Seeking Alpha Premium | MarketBeat All Access | |

Price | $299 ($24.90 / month)

No monthly subscription | $399 ($33.25 / month) |

Best Features | ||

Our Rating |

(4.6/5) |

(4.6/5) |

Read Review | Read Review |

Compare Stock Analysis & Screening Features

In contrast, Interactive Brokers is more suited for active traders, offering advanced trading tools and extensive market access.

-

Stock Screening Tools

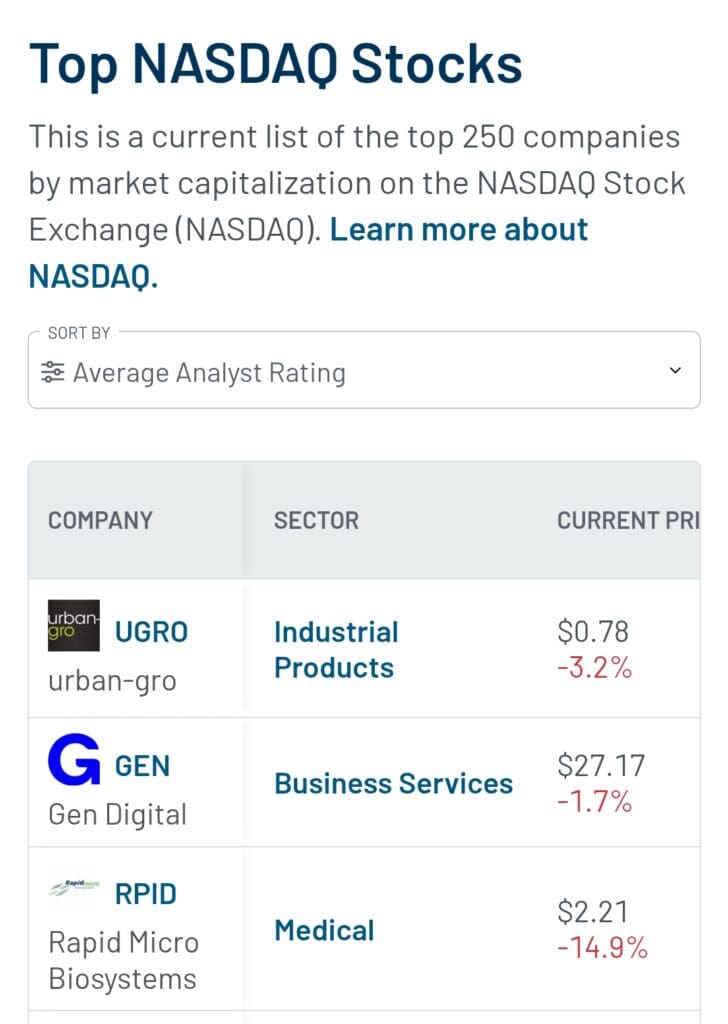

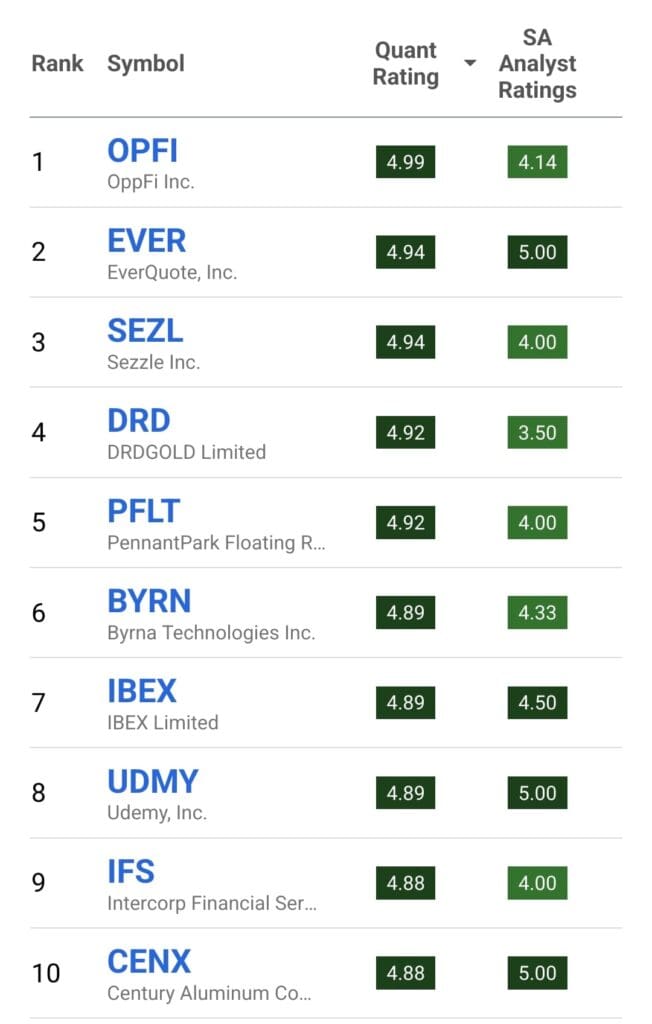

Seeking Alpha Premium provides a robust stock and ETF screener built on its Quant Ratings system. Investors can filter stocks based on valuation, growth, profitability, dividends, and momentum.

For example, you can search for “Strong Buy” stocks with A+ financial grades, ideal for identifying undervalued companies or strong dividend payers quickly.

MarketBeat All Access also offers a detailed screener with filters like MarketRank scores, earnings growth, insider trades, and technical indicators like RSI.

The screener is built for efficiency, helping investors surface trending or undervalued stocks based on real-time metrics and sentiment.

While both tools help narrow stock choices fast, Seeking Alpha’s data-driven Quant Ratings give it a slight edge for long-term, fundamentals-based screening.

-

Fundamental Analysis Tools

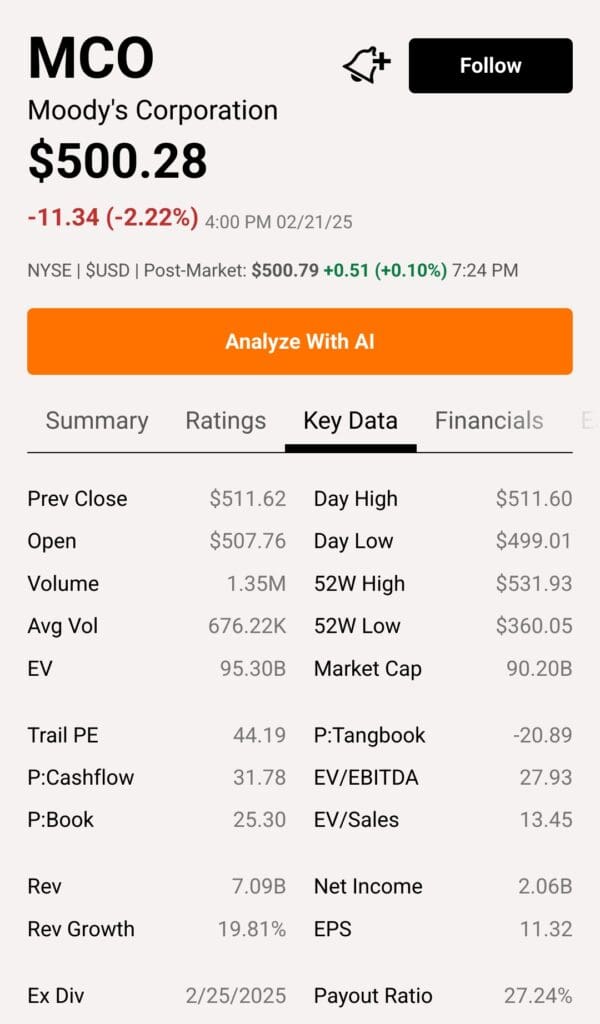

Seeking Alpha Premium offers full access to financial statements, valuation models, dividend safety ratings, and interactive earnings charts.

Investors can also access unlimited premium articles, including in-depth stock analysis, earnings breakdowns, and forecasts—ideal for DIY investors who rely on fundamentals.

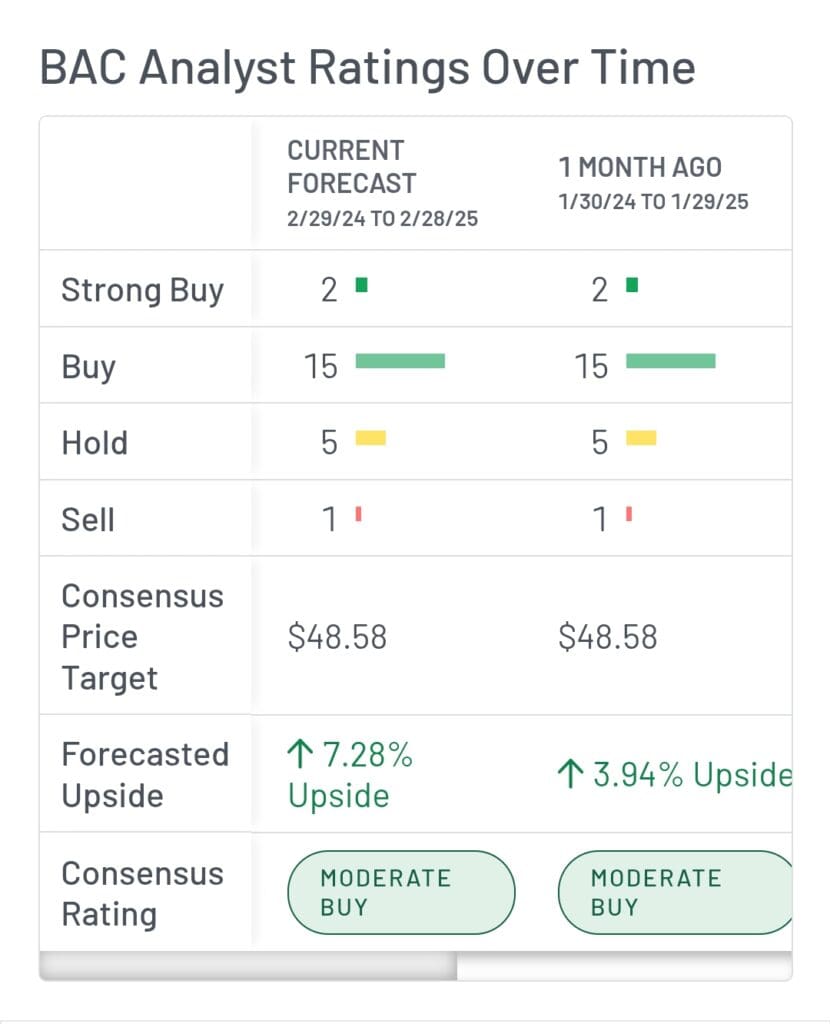

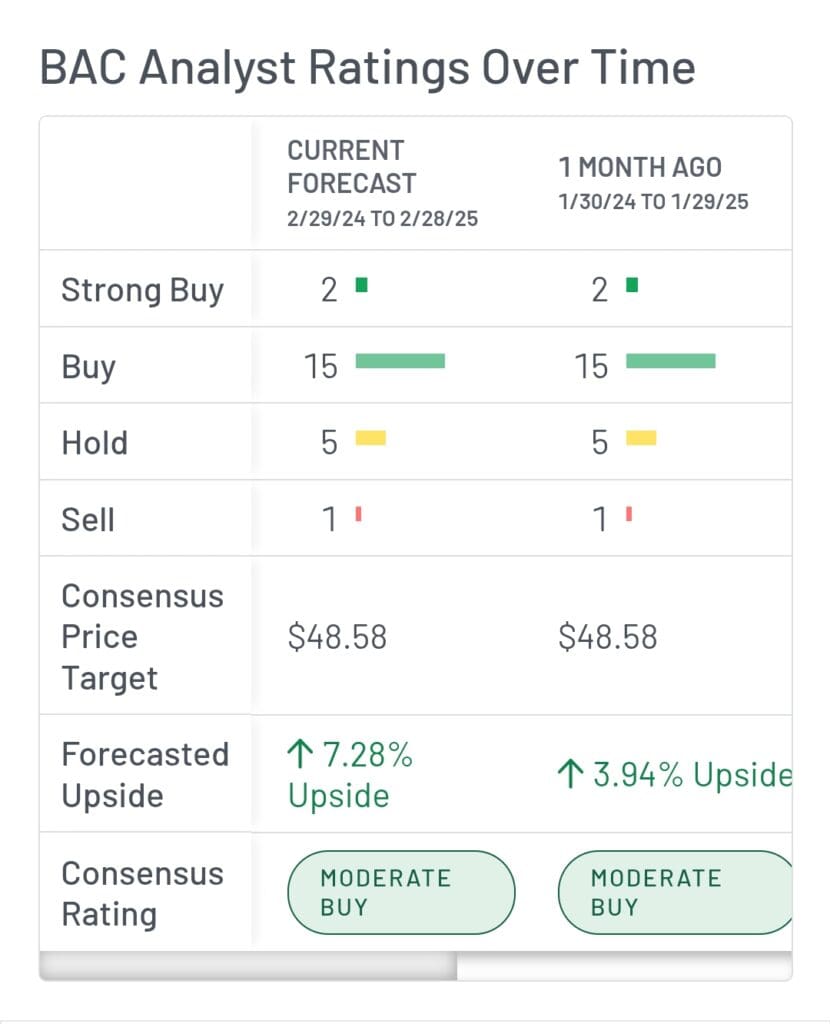

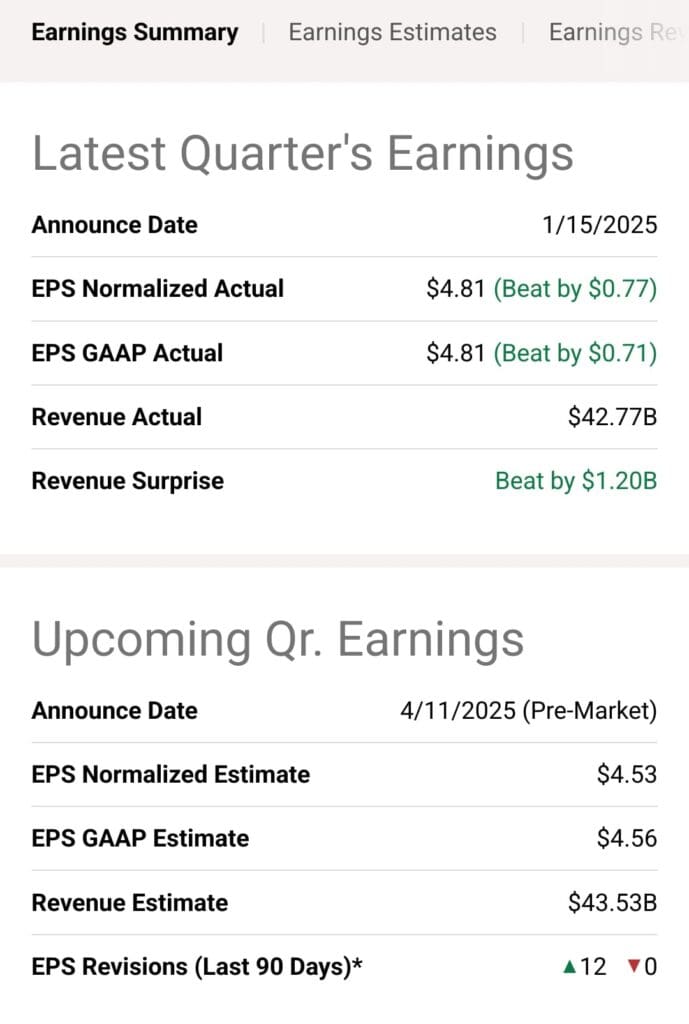

MarketBeat All Access focuses on analyst-driven data. It offers performance ratings for analysts, earnings previews, and proprietary research reports highlighting top-rated stocks.

Investors can track historical accuracy and see which analysts consistently outperform.

While Seeking Alpha emphasizes deep company research and editorial content, MarketBeat helps investors follow analyst sentiment and performance data.

-

Stock Picks & Recommendations

Both platforms help surface strong investment ideas. MarketBeat focuses on fast-moving picks and analyst sentiment, while Seeking Alpha offers algorithm-backed long-term stock rankings.

MarketBeat All Access is built for investors looking for fresh, actionable ideas. The platform offers Top-Rated Analyst Stocks, a weekly Idea Engine based on technical and fundamental factors, and a dedicated section for stocks to short.

These recommendations are based on real-time sentiment, earnings trends, and analyst upgrades.

Seeking Alpha Premium highlights top stocks using its Quant Ratings, ranking them into categories like Top Value Stocks, Top Dividend Stocks, and Small-Cap Leaders.

These lists are based on performance metrics, making them useful for identifying long-term growth or income opportunities.

-

Market Sentiment Analysis

MarketBeat All Access offers real-time news, media sentiment analysis, and trending stock tools. Its momentum alerts highlight stocks gaining attention based on price action, social mentions, or analyst buzz.

For example, traders can spot breakout stocks early by tracking shifts in news tone or analyst commentary.

Seeking Alpha Premium provides a market news dashboard, portfolio alerts, and unlimited access to earnings call transcripts and filings.

These features keep investors informed on performance updates and company fundamentals.

While both platforms deliver timely market data, MarketBeat goes further with sentiment-driven tools that help investors act quickly on trending opportunities.

-

Portfolio Analysis & Alerts

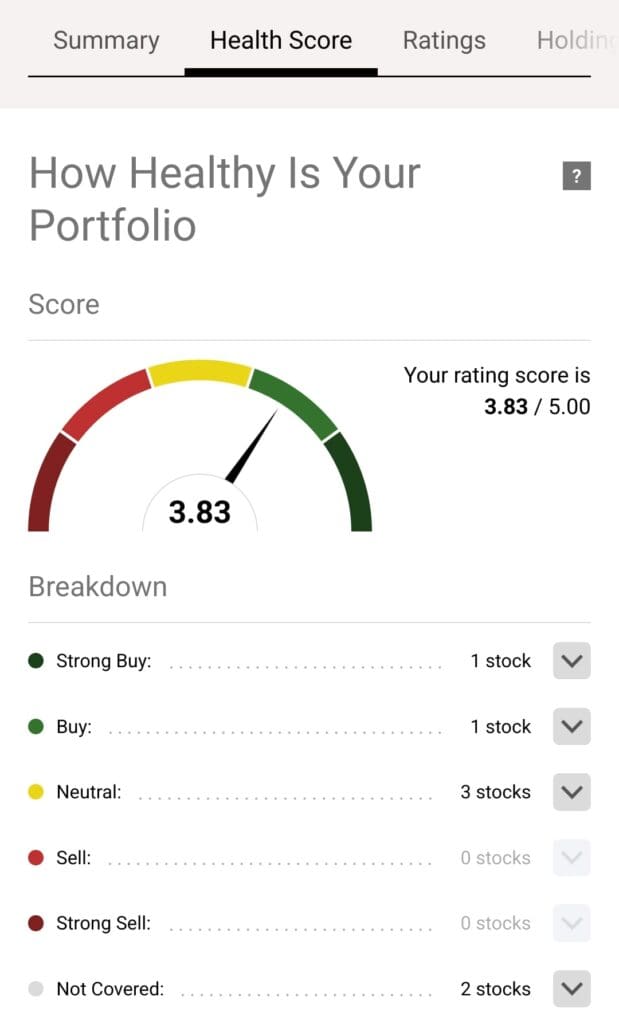

Seeking Alpha Premium offers a Portfolio Health Check that flags overvalued stocks, earnings risk, and dividend safety concerns.

It provides users with alerts based on financial fundamentals, not just price movements, helping long-term investors monitor diversification and income stability.

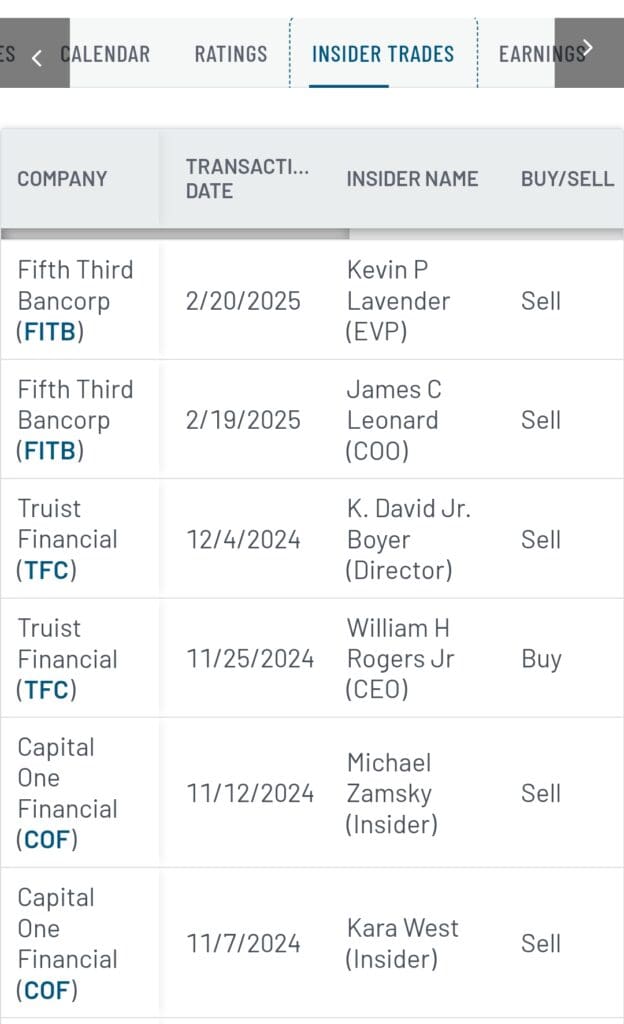

MarketBeat All Access delivers real-time alerts for earnings reports, analyst changes, and insider trades. It also allows investors to compare their portfolio’s returns, volatility, and sector breakdown.

In summary, Seeking Alpha is ideal for fundamentals-based monitoring, while MarketBeat focuses on real-time activity and event-driven alerts.

-

ETF, Bonds & Fund Analysis Tools

Seeking Alpha Premium includes top ETF rankings, performance data, and the ability to screen ETFs using the same Quant Ratings used for stocks. Investors can quickly filter for high-dividend or sector-specific ETFs.

MarketBeat also offers an ETF screener with filters like asset class, AUM, and regional exposure, but it lacks deep ratings or dividend analysis.

-

Technical Analysis Options

MarketBeat All Access offers momentum alerts, RSI filters, and sentiment tools to support basic technical analysis. While it doesn’t include chart overlays, it does help identify trending stocks based on price and volume changes.

Seeking Alpha Premium is focused on fundamentals and does not include chart-based tools or technical indicators. Neither platform offers deep options analysis or Greeks.

Who Should Consider Seeking Alpha Premium?

Investors who rely on deep research, dividend metrics, and long-term stock evaluations will find Seeking Alpha Premium especially valuable.

Long-term investors who want access to full financials, earnings trends, and valuation models for in-depth company analysis.

Dividend-focused investors looking for safety scores, payout ratios, and curated high-yield stock lists.

DIY investors who prefer reading expert articles, sector outlooks, and stock breakdowns from independent analysts.

ETF-focused investors who want performance rankings, Quant Ratings, and dividend-focused fund filters.

Plan | Annual Subscription | Promotion |

|---|---|---|

Seeking Alpha Premium | $299 ($24.90 / month)

No monthly subscription | $4.95 for 1 month |

Seeking Alpha Pro | $2,400 ($200 / month)

No monthly subscription | $99 for 1 month |

Seeking Alpha – Alpha Picks | $499 ($41.58 / month)

No monthly subscription | N/A |

Who Should Consider MarketBeat All Access?

Investors who act on analyst sentiment, trending data, and real-time alerts will benefit most from MarketBeat All Access.

Swing and momentum traders who rely on alerts, trending tickers, and sentiment-driven signals to time trades.

Investors who follow analyst upgrades and want to track the success rate of Wall Street recommendations.

Those who want fresh stock ideas from tools like the Idea Engine™ based on earnings and technical indicators.

Portfolio trackers who value real-time updates on earnings, insider moves, and analyst rating changes.

Bottom Line

Seeking Alpha Premium is built for the research-driven investor—think deep dives, smart Quant Ratings, dividend insights, and sharp financial breakdowns. It’s the go-to for long-term thinkers and fundamentals-first investors.

MarketBeat All Access, on the other hand, is your real-time radar—delivering fast-moving stock alerts, trending picks, analyst scorecards, and momentum signals. Perfect for traders who want to act, not analyze all day.