Thinking about upgrading your investing game? Whether you're just starting out or already deep in the stock market grind, Motley Fool has two standout plans: Stock Advisor and Epic.

Stock Advisor gives you solid picks and smart strategies for long-term growth, while Epic adds more tools, deeper research, and even retirement planning features.

Plan | Annual Subscription | Promotion |

|---|---|---|

Motley Fool Stock Advisor | $199 (16.60 / month)

No monthly plan

| 30-day money-back guarantee |

Motley Fool Stock Epic | $499 (41.60 / month)

No monthly plan

| 30-day money-back guarantee |

Motley Fool Epic Plus | $1,999 (166.60 / month)

No monthly plan

| 30-day money-back guarantee |

What You'll Get On Both Plans?

Here are core features that both Motley Fool Stock Advisor and Epic plans include, helping investors make long-term, research-backed decisions.

-

Stock Picks & Recommendations

Motley Fool is one of the best services for hand-picked stock recommendations for long-term growth.

Stock Advisor includes 2 picks per month, while Epic includes 5, but each plan delivers detailed writeups explaining why the stock was chosen.

These reports highlight a company’s strengths, competitive advantages, and growth outlook.

For example, an investor might receive a pick like Nvidia with commentary on its role in AI, plus suggestions on how it fits within a broader portfolio.

-

Foundational Stock Coverage

Members of both plans gain access to foundational stocks — companies with reliable financials and long-term durability. These are especially useful for building a portfolio base before adding high-growth or speculative stocks.

For instance, a foundational pick might include Costco or Johnson & Johnson, giving investors confidence in volatile markets. Both plans explain why these stocks provide resilience during downturns.

-

Basic Screening Tools

Each plan includes access to a stock screener that allows investors to filter by sectors, market cap, or valuation ratios.

While Epic’s version is more advanced, both tools help users narrow down investment ideas based on their strategy.

For example, a user could screen for mid-cap healthcare stocks with low P/E ratios in both plans to uncover potential undervalued plays.

-

Returns Simulator Tool

The Returns Simulator, available in both plans, helps investors estimate future gains based on portfolio size, holding period, and allocation strategy.

This tool is useful for scenario planning — such as estimating a 10-year return from investing $10,000 across 25 diversified stocks. It encourages goal setting and realistic expectations based on historical patterns and stock quality.

-

My Stocks: Tracking & Alerts

Both plans offer a personalized stock tracking feature called My Stocks. Investors can create watchlists, track portfolio performance, and receive curated updates.

For example, if you add Amazon to your list, you'll get alerts on earnings, Fool commentary, and relevant market news — helping you stay engaged and informed without daily research.

-

Market Sentiment Insight: PGI Tool

The Potential Growth Indicator (PGI) is included in both plans and provides insight into market sentiment based on cash levels in money market accounts.

A low PGI might suggest strong buying activity, while a high PGI signals investor caution.

This tool helps long-term investors decide when the market climate may be more favorable for adding new positions.

-

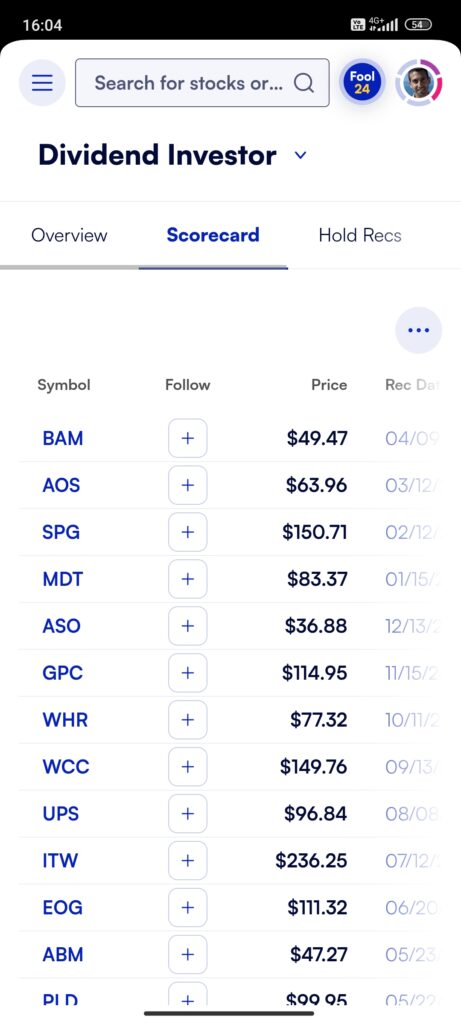

Scorecards with Thematic Recommendations

Both plans give access to thematic scorecards, offering stock picks grouped by investing strategy or market condition.

For example, during a recession, you might access a “defensive stocks” scorecard highlighting stable companies like Procter & Gamble. This feature helps users find ideas that match their personal risk tolerance or current market trends.

Additional Features Worth Mentioning

In addition to major tools, both Motley Fool Stock Advisor and Epic plans include smaller features that enhance the overall investing experience:

Watchlist Integration: Lets users save and monitor their favorite stocks in one place, making it easy to follow updates and recommendations.

Earnings Calendar Access: Provides a calendar of upcoming earnings reports, helping investors stay ahead of major financial announcements and potential stock movements.

IPO Calendar: Tracks upcoming and recent IPOs so members can research newly listed companies before they gain broader market attention.

Dividend Stock Lists: Highlights companies with consistent dividend payments, supporting income-focused strategies alongside growth investing.

Scoreboard Videos & Leaderboard: Daily videos review key stock ideas, while the leaderboard ranks top-rated stocks based on analyst evaluation and performance metrics.

These added features help users stay informed, uncover new ideas, and time their decisions with better clarity, especially when monitoring market developments.

What You'll Get If You Upgrade To The Epic Plan?

Motley Fool Epic includes premium-level features designed to give investors deeper insights, broader coverage, and more advanced portfolio tools. Here are five standout features exclusive to the Epic plan:

-

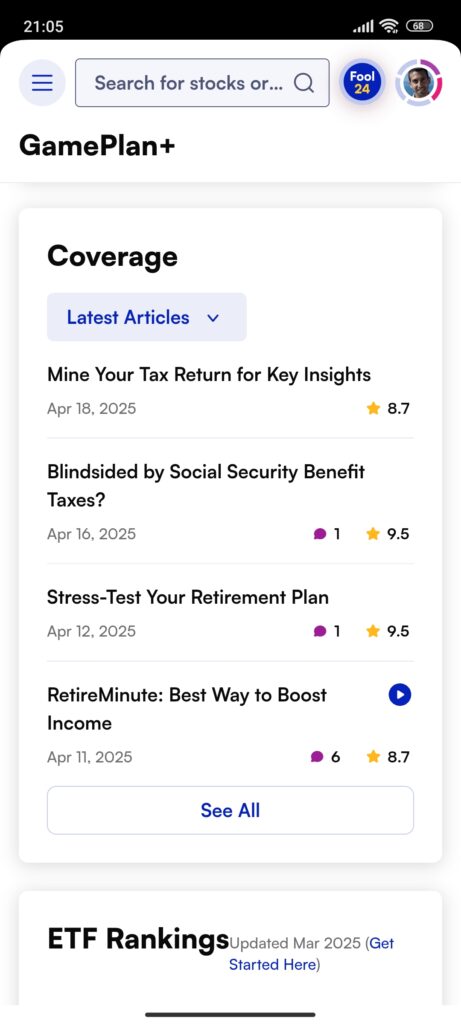

GamePlan+ Full Access

Epic members unlock full access to GamePlan+, a strategic retirement and investing hub with model portfolios, ETF rankings, and withdrawal planning.

Compared to partial access in Stock Advisor, this feature gives complete guidance for long-term wealth building — ideal for planning around life goals or retirement milestones.

-

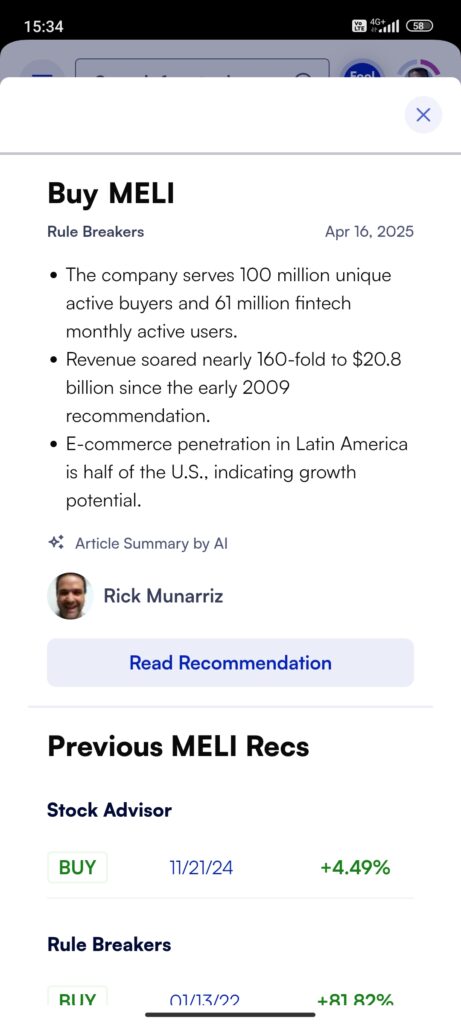

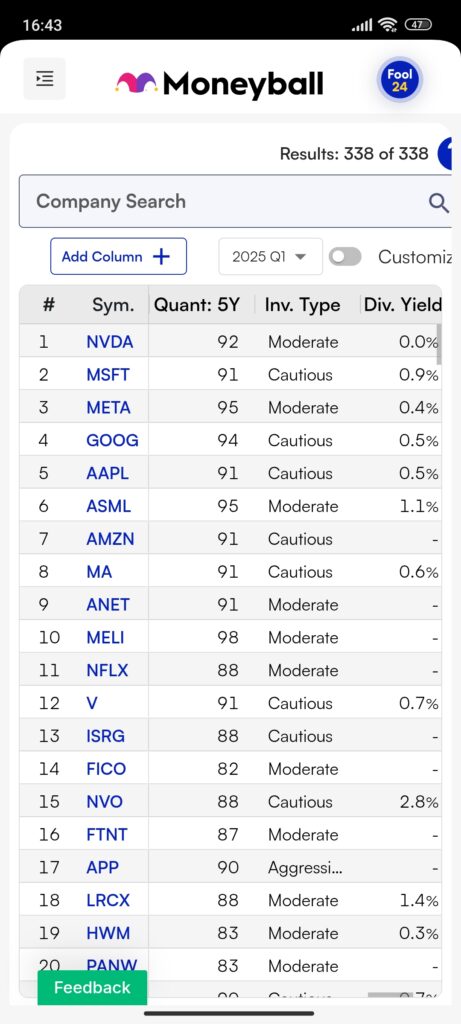

Quant: 5-Year Stock Scoring

Epic includes Quant, Motley Fool’s proprietary scoring system that rates stocks based on financial health, earnings consistency, and growth potential over five years.

This feature doesn’t exist in Stock Advisor and helps investors prioritize high-potential stocks with objective, data-driven analysis — ideal for refining portfolio picks.

-

Epic Opportunities Podcast

This exclusive audio series provides deep dives into high-conviction stock picks and investment strategies not covered in other plans.

Hosted by top analysts, it gives members valuable behind-the-scenes insight into why certain stocks were chosen, offering context beyond traditional written reports.

-

Expanded Analyst Reports

Epic members receive more detailed analyst coverage and stock research than Stock Advisor.

This includes sector deep dives, company breakdowns, and enhanced financial outlooks, helping investors understand broader market trends and evaluate opportunities beyond just the monthly stock picks.

-

Full FoolIQ Access (10 Years of Data)

Unlike the limited 3-year access in Stock Advisor, Epic members get 10 years of historical financial data through FoolIQ.

This unlocks deeper fundamental analysis, including revenue trends, margin shifts, and valuation history — essential for investors focused on long-term performance forecasting.

Who May Prefer the Motley Fool Stock Advisor?

Stock Advisor is a great entry point for long-term investors who want expert-backed ideas without overwhelming complexity.

New Investors Seeking Guidance

Its easy-to-follow recommendations and portfolio-building tips are ideal for beginners.Buy-and-Hold Stock Pickers

Perfect for investors who want to hold high-quality stocks for 3–5 years or more.Investors on a Budget

At a lower price point, Stock Advisor delivers solid value for long-term-focused portfolios.

This plan fits anyone looking for growth, simplicity, and a proven track record of market-beating picks.

Plan | Annual Subscription | Promotion |

|---|---|---|

Motley Fool Stock Advisor | $199 (16.60 / month)

No monthly plan

| 30-day money-back guarantee |

Motley Fool Stock Epic | $499 (41.60 / month)

No monthly plan

| 30-day money-back guarantee |

Motley Fool Epic Plus | $1,999 (166.60 / month)

No monthly plan

| 30-day money-back guarantee |

Which Investor Types May Prefer the Motley Fool Epic Plan?

Epic is best for serious investors who want more picks, deeper research, and full access to premium portfolio tools.

Investors Wanting Broader Coverage

With five monthly picks and 500+ stock coverage, it suits those seeking diversification.DIY Investors Craving Deeper Research

Quant scoring, full FoolIQ, and analyst reports appeal to those who want data-backed decisions.Retirement-Focused Planners

Full GamePlan+ access and ETF rankings make it ideal for long-term wealth and retirement strategy.

Epic is built for those who want more control and insight across every stage of the investing journey.

Bottom Line: Motley Fool Stock Advisor vs Epic

If you're looking for straightforward, high-quality stock picks, Stock Advisor offers a low-cost, proven solution.

For investors ready to level up, Epic unlocks advanced features like GamePlan+, Quant scoring, and full research access — perfect for building a data-driven portfolio.

Both plans are tailored for long-term growth, but Epic gives you the edge if you want broader coverage and deeper insights.