| ||

|---|---|---|

Morningstar Investor | Seeking Alpha Premium | |

Price | $249 ($20.75 / month) | $299 ($24.90 / month)

No monthly subscription |

Best Features | ||

Our Rating |

(4.5/5) |

(4.6/5) |

Read Review | Read Review |

Compare Stock Research & Analysis Features

In this breakdown, we’re putting Seeking Alpha Premium vs. Morningstar Investor head-to-head.

Whether you’re into expert stock picks or proven rankings, we’ll show you which platform gives you more power to level up your investing game.

-

Stock Screening Tools

Morningstar provides a detailed stock screener that allows users to filter by valuation, growth, economic moat, and sector exposure.

It's strong for long-term value-focused investors and gives a fundamental view of stock potential.

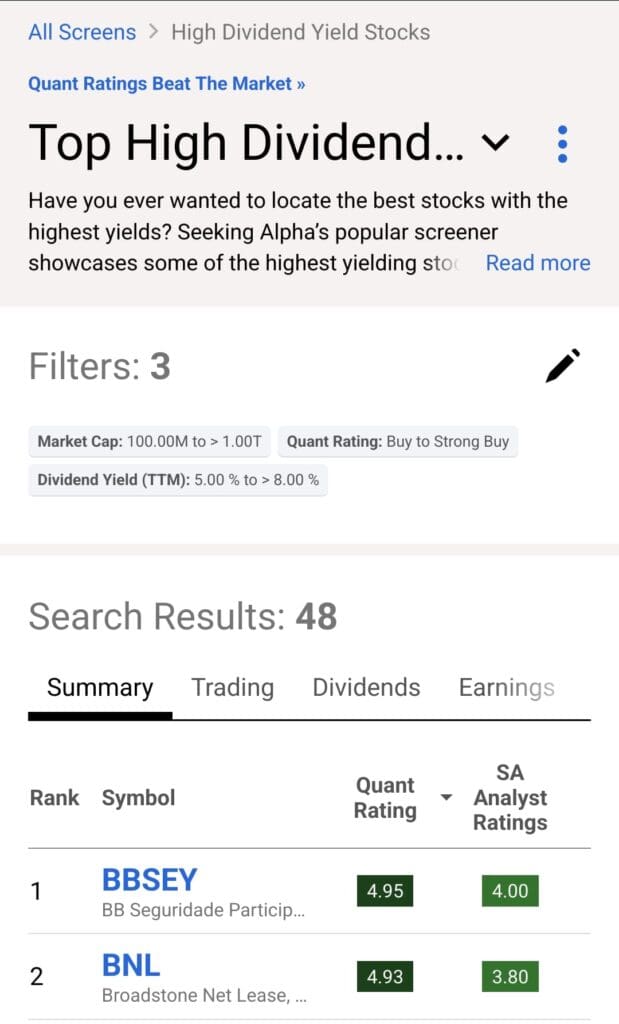

On the other hand, Seeking Alpha Premium's stock screener is more advanced, offering filters like Quant Ratings, Factor Grades, and the ability to sort stocks by valuation, profitability, and momentum.

We found Seeking Alpha’s screener more versatile, especially for those who want to combine fundamental and growth metrics in their search. However, when it comes to ETFs and funds, the Morningstar screener is better.

-

Fundamental Analysis Tools

In our comparison of fundamental analysis tools, Morningstar stands out with its in-depth company research, fair value estimates, and economic moat ratings, ideal for long-term investors.

The independent analyst reports are robust and provide comprehensive breakdowns of stocks, ETFs, and funds.

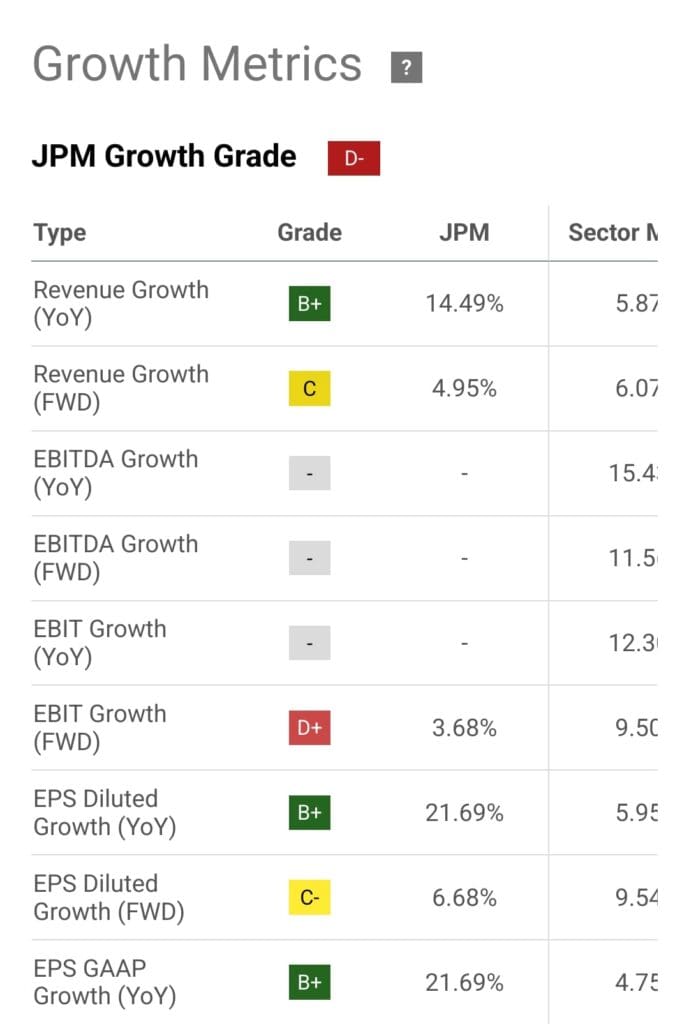

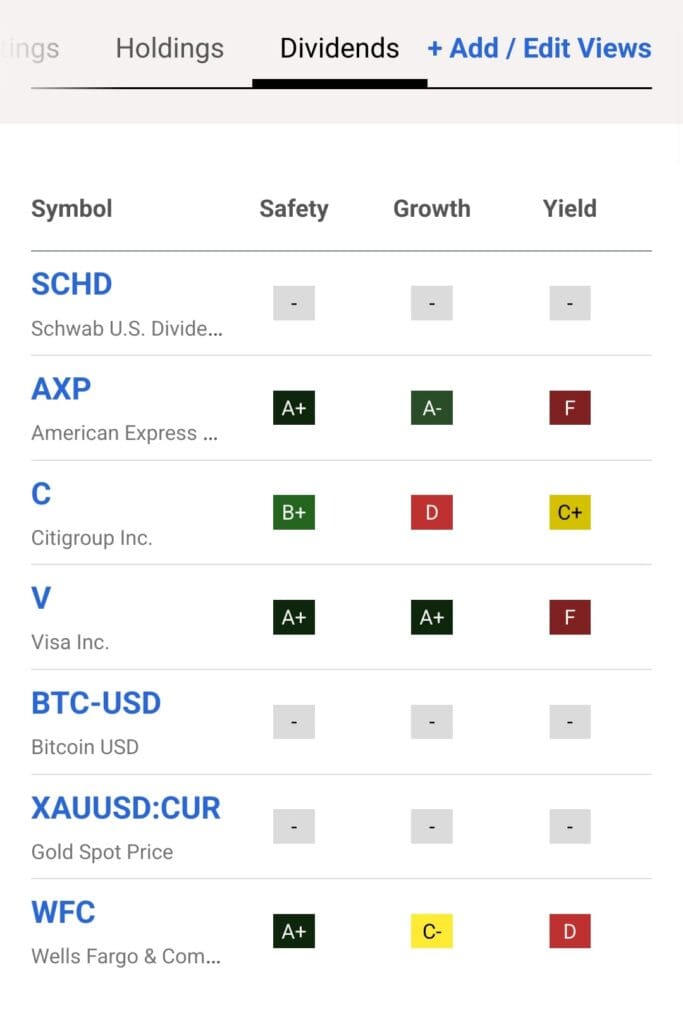

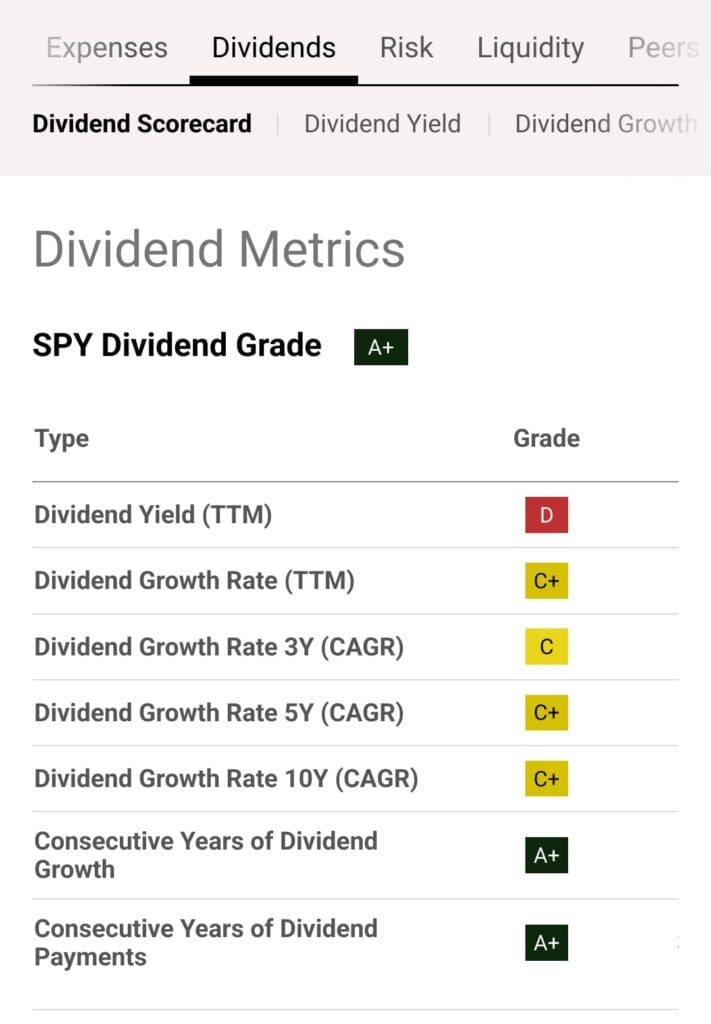

However, Seeking Alpha Premium excels with its Quant Ratings system and Factor Grades, offering data-driven analysis on stock valuation, growth, and profitability.

It also provides access to unlimited premium articles, allowing investors to dive deep into stock performance and analysis.

Overall, Seeking Alpha Premium offers more comprehensive and up-to-date research tools, while Morningstar excels in in-depth analysis.

-

Stock Picks & Recommendations

Morningstar is focused on long-term value investing and offers fair value estimates alongside a robust set of analyst ratings. However, its stock-picking recommendations are less frequent and tend to be conservative.

In contrast, Seeking Alpha Premium offers curated stock lists, such as top dividend stocks and top growth stocks, and access to AlphaPicks, a monthly stock recommendation service.

While Morningstar’s recommendations are grounded in fundamental analysis, Seeking Alpha’s are more dynamic and focus more on real-time data and market trends.

-

Market Sentiment Analysis

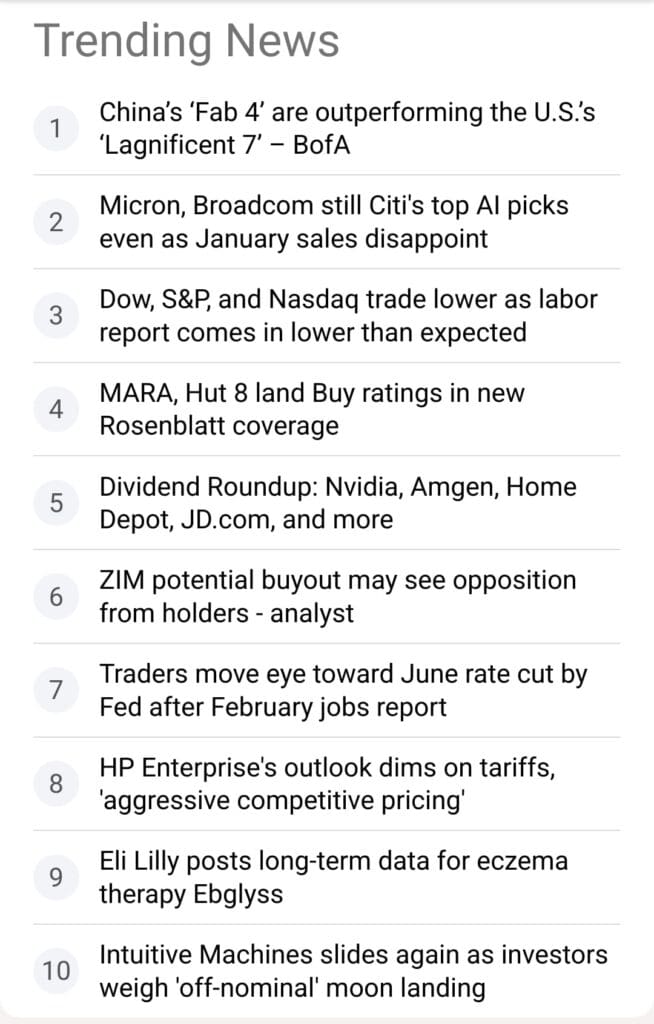

Morningstar Investor offers solid market commentary and analysis, but it lacks the social and real-time sentiment analysis features that Seeking Alpha Premium provides.

Seeking Alpha has a news dashboard, real-time portfolio alerts, and a market news feed that allows users to track major market movements.

Overall, Seeking Alpha Premium excels in market sentiment analysis with its real-time news feed, breaking news alerts, and integration of social features.

-

Portfolio Analysis & Alerts

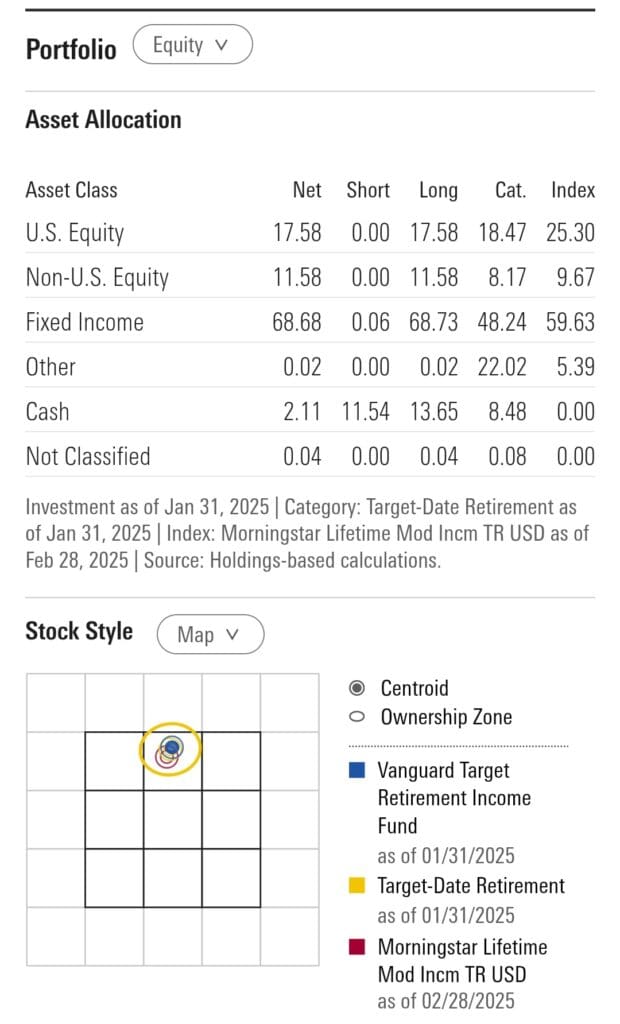

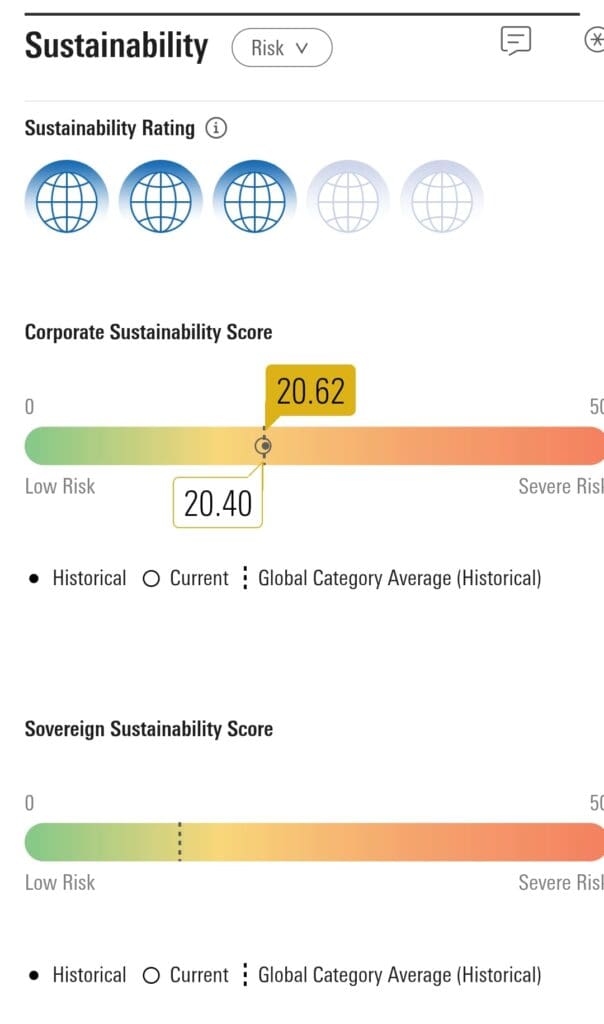

Morningstar Investor is one of the leading portfolio analysis services. Its Portfolio X-Ray tool offers deep insights into asset allocation, sector exposure, and stock overlaps.

It also provides a fee analyzer to identify hidden costs in a portfolio. However, Morningstar’s alerts are limited to email-based notifications and lack real-time push notifications.

In comparison, Seeking Alpha Premium offers real-time portfolio alerts, flagging changes in stock ratings, earnings revisions, and dividend safety scores.

While Seeking Alpha’s portfolio alerts are more immediate, Morningstar’s tools offer more detailed insights into portfolio health.

-

Technical Analysis Options

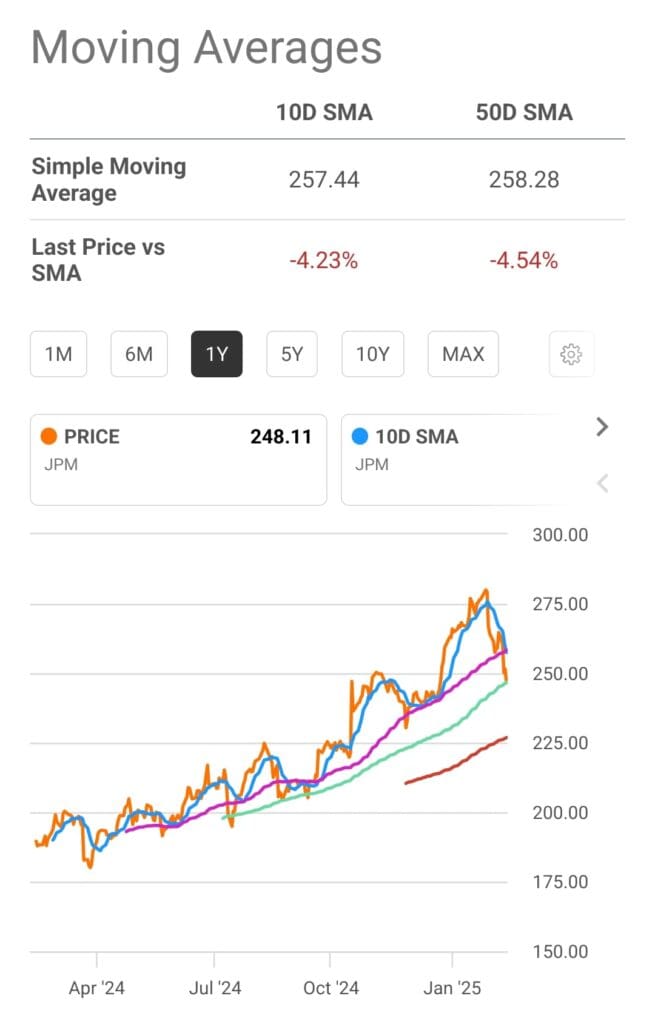

Neither platform stands out in technical analysis, as both focus more on fundamental research.

Morningstar offers basic charting features, including trendlines, moving averages, and RSI indicators.

Seeking Alpha Premium provides more in-depth financial data and earnings charts, but its technical charting capabilities are also basic and lack advanced features.

-

ETF, Bonds & Fund Analysis Tools

Morningstar Investor shines in ETF and mutual fund analysis tools.

It provides in-depth fund ratings, expense ratio comparisons, and performance analysis tools, making it an excellent resource for investors focused on funds.

The platform also offers a mutual fund screener and an ETF screener to filter funds based on performance, fees, and manager quality.

In contrast, Seeking Alpha Premium offers ETF rankings and dividend stock insights but lacks the depth of analysis that Morningstar provides for funds.

While Seeking Alpha’s tools are solid, they are more geared toward stock investors.

Which Investors May Prefer Morningstar Investor?

Morningstar Investor is ideal for long-term investors who focus on excellent fundamental research tools, value investing, and portfolio management.

Value Investors: Morningstar's fair value estimates and economic moat ratings help identify undervalued stocks with strong long-term potential.

ETF & Mutual Fund Investors: The platform extensively analyzes mutual funds and ETFs, with detailed screener tools and fee comparisons.

Retirement Planners: With tools like Portfolio X-Ray and retirement fund insights, Morningstar is great for those building diversified, low-cost retirement portfolios.

Plan | Annual Subscription | Promotion |

|---|---|---|

Morningstar Investor | $249 ($20.75 / month) | 7-Day free trial |

Which Investors May Prefer Seeking Alpha Premium?

Seeking Alpha paid subscription is well-suited for investors looking for real-time data, comprehensive stock analysis, and actionable recommendations.

Growth & Value Investors: With Quant Ratings and Factor Grades, Seeking Alpha offers a data-driven approach to stock selection, highlighting top growth and value stocks.

Dividend Investors: Premium access to dividend stock insights, safety ratings, and yield comparisons makes Seeking Alpha perfect for income-focused investors.

Self-Directed Investors: Investors who prefer doing their own research can benefit from unlimited access to premium articles, earnings call transcripts, and expert analysis.

Plan | Annual Subscription | Promotion |

|---|---|---|

Seeking Alpha Premium | $299 ($24.90 / month)

No monthly subscription | $4.95 for 1 month |

Seeking Alpha Pro | $2,400 ($200 / month)

No monthly subscription | $99 for 1 month |

Seeking Alpha – Alpha Picks | $499 ($41.58 / month)

No monthly subscription | N/A |

Bottom Line

Morningstar Investor excels in mutual fund and ETF analysis, fair value estimates, and comprehensive portfolio management tools.

Seeking Alpha Premium shines with its data-driven stock ratings, advanced screening tools, and access to exclusive expert articles and recommendations.

Both platforms cater to different types of investors, depending on their focus.