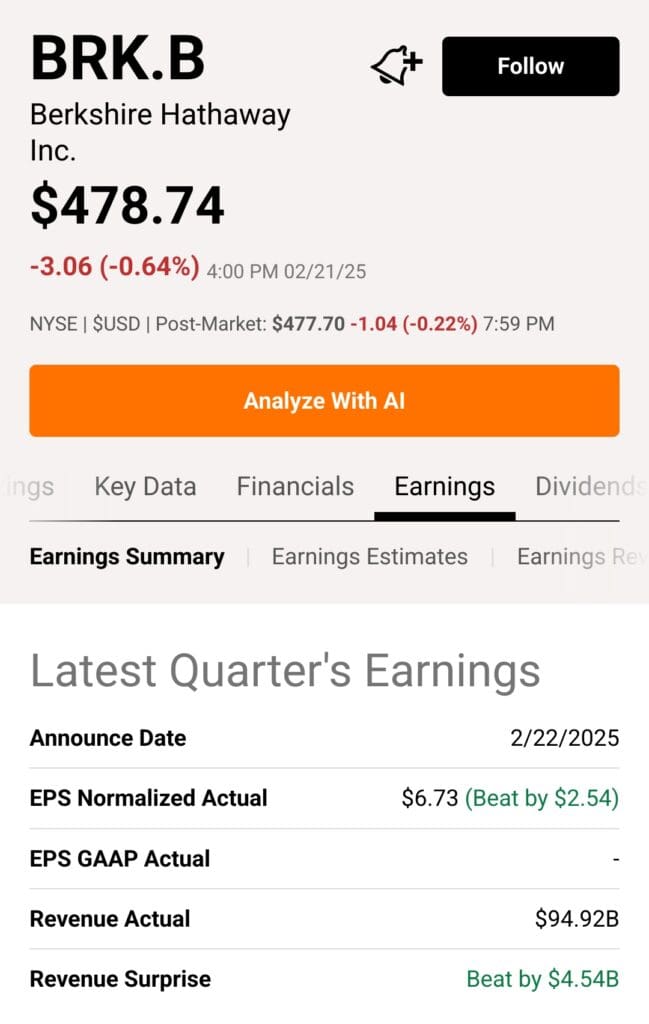

Earnings Reports and Transcripts

Both plans provide access to quarterly earnings transcripts and reports, which are crucial for understanding a company’s financial direction and leadership commentary.

These updates help long-term investors evaluate earnings growth and management insights, even without real-time alerts.

-

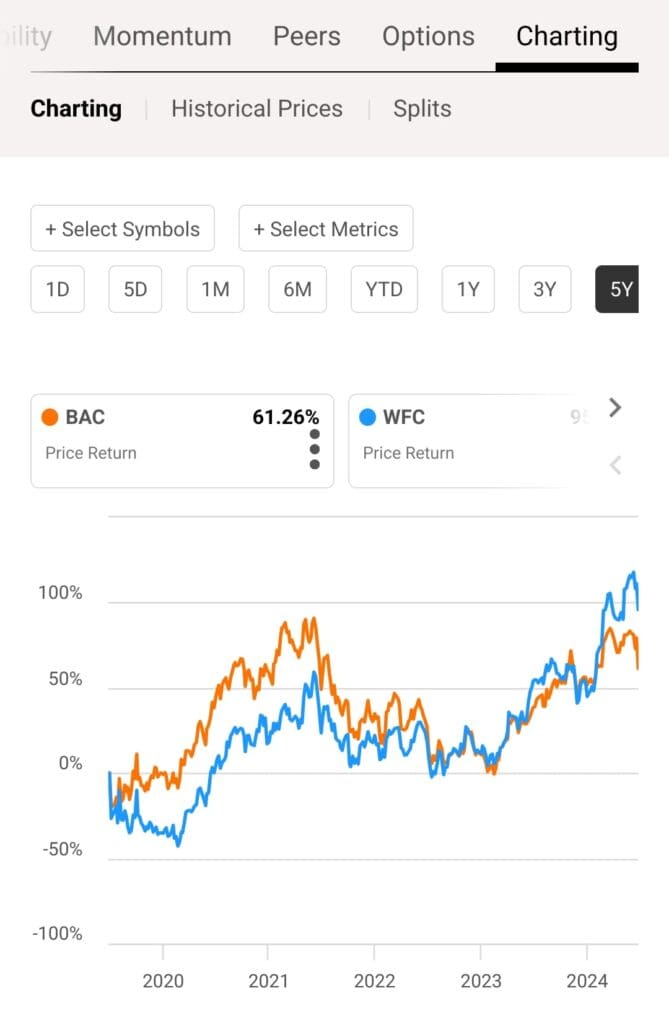

Stock Charts with Technical Indicators

Seeking Alpha integrates TradingView charting in both plans, offering visual historical price tracking with overlays like moving averages and Bollinger Bands.

While not as comprehensive as TradingView’s native platform, this gives both free and Premium users the ability to identify support/resistance levels and spot basic technical trends.

-

Access to Community Articles & Discussions

Both tiers allow users to read many community-contributed articles from investors, analysts, and financial bloggers. This includes analysis of market trends, sector opportunities, and company-specific developments.

While Premium unlocks more in-depth pieces, many articles remain free and insightful.

What You'll Get If You Upgrade To The Premium Plan?

Seeking Alpha Premium offers exclusive tools that go beyond the free plan, delivering deeper analysis, stock ratings, and actionable insights for investors.

-

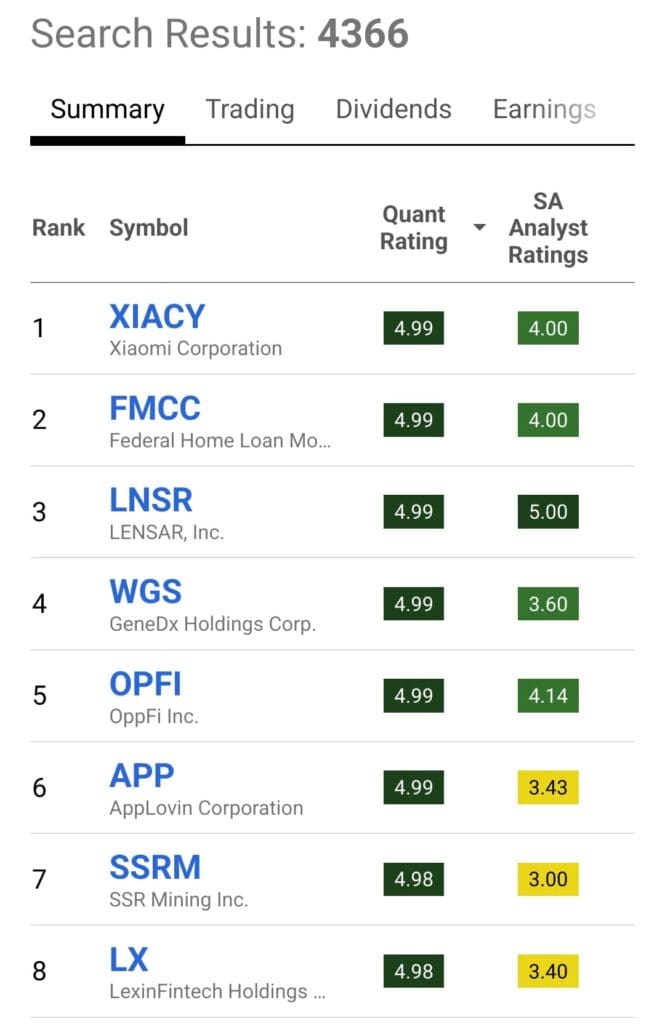

Quant Ratings System

This proprietary feature ranks stocks from Strong Buy to Strong Sell based on valuation, growth, momentum, and earnings revisions.

Unlike the free plan, Premium users get full access to these ratings, which help them filter high-potential stocks using a data-driven approach instead of relying solely on opinions.

-

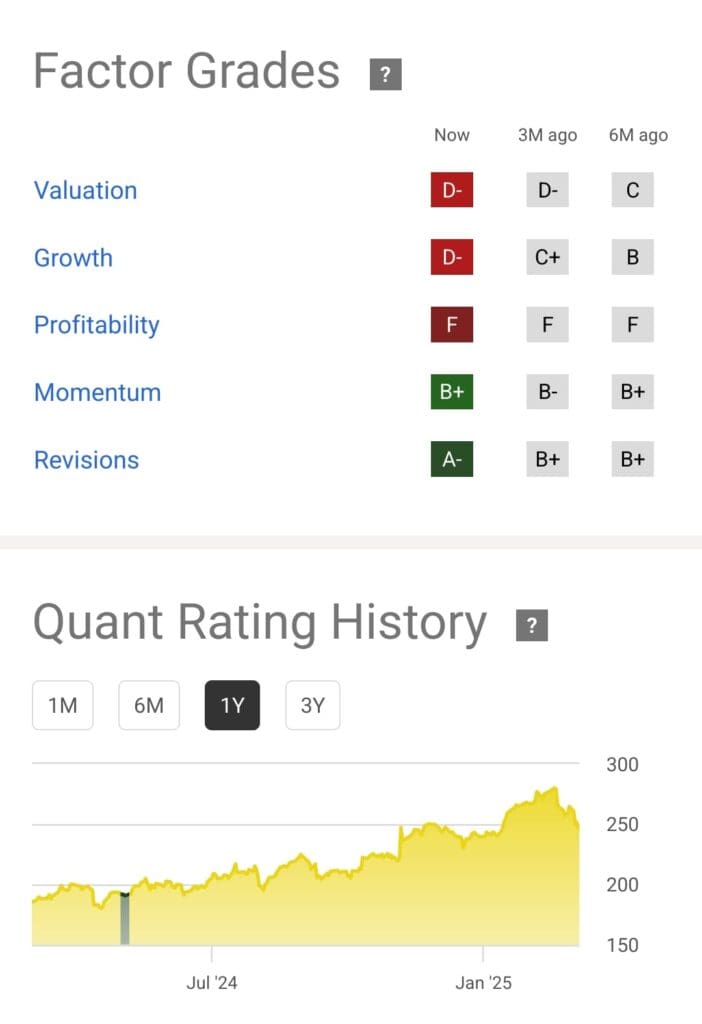

Factor Grades for Stock Analysis

Premium includes A+ to F grades for valuation, profitability, momentum, and growth—making it easier to assess strengths and weaknesses.

While free users can view some financial data, these color-coded grades streamline research for both beginners and seasoned investors.

-

Advanced Stock & ETF Screener

The Premium screener includes filters like Quant Rating, Factor Grades, and dividend safety, offering more precise stock discovery than the Basic version.

For example, users can find undervalued small-cap stocks with high dividend safety in just a few clicks.

-

Compare Stocks Side-by-Side

Premium users can compare up to six stocks across key metrics like valuation, earnings, and profitability.

This side-by-side comparison saves time and supports more confident decision-making—something not available at all on the free plan.

-

Unlimited Premium Articles

Unlock access to expert-level investment analysis, deep dives, and exclusive stock picks.

While Basic users can read limited content, Premium removes the paywall entirely, allowing full access to high-quality research from top analysts and investors.

-

More Features You Get with Premium

Beyond the major tools, Seeking Alpha Premium also includes several smaller yet powerful features designed to enhance research and portfolio monitoring.

Real-Time Portfolio Alerts: The free version does not provide instant alerts for earnings changes, stock downgrades, or major price movements.

Dividend Safety Ratings: Evaluate the reliability of a stock’s dividend using proprietary safety scores that indicate payout sustainability and risk.

Author Performance Tracking: Follow contributors with strong historical accuracy and performance, helping you prioritize quality insights and proven analysis.

Valuation Models & Fair Value Estimates: Premium users can view whether a stock is undervalued or overvalued based on internal fair value assessments.

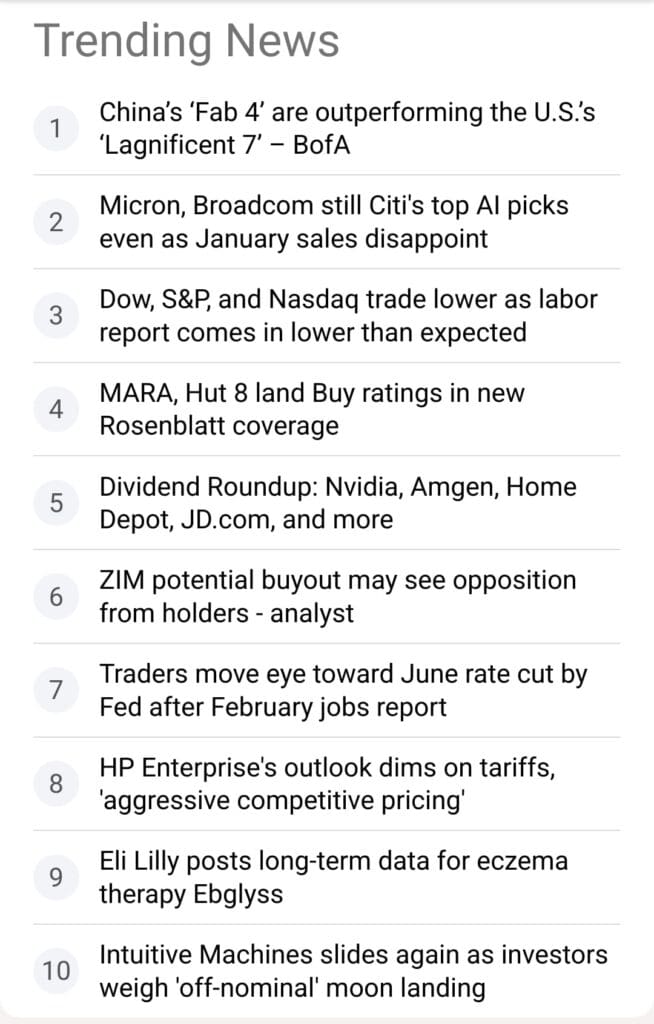

Unlimited News Dashboard: Get full access to curated news on your watchlist stocks, sectors, and economic events without hitting article limits.

These extra features make stock evaluation and portfolio tracking more actionable and precise—especially useful for serious, data-driven investors.

Which Investor Types May Want to Upgrade?

Investors who want deeper insights, data-backed ratings, and curated stock ideas may find real value in upgrading to Seeking Alpha Premium.

Fundamental Analysts: Those who analyze earnings, valuation metrics, and financial statements benefit from Quant Ratings, Factor Grades, and comparison tools.

Dividend-Focused Investors: Premium offers dividend safety scores and payout reliability insights, ideal for building a stable income-generating portfolio.

Self-Directed Investors: DIY investors who prefer making their own decisions will appreciate full access to premium articles, alerts, and stock rankings.

ETF Screeners: If you're evaluating ETFs by sector exposure, risk metrics, or momentum, Premium tools help filter high-quality options fast.

Plan | Annual Subscription | Promotion |

|---|---|---|

Seeking Alpha Premium | $299 ($24.90 / month)

No monthly subscription | $4.95 for 1 month |

Seeking Alpha Pro | $2,400 ($200 / month)

No monthly subscription | $99 for 1 month |

Seeking Alpha – Alpha Picks | $499 ($41.58 / month)

No monthly subscription | N/A |

Which Investor Types Prefer Seeking Alpha Basic Plan?

For casual investors or those just starting out, Seeking Alpha’s free plan offers enough tools to monitor markets and research stocks.

Beginner Investors: Free access to earnings reports, financials, and articles makes it a great entry point for learning the basics.

Long-Term Holders: Investors focused on company fundamentals and not short-term trading don’t need real-time alerts or advanced tools.

Dividend Trackers: Basic plan users can still view dividend yields, payout history, and dividend stock lists for income research.

Market Observers: If you mainly want to follow news, trends, and updates without deep analysis, the free plan works well.

Bottom Line: Is It Worth To Upgrade?

If you're serious about investing, Seeking Alpha Premium adds real value—especially for dividend seekers, stock pickers, and self-directed investors.

With Quant Ratings, advanced screeners, and unlimited premium content, it’s a major upgrade from the free plan.

But, casual users and beginners will still find the free version a solid start.