Table Of Content

What Is a Software Wallet?

A software wallet is a digital application that stores your private keys and allows you to manage, send, and receive cryptocurrencies. These wallets are typically installed on your desktop, mobile device, or accessed through a web browser.

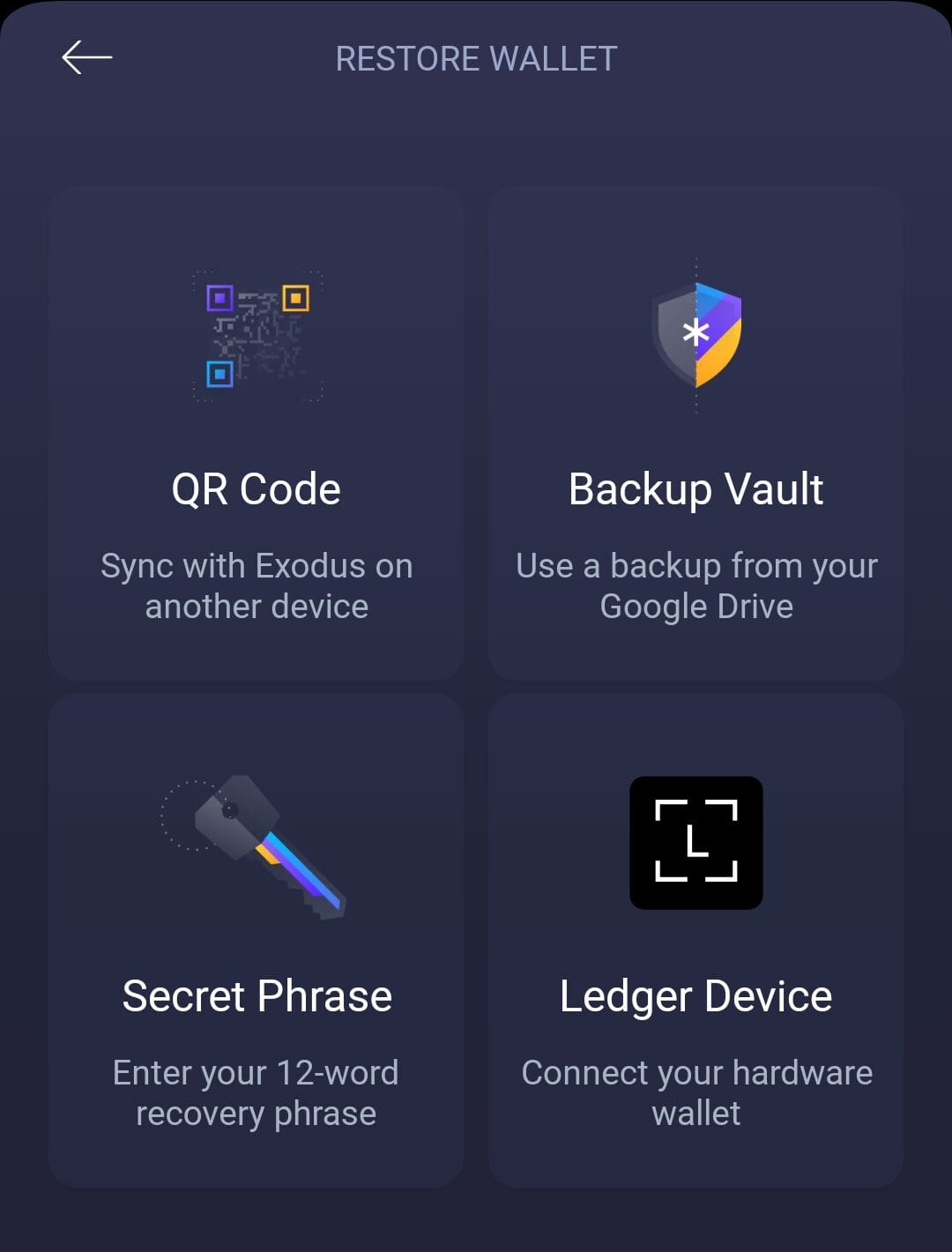

Because they're connected to the internet, they're considered hot wallets. For example, apps like Exodus, Trust Wallet, or MetaMask make it easy for users to interact with DeFi platforms or swap tokens directly.

However, they require strong security practices, as a compromised device can lead to stolen assets. Therefore, software wallets offer flexibility but must be used cautiously.

Pros | Cons |

|---|---|

Easy To Use | Internet-Connected Risk |

Free Or Low Cost | Vulnerable To Malware |

Fast Access To Funds | Device Loss = Asset Risk |

Supports Many Tokens | May Require Regular Updates |

What Is a Hardware Wallet?

A hardware wallet is a physical device designed to store your crypto’s private keys offline, which helps protect them from hacking and malware. These are cold wallets, meaning they’re not exposed to the internet unless connected for a transaction.

Popular examples are devices like Ledger Nano X or Trezor Model T. They’re ideal for long-term investors who don’t need frequent access but prioritize maximum security.

As a result, hardware wallets are commonly used for storing large crypto holdings. They also require a PIN and recovery phrase for backup in case of loss.

Pros | Cons |

|---|---|

Highly Secure Storage | Costs Money To Purchase |

Offline By Default | Slower To Access Funds |

Resistant To Malware | Can Be Lost Or Damaged |

Backup Recovery Phrase | Less Beginner-Friendly |

Hardware vs. Software Wallets: Key Differences

When deciding between a hardware and software wallet, understanding how each handles security, accessibility, costs, and risk is essential for crypto users.

-

Connection to the Internet

Hardware wallets are considered cold storage because they stay offline unless plugged in, while software wallets are hot wallets that remain internet-connected. This difference impacts both convenience and risk.

Hardware is offline by default – It significantly reduces exposure to hacking or phishing attacks.

Software runs on your phone or PC – That means easier access, but also more vulnerability.

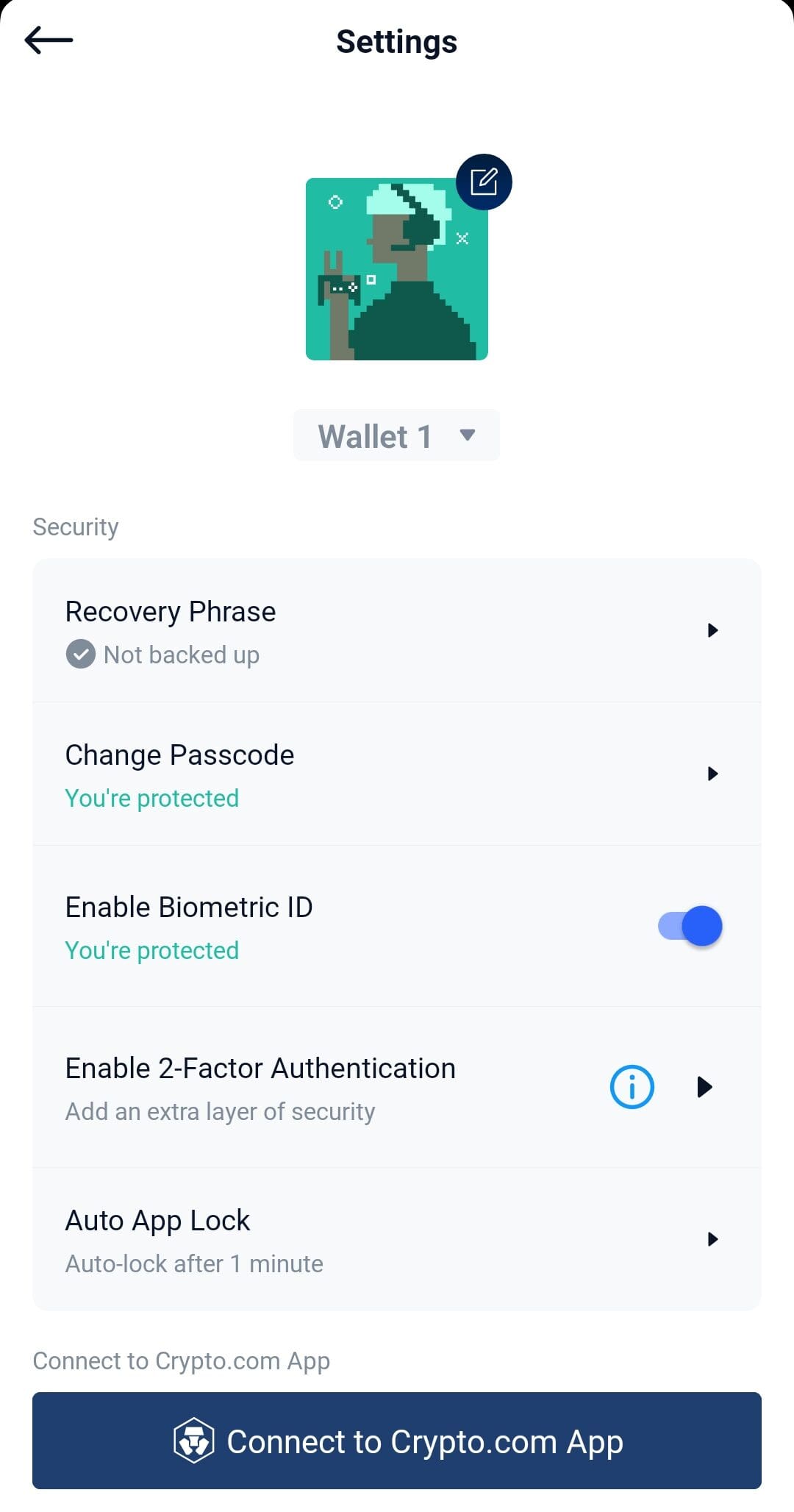

Hot wallets require extra security practices – Enabling 2FA or avoiding suspicious links becomes crucial.

Because of this, users trading frequently with platforms like Uniswap or Binance may prefer software wallets, while long-term holders often store coins offline for safety.

-

Security and Risk Exposure

Security is a major difference—hardware wallets are known for storing private keys in a secure chip, while software wallets rely on your device’s OS security.

Hardware uses secure elements – Devices like Ledger Nano X never expose your keys to the internet.

Software wallets store keys locally – If your phone or computer is infected, your crypto could be at risk.

Malware can extract sensitive info – Especially when users skip updates or use shady apps.

As a result, hardware wallets are often preferred by users holding larger amounts of crypto like Bitcoin, Ethereum, or USDC, while software wallets are more suited to smaller, active wallets.

-

Ease of Use and Speed

Software wallets are faster and easier to operate for most users, especially beginners, but hardware wallets require an extra step every time you transact.

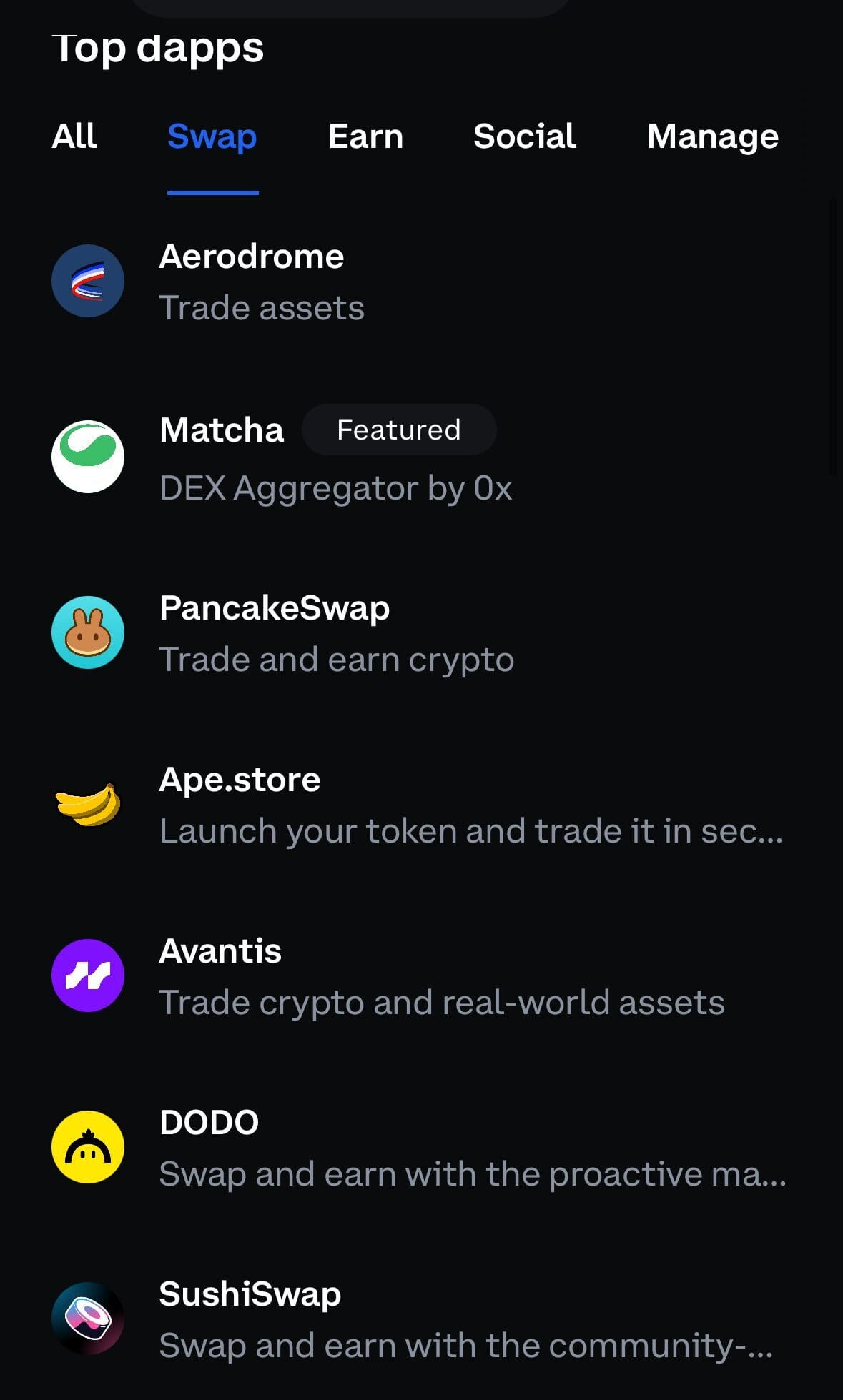

Software allows instant transfers – Apps like Trust Wallet or MetaMask can execute trades in seconds.

Hardware adds physical confirmation – You need to approve each transaction on the device itself.

Software integrates easily with dApps – Useful for interacting with DeFi protocols or staking platforms.

Therefore, users who actively swap or stake coins like AVAX, Polygon, or Solana might lean toward software wallets. Still, hardware wallets aren't hard—they just require a bit more setup.

-

Cost and Backup Options

Software wallets are free to use, but hardware wallets come with a price tag, often between $50 and $200. Still, both require good backup practices.

Hardware requires an upfront purchase – Models like Trezor T or Ledger Nano X aren't free.

Software is mostly free to download – Apps are often available on iOS, Android, and browser extensions.

Both rely on seed phrases – If you lose that, access to your funds could be gone forever.

While cost may deter some users, hardware wallets are worth the investment if you're holding significant crypto assets. Always back up your recovery phrase and store it offline.

When a Software Wallet May Be a Good Idea

A software wallet is often the better choice when speed, convenience, and app-based crypto use are key to your strategy.

Frequent Trading or Swapping – If you often trade on exchanges like Uniswap, software wallets allow you to execute transactions quickly without needing to plug in hardware.

Mobile Crypto Use – Apps like Trust Wallet and Exodus make it easy to send, receive, and manage crypto on the go.

Interacting with DeFi & NFTs – Software wallets like MetaMask are widely used for staking, lending, or minting NFTs directly from your browser.

Lower Stakes, Higher Speed – If you're only storing small amounts of Bitcoin or Ethereum, software wallets may offer enough security for your needs.

As a result, users who prioritize access over deep security often prefer software wallets.

When a Hardware Wallet May Be a Good Idea

A hardware wallet becomes a smart investment when you're focused on long-term security, offline storage, and large crypto holdings.

HODLing High-Value Coins – If you're holding substantial amounts of Bitcoin, USDC, or ETH, cold storage helps minimize hacking risks.

Avoiding Malware or Phishing – Because private keys never leave the device, you're protected even if your computer or browser is compromised.

Long-Term Investing – A hardware wallet is ideal for storing crypto you don’t plan to touch frequently, such as for retirement or passive holding.

Secure Backups and Recovery – Devices like Ledger or Trezor offer strong PIN protection and recovery seed systems in case of theft or loss.

Therefore, serious investors seeking peace of mind often choose hardware wallets for storing their cryptocurrency assets securely offline.

FAQ

Yes, many investors use both. A hardware wallet secures long-term holdings, while a software wallet offers quick access for trading or staking.

Most support major coins like Bitcoin and Ethereum, but compatibility with smaller or newer tokens varies by device. Always check supported assets before buying.

It’s not recommended. Using a software wallet over public Wi-Fi increases exposure to hacking or phishing. Use a VPN or mobile data for added safety.

Only if you backed up your recovery seed phrase. Without it, there is no way to retrieve lost assets from a hardware wallet.

No wallet is 100% immune. However, because hardware wallets store keys offline, they are far less vulnerable to common attacks like malware or phishing.

You can view your balance offline, but transactions require an internet connection to be signed and broadcasted to the blockchain network.

Regularly. Developers release updates to patch vulnerabilities and improve features, so staying updated is important for both security and usability.

Yes, many hardware wallets like Ledger and Trezor support NFTs, but you’ll need to use a compatible interface like MetaMask or Ledger Live.

Your crypto is safe unless they know your PIN. After a few failed attempts, the device locks or wipes itself, but recovery requires your seed phrase.