Table Of Content

What Is Stock Sentiment Analysis?

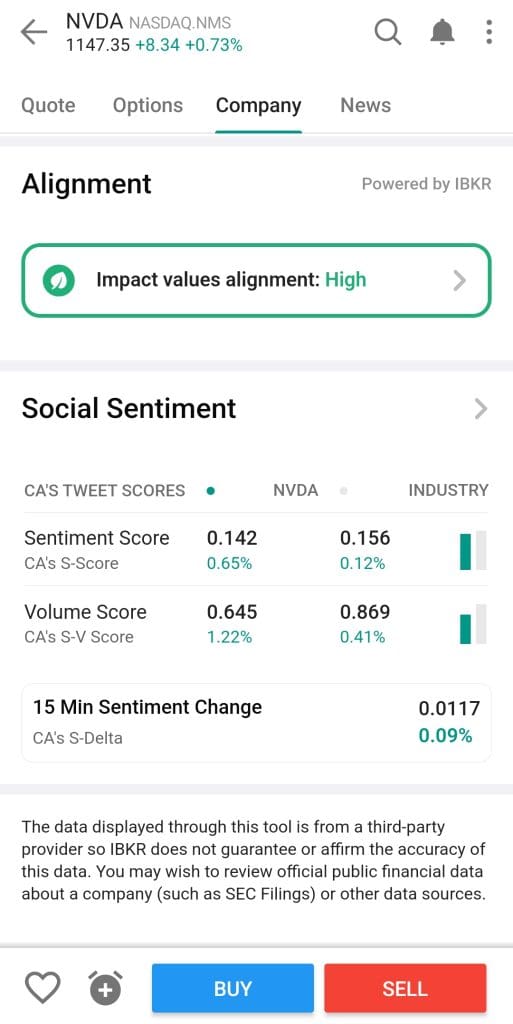

Stock sentiment analysis is the process of evaluating the tone or attitude of news articles, social media posts, earnings transcripts, and analyst commentary to gauge how investors feel about a particular stock or the broader market. It aims to quantify emotional and psychological elements that influence investor behavior.

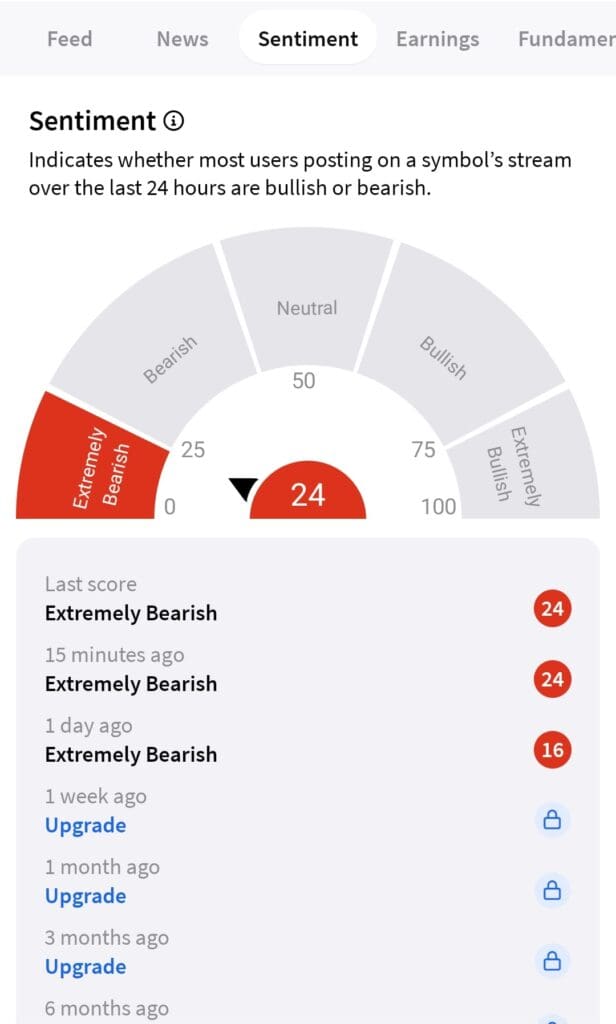

Identifies Bullish or Bearish Signals: By assessing whether sentiment is positive or negative, traders can anticipate potential price movements.

Combines with Technical and Fundamental Analysis: It does not replace traditional methods, but rather adds a behavioral layer to decision-making.

Used by Retail and Institutional Investors: For example, hedge funds might use sentiment data to detect early signs of a trend reversal.

Because sentiment can shift quickly, tools like real-time dashboards or social media monitors help investors stay updated on market mood swings.

How News Sentiment Impacts Stock Prices

News sentiment plays a significant role in short-term price movements. Positive headlines can attract buyers, while negative coverage often sparks sell-offs—even when fundamentals remain unchanged.

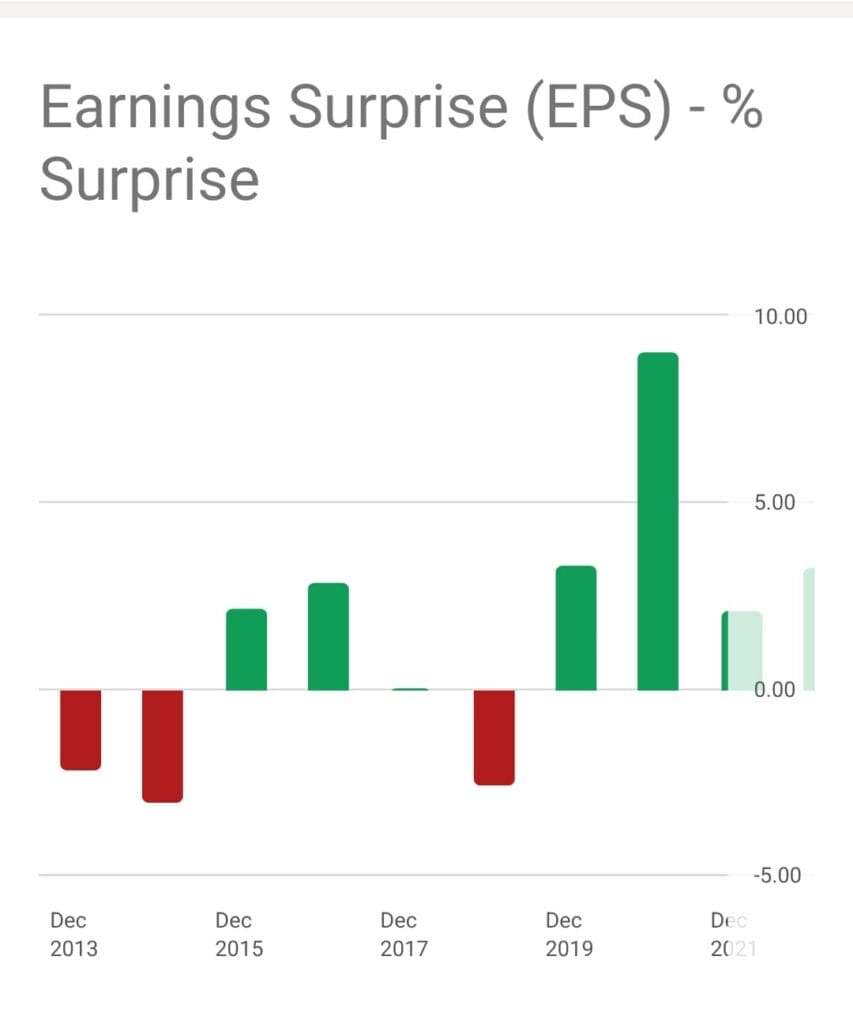

Earnings Surprises and Guidance: A company beating earnings but offering weak forward guidance may trigger negative sentiment and a price drop.

Macroeconomic and Geopolitical News: Reports about interest rate hikes, inflation, or war can sharply influence investor sentiment across sectors.

Social Media and Virality: Platforms like X (formerly Twitter) or Reddit can amplify sentiment, especially in small-cap or meme stocks.

As a result, investors use sentiment analysis to filter noise and recognize whether news is already “priced in” or likely to shift public perception.

How to Measure Investor Sentiment in the Stock Market

Investor sentiment can be gauged through both quantitative indicators and qualitative analysis that reflect mood shifts across various asset classes.

Put/Call Ratio: A high ratio suggests bearish sentiment, while a low ratio indicates bullish speculation among options traders.

Volatility Index (VIX): Often called the “fear gauge,” the VIX rises when market participants expect increased uncertainty or downside risk.

AAII Sentiment Survey: The American Association of Individual Investors regularly polls members to track retail investor outlook.

Social Media and News Monitoring: AI tools track trends and tone across platforms like Reddit, X, and financial news to spot sentiment spikes.

Because investor emotions often lead to overreactions, tracking sentiment helps traders identify potential reversals or crowded trades.

Popular Sentiment Indicators Used by Traders

Sentiment indicators offer quantifiable ways to track crowd behavior and potential turning points in the market. They can be especially useful during earnings season or in high-volatility environments.

Bullish Percent Index (BPI): Measures the percentage of stocks on Point & Figure buy signals within a sector or index.

Short Interest Ratio: A high ratio signals bearish sentiment or potential for a short squeeze if sentiment shifts.

Fear & Greed Index: Created by CNN, this blends various data points like volatility, momentum, and safe-haven demand.

Net Long/Short Positioning from CFTC: Futures data shows how institutional investors are positioned across asset classes.

Because these indicators reveal positioning and emotional extremes, they are often used as contrarian signals or to confirm broader market trends.

How to Combine Sentiment With Fundamental Analysis

Blending sentiment analysis with fundamental analysis can improve both timing and conviction in investment decisions. While fundamentals tell you what to buy, sentiment helps determine when to act.

For example, if a stock has strong fundamentals—like consistent revenue growth and a low debt-to-equity ratio—but is experiencing negative sentiment due to a short-term controversy, that may present a buying opportunity.

Conversely, if sentiment is overly bullish but fundamentals are weak, it could signal an overvalued asset.

A value investor might screen for undervalued stocks with pessimistic sentiment and wait for reversal signs.

Growth traders could focus on companies with improving fundamentals and increasingly positive sentiment in earnings calls or news coverage.

Therefore, combining both tools provides a fuller picture, balancing long-term potential with short-term market psychology.

Risks and Limitations of Sentiment Analysis

While sentiment tools are powerful, they are not foolproof. Misinterpretation or over-reliance can lead to poor decisions, especially when sentiment is disconnected from fundamentals.

False Signals: Trending topics on social media can be manipulated or reflect herd behavior that reverses quickly.

Lagging or Noisy Data: Some sentiment metrics rely on historical data that may no longer be relevant.

Emotional Bias: Traders may interpret sentiment in a way that confirms their existing view (confirmation bias).

Platform-Specific Gaps: Some tools may miss emerging trends on lesser-known platforms or non-English content.

Therefore, sentiment should be one part of a larger decision-making framework, not a standalone strategy.