Gemini | eToro | |

Supported Coins | +150 | N/A |

Spot Trading Fees | $0.99 – 1.49% (Web & Mobile), 0.20% – 0.40% (Active Trader)

For Gemini’s website or mobile app users are charged 0.50% convenience fee For Active Trader, 0.40% for taker trades and 0.20% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.03%. | 1% |

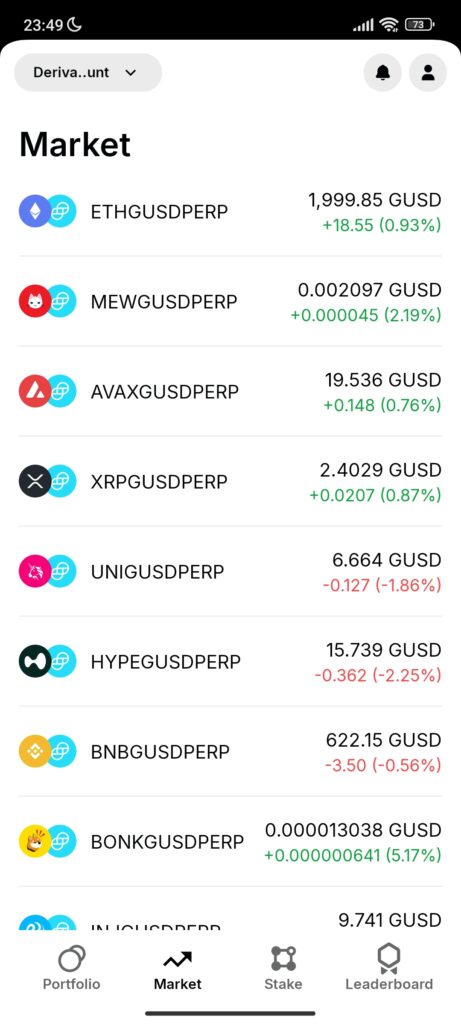

Future Trading Fees | $3–$5 per action | |

Our Rating |

(4.2/5) |

(4.4/5) |

Read Review | Read Review |

Gemini vs eToro: Compare The Best Features

When choosing between Gemini and eToro, it’s important to look deeper into how each platform actually works day-to-day.

In this side-by-side comparison, we’ll break down their ease of use, crypto selection, Web3 capabilities, and trading features — helping you pick the right one for your investing style.

-

Ease of Use & Mobile App Experience

Gemini focuses on simplicity and professionalism, offering a clean web platform and a mobile app that mirrors its desktop experience.

Beginners can quickly buy Bitcoin or set up recurring purchases, while advanced users switch to ActiveTrader for deeper features.

eToro stands out for its social feed, CopyTrader functionality, and intuitive app that feels more like a social network than a traditional exchange. Users can track top traders and invest with a few taps.

Overall, eToro feels more engaging and beginner-friendly for everyday users, while Gemini offers a more traditional, secure trading environment.

-

Cryptocurrency Selection

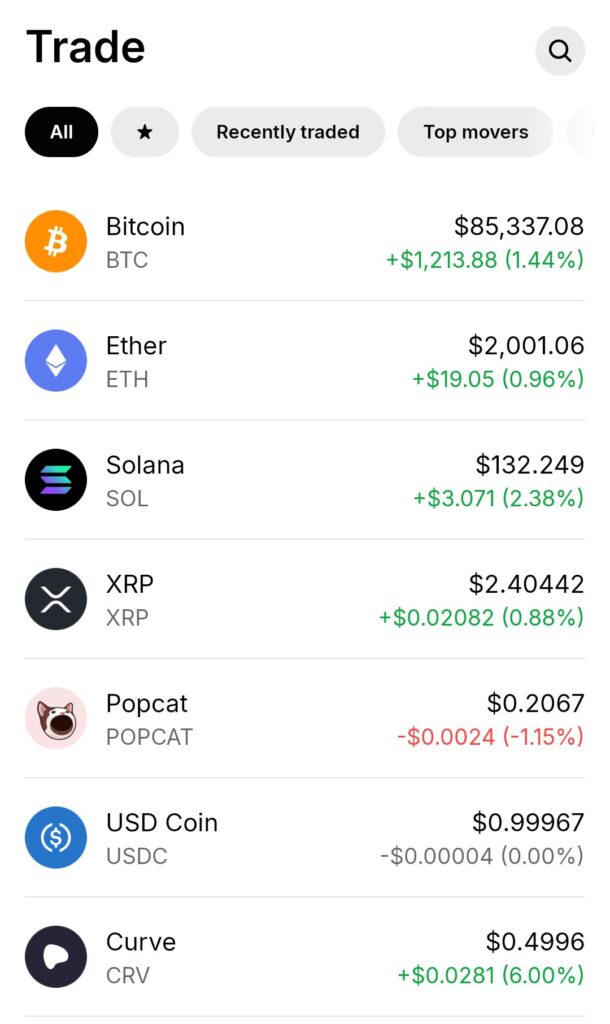

Gemini supports +150 cryptocurrencies, including Bitcoin, Ethereum, stablecoins like GUSD, and access to NFTs via Nifty Gateway. It’s strong for investors focused on top coins and regulated assets.

While eToro offers a broader selection of cryptocurrencies globally (+25), it provides a much smaller crypto selection for U.S. users—mainly Bitcoin, Ethereum, and Bitcoin Cash. There’s no crypto-to-crypto trading, either.

-

Trading Crypto Features & Experience

Gemini offers better tools for advanced crypto traders, while eToro provides innovative investing shortcuts for beginners and casual users.

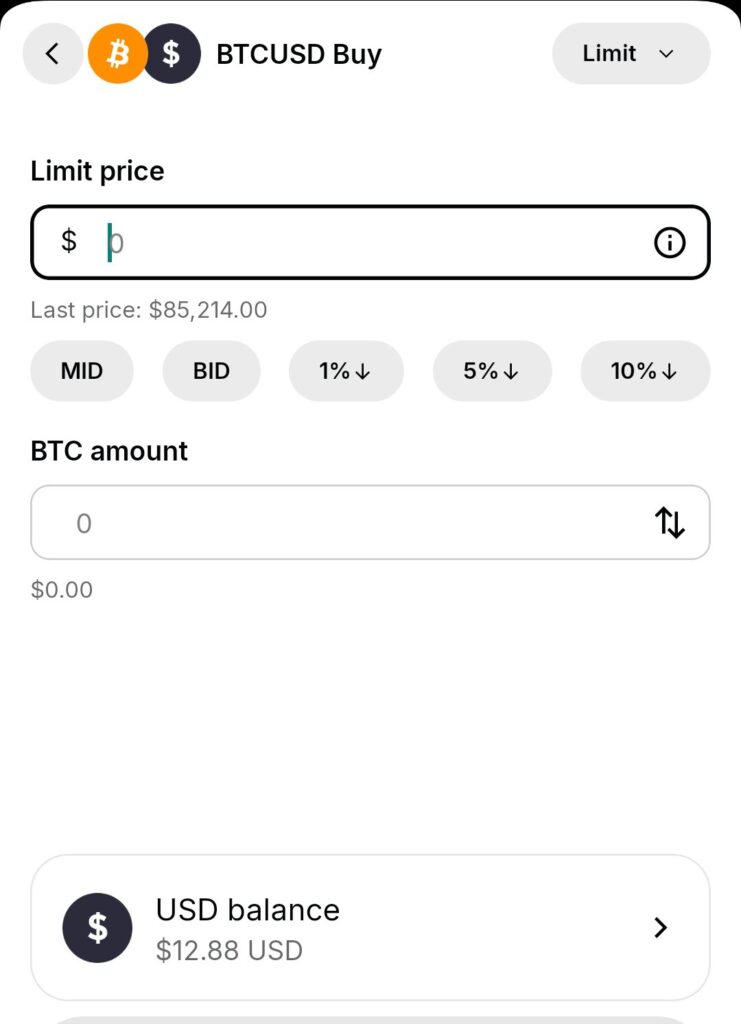

Gemini’s ActiveTrader offers advanced charting tools, limit/stop orders, and lower maker-taker fees — ideal for serious traders.

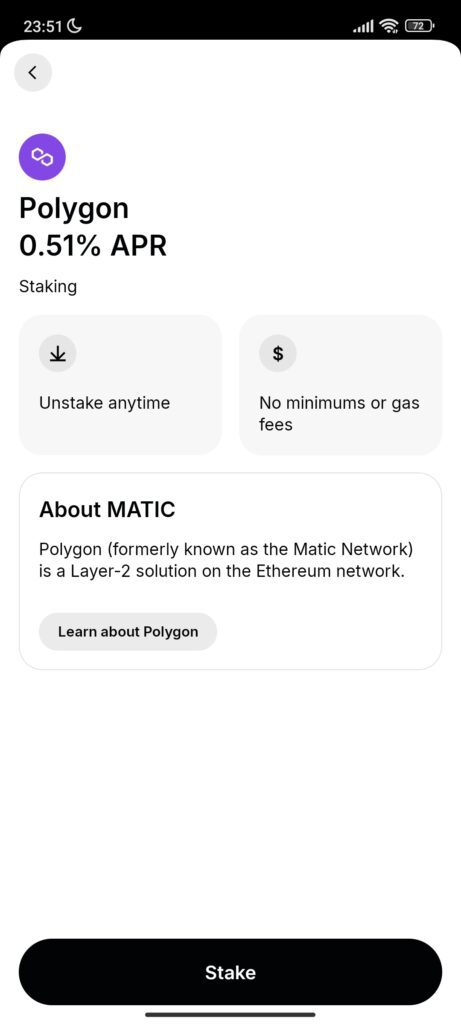

You can stake ETH and MATIC, trade OTC for large orders, and store assets in institutional-grade cold storage.

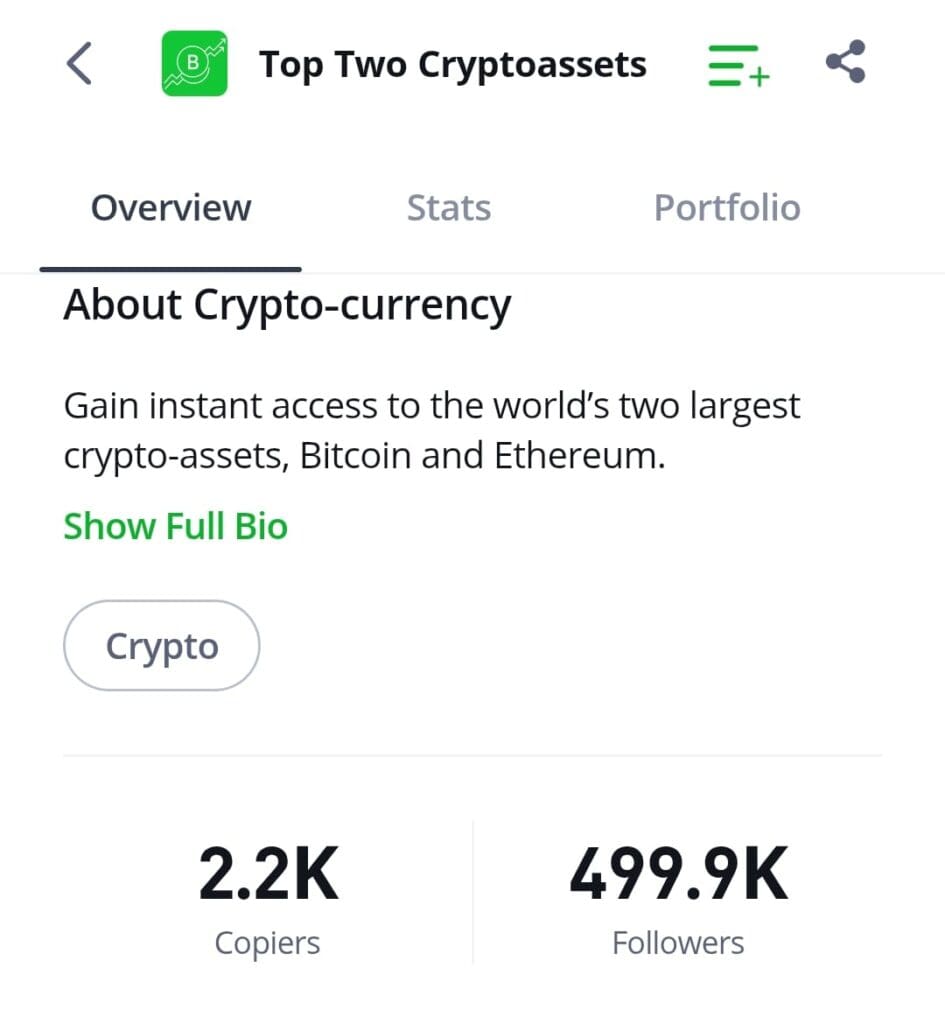

eToro focuses on ease and social trading: CopyTrader allows users to copy professional investors, Smart Portfolios offer curated investment bundles, and users can practice strategies with a $100,000 virtual trading account.

However, it lacks complex trading options, such as derivatives and margin, for cryptocurrencies.

-

Staking Options and Rewards

Gemini offers staking for Ethereum (ETH) and Polygon (MATIC) in the U.S., with a 15% fee on rewards. Users benefit from a secure, regulated platform with features like slashing protection and cold storage.

However, staking options are limited, and U.S. users cannot stake Solana (SOL).

eToro supports staking for Ethereum (ETH), Cardano (ADA), and Tron (TRX), with rewards distributed monthly. The platform automatically enrolls eligible users, simplifying the process.

Reward percentages vary based on user tier, with higher tiers receiving up to 90% of the staking yield.

-

DApps and Web3 Integration

Gemini connects users to Web3 primarily through Nifty Gateway for NFT trading and a few decentralized app (DApp) partnerships. Users can buy NFTs with credit cards or crypto and store them securely.

eToro has limited direct DApp or Web3 integration; its main focus is traditional investing and social trading. It does not offer direct access to DeFi, NFT marketplaces, or staking protocols within the app.

Overall, Gemini is better for users seeking Web3 exposure through NFTs, while eToro stays focused on social investing.

-

Wallet Options

Gemini provides an insured hot wallet with robust security measures, including cold storage for most assets. Users can also transfer assets to external wallets, offering flexibility.

eToro offers the eToro Money Wallet, allowing users to store, send, and receive crypto. However, once crypto is transferred to the wallet, it cannot be moved back to the trading platform.

-

Trading Bots and Automation

Gemini does not offer native trading bots but supports API integrations, allowing users to connect third-party automation tools like TradersPost.

eToro lacks traditional trading bots but features CopyTrader, enabling users to automatically replicate the trades of experienced investors.

Which Investors May Prefer Gemini Exchange?

Gemini is a better choice for investors who value security, regulation, and a professional trading experience. It’s ideal for:

Security-Focused Investors: Those who prioritize top-tier security standards, including cold storage and strong regulatory compliance.

Active Traders: Investors who need advanced trading tools like limit orders, stop orders, and lower fees through ActiveTrader.

U.S. Investors Seeking Broad Access: Users who want to access a wide range of cryptocurrencies and stablecoins in all 50 states.

NFT and Web3 Enthusiasts: Those interested in buying and storing NFTs via Nifty Gateway with integrated fiat payment options.

Which Investors May Prefer eToro Crypto?

eToro fits investors who are new to crypto or prefer a more social, simplified trading experience. It’s ideal for:

Beginner Investors: Those who want an intuitive platform with a social feed, simple trading, and CopyTrader to mirror experts.

Social Traders: Investors looking to interact, follow, and copy the strategies of other top-performing traders.

Multi-Asset Investors: Users who want access not only to crypto but also to stocks, ETFs, and Smart Portfolios in one place.

Hands-Off Investors: Those who prefer pre-built Smart Portfolios for thematic investing without picking individual assets.

Bottom Line

Gemini shines with its focus on high security, professional-grade trading tools, and broader crypto access for U.S. investors.

eToro excels in offering a social, beginner-friendly environment with innovative features like CopyTrader and Smart Portfolios.

Choosing between them depends on your goals: go with Gemini for serious, secure crypto investing, or pick eToro for easy access, social investing, and a multi-asset platform experience.