Table Of Content

Trying to manage your own investments can be tricky—especially with all the ups and downs in the market.

That’s where automated investing comes in. It’s a simple, technology-driven approach to growing your money without needing to be a financial expert.

From setting your goals to managing risk, automated tools do most of the work behind the scenes.

What Is Automated Investing and How Does It Work?

Automated investing is a system where software manages your investments based on your goals, timeline, and risk tolerance.

Instead of picking individual stocks or managing your portfolio manually, you answer a few questions—like how much you want to invest and when you’ll need the money.

The platform (often called a robo-advisor) builds and manages a diversified portfolio for you.

Most automated investing tools use exchange-traded funds (ETFs) to keep costs low and diversification high. They also handle portfolio rebalancing—adjusting your investment mix over time—and tax strategies like loss harvesting.

Many offer features like goal tracking, automatic deposits, and retirement planning tools. It’s a “set it and forget it” style of investing that works especially well for long-term strategies.

Whether you’re saving for retirement, a home, or just building wealth, automated investing aims to make the process simple and hands-off.

AI and Machine Learning Are Changing Automated Investing

AI and machine learning are making automated investing smarter. Traditional robo-advisors rely on fixed models, but with AI, systems can adapt to new data in real time.

These tools can now analyze massive amounts of market data, news, and trends to better optimize portfolios. They can also personalize strategies based on user behavior, spending habits, or financial goals.

As a result, AI-driven platforms are starting to offer more dynamic investment strategies that go beyond the basic risk-level approach.

It’s still early, but the technology is helping investors get more tailored and efficient results with even less effort.

Pros and Cons of Automated Investing

Here are the main pros and cons of automated investing to help you decide if it’s the right strategy for your goals.

Pros | Cons |

|---|---|

Easy to Use | Limited Customization |

Low Fees | Not Ideal for Complex Needs |

Emotion-Free Decisions | Market Risk Still Applies |

Hands-Off Management | Tech Glitches or Errors |

Automatic Rebalancing | Lack of Human Insight |

Goal-Based Planning | May Feel Impersonal |

- Easy to Use

Most platforms walk you through a quick setup process with simple questions. No financial background is needed to start investing.

- Low Fees

Robo-advisors usually charge lower management fees than human advisors, helping you keep more of your returns.

- Emotion-Free Decisions

Automated systems remove human emotion from investing, which can reduce impulsive decisions during market ups and downs.

- Hands-Off Management

Once your account is set up, everything from deposits to rebalancing is handled for you.

- Automatic Rebalancing

Your portfolio is regularly adjusted to maintain your target allocation as markets change.

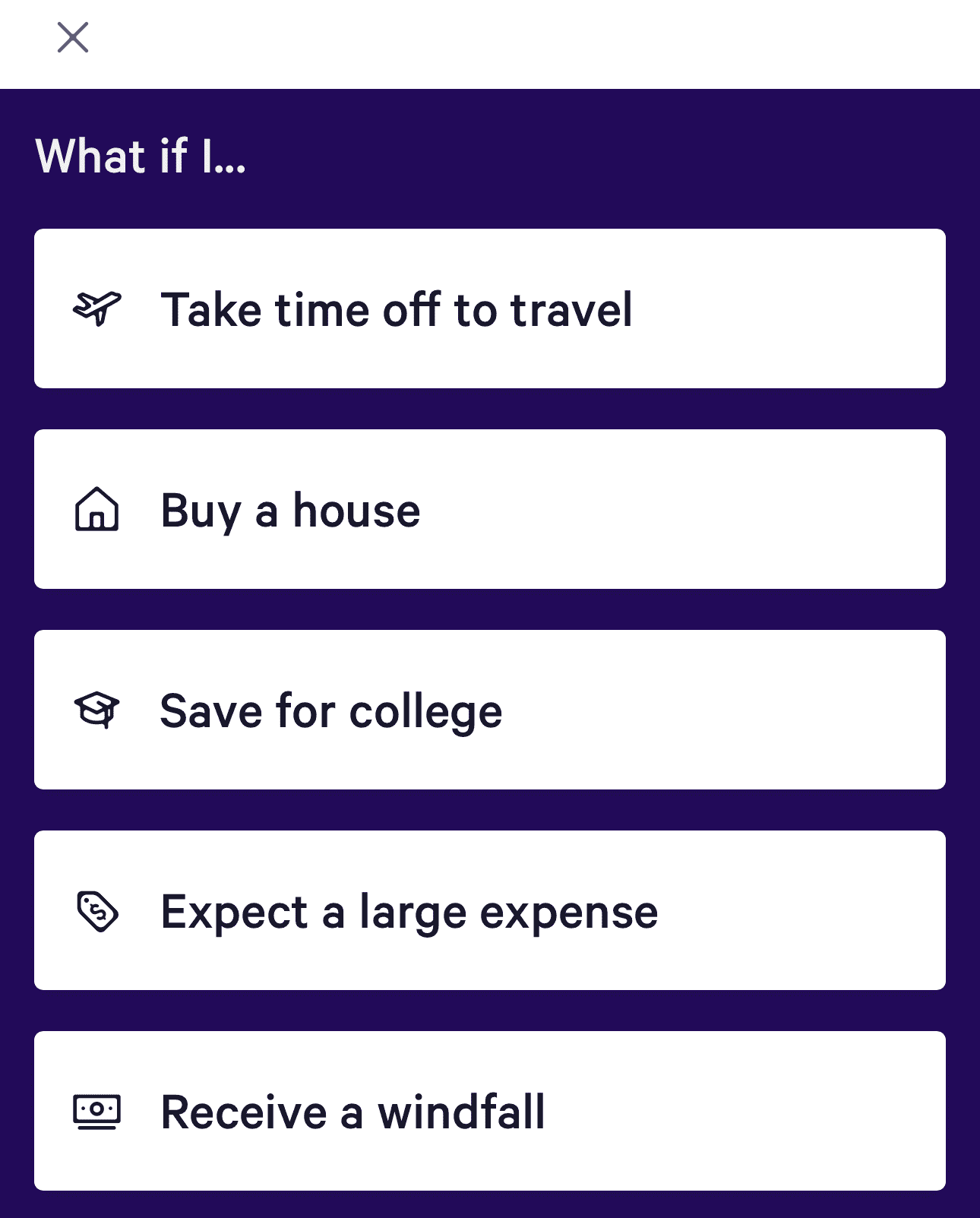

- Goal-Based Planning

Many platforms let you set specific goals—like retirement or a home purchase—and tailor your investments accordingly.

- Limited Customization

You typically can't choose individual stocks or tweak portfolio strategy beyond risk level.

- Not Ideal for Complex Needs

If you need detailed tax strategies or estate planning, a robo-advisor may not be enough.

- Market Risk Still Applies

Automation doesn't shield your investments from losses in a downturn.

- Lack of Human Insight

You won’t get personalized advice or emotional support in volatile markets.

- May Feel Impersonal

Some investors prefer talking to a human advisor about their financial goals and concerns.

- Tech Glitches or Errors

Like any software, there’s a chance of algorithm errors or system issues.

Who Should Consider Automated Investing?

Automated investing isn’t for everyone—but for many people, it offers a smart, low-maintenance way to build long-term wealth. It’s ideal for those who want a hands-off approach or don’t have the time (or desire) to manage investments themselves. Here are some types of investors who could benefit the most:

Beginner Investors: If you’re just starting and unsure how to build a portfolio, automated tools provide a guided, low-risk entry point.

Busy Professionals: Don’t have time to track markets? Automation handles everything, from deposits to rebalancing, with minimal involvement.

Long-Term Savers: Automated investing works best over time, making it a good fit for retirement or major savings goals.

Budget-Conscious Investors: Many robo-advisors have low fees and low minimums, making them accessible to people with smaller account sizes.

Emotion-Prone Investors: If you tend to panic or make impulse trades, automated systems help remove emotion from the equation.

People Seeking Simplicity: For anyone who wants a “set it and forget it” approach, automation keeps things streamlined and consistent.

Ultimately, if you want a smart, stress-free way to invest consistently, automated investing might be worth exploring.

Popular Robo-Advisors for Automated Investing

Not all robo-advisors are built the same. The best one for you depends on your goals, budget, and preferences.

Here are some of the top-rated platforms to consider for automated investing:

Betterment: Great for beginners, with a user-friendly interface, goal tracking tools, and tax-loss harvesting included in premium plans.

Wealthfront: Offers strong financial planning tools, automatic rebalancing, and access to a high-yield cash account.

SoFi Invest: No advisory fees, and it includes free access to human financial planners for added support.

Fidelity Go: A solid choice from a trusted name, especially for people already using Fidelity accounts.

Schwab Intelligent Portfolios: No advisory fees and includes automatic tax-loss harvesting for portfolios over a certain size.

Acorns: Designed for micro-investing—rounds up your purchases and invests the spare change, great for total beginners.

Each of these platforms has its own strengths, from lower fees to more customization. Consider your needs, then compare features to find the right fit.

FAQ

Benefits include low fees, hands-off management, portfolio rebalancing, and emotion-free decision-making.

Yes, it’s ideal for beginners who want a simple, guided way to start investing without needing deep financial knowledge.

Automated investing is software-based and low-cost, while financial advisors provide personalized human advice but often charge more.

Yes, since it involves market investments, there's always a risk of losses, just like with traditional investing.

Some platforms have no minimums, while others may require as little as $5 to $500 to get started.

Yes, most robo-advisors offer IRAs and can help automate long-term retirement savings.

Returns vary with the market and your chosen risk level, but they aim to match average market performance over time.

A robo-advisor is a digital platform that uses algorithms to manage your investments automatically.

Yes, most robo-advisors charge lower fees than traditional financial advisors, making them more cost-effective.

To some extent—most platforms let you choose your risk level and goals, but customization is limited compared to DIY investing.

Most portfolios are made up of low-cost ETFs that include stocks, bonds, and sometimes real estate or commodities.