Table Of Content

If you’re thinking about buying gold or silver for the first time, SD Bullion is a great place to start.

Whether you want a few gold coins or a stack of silver bars, they’ve got a wide selection, and the prices are usually better than what you’ll find at local shops.

Here's what customers think on it:

Platform | Rating |

|---|---|

Trustpilot

| 4.3 (2,648 reviews) |

Better Business Bureau (BBB) | A+ | Accredited Since 2014 |

Sitejabber | 3.3 (641 reviews) |

In this guide, we will walk you through exactly how to buy precious metals step-by-step using SD Bullion.

How to Buy Precious Metals on SD Bullion

Let’s break it down and see how to actually buy gold, silver, and other precious metals on SD Bullion:

1. Start with Your Goals and Budget

Before diving into products, it helps to know what you're aiming for. Are you buying gold as a long-term hedge, or looking for silver you can stack regularly? Your answers shape what type of metals and formats to choose.

Here are a few things to think about:

Set your budget — whether it’s $500 or $5,000, SD Bullion has options at nearly every price point.

Decide on metal type — gold, silver, platinum, or palladium.

Think about liquidity — coins like American Eagles are easier to resell than large bars.

2. Set Up Your SD Bullion Account

To place an order, you'll need to create a free account. It takes just a couple of minutes and gives you access to order tracking, payment instructions, and special pricing.

What you'll need:

Basic info — name, email, shipping address.

No ID upload required unless you're opening a Gold IRA.

Helps speed up the checkout and lets you view your order history anytime.

3. Browse Products by Metal, Type, and Size

SD Bullion has a clean layout that makes it easy to explore. You can shop by metal (gold, silver, platinum), format (coins, bars, rounds), or even check out current deals under “On Sale.”

Quick ways to filter:

By weight – from fractional grams to 1 oz, 10 oz, or 1 kilo bars.

By mint – U.S. Mint, Royal Canadian Mint, and more.

IRA-eligible products are clearly marked.

Each listing shows availability, pricing per ounce, and quantity discounts—handy if you’re buying in bulk.

4. Add to Cart and Choose a Payment Method

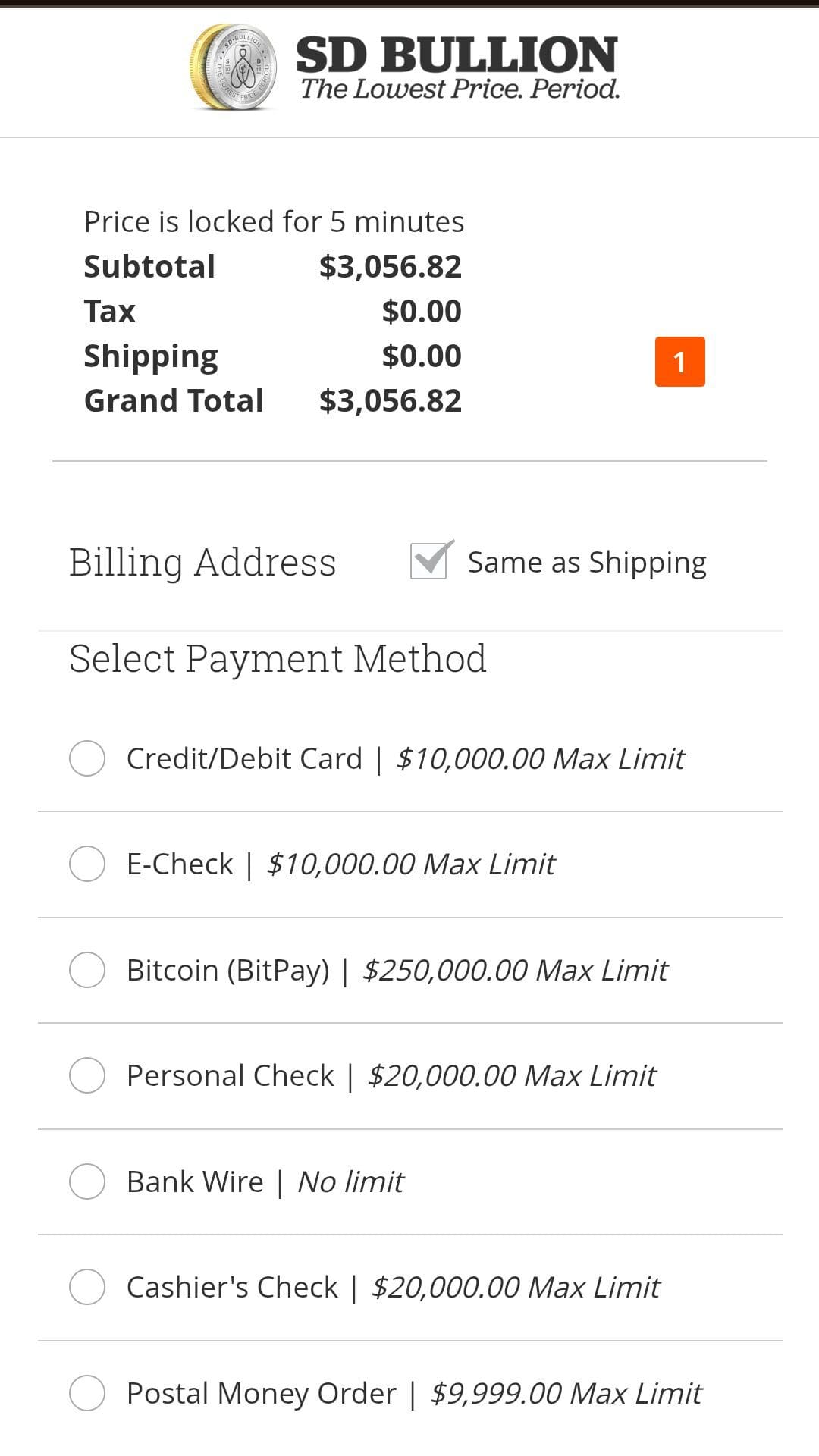

Once you’ve picked your metals, it’s time to check out. Prices are locked in when you submit your order, so acting quickly can make a difference—especially during market swings.

Payment options include:

ACH/eCheck, personal check, or wire transfer – usually offer the best pricing.

Credit/debit card – convenient but may come with a slightly higher premium.

Bitcoin – also accepted for orders under a certain limit.

You’ll get a confirmation email with order details and payment instructions after checkout.

5. Track Your Order with Full Insurance

After your payment clears, SD Bullion ships your order discreetly, fully insured, and with a tracking number sent to your email. Shipping times typically range from 3–10 business days depending on payment type.

What to expect:

Delivery via USPS, UPS, or FedEx depending on order value.

Plain, secure packaging with no mention of precious metals.

Signature required on high-value orders for extra security.

If anything happens in transit—like loss or damage—their insurance policy has you covered.

Does SD Bullion Offer a Buyback Program

Yes, SD Bullion does offer a buyback program, making it easy to sell your gold, silver, or platinum when you're ready.

The process is pretty straightforward: you call their trading desk to lock in your price, then ship your metals to them (insured, of course).

Once received and verified, you’ll get paid by check, wire, or crypto—whatever you prefer.

Gold vs. Silver vs. Platinum on SD Bullion: Which Is Best?

Choosing between gold, silver, and platinum depends on your budget, goals, and how much risk you're comfortable with. Here’s a quick breakdown of each:

Metal | Best For | Price Range | Use Case |

|---|---|---|---|

Gold | Long-term stability | High | Wealth preservation |

Silver | Affordable stacking | Low | Entry-level, bulk |

Platinum | Diversification + riskier | Medium-High | Industrial, niche |

-

Gold

Gold is SD Bullion’s most popular metal for long-term investors. It’s higher in price per ounce but known for its stability and global recognition.

SD Bullion offers a wide range of gold coins and bars—including IRA-eligible options—making it ideal for those looking to preserve wealth and diversify with physical assets.

-

Silver

Silver is a top seller on SD Bullion thanks to its affordability and accessibility. It’s perfect for new buyers or anyone stacking regularly, with options like 1 oz rounds, 10 oz bars, and junk silver bags.

-

Platinum

While less common, for investors wanting to go beyond the usual gold and silver, SD Bullion offers platinum bars and select coins.

How to Get the Best Prices on SD Bullion

If you're buying precious metals on a budget—or just want to get the most for your money—there are a few ways to save on SD Bullion. Here’s how to lock in the best deals:

Use wire or eCheck payments: These payment methods usually qualify for the lowest prices. Avoid credit cards if possible.

Buy in bulk: Many items offer tiered pricing. The more you buy, the lower your cost per ounce.

Shop the “Deals” section: SD Bullion regularly discounts overstocked or promotional products.

Stick to low-premium items: Generic bars and rounds typically cost less than government-minted coins.

Sign up for their email list: You’ll get alerts for flash sales and limited-time offers.

A little planning can go a long way toward maximizing value on your next gold or silver order.

FAQ

While you can browse products without an account, you’ll need to create one to complete a purchase, access order history, and track deliveries.

In most cases, purchases are not reported. However, certain cash transactions or large sales may trigger reporting requirements—check their terms or consult a tax professional.

Yes, SD Bullion offers secure storage through their partnered vaulting service. This is ideal if you don’t want to store physical metals at home.

Orders cannot be canceled once placed without penalty. Since prices are locked in, canceling typically incurs a market loss fee.

No, SD Bullion only ships to addresses within the United States and U.S. territories. International orders are not supported at this time.

All orders are fully insured during shipping. If your package is lost or damaged, SD Bullion will work with the carrier to resolve the issue and replace or refund the order.

There’s no strict minimum, but smaller orders may carry higher premiums per ounce. Bulk purchases often unlock better pricing.