What Is Morningstar Investor

Morningstar Investor is an investment research platform that provides data-driven insights, portfolio management tools, and expert analysis to help investors make informed decisions.

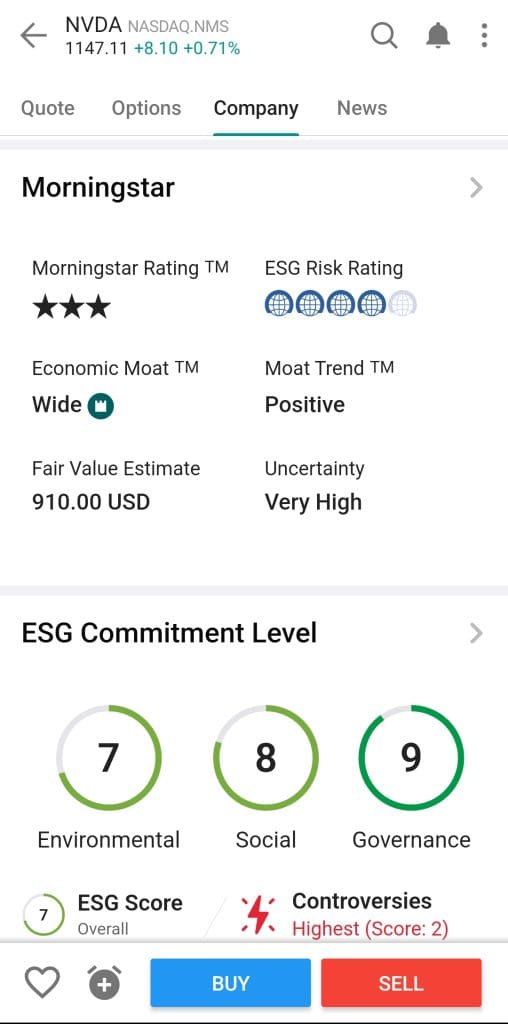

It offers in-depth research on stocks, ETFs, and mutual funds, with features like Fair Value Estimates, Economic Moat Ratings, and independent analyst reports.

The platform caters primarily to long-term investors, dividend-focused investors, and those looking to manage their portfolios efficiently, though it lacks real-time stock data and advanced technical analysis tools.

Plan | Annual Subscription | Promotion |

|---|---|---|

Morningstar Investor | $249 ($20.75 / month) | 7-Day free trial |

How to Use Morningstar Investor Fundamental Analysis

Morningstar Investor is one of the best premium tools for fundamental analysis. It helps investors conduct in-depth research and make informed decisions about stocks, ETFs, and mutual funds.

These tools provide valuable insights into a company’s valuation, financial health, competitive advantage, and long-term growth potential.

1. Leverage the Fair Value Estimate for Valuation Insights

Morningstar’s Fair Value Estimate helps investors determine whether a stock is overvalued, undervalued, or fairly priced based on financial modeling and analysis.

This tool is key for long-term investors who focus on fundamental value rather than short-term market fluctuations.

Fair Value vs. Market Price: Compare the fair value estimate with the current market price to identify potential buying or selling opportunities.

Growth & Profitability Metrics: Morningstar’s analysis includes revenue growth, return on equity (ROE), and profitability to gauge a company’s financial health.

Valuation Perspective: A stock trading well below its fair value estimate may signal an undervalued investment opportunity, while a stock trading above its fair value estimate may be overvalued.

-

Example

An investor looking for undervalued stocks might find that Company A’s fair value is $80, while the stock is trading at $60.

This discrepancy indicates a potential buying opportunity based on Morningstar’s valuation analysis.

2. Utilize the Economic Moat Rating for Competitive Insights

Morningstar’s Economic Moat Rating evaluates a company’s competitive advantage and ability to maintain profitability over time. The moat rating is crucial for assessing the sustainability of a company's business model.

Wide Moat: Companies with a wide moat are expected to maintain their competitive advantage for the long term, making them more reliable investments.

Narrow Moat: Companies with a narrow moat may face more competition and may have less predictable future returns.

No Moat: These companies lack a strong competitive advantage, potentially making them riskier investments.

3. Use the Stock Screener for Tailored Research

Morningstar Investor’s Stock Screener allows investors to filter stocks based on a variety of criteria to identify investments that align with their goals and risk tolerance. The screener can help investors focus on long-term growth, value stocks, or dividend-paying investments.

Valuation Criteria: Filter stocks by price-to-earnings (P/E) ratio or price-to-book (P/B) ratio to identify undervalued or overvalued stocks.

Growth Indicators: Select stocks based on revenue growth, earnings revisions, and profitability.

Dividend Metrics: Screen for stocks with stable dividend yields and strong payout ratios for income-focused investors.

-

Example

An investor interested in large-cap, undervalued stocks with growth potential might filter for:

Market Cap: Over $10B

P/E Ratio: Below 15

Economic Moat: Wide

This screener setup helps identify well-established companies with strong growth prospects and a competitive edge.

4. Benefit from Independent Analyst Reports

Morningstar is one of the best sources for expert-driven Analyst Reports that offer a deep dive into a company’s financial health, competitive positioning, and long-term prospects. These reports are highly valuable for investors who rely on expert analysis and independent opinions.

Investment Philosophy: Each report outlines the analyst’s approach to stock selection, whether it’s growth-focused, value-driven, or income-oriented.

Management Quality: Analysts evaluate the effectiveness of company leadership and management strategies.

Risk & Opportunities: Reports assess both the risks and opportunities that could affect the stock’s performance.

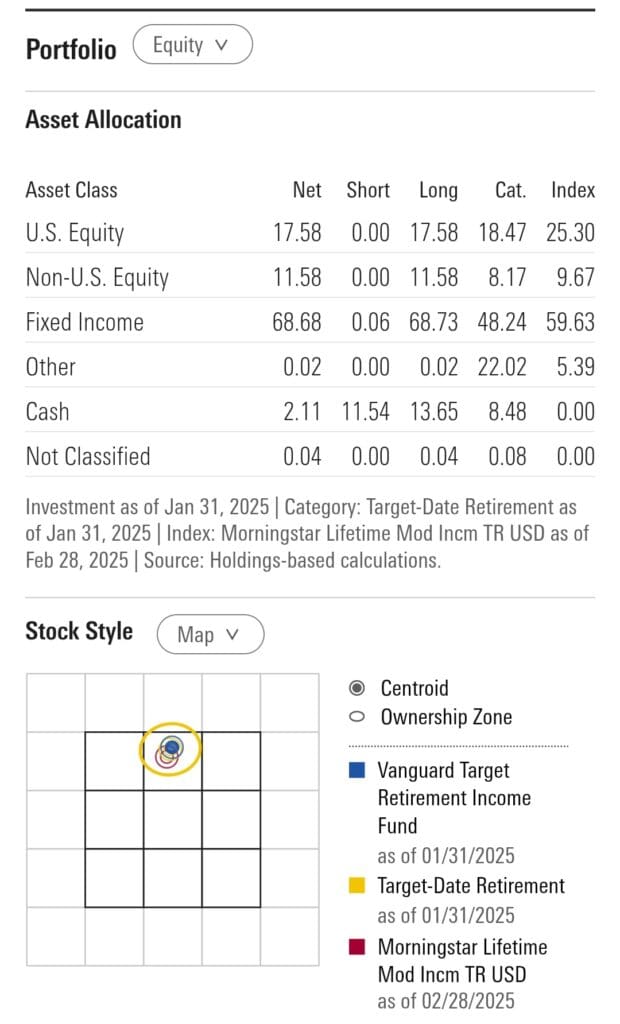

5. Portfolio X-Ray Tool

Morningstar’s Portfolio X-Ray Tool helps investors assess their portfolio's asset allocation, sector exposure, and diversification. It provides insights into how well your investments are balanced and whether they align with your goals.

Asset Allocation: Breaks down the percentage of stocks, bonds, and other assets in your portfolio.

Sector Exposure: Identifies the sectors your investments are concentrated in, helping you avoid overexposure to a particular sector.

Geographic Exposure: Assesses your portfolio's global diversification by tracking international versus domestic investments.

-

Example

An investor may use the Portfolio X-Ray tool to see if their portfolio is overly weighted in U.S. technology stocks, prompting a more diversified approach with international or bond exposure.

6. Fee Analyzer Tool

Morningstar’s Fee Analyzer identifies hidden fees in mutual funds and ETFs, which can erode long-term returns. The tool helps investors minimize expenses by offering a clear view of the fees associated with their holdings.

Expense Ratios: Highlights the ongoing costs associated with each fund, such as management fees.

Transaction Fees: Identifies hidden charges that may not be immediately apparent.

Fee Impact on Returns: Demonstrates how fees impact your long-term investment returns.

7. Risk & Style Analysis

Morningstar’s Risk & Style Analysis tool helps investors understand the risk profile and investment style of their holdings, providing insights into whether a portfolio is too conservative or aggressive.

Risk Level: Assess whether your portfolio is too volatile or conservative based on historical performance.

Investment Style: Identifies whether your portfolio is growth-oriented, value-focused, or income-generating.

Risk vs. Return: Helps you balance your risk tolerance with the potential for returns.

-

Example

An investor looking for more stable returns might use the tool to find that their portfolio is tilted towards growth stocks with high volatility.

This could prompt them to reallocate toward more conservative, income-generating assets.

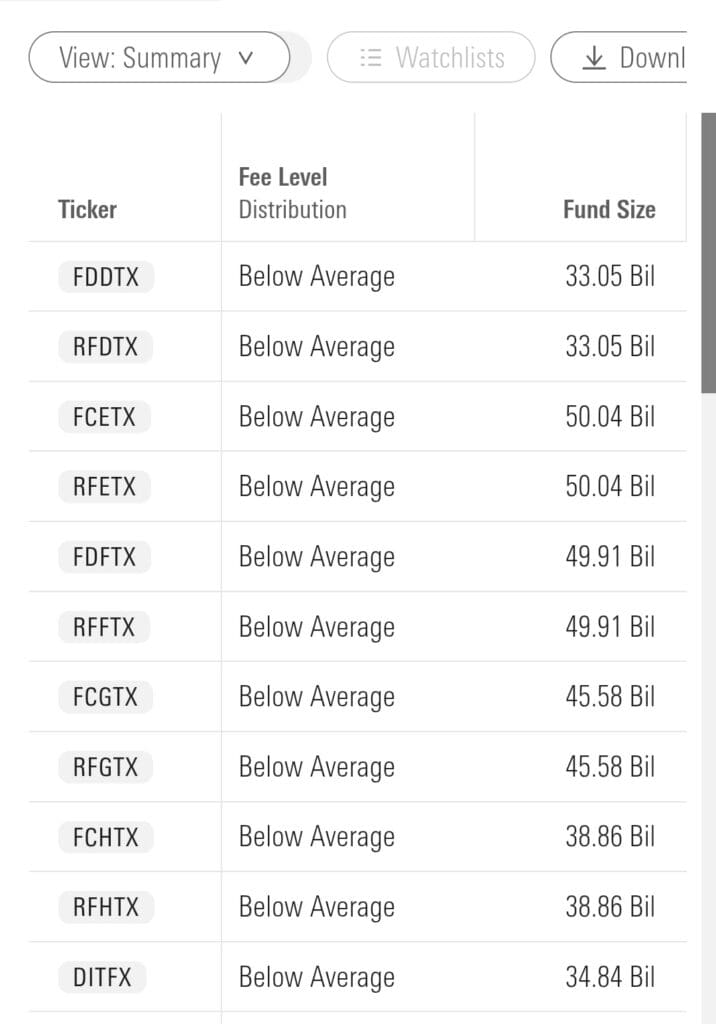

8. Mutual Fund & ETF Screeners

Morningstar provides dedicated screeners for mutual funds and ETFs, allowing investors to filter investments by cost, performance, risk, and management quality.

Fund Category Filters: Based on your strategy, select from bond, balanced, international, or domestic equity funds.

Expense Ratios: Identify low-cost funds, which are especially important for long-term performance.

Morningstar Medalist Ratings: Use forward-looking Gold, Silver, or Bronze ratings to spot high-quality funds.

9. Morningstar Style Box

The Style Box is a nine-square grid that categorizes stocks and funds by market capitalization and investment style (value, blend, growth), helping investors visualize portfolio exposure.

Style Allocation: Determine whether your portfolio leans toward growth or value.

Size Breakdown: Identify if you’re overexposed to small-, mid-, or large-cap companies.

Diversification Gaps: Spot missing asset styles and rebalance accordingly.

A conservative investor might discover their portfolio is overweight in small-cap growth stocks and may shift to large-cap value holdings to reduce volatility.

10. Market & Sector Trend Analysis

Morningstar delivers macroeconomic commentary, sector performance analysis, and industry trends, which help investors align their strategies with broader market movements.

Sector Comparisons: See how sectors like tech, energy, or healthcare are performing relative to benchmarks.

Industry Reports: Learn how companies compare to peers in their category.

Economic Trends: Monitor inflation, interest rates, and GDP changes to anticipate market impact.

An investor tracking economic cycles might review Morningstar’s sector outlooks and overweight their portfolio toward defensive sectors like healthcare during downturns.

FAQ

While Morningstar doesn’t have a dedicated sector rotation tool, its sector and industry trend analysis helps investors monitor outperforming or lagging sectors. This data can guide tactical reallocation decisions across market cycles.

Morningstar doesn’t offer traditional backtesting like trading platforms, but investors can review historical performance, risk metrics, and trailing returns to assess how a strategy would have performed over time.

Morningstar allows investors to filter ETFs and mutual funds by tax cost ratio and turnover rate, helping users choose tax-efficient investment options for taxable accounts.

Yes, Morningstar Investor lets users create and compare multiple portfolios using tools like Portfolio X-Ray. This is helpful for evaluating different strategies or accounts side by side.

Morningstar’s ESG ratings include environmental, social, and governance factors, but also assess sustainability risks at the portfolio level, such as carbon intensity and climate risk exposure.

Yes, Morningstar provides payout ratio, dividend consistency, and historical yield trends to help investors assess how sustainable and reliable a company’s dividend stream is.

Stock reports include fair value estimates, growth forecasts, competitive positioning, financial metrics, and risk commentary, offering a well-rounded view of each company.

Morningstar covers many REITs and real asset funds. Investors can screen by asset class, check historical returns, and view income characteristics such as yield and payout ratios.

Morningstar rates fund managers as part of the Medalist system and provides insights into their tenure, investment approach, and track record compared to peers.