Stash

Monthly Fee

Minimum Deposit

Our Rating

APY Cash Account

-

Overview

- FAQ

Stash is created as a complete service platform to make investing approachable for newbies and help people to build long term wealth. It offers users the ability to invest in stocks, ETFs, and other financial products with minimal funds. Stash offers banking, investments, Smart Portfolios, IRAs and even a rewards debit card.

The platform has been around since 2015 and customers only need a minimum deposit of $1 to get started. There is a monthly fee, depending on the account type and service tier.

If you’re just starting out on your investing journey, Stash could be a good fit, so in this review, I’ll walk you through all the features I loved about Stash and some areas for improvement to help you decide if it could be the platform for you.

What types of accounts does Stash offer?

Stash offers taxable investment accounts, tax-advantaged IRAs (both traditional and Roth), and custodial accounts for minors.

Can I manually manage my investments on Stash?

Yes, if you prefer a hands-on approach, you can choose your own stocks and ETFs to create a custom portfolio using Stash's brokerage account.

What rewards does the Stash debit card offer?

Purchases made with the Stash debit card earn fractional shares of stock as rewards. The reward rate varies based on your subscription plan.

Does Stash charge trading commissions?

No, Stash does not charge trading commissions. However, trades are only processed during four windows each day to discourage day trading.

Does the Stash banking account offer interest?

No, the Stash banking account does not earn any interest (APY).

Does Stash provide access to human financial advisors?

No, Stash does not offer access to human financial advisors. All investment advice is automated through the app.

Who should use Stash?

Stash is ideal for beginners who want an easy-to-use platform to learn about investing and manage their money in one place. However, those seeking lower fees or more comprehensive services might consider other options.

Are there any fees associated with Stash’s banking services?

Stash’s banking services do not have overdraft fees, minimum balance requirements, or monthly maintenance fees.

Pros | Cons |

|---|---|

Good Selection of Investment Assets | No Interest on Banking Account |

Managed Portfolios | No Human Advisors |

Online Banking Account with Budgeting Tools | No Tax Loss Harvesting |

Stock Rewards with Debit Card Purchases | No Minimal Free Option |

Stash Features I Mostly Liked

Here are the key features that I found most appealing in Stash:

-

Smart Portfolio

Smart Portfolio is Stash’s automated investing feature. With this, I can enjoy a professionally managed, easy to use portfolio that has been designed and built to optimize the returns according to my preferred risk level.

The Stash team automatically monitors and manages my investments and I can choose to auto invest to take the hassle of out of investing.

I can even see the projection of my portfolio over time and see how changing my monthly auto invest will impact the potential value of my portfolio.

The Smart Portfolio feature is automatically included in Stash subscriptions, so I don’t need to worry about management fees or add on commission charges.

-

Self Directed Investing

While I enjoy the auto investing, I do love that Stash also allows self directed investing. I can choose from a selection of over 4,000 individual stocks with fractional shares available.

There are also curated collections of stocks if I’m struggling for inspiration of what to buy.

I can also explore ETFs (exchange traded funds) to easily diversify my portfolio. This allows me great control over my portfolio.

-

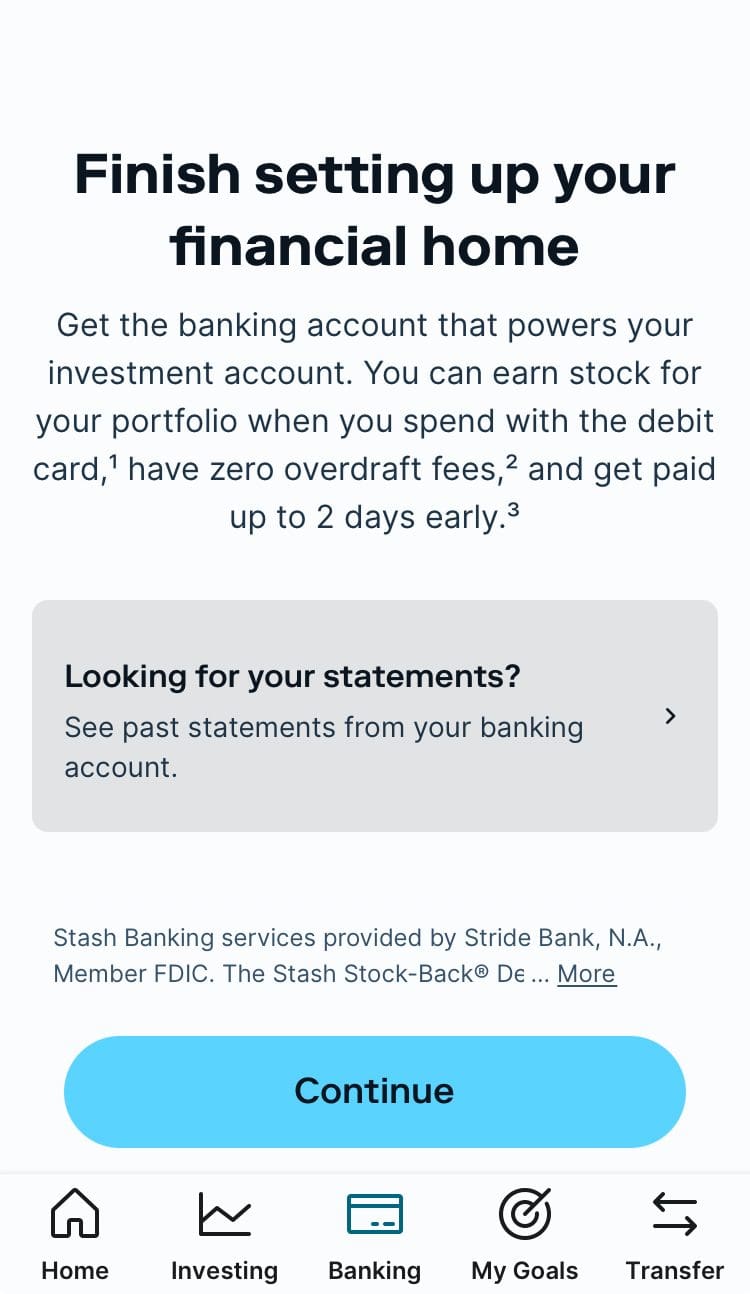

Stash Banking

With either banking tier there are no hidden fees. I don’t need to worry about overdraft fees, monthly maintenance charges, minimum balance requirements or set up costs. I can use my Stash debit card at an ATM network with more than 55,000 machines with no fees.

There are instant transfers between my banking account and my Stash investment portfolio, so I don’t experience the frustration of waiting for my funds to clear from an external bank account.

-

Savings Goals

The Stash bank account also has a savings goals feature that allows me to customize my account and use it for everyday expenses and saving for my vacation. This is a simple process as you can see in this screenshot.

-

The Stock Back Card

The stock back card is a debit card linked to my Stash bank account. As the name suggests, it offers stock back as a reward for purchases. It works a little like a rewards credit card, but rather than getting airline miles or cash back, I get stocks.

If I had the Stash Growth plan, I would earn 0.125% back on every dollar, but since I prefer the Stash+, I can enjoy 1% back.

There is a cap to this level. If I spend over $1,000 in a month, the remaining amount attracts a 0.125% reward.

However, there are occasionally promotions and bonuses, particularly with certain merchants, when I can earn up to 3% back, while Stash Growth customers can earn up to 2% back.

-

Retirement Accounts

The Stash subscription also includes one IRA account, so I don’t need to think about add on commissions or charges.

I can choose from a Traditional or Roth IRA with just a $5 minimum investment. I can also use the auto invest function to automatically add funds to my IRA.

What is particularly nice about Stash is that I can also access retirement advice. Stash is a registered investment advisor and the team can provide answers to any of my retirement questions or queries.

-

Diversification Analysis

Another feature I really loved with Stash is that I can analyze my portfolio to check the diversification. As you can see in this screenshot:

This is important when self directed investing as diversification is vital for optimal returns and increasing the chances of meeting my investing goals.

The analysis uses my investing preferences to check if I’m on track for a diverse portfolio. It also provides recommendations to work towards balance in my portfolio.

-

StashWorks

StashWorks is a partnership program for businesses, so employers can offer this as a workplace benefit. Essentially, employees can access the Stash banking and investing benefits including IRAs without needing to pay a subscription fee.

While I’ve not used this feature personally, I love that Stash is helping businesses and their teams reduce the stress of low savings and boost workforce morale and productivity.

Additional Features That Helped Me

Besides the main features I use regularly, there are additional features for investors:

-

Intuitive Research Tools

While indepth research can be great, it can also be a little overwhelming. I found it helpful that Stash had intuitive research tools.

I can browse the various asset classes and by clicking on one, I can get company information and a performance breakdown.

As you can see from the screenshot above, there is also the option to buy the stock directly from this company information screen. So, I don’t need to have to click through to different screens if I find a company that interests me.

Although this is far more basic than some of the other platforms, it is quite newbie friendly.

-

DRIP

DRIP or Dividend Reinvestment Programs are an effective way to put every dollar to work. Essentially, Stash will instantly reinvest the dividends for me.

So, if I invest in a company or fund that pays dividends, the funds won’t be sitting in my account until I decide what to do with them.

This is not a unique feature, but it is nice that Stash offers it with no limitations or restrictions. Some platforms only allow DRIP with a higher value portfolio.

-

Stash101

Stash has an interesting collection of learning resources, but the stand out is the Stash101 collection.

This is essentially a course that is designed to take you from investing newbie to personal finance expert. Stash clients can complete the full course or simply pick and choose from the mini courses and articles.

I thought this was a very helpful feature, since I could scan through the topics and skip the ones that I’m already familiar with.

What is nice is that the topics are not limited to investing and there are some useful resources on Crypto, budgeting, the concept of financial freedom and more.

-

Calculators

Stash offers access to a number of different calculators including a retirement calculator and a compound interest calculator.

These are handy tools that I found helpful. I could play around with the figures to work out my optimum pension fund amount, how much I need to contribute and other details. Stash also offers some helpful advice and guidance to assist in achieving financial goals.

Although it is possible to find these types of tools elsewhere, it is nice that they are included in the overall Stash platform. Additionally, you don’t need to be a member to use the calculators, so you can play around with them before you sign up.

-

The Stash Tax Center

Tax can get a little complicated, particularly when you start investing, so I found it nice that Stash has a dedicated tax center. The Tax Center includes a wealth of resources I thought were helpful for before and after filing. There are tax related articles, FAQs and more that can be helpful to get to grips with the potential issues.

Of course, this doesn’t replace specific professional advice, but it can highlight if there is something that I need to discuss with my tax advisor before the start of tax season.

How's Stash Customer Support?

Stash has a comprehensive help section on its website, which is helpfully divided into categories such as banking, retirement, account set up etc.

There is also a tips section with plenty of guidance to help. However, if I can’t find the answer on the website, I found it helpful that the Stash customer support team was responsive.

The primary way to speak to the support team is via the chat function, which opens automatically if you click on the “ask a question” prompt on the website, but you can also access it via the app as you can see in the screenshot below.

The chat feature prompts with some common questions, so I don’t necessarily need to type out my entire inquiry. However, when I did have specific issues, I found the chat very responsive.

What Can Be Improved

No platform is perfect and there are some areas where Stash could make some improvements. These include:

- No Tax Loss Harvesting on Smart Portfolios: While the Smart Portfolios are a great feature, it would be nice if tax loss harvesting was included. Even if my portfolio is quite modest, it is still nice to reduce my tax burden by offsetting my gains. Since tax loss harvesting is available as standard with many other robo platforms, it is a glaring omission.

- No Minimal Free Option: $3 a month seems like an insignificant amount, if you only have a small portfolio, it can quickly add up. For example, if my portfolio was $1,000, that $3 per month would add up to 3.6% as an annual fee. Although it is possible to offset this with the stock back debit card, you would need to be a heavy spender to eliminate it altogether.

- No Human Advisors: Although the platform has some great features that can help, particularly newbies, these are limited to guides and articles. There are no human advisors offering live professional advice.

- No Interest on the Bank Account: Earning stock as a reward for debit card use is nice, but if you have cash in your Stash bank account, it won’t earn a cent. There is no APY for cash balances, which means the account does not compare favorably to others.

Which Type of Investor is Best Suited to Stash?

Although Stash could be a good fit for many types of investors, some investors are likely to appreciate its feature set:

-

Complete Newbies

Stash has some fantastic resources to help complete newbies start their investing journey.

From the articles and easy to use platform to the Stash101 course, even if you have no ideas about investing, Stash can guide you through the process.

-

Those Who Want Automation and Self Directed

Stash’s Smart Portfolios are solid, but there are also plenty of options for self directed investing.

Since both are available with even the basic subscription, this offers a nice balance if you’re undecided if you want to take a hands off approach or prefer to be more active.

-

Heavy Debit Card Users

If you tend to use your debit card frequently, the Stash bank account and associated Stock Back card could be a fantastic way to boost your investment portfolio.

This is only particularly applicable if you’re prepared to upgrade to Stash+ or you’re likely to spend well in excess of $1,000 a month with your debit card.

Bottom Line

Stash is a solid trading platform, but if you’re an experienced trader looking for comprehensive research and live data access, you’re likely to find this platform a little limited.

While it does have some great perks, with a limit of one IRA and fairly basic research, Stash is more aimed at the newbie investor.

Review Brokerage Accounts

How We Rated Brokerage Accounts: Review Methodology

At The Smart Investor, we evaluated brokerage account platforms based on their overall value, features, and user experience compared to other leading alternatives. Our hands-on testing focused on key factors that matter most to investors, including fees, trading tools, investment options, and security. Each platform was rated based on the following criteria:

- Fees & Commissions (20%): We prioritized commission-free trading and low-margin rates. The best platforms had zero hidden fees, while others charged for inactivity or withdrawals.

- User Experience & Interface (20%): A clean, easy-to-navigate platform with smooth execution scored highest. Some apps felt outdated or laggy, impacting the experience.

- Trading Tools & Features (30%): We favored platforms with real-time data, smart order types, and special features that support smart investing. Some lacked depth, making it harder for active traders.

- Automated Investing (10%) : The best platforms offered AI-driven portfolios, robo-advisors, and automatic rebalancing. Some lacked automation or charged high fees for managed accounts.

- Investment Options (10%): Platforms with stocks, ETFs, options, crypto, and fractional shares scored highest. A few lacked key asset classes or international access.

- Account Types (5%): The best platforms supported taxable accounts, IRAs, and custodial options. Some lacked flexibility, limiting investment strategies.

- Cash Management & Banking Features (5%): We favored platforms with high-interest cash accounts, debit cards, and seamless banking. Many lacked competitive rates or useful features.