InvestingPro+ | Motley Fool Epic | |

Price | $300 ($24.99 / month) | $499 (41.60 / month)

No monthly plan

|

Best Features | ||

Our Rating |

(4.6/5) |

(4.4/5) |

Read Review | Read Review |

Compare Stock Research & Analysis Features

In this comparison, we’re diving into InvestingPro+ vs. Motley Fool Epic, breaking down their features and tools.

We’ll help you figure out which platform brings the best value for stock research, market analysis, and investment strategies – so you can level up your investing game.

-

Stock Screening Tools

InvestingPro+ offers a highly advanced stock screener with over 1,200 financial metrics, providing a deep and customizable filtering process.

It allows users to research and filter stocks based on valuation, profitability, growth potential, and financial stability, which is great for both traders and long-term investors.

Motley Fool Epic, on the other hand, has a simpler stock screener that’s more focused on identifying stocks for long-term growth.

It doesn’t offer as many filtering options, but it’s easy to use for beginners and those seeking a diversified portfolio.

Overall, InvestingPro+ provides more detailed and customizable stock screening tools.

-

Fundamental Analysis Tools

When it comes to fundamental analysis tools, InvestingPro+ excels with its comprehensive data.

It provides over 10 years of stock financial history, more than 14 financial valuation models (like DCF and Dividend Discount), and company health scores.

Motley Fool Epic also provides solid analysis with 10 years of financial data and stock reports, but it lacks in-depth tools like DCF and valuation models.

But, its focus is on stock picks with curated reports rather than comprehensive financial models.

Therefore, InvestingPro+ offers more robust and detailed fundamental analysis tools.

-

Stock Picks & Recommendations

Motley Fool Epic offers more frequent and diversified stock recommendations.

Motley Fool Epic offers five stock recommendations each month, handpicked by analysts, with in-depth reports detailing why each stock is recommended.

The focus is on long-term growth and includes additional scoring systems and sector-specific insights.

InvestingPro+ provides AI-powered stock picks through its ProPicks tool, which curates stock recommendations based on historical performance and financial trends.

However, it focuses mainly on valuation and fundamentals rather than market momentum.

-

Market Sentiment Analysis

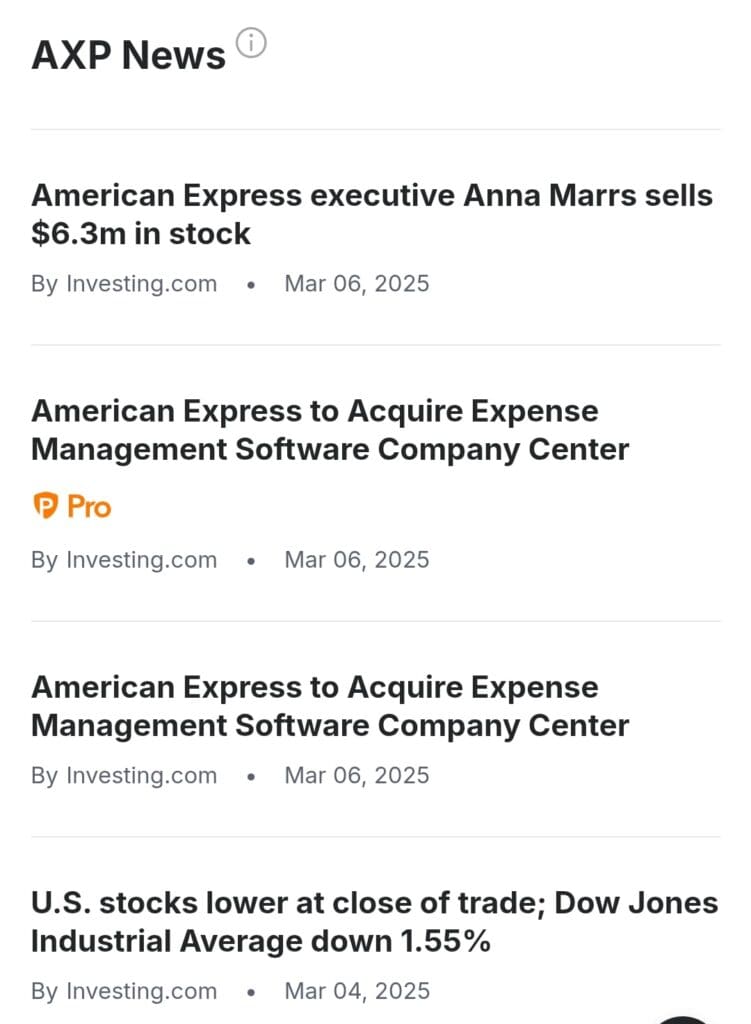

Market sentiment analysis is another area where the two platforms differ. InvestingPro+ provides premium market news but lacks the social features seen in other platforms.

It includes stock alerts, watchlists, and real-time data, which can help investors track sentiment and market movements.

Motley Fool Epic, on the other hand, includes PGI (Potential Growth Indicator), which tracks market sentiment by analyzing the cash in money market accounts.

It also provides exclusive analyst coverage, sector insights, and podcast episodes on the latest stock picks. However, it doesn’t offer live breaking news or ticker-based social interactions.

Overall, Motley Fool Epic’s market sentiment tools provide more in-depth market insights through exclusive analyst coverage and sentiment tracking.

-

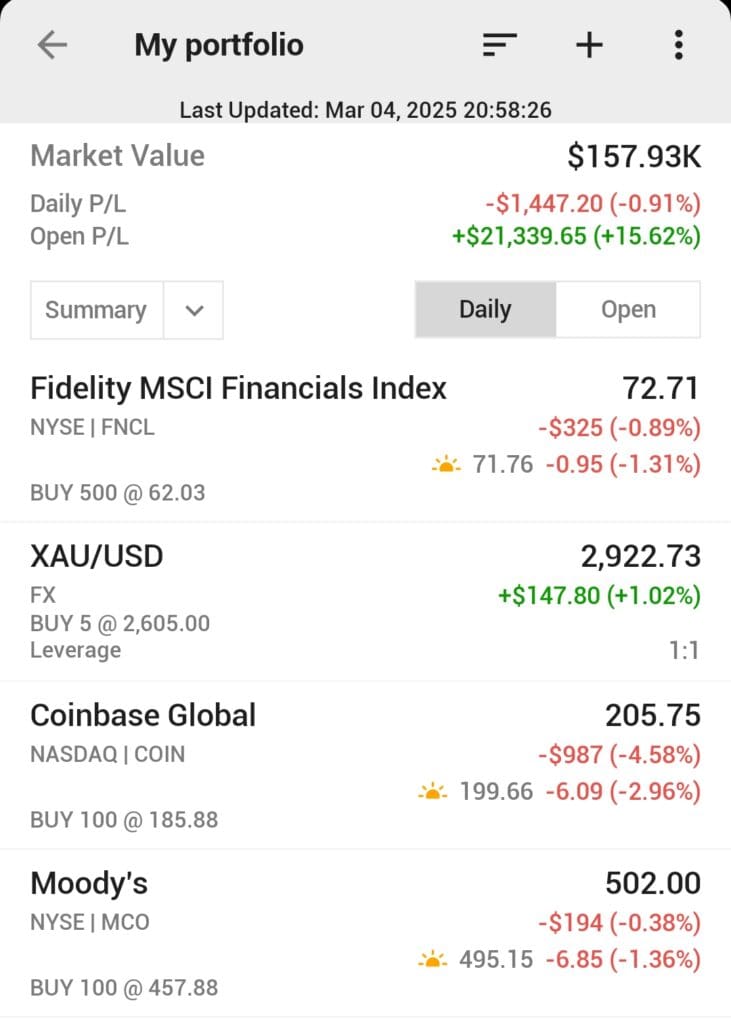

Portfolio Analysis & Alerts

InvestingPro+ offers portfolio analysis tools, but it doesn't sync directly with brokerage accounts for real-time updates. It also provides alerts for price movements, earnings updates, and valuation changes.

Motley Fool Epic offers a personalized stock tracking tool, My Stocks, that lets investors build customized watchlists and receive curated analysis, though it lacks automated portfolio management or real-time tracking.

-

Technical Analysis Options

InvestingPro+ provides basic but functional technical analysis tools, while Motley Fool Epic lacks comprehensive technical analysis features.

InvestingPro+ offers basic charting tools, including customizable stock charts, moving averages, RSI, and Bollinger Bands, which are suitable for general technical analysis.

However, it falls short compared to platforms like TradingView, as its charting capabilities are more basic and less customizable.

Motley Fool Epic, by contrast, does not provide interactive charts or advanced technical analysis tools, as it focuses more on long-term fundamentals.

-

ETF, Bonds & Fund Analysis Tools

InvestingPro+ focuses primarily on stock analysis but includes some ETF and fund analysis tools within its stock comparison feature.

It lacks in-depth tools for bonds or other fixed-income securities, making it less suitable for diversifying into other asset classes.

Motley Fool Epic, while strong on stock picks, does not offer tools for analyzing bonds or funds. However, it includes ETF rankings and portfolio strategies, helping investors diversify with ETFs.

Overall, InvestingPro+ provides better overall tools for ETF analysis, but neither platform offers comprehensive bond analysis.

Which Investors May Prefer InvestingPro+?

InvestingPro+ is ideal for data-driven investors who prioritize in-depth analysis and fundamental research. It’s best suited for those who rely on extensive financial data and valuation models.

Fundamental Analysts: Investors who focus on deep financial metrics, valuation models (like DCF), and long-term performance will benefit most.

Value Investors: The Fair Value Gap analysis and AI-powered stock picks help identify undervalued stocks with strong fundamentals.

Dividend Investors: This report's detailed dividend insights, payout history, and forecasts are perfect for income-focused investors.

Strategic Traders: Investors combining fundamental analysis with strategic stock picking will find the stock comparison and health scores particularly useful.

Plan | Monthly Subscription |

|---|---|

InvestingPro | $15.99

$120 ($9.99 / month)

if paid annually |

InvestingPro+ | $39.99

$300 ($24.99 / month) if paid annually |

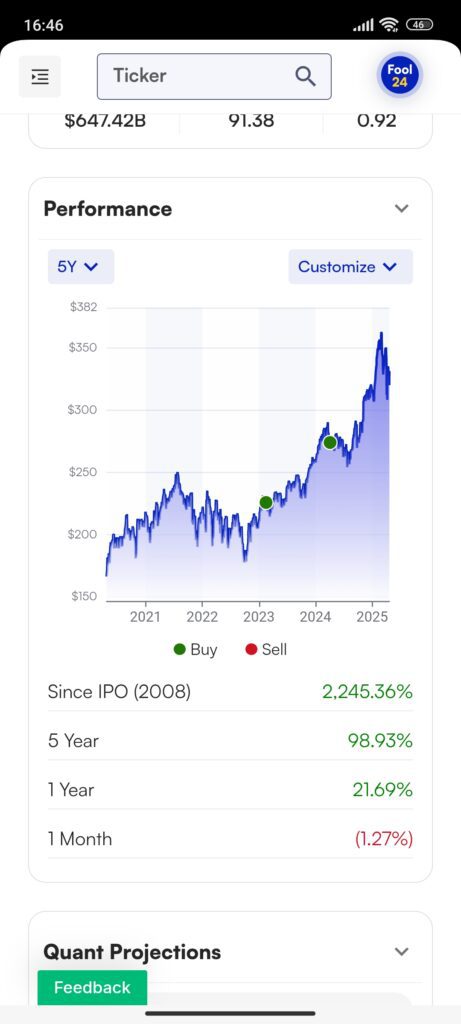

Which Investors May Prefer Motley Fool Epic?

Motley Fool Epic is perfect for long-term investors seeking a diversified portfolio, with enhanced stock recommendations and growth potential.

Growth Investors: The monthly stock picks and extended financial data help identify high-growth companies with strong market leadership.

Retirement Investors: The GamePlan+ access provides tailored portfolio strategies for retirement-focused investing, making it ideal for long-term financial security.

AI-Driven Investors: Those who value AI-powered stock analysis and sector insights will appreciate the Moneyball Database and Quant: 5Y Scoring.

Diversified Portfolio Seekers: The broad coverage, including ETF rankings and sector strategies, makes it ideal for investors wanting diversified, long-term growth.

Plan | Annual Subscription | Promotion |

|---|---|---|

Motley Fool Stock Advisor | $199 (16.60 / month)

No monthly plan

| 30-day money-back guarantee |

Motley Fool Stock Epic | $499 (41.60 / month)

No monthly plan

| 30-day money-back guarantee |

Motley Fool Epic Plus | $1,999 (166.60 / month)

No monthly plan

| 30-day money-back guarantee |

Bottom Line

InvestingPro+ excels with its in-depth fundamental analysis, AI-powered stock picks, and customizable screener, making it ideal for value and dividend investors.

Motley Fool Epic shines with its broad stock recommendations, portfolio strategies, and AI-driven tools, perfect for long-term growth and retirement-focused investors.

Both platforms offer valuable features but cater to different investment styles.