Table Of Content

What Is a Crypto Exchange?

A crypto exchange is a digital platform that allows users to buy, sell, and trade cryptocurrencies like Bitcoin, Ethereum, and others. These platforms operate similarly to stock exchanges but focus on crypto assets.

Crypto exchanges provide access to real-time pricing, trading pairs, and often include wallet services, security tools, and analytical features.

Some cater to beginners with simple interfaces, while others offer advanced tools for experienced traders.

How Does a Crypto Exchange Work?

Crypto exchanges function by matching buyers and sellers of cryptocurrencies through an internal order book. They facilitate secure and fast transactions using blockchain technology, digital wallets, and various payment methods.

Account Setup and Verification: Users must register and complete identity verification, especially on centralized platforms, in order to comply with regulations.

Deposits and Wallets: Funds are deposited via bank transfers, cards, or crypto wallets. Exchanges often provide built-in wallets for holding assets.

Trading Mechanisms: Orders can be market-based or limit-based, allowing users to execute trades instantly or at target prices.

Security and Custody: Exchanges implement measures such as two-factor authentication, cold storage, and encryption to protect user funds.

Because transactions are recorded on the blockchain, users can verify completed trades independently. Also, fees vary depending on the platform, asset type, and transaction volume.

Types of Crypto Exchanges: CEXs vs. DEXs vs. Hybrids

Crypto exchanges are divided into centralized, decentralized, and hybrid platforms — each serving different investor needs.

Centralized Exchanges (CEXs): Platforms like Coinbase and Binance manage user accounts and provide fast, user-friendly trading. However, they control your private keys.

Decentralized Exchanges (DEXs): Services such as Uniswap operate on smart contracts and don't hold user funds, offering privacy and control but with limited support.

Hybrid Exchanges: These combine the ease of CEXs with the security and control of DEXs. An example is Qurrex, which blends centralized speed with decentralized transparency.

Peer-to-Peer (P2P) Marketplaces: Platforms like Paxful allow users to trade directly, supporting various payment methods and offering escrow protection.

Because each type has trade-offs in terms of custody, speed, and compliance, choosing the right exchange depends on your priorities — whether that’s security, ease of use, or decentralization.

Feature | CEX (e.g., Binance) | DEX (e.g., Uniswap) | Hybrid (e.g., Qurrex) |

|---|---|---|---|

Control of Funds | Platform-controlled | User-controlled | User + Platform |

KYC Requirements | Mandatory | Rarely Required | Often Optional |

Liquidity | High | Varies by token | Moderate to High |

Speed of Transactions | Fast (central server) | Slower (blockchain) | Optimized for speed |

User Interface | Beginner-friendly | Developer-oriented | Mixed |

Getting Started With a Crypto Exchange

To start using a crypto exchange legally and safely, follow these essential steps to register, fund, and securely trade your assets.

Step 1: Choose a Reputable Exchange

Begin by selecting a licensed and secure crypto exchange that suits your goals, whether you're buying, trading, or holding crypto.

Check for Regulation: To ensure legal compliance, choose platforms regulated in your country (e.g., Coinbase in the U.S. or Bitstamp in the EU).

Look at Security Measures: Opt for exchanges offering two-factor authentication, cold wallet storage, and insurance protection.

Read User Reviews: Platforms like Trustpilot and Reddit can reveal real-world user experiences and reliability.

Choosing a compliant exchange reduces the risk of fraud or asset loss. Regulated platforms must also adhere to KYC (Know Your Customer) laws, which help protect your identity and funds.

Platform | Coins | Spot Trading Fee | Best For | Crypto.com | +350 | 0.075%

For both maker and taker orders. The more you trade, the lower the fees – can decrease to as low as 0% – 0.050%. Holding and staking CRO tokens, Crypto.com native token, unlocks additional fee discounts. | All-in-One Crypto Services |

|---|---|---|---|

Kraken | +300 | 0.40% – 0.25%

0.40% for taker trades and 0.25% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.10%. Using GT tokens to pay trading fees offers a 10% discount | Advanced Traders |

Coinbase | +250 | $0.99 – 2.00% (Standard), 0.05% – 0.60% (Advanced Trade)

For transactions above $200 (standard account): 1.49% fee for using a bank account or USD wallet, 3.99% fee for using a debit or credit card. For Coinbase Advanced Trade: 0.60% for taker trades and 0.40% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.05%. | Beginners |

Gemini | +150 | $0.99 – 1.49% (Web & Mobile), 0.20% – 0.40% (Active Trader)

For Gemini’s website or mobile app users are charged 0.50% convenience fee For Active Trader, 0.40% for taker trades and 0.20% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.03%. | Compliance & Regulation |

Robinhood | +20 | $0 | Fee-Free Trading |

MEXC | +2,300 | 0% – 0.10%

0.00% for taker trades and 0.10% for maker trades. | Low Fee |

Step 2: Create and Verify Your Account

Once you’ve selected a platform, you’ll need to register and complete identity verification as part of anti-money laundering (AML) requirements.

Provide Basic Information: You'll typically need to share your name, address, and government-issued ID.

Submit Proof of Identity: Upload a passport or driver’s license to confirm your identity and meet KYC standards.

Wait for Approval: Verification can take anywhere from minutes to a few days, depending on the platform and region.

Although it may seem intrusive, verification is legally required and adds a layer of safety by discouraging illicit activity. As a result, it ensures your account remains in good standing.

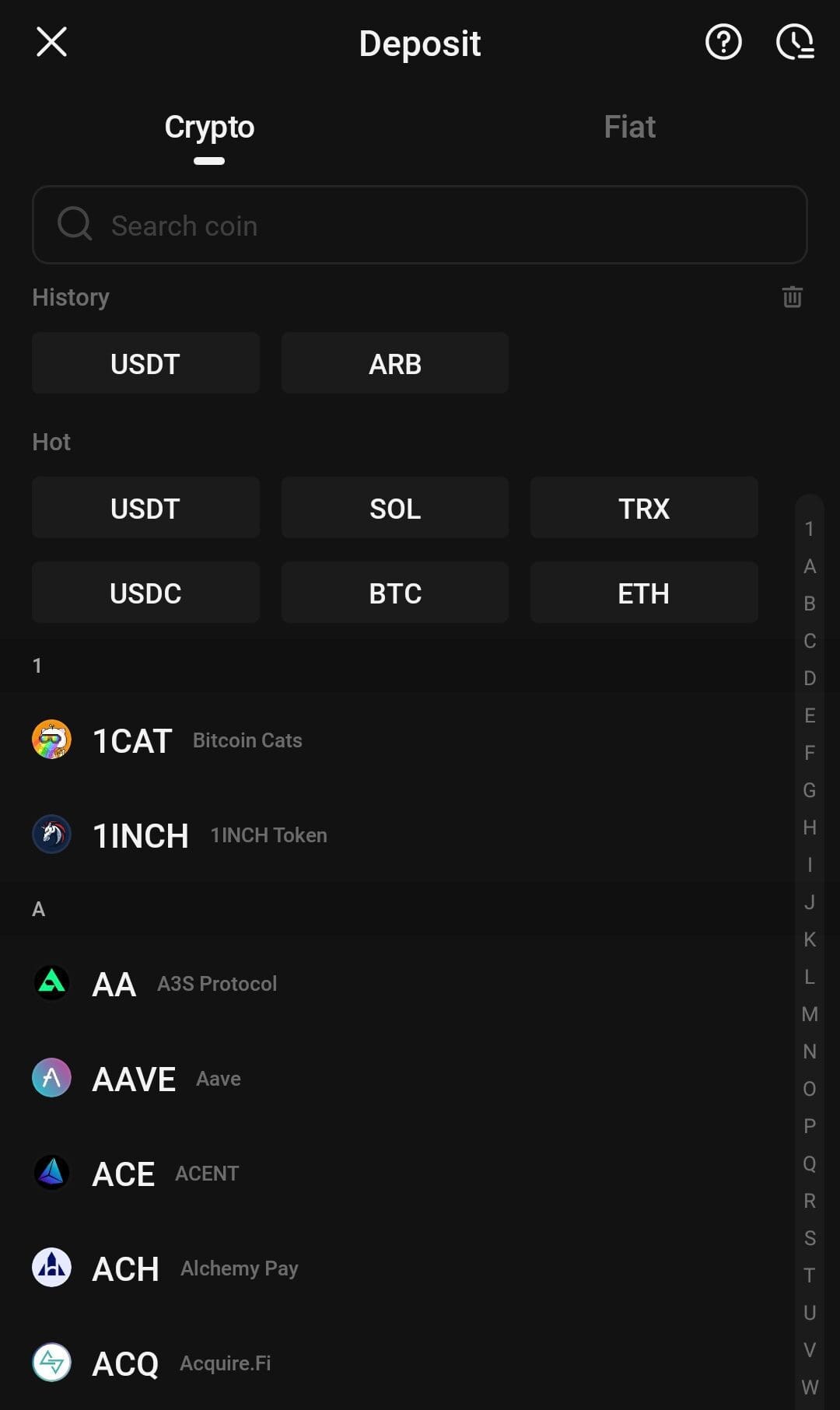

Step 3: Deposit Funds

After your account is approved, you can legally deposit funds to begin trading.

Use Bank Transfer or Card: Many platforms support ACH transfers, credit/debit cards, and sometimes PayPal.

Check Fees and Limits: Exchanges charge different fees based on funding method and location.

Secure a Crypto Wallet: Consider using your own non-custodial wallet for added protection after purchase.

Depositing via verified channels ensures compliance and helps prevent delays. Because banks work with licensed exchanges, your funds will typically be processed smoothly and traceably.

Step 4: Start Trading or Investing

With funds in your account, you can start buying crypto for trading, long-term holding, or even earning through staking.

Use Spot or Limit Orders: Beginners may prefer market orders for simplicity, while advanced users set limit prices.

Explore Trading Pairs: You can exchange between crypto-to-crypto or crypto-to-fiat (e.g., BTC/USD).

Track Your Portfolio: Use built-in tools or apps like CoinStats or Delta to manage performance.

Trading involves risk due to market volatility. Therefore, always start small, especially if you're new, and consider diversifying your portfolio gradually as you gain experience.

How Crypto Exchanges Differ From Each Other

Crypto exchanges vary widely in functionality, security, and services — making it important to compare before signing up.

Trading Features and UI: Platforms like Binance offer advanced tools, while Coinbase focuses on simplicity for beginners.

Supported Assets and Pairs: Some exchanges offer hundreds of coins (e.g., KuCoin), but others only support major cryptos.

Security Protocols: Centralized exchanges hold your keys, but DEXs like Uniswap allow full user control and reduce custodial risk.

KYC and Privacy Requirements: CEXs require full identity verification, whereas DEXs often allow anonymous trades.

Regional Restrictions: Certain exchanges are banned in specific countries due to regulations — for example, Binance.US differs from Binance Global.

Because no two platforms are exactly alike, your choice should depend on whether you prioritize ease of use, number of assets, or control over your private keys.

-

Popular Crypto Exchanges for Beginners

If you're new to crypto, some platforms are designed to make buying, selling, and learning about crypto easier and safer.

Coinbase: Known for its intuitive design and strong regulatory compliance, Coinbase is often the first choice for U.S. beginners.

Kraken: It offers a clean interface and comprehensive security, along with educational content that helps users understand each step.

Bitstamp: As one of the oldest exchanges, Bitstamp combines simplicity with trustworthiness, making it a solid option for cautious newcomers.

eToro: Popular for social trading, eToro allows beginners to follow and copy experienced crypto investors’ trades in real-time.

These platforms offer streamlined onboarding, but also ensure compliance with KYC and AML laws. Because of their legal structure and support resources, beginners can start with confidence.

-

Popular Crypto Exchanges for Traders & Investors

Active traders and long-term investors often look for platforms with high liquidity, advanced tools, and broad asset availability.

Binance: Offers hundreds of crypto pairs, futures, margin trading, and detailed analytics—ideal for daily or high-frequency traders.

Crypto.com: Combines an exchange with staking, DeFi access, and crypto debit cards, appealing to both passive and active investors.

KuCoin: With low fees and a wide selection of altcoins, KuCoin attracts seasoned traders looking for lesser-known opportunities.

Because these exchanges support technical trading tools and offer broader market access, they suit users with a clear investment strategy. Also, some platforms include rewards programs or interest accounts, adding more utility for investors.

FAQ

A wallet stores your crypto, while an exchange is a platform for trading it. Some exchanges include built-in wallets, but using a separate non-custodial wallet is safer for long-term storage.

Some decentralized exchanges allow anonymous use, but most centralized platforms require identity verification due to financial regulations.

While many exchanges use strong security, holding crypto on them can be risky due to hacks. It’s safer to transfer funds to a personal wallet.

Check if the exchange is licensed or regulated by a government agency in your region. You can also review their legal disclosures or use government registries.

Yes, due to market volatility or hacking incidents. Always research, diversify, and use proper risk management.

No. Some exchanges are crypto-only, while others support fiat pairs like USD/BTC. Always confirm supported payment methods before signing up.

No. Fees vary based on trading volume, payment method, and exchange type. High-volume traders may get discounts.

If hacked, you could lose access to your funds. Some exchanges offer insurance or reimbursements, but not all do, so always read their policies.

They earn through trading fees, withdrawal fees, and sometimes spreads between buying and selling prices.