InvestingPro+ | Stock Analysis Pro | |

Price | $300 ($24.99 / month) | $79 ($6.58 / month) |

Best Features | ||

Our Rating |

(4.6/5) |

(4.4/5) |

Read Review | Read Review |

InvestingPro+ vs. Stock Analysis Pro: Compare Features

Let’s dive into a comparison of InvestingPro+ and Stock Analysis Pro, breaking down their features and tools.

We’ll help you figure out which platform gives you the best bang for your buck when it comes to stock research, market analysis, and investment strategies

-

Stock Screening Tools

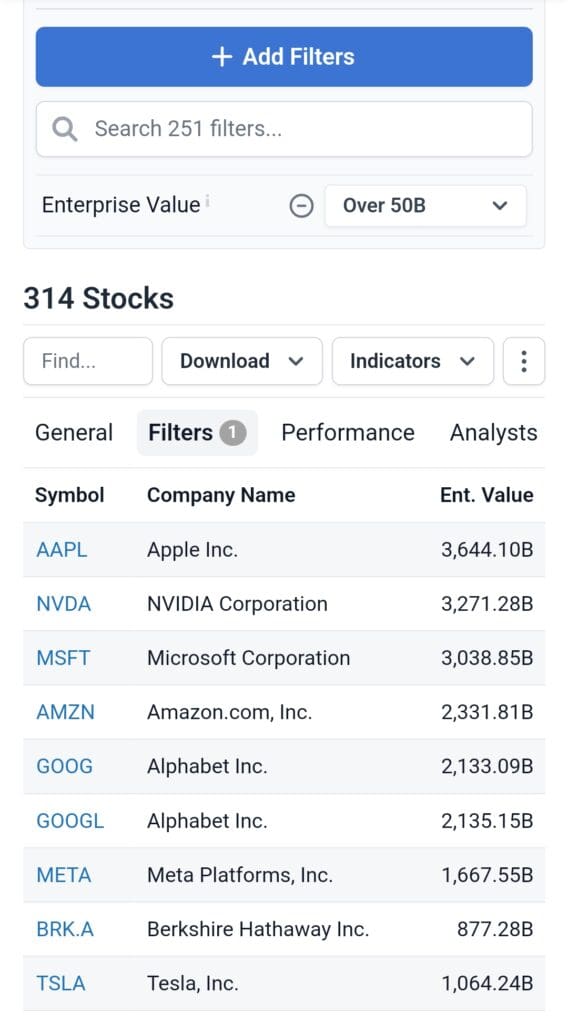

We tested the stock screening capabilities of Stock Analysis Pro and InvestingPro+, and both platforms provide strong options for screening stocks based on various financial metrics.

Stock Analysis Pro offers an advanced stock screener with over 200 filters. It allows investors to analyze stocks with detailed financial data and forecasts, and screeners can be saved and downloaded in Excel/CSV format.

On the other hand, InvestingPro+ shines with its 1,200+ fundamental metrics and customizable metric views. This makes it more versatile for data-driven investors who need a deeper analysis.

InvestingPro+ also allows for AI-powered stock picks, adding extra value to the screening process.

-

Our Winner

InvestingPro+ provides a more comprehensive and customizable screening tool with a broader selection of metrics.

-

Fundamental Analysis Tools

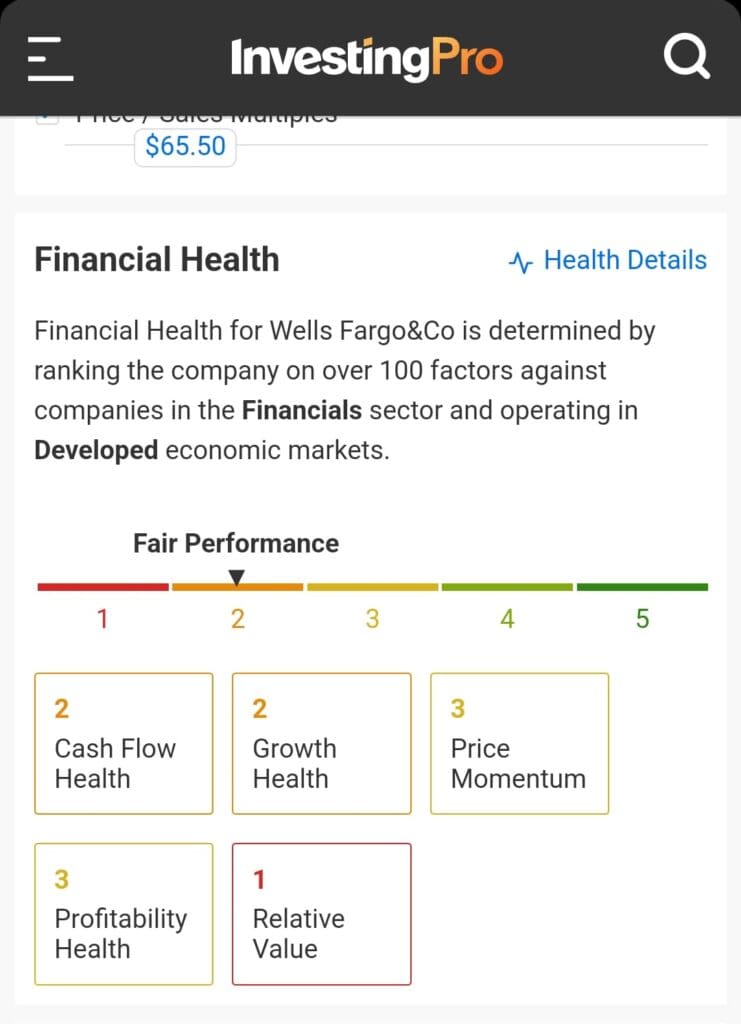

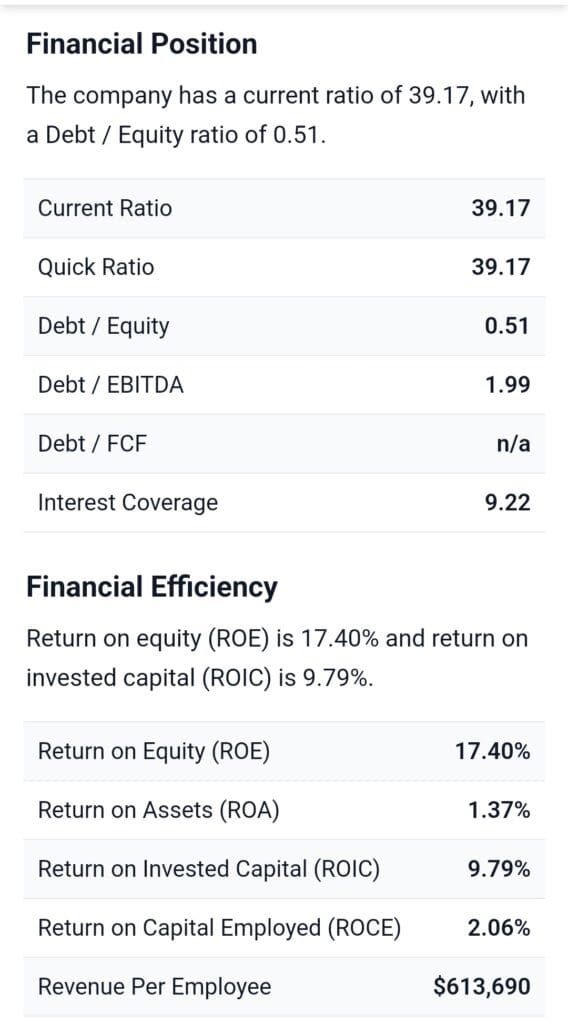

Both Stock Analysis Pro and InvestingPro+ offer robust fundamental analysis tools, but each has its unique strengths.

InvestingPro+ gives access to 10 years of financial data and 14+ financial valuation models (including DCF and Dividend Discount models).

It also includes AI-powered stock insights (ProPicks) and a company health score, which gives a clear view of a stock’s stability.

Stock Analysis Pro excels with its long-term financial history (up to 40 years) and full access to corporate actions data, providing deep insights into a stock's historical performance. It also offers strong financial reports and analysis from top Wall Street analysts.

However, it lacks Wall Street analyst ratings and AI-driven insights.

-

Our Winner

InvestingPro+ provides a more advanced and AI-driven fundamental analysis suite.

-

Stock Picks & Recommendations

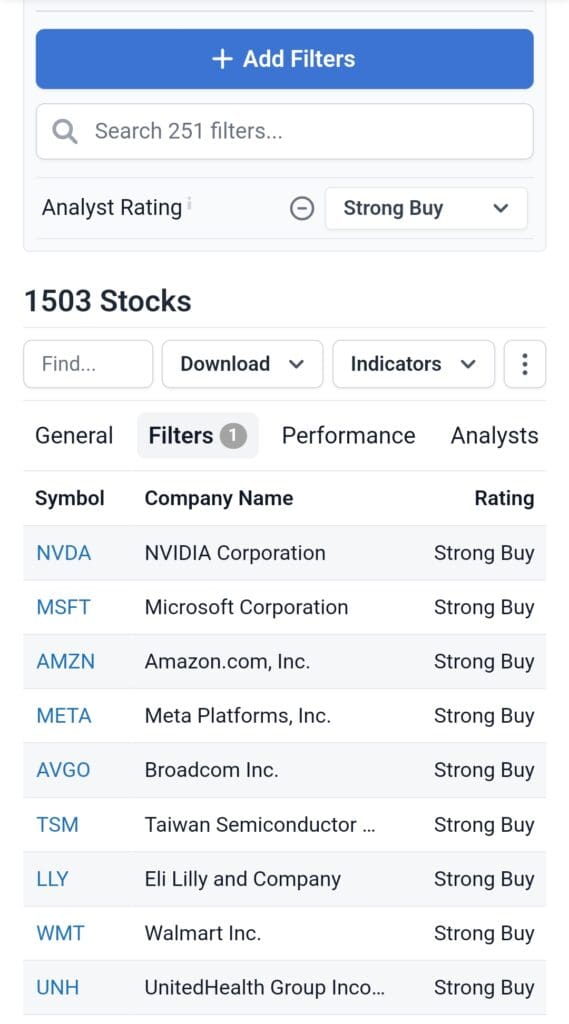

Stock Analysis Pro offers a list of the “Top 50 Strong Buy Stocks,” which is based on analyst ratings, but it doesn't provide personalized stock recommendations or AI-generated insights.

This makes it useful for self-directed investors, but less so for those seeking curated stock picks.

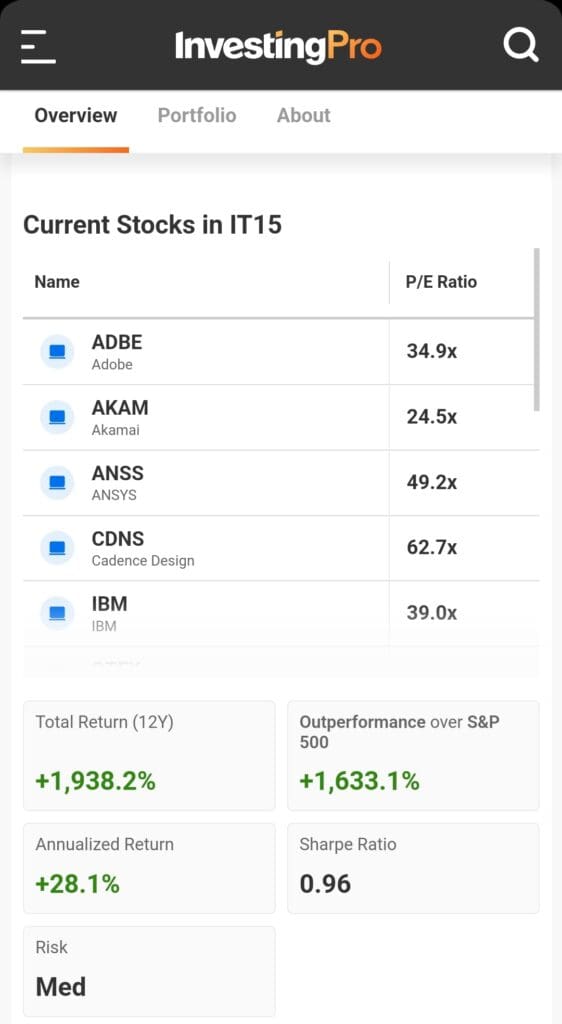

InvestingPro+, on the other hand, stands out with its AI-powered ProPicks, which provide tailored stock recommendations based on key financial trends, historical performance, and valuation.

This makes InvestingPro+ the go-to platform for investors looking for guided stock picks and automated insights.

-

Our Winner

InvestingPro+ is the clear winner with its AI-driven stock picks and personalized recommendations.

-

Market Sentiment Analysis

Stock Analysis Pro offers a news section that aggregates relevant market updates, which can help investors stay informed, but it lacks real-time data and social features.

It does not have integrated sentiment indicators or social media insights.

InvestingPro+, however, provides real-time premium market news and also offers AI-powered ProTips to highlight key stock insights.

-

Our Winner

While neither platform offers deep social media integration like StockTwits, InvestingPro+’s access to more dynamic, real-time market data and news updates offers a more comprehensive market sentiment analysis.

-

Portfolio Analysis & Alerts

Both platforms provide useful portfolio management features, though there are key differences.

Stock Analysis Pro offers unlimited watchlists and portfolios, with tracking for stock price movements, target prices, and performance, but it lacks portfolio performance analysis or risk management tools.

InvestingPro+, on the other hand, provides stock alerts and watchlists, but it doesn’t offer real-time portfolio syncing with brokerage accounts.

Despite the lack of direct integration, InvestingPro+ excels with customizable alerts for price changes and earnings reports, keeping investors informed of key events.

-

Our Winner

Stock Analysis Pro offers more watchlist management options, but InvestingPro+ provides better alert features and customization.

-

Technical Analysis Options

Stock Analysis Pro provides an interactive charting tool with over 200 technical indicators, including moving averages, RSI, and Bollinger Bands.

This tool allows for detailed trend analysis and comparisons, but it lacks the real-time data and advanced charting features that some active traders might require.

On the other hand, InvestingPro+ offers decent technical analysis tools but with fewer advanced features. The charts are customizable, allowing for basic analysis like moving averages and RSI.

-

Our Winner

Stock Analysis Pro

-

ETF, Bonds & Fund Analysis Tools

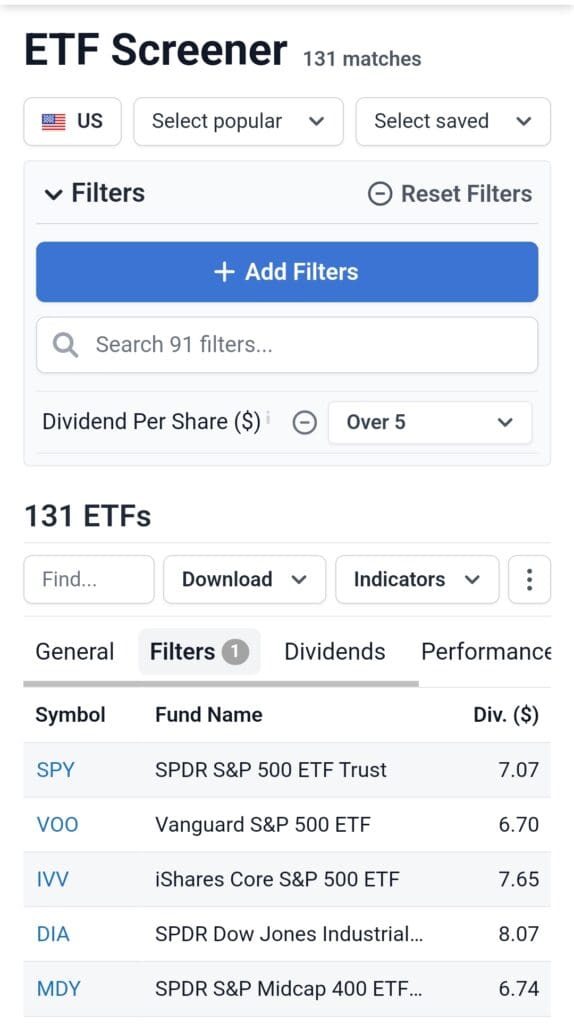

Stock Analysis Pro offers an advanced ETF screener with over 200 indicators, including fund composition, assets under management, and dividend yield.

It allows for in-depth analysis of ETFs and full access to ETF holdings, providing a comprehensive view of their underlying assets. However, it does not focus on bonds.

InvestingPro+ provides a solid tool for ETF and stock analysis but lacks the depth in ETF comparison tools found in Stock Analysis Pro.

While it has access to financial models and metrics, its analysis for bonds and funds is not as robust as Stock Analysis Pro’s specialized ETF screener.

-

Our Winner

Stock Analysis Pro excels in ETF analysis, making it the better choice for fund analysis.

Which Investors May Prefer InvestingPro+?

Investing.com subscription is perfect for investors who rely on deep financial analysis, AI-driven insights, and customizable stock research tools.

Data-Driven Investors: Access to 1,200+ metrics for in-depth stock screening and analysis.

AI-Driven Investors: AI ProPicks offer curated stock recommendations based on historical performance and valuation trends.

Long-Term Investors: The 10-year financial data helps investors spot long-term trends in earnings, revenue, and profitability.

Dividend Investors: Detailed dividend insights and payout data for those focusing on income-generating portfolios.

Plan | Monthly Subscription |

|---|---|

InvestingPro | $15.99

$120 ($9.99 / month)

if paid annually |

InvestingPro+ | $39.99

$300 ($24.99 / month) if paid annually |

Which Investor Types Prefer Stock Analysis Pro?

Stock Analysis subscription is ideal for budget-conscious investors who value comprehensive historical data, analyst rankings, and advanced screening tools without breaking the bank.

- Budget-Conscious Investors: More affordable compared to alternatives while still providing valuable research tools and features.

- Self-Directed Investors: Perfect for those who prefer conducting their own research with in-depth stock and ETF data.

- Long-Term Investors: Access to up to 40 years of financial history for tracking long-term performance and trends.

- Fundamental Analysts: Robust features for evaluating financials, valuation metrics, and corporate actions.

Plan | Annual Subscription | Promotion |

|---|---|---|

Stock Analysis Pro | $79 ($6.58 / month) | 60-day money back guarantee |

Bottom Line

Stock Analysis Pro excels in providing deep financial history, analyst rankings, and advanced stock and ETF screeners. It's perfect for self-directed, long-term investors who prioritize detailed research tools.

On the other hand, InvestingPro+ stands out with its AI-driven stock picks, customizable dashboards, and advanced screener features, making it ideal for data-driven investors seeking smarter stock insights.