Table Of Content

What Makes a Good Crypto Screener?

A quality crypto screener helps investors quickly analyze thousands of coins using relevant, real-time, and customizable filters and tools.

Live Market Data: Price, volume, and market cap updates should be real-time to catch fast-moving opportunities.

Custom Filters: Ability to screen by technical indicators, sectors (like DeFi or AI), or fundamentals such as tokenomics.

Technical & Fundamental Metrics: Includes RSI, MACD, circulating supply, or project development activity to support both traders and investors.

Alerts & Notifications: Set alerts for breakout patterns, price thresholds, or volume surges.

Easy Interface & Integrations: A user-friendly dashboard with portfolio tools or charting integration improves usability and decision-making.

A good screener adapts to your strategy—whether you’re flipping altcoins or researching long-term DeFi projects.

Best Free and Paid Crypto Screeners

These top crypto screeners help you analyze price trends, filter coins by technical or fundamental data, and track performance more effectively.

1. Altfins

Altfins is a powerful crypto screener built for technical traders who want more than just price tracking. It stands out by offering actionable trade setups and chart pattern recognition.

Advanced Technical Filters: Scan coins based on RSI, MACD crossovers, support/resistance zones, and more.

Chart Pattern Detection: Identifies triangles, breakouts, and head & shoulders patterns automatically to assist with timing trades.

Trade Ideas & Watchlists: Access curated long/short setups and save them for tracking.

The free plan includes limited scans and basic watchlists, but upgrading unlocks unlimited screeners, real-time signals, and alerting features.

Altfins is ideal for active crypto traders who want to automate their technical screening process.

2. Messari

Messari is a data-rich crypto research platform with a high-quality screener focused on fundamental metrics and on-chain data. It's popular among institutional and long-term investors.

Deep Fundamental Filters: Screen coins by sector (e.g., DeFi, Layer 2), tokenomics, or revenue and inflation models.

Institutional-Grade Data: Includes metrics like developer activity, on-chain volume, and governance participation.

Project Profiles & News: Each coin includes a full project overview, roadmap, and recent updates.

The free version includes standard filters and profiles, while the Pro plan adds advanced metrics, export capabilities, and curated dashboards. Messari is ideal for research-driven investors.

3. CoinMarketCap

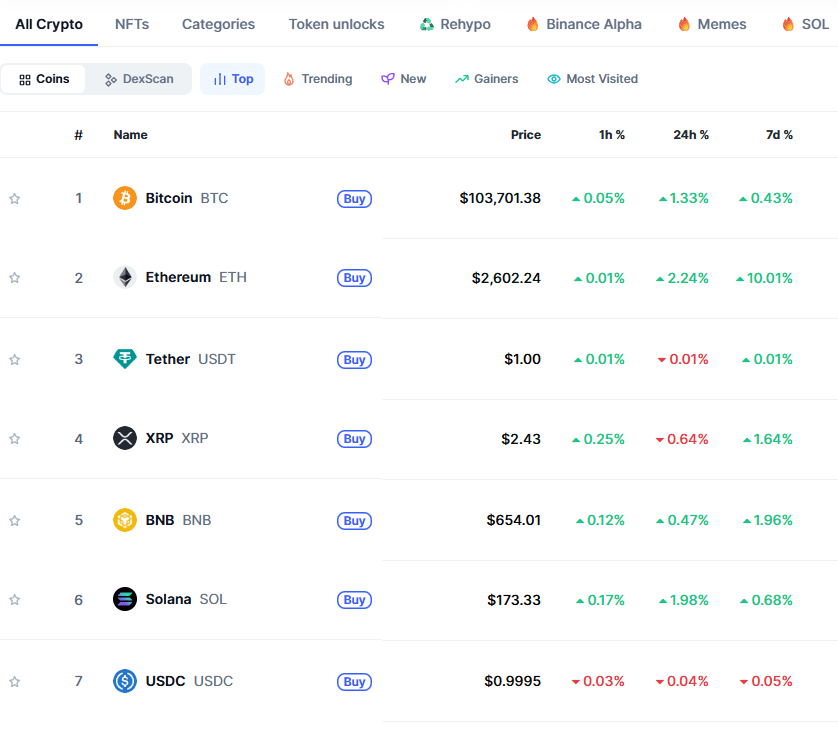

CoinMarketCap is one of the most widely used crypto platforms for price tracking, and it offers a beginner-friendly screener with customizable filters.

Customizable Filters: Sort by price, volume, market cap, percentage change, and more.

Trending & Most Visited Lists: See which coins are gaining traction based on community interest.

Historical Snapshots: View data from specific dates to analyze past performance.

Free to use, CoinMarketCap is ideal for casual investors who want quick insights without complex setups. While it lacks deep technical filters, it excels in ease of use and accessibility.

4. CoinGecko

CoinGecko offers a robust crypto screener with an emphasis on transparency and decentralized asset tracking. It supports thousands of tokens and exchanges.

Filter by Platform & Category: Screen by Ethereum, Solana, or niche sectors like yield farming or AI tokens.

Developer & Community Scores: Evaluate project credibility using GitHub activity and social signals.

DeFi & NFT Insights: Also includes tracking tools for liquidity pools and NFT-related tokens.

Completely free, CoinGecko is perfect for users who want broad coverage across all token types, including low-cap or emerging coins. It’s a favorite among DeFi explorers.

5. TradingView

TradingView is a premium charting platform that supports crypto screening alongside traditional assets. Its crypto screener is highly customizable and integrates seamlessly with its chart tools.

Custom Scripts & Indicators: Use PineScript to create your own technical indicators.

Screener + Charting Integration: Directly open coins on advanced charts to analyze entries and exits.

Cross-Asset Screening: Scan crypto alongside stocks, forex, and commodities for macro strategies.

The free plan includes limited screeners and alerts, while the TradingView subscription unlocks faster data, extended indicators, and backtesting tools. Ideal for technical traders who want complete flexibility.

6. BitScreener

BitScreener blends crypto data with financial analytics to offer a unique approach to screening. It’s designed for investors who want a mix of charts, news, and fundamentals in one place.

Multi-Factor Screening: Filter coins by market cap, technical signals, and volume changes.

News Integration: Displays latest news headlines and social mentions directly within the screener.

Portfolio Tracking: Monitor your investments while researching new ones on the same dashboard.

While free to use, the Pro version adds ad-free access, deeper analytics, and charting features. BitScreener is a great pick for investors who value integrated tools and real-time updates.

How to Use a Crypto Screener to Identify Trading Opportunities

A crypto screener helps you spot breakout coins, trends, and undervalued assets faster by narrowing down thousands of tokens.

Filter by Volume and Price Action: Start by screening for coins with unusual volume spikes or strong daily price movements to catch momentum trades.

Apply Technical Indicators: Use tools like RSI, MACD, or Bollinger Bands to find overbought or oversold conditions and possible reversal setups.

Sort by Market Cap or Category: Narrow results by small caps or specific sectors like DeFi, gaming, or Layer 1 chains to match your niche.

Look at Breakout Patterns: Some screeners highlight coins breaking resistance or forming patterns like triangles, which can signal potential entries.

Set Custom Alerts: Create alerts for price thresholds, volume surges, or technical crossovers to act quickly when setups appear.

By combining filters and technical tools, you can discover opportunities that match your risk profile and trading style.

Whether you’re swing trading or scalping, using a screener cuts down noise and helps you focus on high-probability setups across volatile markets.

FAQ

A tracker monitors specific coins you've already chosen, while a screener helps you discover new coins based on custom filters and conditions.

Yes, some screeners like CoinGecko and Messari offer filters for DeFi, NFT, or GameFi categories so you can focus on specific sectors.

Most reputable screeners are safe to use for data viewing. However, always avoid connecting wallets or inputting sensitive information on unknown sites.

Many platforms like CoinMarketCap and TradingView have mobile apps or responsive sites, allowing you to screen on the go.

Some screeners, especially premium ones, offer real-time alerts via email, SMS, or push notifications when coins hit certain levels or signals.

Yes, screeners often let you filter by network, such as Ethereum, Solana, or Binance Smart Chain, to focus on coins within one ecosystem.

Traders prioritize technical signals and real-time changes, while investors might focus more on fundamentals, tokenomics, or developer activity.

Some platforms, like BitScreener or Messari, provide social trends or community scores, helping gauge hype or engagement levels.

Yes, by using filters like low market cap, strong developer activity, or low P/E ratios (for tokenized assets), you can spot undervalued options.

Most support both. Tools like CoinGecko offer thousands of altcoins, including low-cap or recently launched projects not found on all screeners.