WallStreetZen (Free Plan)

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Pros & Cons

WallStreetZen’s free plan is a solid tool for investors who want easy-to-understand stock research without deep technical analysis.

It offers stock data, analyst forecasts, and curated stock lists, helping users discover investment opportunities quickly.

The Due Diligence Score is a standout feature, breaking down a stock’s fundamentals into simple categories like valuation, financial health, and growth potential.

Investors can track stocks using watchlists and stay updated with earnings reports, analyst upgrades/downgrades, and insider transactions.

The platform also provides a stock screener, and users get (limited) access to analyst ratings.

However, day traders, advanced analysts, and technical traders may find it lacking due to limited charting tools, real-time data, and portfolio tracking.

- Stock Idea Lists

- Due Diligence Score

- Stock Screener

- Top Performing Analysts

- Zen Ratings System

- Stock Forecasts

- Earnings & Dividends Calendar

- Insider Transactions Tracker

- 52-Week Highs & Lows

- Most Active Stocks List

- Buy The Dip Stocks

- Real-Time Watchlist Updates

- Easy-to-understand stock research

- Curated stock idea lists

- Due Diligence Score system

- Analyst forecasts & ratings

- Stock screener for filtering

- Limited technical analysis tools

- No real-time market data

- No portfolio tracking feature

- Premium features locked behind paywall

- Limited customization for research

Research Stocks With WallStreetZen’s Free Tools

We tested WallStreetZen’s stock research features, from stock screeners to stock ideas, to see how they help investors:

-

Stock Ideas

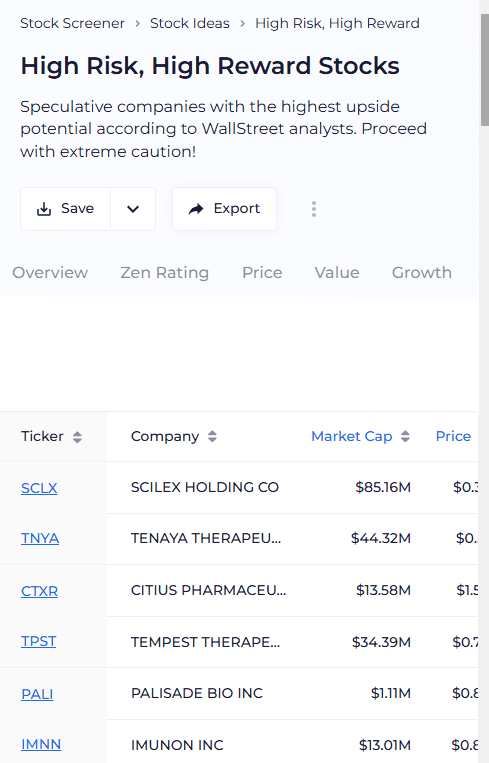

One of the best free features is access to various stock idea lists, including undervalued stocks, high-growth small caps, and speculative high-risk stocks.

These lists help investors quickly find recommended stocks that fit different investing strategies without manual searching.

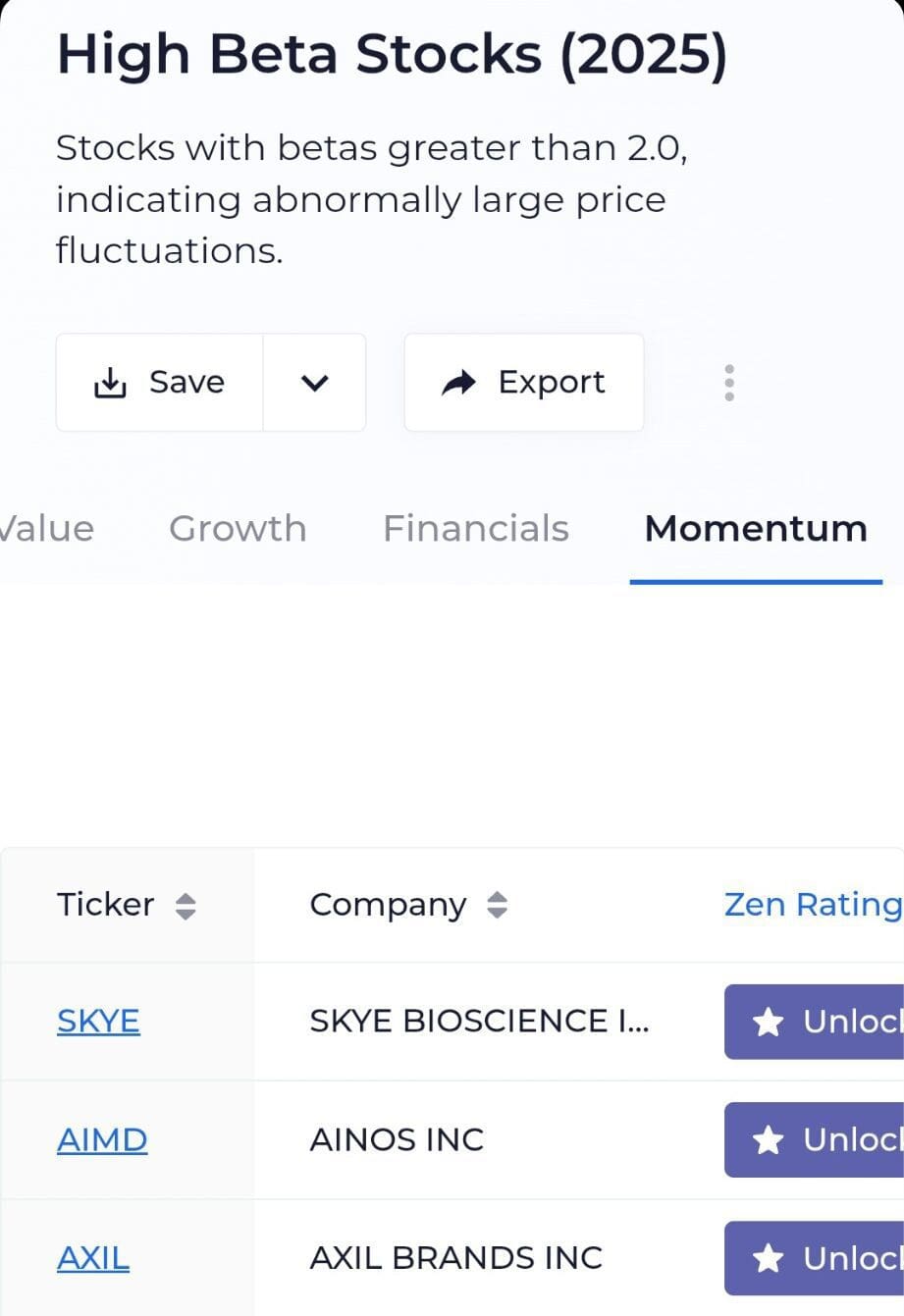

For example, here is a list of high beta stocks, by momentum:

We found the “Most Undervalued Stocks” and “Strong Balance Sheet” lists particularly useful, as they highlight companies with solid fundamentals at potentially attractive prices.

The “Potential Tenbaggers” and “High-Risk, High-Reward” lists cater to those looking for aggressive growth opportunities.

Each list provides key metrics, including valuation scores and recent price performance, making it easier to evaluate potential picks.

However, free users also miss out on the premium list,s such as “A-rated” stocks, artificial intelligence investing, or strong buy stocks from top Wall Street analysts.

-

Stock Analysis

WallStreetZen provides a strong foundation for stock analysis by offering key data points and forecasts on over 6,000 stocks.

The platform simplifies the research process by presenting financial metrics, valuation scores, growth trends, and company fundamentals in a clear and accessible format.

We found the analysis particularly useful for quickly gauging a stock’s financial health, as the platform highlights critical factors such as earnings performance, profitability, and debt levels.

Additionally, WallStreetZen incorporates Wall Street analyst ratings and forecasts, helping investors understand potential price movements based on expert opinions.

The interface is user-friendly, making it easy for both beginners and seasoned investors to navigate stock pages and extract key insights.

-

Stock Screener

The free stock screener on WallStreetZen is a handy tool for quickly finding stocks that match specific criteria.

It allows investors to filter stocks based on basic factors such as price range, market capitalization, and performance indicators.

We tested it by searching for undervalued stocks and those with strong balance sheets, and the results were well-structured and easy to analyze.

The screener works well for those who want a simple way to discover investment opportunities without digging through endless stock lists manually.

Must-Try Features On WallStreetZen’s Free Plan

We explored WallStreetZen’s leading free tools, from analyst rankings to due diligence score and watchlist:

-

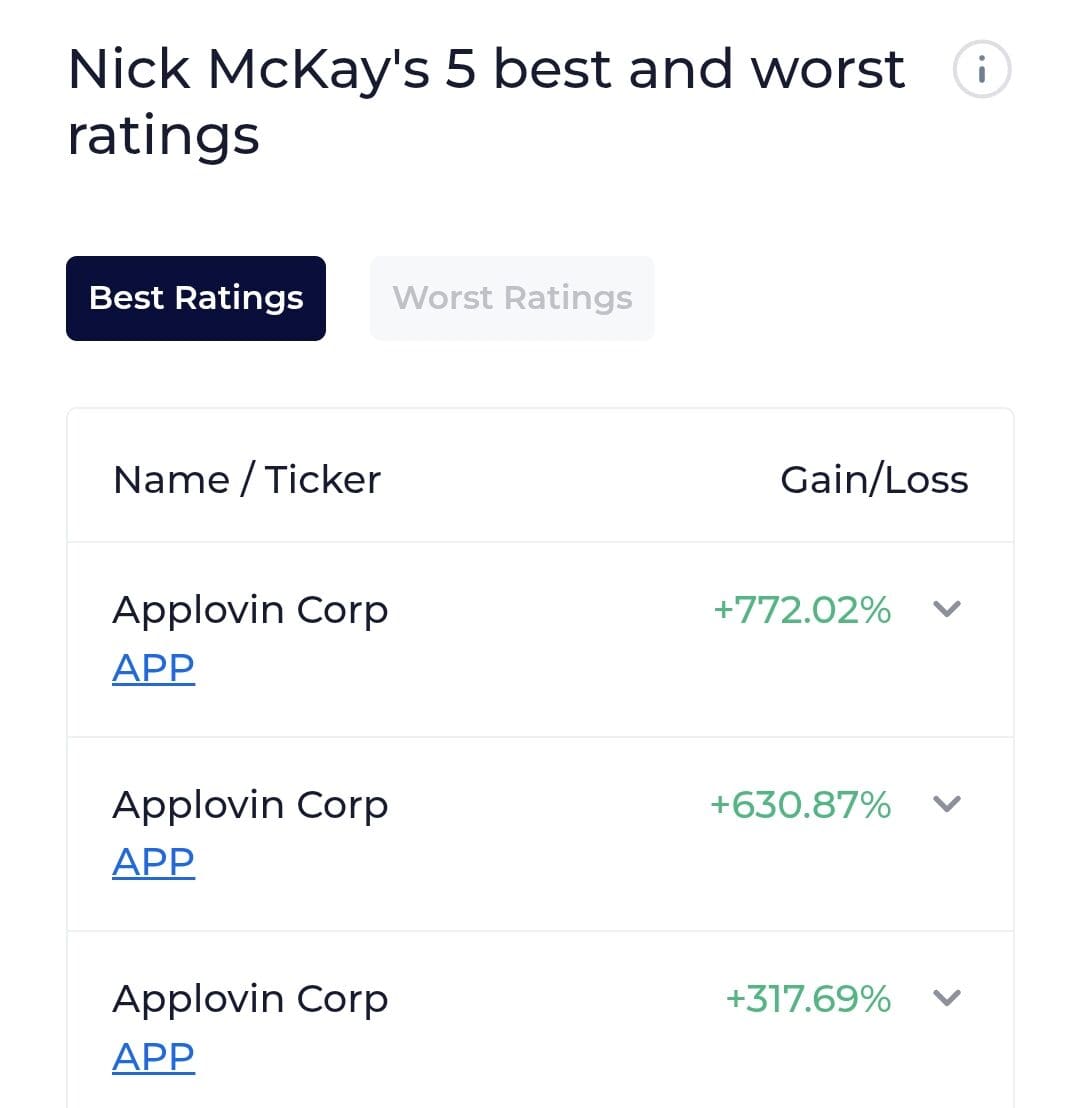

Top Performing Analysts

WallStreetZen's Top Analysts feature helps investors follow the best-performing analysts and see their latest stock recommendations.

The platform ranks over 3,000 analysts based on average return, win rate, and number of ratings, ensuring that users can rely on experts with a strong track record.

Clicking on an analyst’s stock pick takes you directly to the forecast page, where you can see consensus ratings, price targets, and supporting research.

Free users can only view 10 analyst profiles per month, while premium users get unlimited access and additional sorting options (like filtering by the latest recommendations).

-

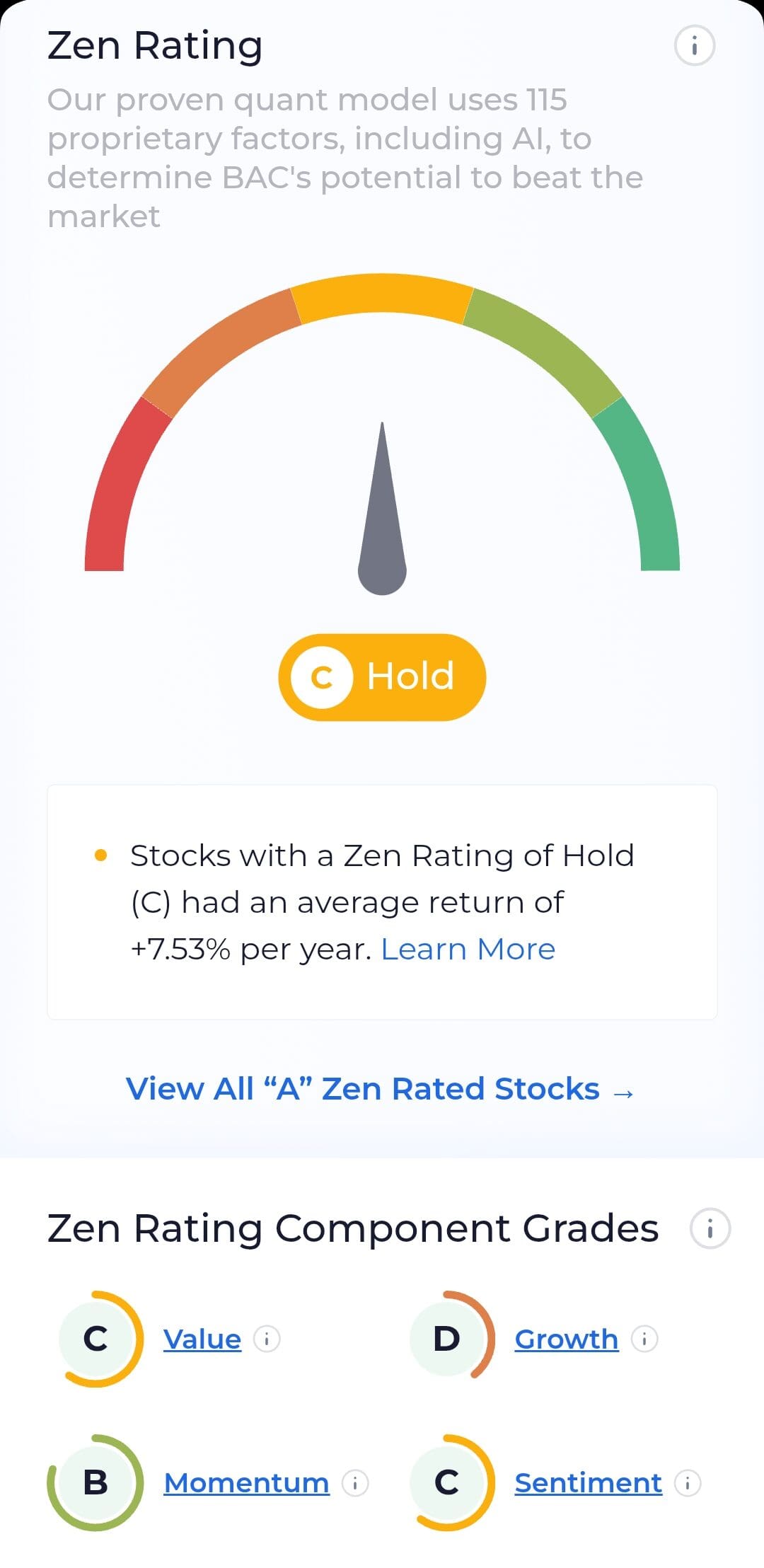

Zen Ratings – A Stock Rating System for Smarter Investing

WallStreetZen’s Zen Ratings is a proprietary stock rating system designed to help investors consistently outperform the market.

The system ranks stocks using 115 different factors, analyzing financials, growth, value, momentum, sentiment, safety, and AI-based predictions.

The system sorts stocks into five categories, ranging from A (Strong Buy) to F (Strong Sell), making it easy for investors to identify high-potential stocks while avoiding weak ones.

We tested the feature by looking at A-rated stocks and found that the platform provides clear insights into why a stock is rated highly, including historical performance, earnings trends, and risk factors.

While the Zen Ratings system is available for free, full access to A-rated stocks, industry rankings, and daily rating upgrades/downgrades is reserved for premium users.

-

Due Diligence Score & Fundamental Stock Checks

WallStreetZen’s Due Diligence Score is designed to help investors quickly evaluate a stock’s fundamental strengths and weaknesses.

It automates traditional fundamental analysis by scoring stocks across five key dimensions: Valuation, Financials, Forecast, Performance, and Dividends.

Each dimension runs 5-10 due diligence checks, and stocks earn a pass (1) or fail (0) score for each test.

The total Due Diligence Score is the average across all dimensions, giving investors a single, easy-to-understand number that represents the stock’s overall financial health.

We found this feature particularly useful for getting a quick snapshot of a company’s fundamentals without diving deep into financial statements.

The automated system makes it easy to compare stocks side by side, and the single-line explanations clarify why a stock passes or fails a check.

-

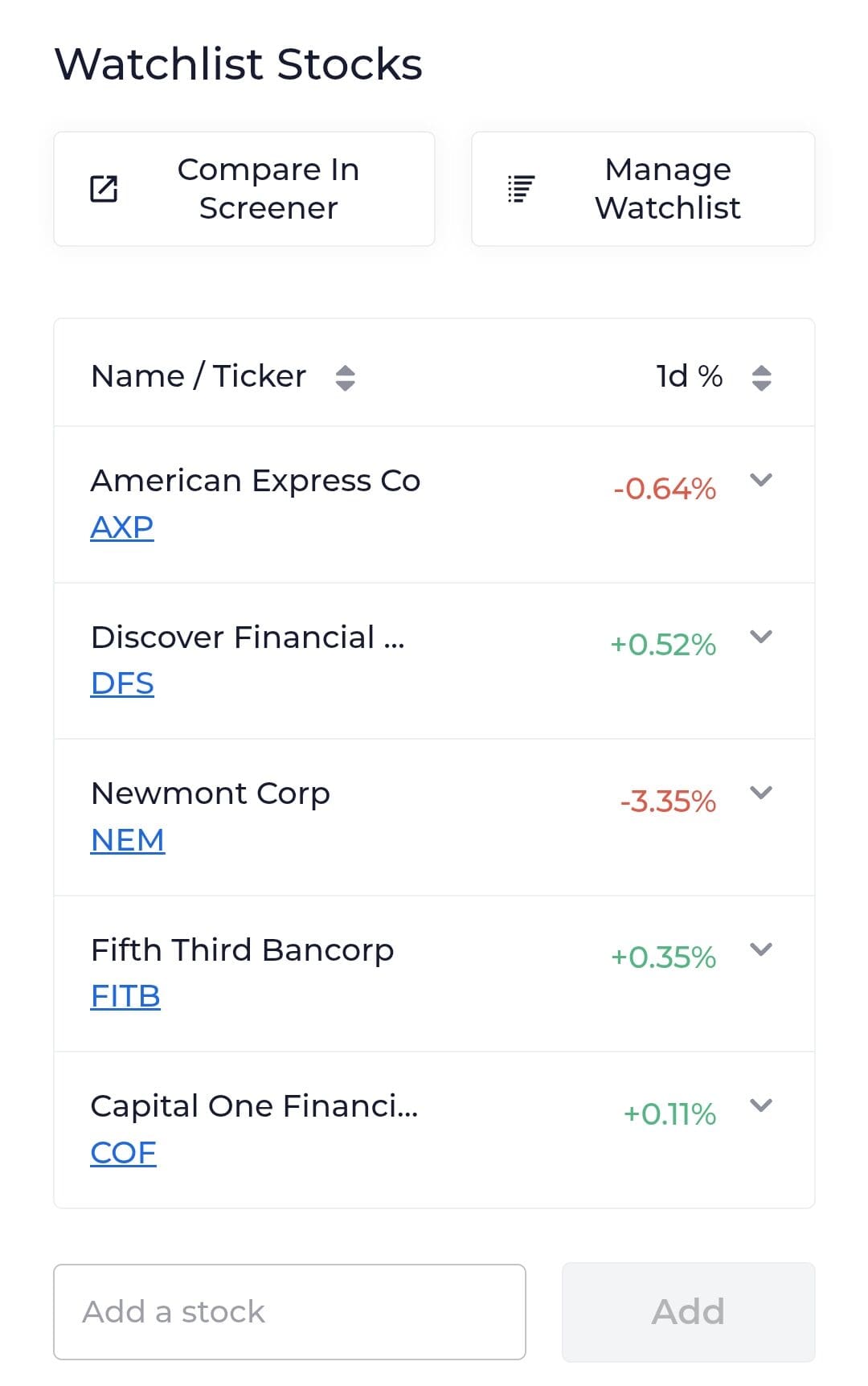

Watchlists & Real-Time Updates

Creating and tracking watchlists is a breeze with WallStreetZen.

The free plan allows users to follow specific stocks and receive real-time updates on earnings reports, dividend announcements, insider buying/selling, and analyst upgrades or downgrades.

We found this feature helpful in staying on top of market-moving news without having to sift through multiple sources. The integration of key updates within stock pages means you can quickly see what’s affecting a stock’s price.

The news feed includes headlines and summaries, making it easy to grasp key insights without reading full reports

Additional Features & Tools

WallStreetZen’s free plan includes several additional tools designed to help investors analyze stocks, track market trends, and discover investment opportunities.

Here are 10 valuable features available at no cost:

- Stock Forecasts: Offers analyst price targets and projections for individual stocks, helping investors gauge future growth potential based on expert opinions.

- Earnings & Dividends Calendar: Tracks upcoming earnings reports and dividend payment dates, helping investors stay informed about important events affecting their portfolio.

- Insider Transactions Tracker: Displays recent insider buying and selling activity, which can signal confidence or concerns from company executives.

- 52-Week Highs & Lows lists: Highlights stocks trading at their highest or lowest points in the past year, useful for identifying momentum trends or potential value plays.

- Most Active Stocks list: Displays stocks with the highest trading volume, often indicating strong investor interest or recent news catalysts.

- Low Beta & Extreme Volatility Stocks list: Helps investors find stable, lower-risk stocks or highly volatile stocks that could offer bigger price swings.

- Buy the Dip Stocks list: Shows companies with solid fundamentals that have recently dropped in price, potentially offering good buying opportunities.

Where WallStreetZen Falls Short: Key Downsides

WallStreetZen’s free plan offers solid tools for stock research, but there are some clear limitations compared to its premium plan and competitors. Here are areas where it falls short and could improve:

-

Limited Charting and Technical Analysis Tools

WallStreetZen focuses heavily on fundamental analysis, but its free plan lacks advanced charting and technical indicators.

While users can view basic stock price trends, they won’t find candlestick charts, moving averages, RSI, or MACD, which are standard many other platforms.

This makes it difficult for active traders who rely on technical analysis to make short-term decisions.

-

No Portfolio Tracking or Analysis

Unlike competitors such as Seeking Alpha, Morningstar, or MarketWatch, WallStreetZen doesn’t offer portfolio tracking or performance analysis in its free plan.

Users can create watchlists, but there’s no way to track real-time portfolio gains, losses, or allocation insights. Without this feature, investors must manually track their holdings elsewhere.

This is a big drawback for those who prefer an all-in-one stock research and portfolio management tool.

-

Limited Features Compared to the Premium Plan

WallStreetZen’s free plan provides great stock insights, but nearly all of its best features—like full analyst rankings, unlimited stock ratings, and detailed due diligence reports—are locked behind the premium paywall.

Free users don’t get custom stock alerts, which means they have to manually track updates. Additionally, the “Why Price Moved” feature, which explains stock price fluctuations, is only available for three stocks per month, unlike the premium plan.

While free users can access some stock data, the depth and customization of research are significantly reduced.

Competing platforms like Zacks and Finviz offer more free features, making WallStreetZen’s free plan feel more restricted.

WallStreetZen’s Free Plan: Who Can Make The Most Of It?

WallStreetZen’s free plan is best suited for investors who focus on fundamental analysis and want a simplified approach to stock research. Here are six types of investors and traders who might find it useful:

- Investors Who Want Stock Recommendations: Offers curated stock picks, Zen Ratings, and analyst “Strong Buy” picks, making it ideal for those who prefer pre-vetted investment ideas over deep research.

- Beginner Investors: The easy-to-understand interface and simplified analysis make it a great starting point for new investors who want to learn about stock research without getting overwhelmed by complex data.

- Stock Screeners & Idea Seekers: Investors who enjoy browsing stock ideas and pre-built screeners will benefit from the curated lists of undervalued, growth, and high-potential stocks.

- Dividend Investors: The platform tracks dividend stability and growth, making it useful for those looking for income-generating stocks with strong financials.

Who Should Skip WallStreetZen?

WallStreetZen’s free plan has strong fundamental analysis tools, but it may not be the best fit for everyone. Here are types who might find it lacking:

- Day Traders: Lacks real-time data, advanced charting, and technical indicators like RSI, MACD, and Bollinger Bands, making it difficult for short-term traders who rely on quick market movements.

- Technical Analysts: The free plan has basic stock charts but lacks advanced custom indicators, trend analysis tools, and in-depth historical data, making it less useful for traders who rely heavily on technical setups.

- Portfolio Managers & Active Investors: No portfolio tracking or real-time alerts, which makes it harder for those managing multiple holdings to track performance efficiently.

- Advanced Fundamental Analysts: While it provides basic financial data and stock ratings, it lacks deep research, reports and advanced fundamental tools.

WallStreetZen Free vs Premium: Worth To Upgrade?

The free version provides basic stock research, limited analyst ratings, and a general stock screener—good for casual investors.

Plan | Subscription | Promotion |

|---|---|---|

WallStreetZen Premium | $234 ($19.50 / month)

No monthly plan | $1 for 14-day trial

$1 for 14-day trial including 90-day money-back guarantee

|

However, WallStreetZen Premium unlocks unlimited analyst rankings, advanced stock screening, exclusive stock lists, and Zen Ratings-based filtering, making it far more powerful for serious investors.

If you rely on expert insights and deep fundamental analysis, the Premium plan is a strong upgrade.

FAQ

Analysts are ranked based on average return, win rate, and the number of ratings they've issued.

An analyst's overall ranking considers consistency and the volume of ratings, so a high rank can coexist with a lower average return.

Analysts may not frequently update their ratings; thus, some recommendations might be older but are retained for historical context.

No, you can export data into a spreadsheet for further analysis only in the premium version.

Currently, there isn't a dedicated app, but the website is optimized for mobile use.

Zen Investor is a stock-picking newsletter, while WallStreetZen Premium offers advanced tools and features for in-depth stock analysis.

Data updates vary: stock prices update every few seconds, valuation metrics daily, and financial reports quarterly.

Premium offers unlimited access to features like advanced screeners, top analyst recommendations, and detailed stock analyses.

Review Free Stock Analysis Tools

Investment Analysis & Research Tools : Review Methodology

At The Smart Investor, we evaluated free investment research platforms based on the quality and depth of their features compared to other free alternatives. Each platform was rated based on the following criteria:

- Fundamental Analysis Tools (25%): We assessed the availability of key financial data, including income statements, balance sheets, cash flow, valuation metrics, and analyst estimates. Platforms with more in-depth historical data, forward-looking projections, and research reports scored higher.

- Technical Analysis Features (20%): We examined the variety and quality of technical indicators, charting tools, and real-time price data. Platforms that offered customizable interactive charts, trend analysis, and multiple timeframes received better ratings.

- Stock Screener & Free Filters (15%): A strong stock screener is crucial for research, so we rated platforms based on the number and depth of filtering options. Higher scores were given to platforms that allowed customized searches using fundamental, technical, and sector-based criteria.

- Portfolio Tracking & Alerts (15%): We reviewed the ability to track multiple portfolios, set up watchlists, and receive alerts on stock movements. Platforms offering real-time updates, dividend tracking, and personalized notifications ranked higher.

- Ease of Use & User Experience (15%): Platforms were rated on their design, navigation, and accessibility across devices. Those with intuitive layouts, easy-to-read data, and smooth user experiences received better scores.

- Additional Perks & Limitations (5%): We considered unique tools, premium research access, and potential feature restrictions. Platforms with added perks like AI analysis or fewer paywalls scored higher, while those with aggressive ads or major limitations were rated lower.

- Community & Social Features (5%): Platforms with investor discussion forums, sentiment tracking, or social trading features were rated higher. Those lacking community-driven insights or engagement tools scored lower.