What Is Morningstar Investor?

Morningstar Investor is a research and portfolio analysis platform tailored for long-term investors. It offers in-depth tools to evaluate stocks, ETFs, and mutual funds using fundamental data, analyst ratings, and fair value estimates.

The platform includes three key screeners:

- Stock Screener (focused on valuation, profitability, and moat)

- ETF Screener (for filtering by cost, risk, and strategy)

- Mutual Fund Screener (for tracking returns, expenses, and manager quality).

These tools help investors identify high-quality, cost-efficient investments suited to their financial goals.

How to Use Morningstar Investor Stock & ETF Screeners

Morningstar Investor offers powerful stock and ETF screeners designed for long-term investors who prioritize fundamentals over technical signals.

These screeners help users narrow down quality investment opportunities using Morningstar's proprietary ratings, valuation metrics, and competitive advantage insights.

1. Search for High-Yield Dividend Stocks or Funds

Morningstar’s screeners can target stocks, ETFs, or funds that pay consistent and high dividend income—ideal for income-focused investors.

Dividend Yield Filter: To identify income opportunities, focus on securities with yields above a certain threshold (e.g., 4%).

Dividend Growth Trends: Use report-level data to check if dividends have been increasing over time, not just high in the present.

Payout Ratio for Sustainability: Screen out high-risk payers by filtering for payout ratios under 60%, which suggests the dividend is likely sustainable.

-

Example

An investor seeking stable income screens for:

Dividend Yield: Over 4%

Payout Ratio: Under 60%

Sector: Utilities

This identifies dividend stocks with reliable income and low risk of payout cuts.

2. Target Sector-Specific Opportunities

Morningstar lets users filter by sector or industry exposure, helping investors focus on economic trends or fill diversification gaps.

Sector Filter: Narrow results to areas like Technology, Healthcare, or Financials to align with macro views or rotation strategies.

Combine with Fundamentals: Pair sector filters with valuation metrics or moat ratings to find value within a specific industry.

Diversification Insight: Helps investors avoid over-concentration in a single sector by analyzing how a holding fits within the broader portfolio.

-

Example

An investor bullish on healthcare innovation screens for:

Sector: Healthcare

Economic Moat: Wide

Earnings Growth: Over 8%

This finds strong companies with defensible market positions in the healthcare space.

3. Discover Top-Rated Passive Index Funds

Morningstar’s ETF and mutual fund screeners can identify low-cost, highly rated passive funds suitable for long-term investing.

Fund Type Filter: Filter for index-tracking funds versus active management.

Medalist Ratings: Use Gold or Silver Medalist Ratings to find index funds that outperform peers in structure, tracking accuracy, and cost.

Compare Tracking Errors: In fund reports, investors can examine how closely an index fund mirrors its benchmark.

-

Example

A cost-conscious investor screens for:

Fund Type: Passive Index Fund

Expense Ratio: Under 0.10%

Medalist Rating: Gold

This narrows the list to index funds that are not only cheap but also expertly managed.

4. Screen for Undervalued Stocks Using the Fair Value Estimate

Morningstar’s Fair Value Estimate helps investors evaluate whether a stock is trading at a discount or premium relative to its calculated intrinsic value.

Price/Fair Value Ratio: This filter compares a stock’s current market price to Morningstar’s analyst-driven fair value. A ratio below 1.00 suggests the stock may be undervalued.

Valuation-Based Filtering: Combine the fair value filter with metrics like P/E ratio and profit margins to validate whether the discount is supported by fundamentals.

Analyst-Driven Valuations: Since Morningstar’s fair value estimates are based on detailed financial modeling, they provide more context than just market sentiment.

-

Example

An investor seeking discounted growth stocks applies:

Price/Fair Value: Below 0.80

Revenue Growth: Over 10%

Sector: Technology

This strategy identifies companies trading at a discount despite strong earnings momentum.

5. Find Funds with Strong Historical Returns and Low Risk

Morningstar lets you screen mutual funds and ETFs based on both past performance and volatility—useful for long-term investors focused on consistency and capital preservation.

3-, 5-, 10-Year Returns: Filters based on trailing returns help identify funds that have outperformed peers over meaningful time periods.

Risk Level: Use Morningstar’s risk ratings (Low, Below Average, Average, etc.) to avoid overly volatile funds that may not suit your strategy.

Sharpe Ratio & Standard Deviation (via report): Though not direct filters, these metrics are shown in fund profiles to evaluate return relative to risk.

-

Example

An investor prioritizing long-term stability sets:

5-Year Return: Top quartile

Risk Level: Low

Fund Type: Actively Managed Mutual Fund

This highlights well-managed funds with strong, consistent results.

6. Filter by Stock Style Using the Morningstar Style Box

The Morningstar Style Box allows users to categorize and screen stocks based on company size (market cap) and investment style (value, blend, growth), offering better portfolio balance and risk alignment.

Market Capitalization Filter: Select between large-cap (established), mid-cap (growing), and small-cap (emerging) stocks to match risk preferences.

Style Filters: Choose Value (undervalued), Growth (rapid expansion), or Blend (a mix) to reflect your investment thesis.

Diversification Benefits: By identifying style gaps in your portfolio, the Style Box helps ensure exposure across different types of equities.

7. Screen by Fund Manager Performance or Tenure

Morningstar allows filtering funds based on the portfolio manager's experience and track record, a critical but often overlooked factor in fund performance.

Manager Tenure: Filter for managers with long-standing tenure (e.g., 10+ years), which often signals consistency and deep expertise.

Medalist Rating: Pair with a Gold or Silver Medalist rating to ensure the fund’s strategy, team, and fee structure are also well-regarded.

Fund Category: Further narrow your results by selecting asset class or fund strategy, such as mid-cap growth or balanced funds.

-

Example

A user searching for experienced fund managers filters by:

Manager Tenure: Over 10 years

Medalist Rating: Gold or Silver

Category: Mid-Cap Blend

This helps uncover long-term, actively managed funds with stable leadership and proven outcomes.

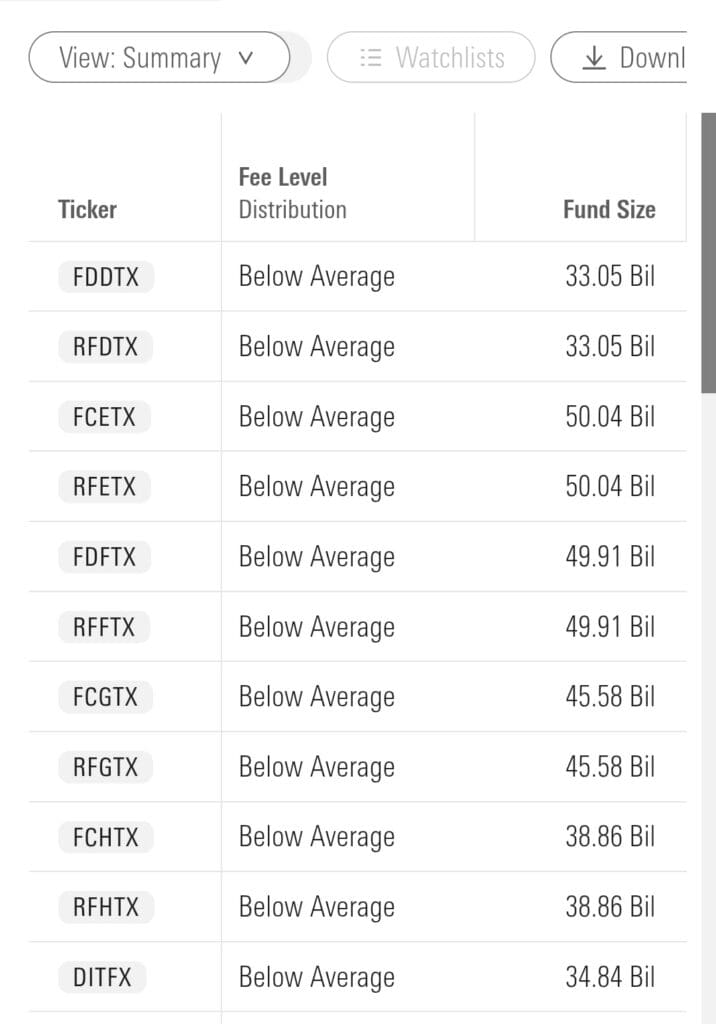

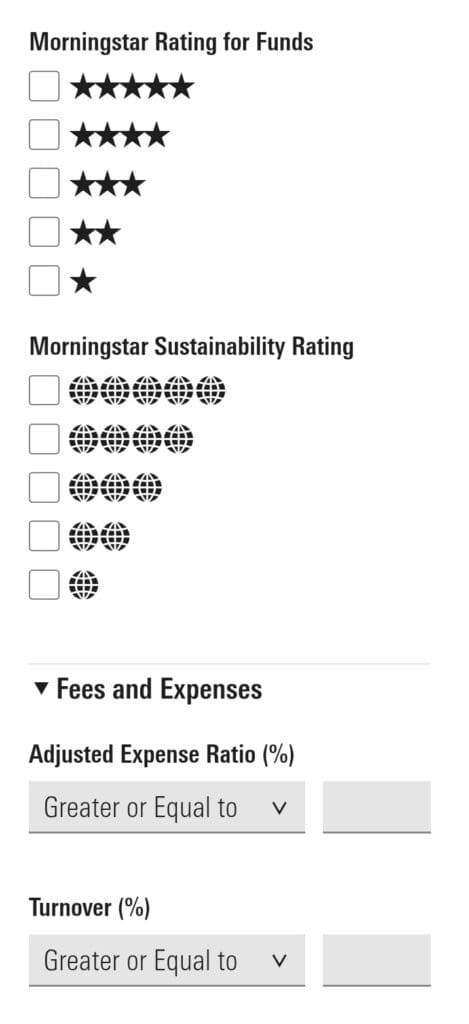

8. Filter Funds by Expense Ratio to Minimize Long-Term Costs

Morningstar allows users to screen ETFs and mutual funds by expense ratio, helping investors reduce cost drag over time.

Expense Ratio Filter: Select a maximum threshold (e.g., under 0.20%) to identify low-cost funds that are more efficient for long-term portfolios.

Compare Similar Categories: View how funds with similar strategies (e.g., large-cap index) differ in costs, even if their performance is close.

Impact on Compounding: Morningstar clearly shows how small cost differences can significantly impact long-term returns due to compounding.

-

Example

An investor building a retirement portfolio filters for:

Fund Type: ETF

Expense Ratio: Under 0.15%

Category: U.S. Large-Cap Blend

This brings up diversified, low-cost ETFs suitable for buy-and-hold strategies.

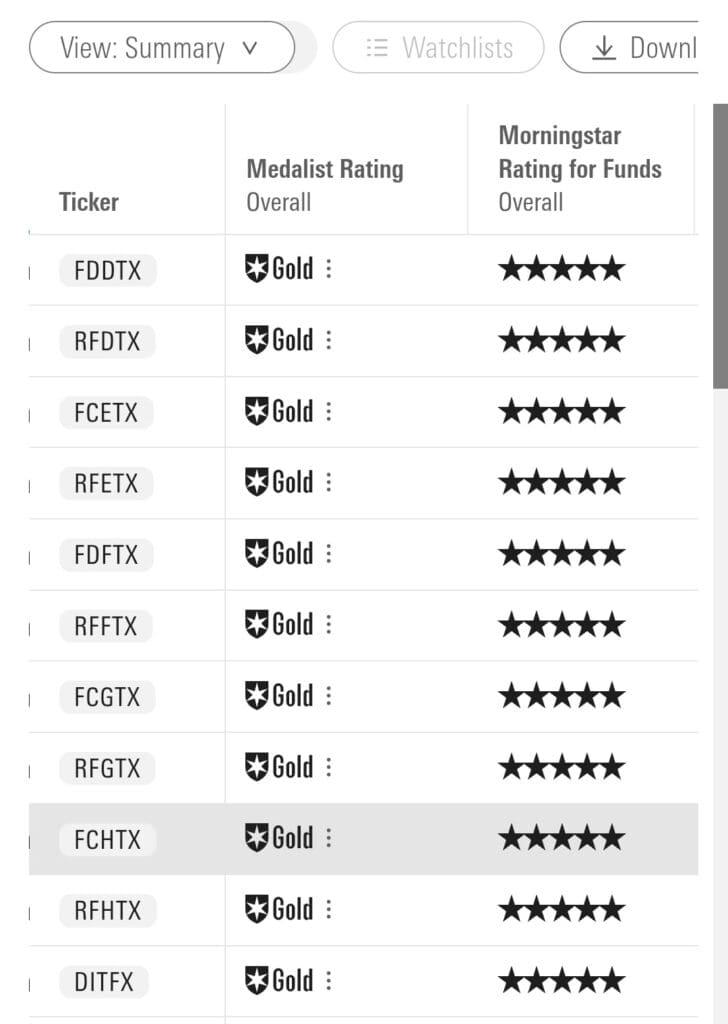

9. Filter by Morningstar Ratings for Long-Term Potential

Morningstar’s Star Ratings and Medalist Ratings provide essential insight into an investment’s historical performance and forward-looking potential.

Star Ratings (1–5 stars): Based on risk-adjusted returns compared to similar investments over 3-, 5-, and 10-year periods. Higher ratings indicate strong past performance relative to peers.

Medalist Ratings (Gold, Silver, Bronze, Neutral, Negative): Forward-looking analyst or machine-assigned ratings that assess a fund’s strategy, management, and fees to determine its long-term outlook.

Use with Confidence: Medalist ratings are particularly useful for screening funds that may not yet have strong historical performance but are expected to outperform based on process and people.

10. Screen for Stocks with Wide Economic Moat Ratings

The Economic Moat Rating reflects a company's competitive advantage and ability to protect profits over time—an essential indicator for buy-and-hold investors.

Moat Categories: Filter stocks by “Wide”, “Narrow”, or “None” based on Morningstar’s qualitative analysis of business durability.

Longevity Indicator: Companies with Wide moats tend to maintain high returns on capital and fend off competition longer than peers.

Best Used With Valuation: Combine with the Fair Value filter to find high-quality businesses trading below intrinsic value.

FAQ

Morningstar Investor focuses heavily on U.S.-listed securities, but some international ETFs and ADRs are included. However, full analyst coverage and fair value estimates are mostly limited to domestic stocks and funds.

You can access a limited version of Morningstar’s screening tools through their mobile app, but the desktop platform provides more advanced filtering, customization, and in-depth reports.

Yes, Morningstar allows users to save custom screening criteria for both stocks and funds. This feature is helpful for creating reusable filters tailored to your strategy or watchlist themes.

No, the platform keeps stock, ETF, and mutual fund screeners separate. Each has its own filtering system and data fields based on the asset type.

While there's flexibility, Morningstar does limit some advanced layering, especially on the free version. However, most users will find the available filter combinations sufficient for detailed screening.

Morningstar screeners are designed for fundamental analysis, not technical trading. You won’t find filters for RSI, MACD, or chart patterns like you would on TradingView or Finviz.

Morningstar does not offer true backtesting. However, fund and stock reports often include 3-, 5-, and 10-year performance data to help evaluate past outcomes of similar criteria.

Morningstar doesn’t include model portfolios in its screener, but some analyst reports and premium research highlight curated lists of recommended stocks and funds.

Exporting screener results is not natively available for all users. Higher-tier Morningstar users (typically institutional or enterprise) may have access to download tools, but retail users often rely on copy/paste.