| ||

|---|---|---|

Seeking Alpha Premium | TipRanks Premium | |

Price | $299 ($24.90 / month)

No monthly subscription | $359 ($30 / month)

No monthly plan |

Best Features | ||

Our Rating |

(4.6/5) |

(4.6/5) |

Read Review | Read Review |

Compare Stock Analysis & Screening Features

In this article, we’ll compare two of the best platforms for stock picks and analysis: Seeking Alpha Premium and TipRanks Premium, highlighting their key features.

We’ll walk you through their stock research features, screening tools, portfolio management, and expert recommendations to help you determine which platform suits your investment strategy.

-

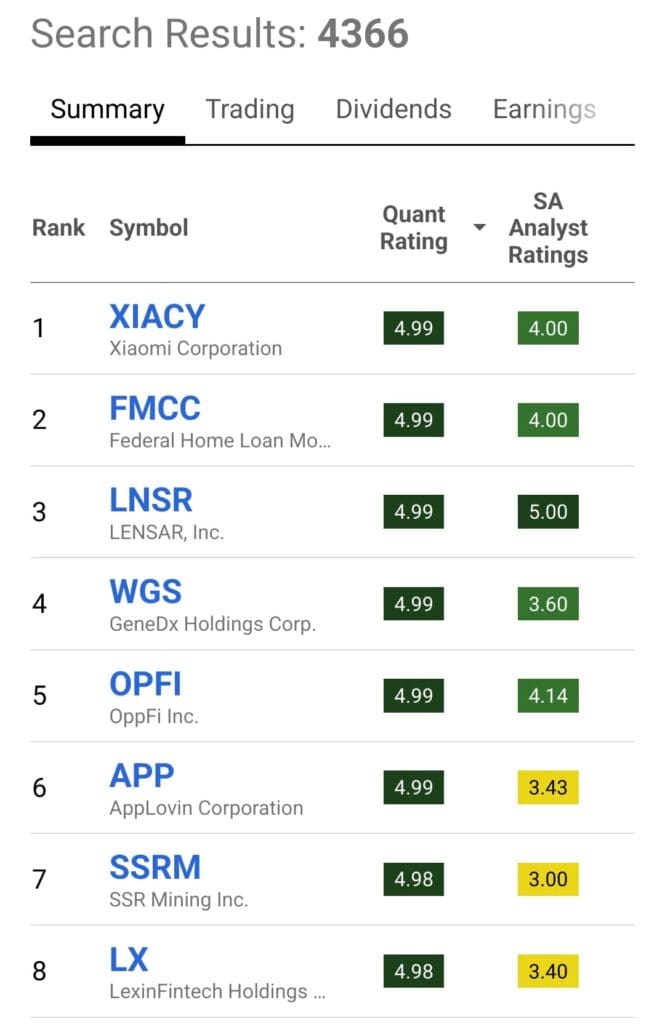

Stock Screening Tools

Seeking Alpha Premium offers a robust screener based on valuation, growth, profitability, dividends, and momentum.

What sets it apart is its integration of Quant Ratings and Factor Grades, allowing users to quickly identify Strong Buy-rated stocks with data-backed grades across key financial metrics.

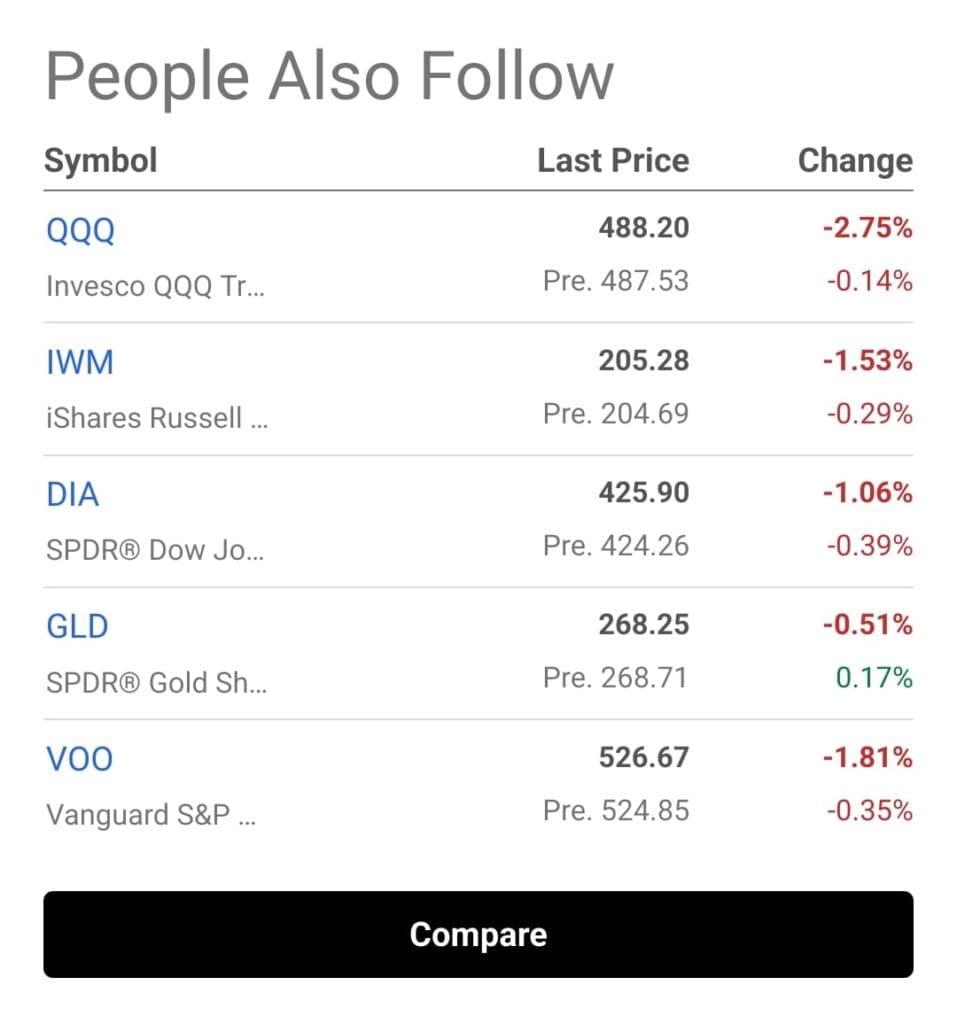

The ETF screener is also categorized by top-rated lists like Top Dividend or Top Growth.

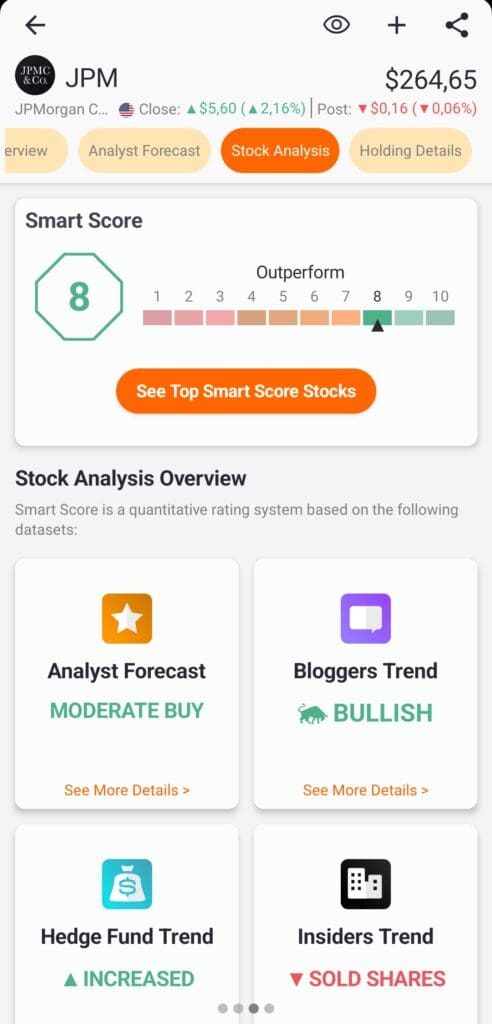

TipRanks Premium, on the other hand, centers its screener around Smart Score — a 1–10 rating system that combines analyst ratings, hedge fund activity, insider transactions, and more.

It also allows filtering by top analyst consensus and sentiment indicators like blogger and news sentiment. However, ETF screening and financial filters are more limited than Seeking Alpha.

-

Fundamental Analysis Tools

Seeking Alpha Premium excels in deep fundamental research with access to full financials, earnings data, dividend safety scores, and valuation models.

Users can read unlimited expert-written articles, including earnings breakdowns and sector outlooks, while also accessing earnings call transcripts and SEC filings.

Quant Ratings and Factor Grades provide a unique algorithmic perspective.

TipRanks Premium provides detailed analyst ratings, insider activity, and Smart Score rankings.

It includes income statements and balance sheets, but lacks the same depth in visual charting and written research.

There’s no unlimited library of analyst-style articles or access to earnings call transcripts in real-time.

-

Stock Picks & Recommendations

TipRanks Premium focuses heavily on expert-backed picks. It highlights Top Analyst Stocks, Top Insider Stocks, and Smart Score 9–10 stocks.

These recommendations are based on a blend of analyst performance, hedge fund moves, and insider buying. Investors can follow up to 5 top analysts and receive alerts when they act.

Seeking Alpha Premium provides curated lists like Top Growth Stocks or Yield Monsters, based on Quant Ratings.

However, it doesn’t offer individual analyst recommendation tracking like TipRanks, and Alpha Picks is a separate service not included in Premium.

-

Market Sentiment Analysis

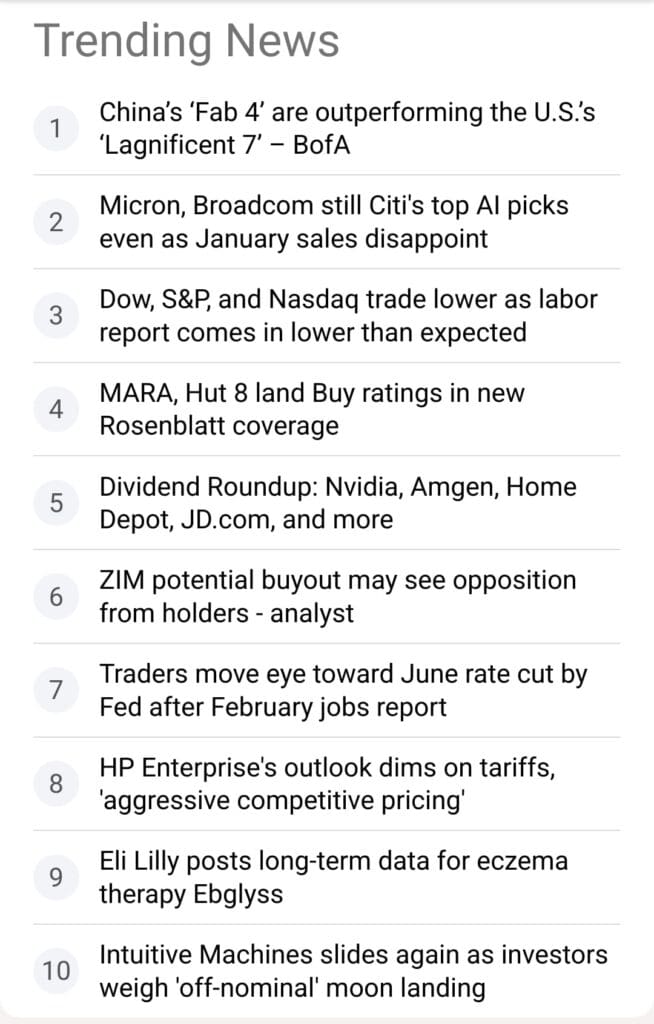

TipRanks Premium focuses more on sentiment data. It tracks blogger opinions, news sentiment, investor sentiment, and even hedge fund activity.

While it lacks breaking news alerts, it gives users a more transparent look at how different players feel about a stock — though without deep news coverage.

Seeking Alpha Premium provides a rich news dashboard, unlimited access to market news, and real-time alerts on stock movements and portfolio warnings.

Articles often capture analyst upgrades/downgrades and macroeconomic shifts. However, it doesn’t include social sentiment or crowd-sourced insights.

-

Portfolio Analysis & Alerts

Seeking Alpha Premium offers a portfolio health check tool that flags overvalued stocks, earnings risks, and weak fundamentals.

Users receive alerts on dividend safety and diversification issues but lack automated rebalancing or customization.

TipRanks Premium provides a more interactive portfolio dashboard with smart scores, asset allocation insights, and volatility tracking.

It also includes calendar views for earnings and dividends, and personalized news per portfolio.

-

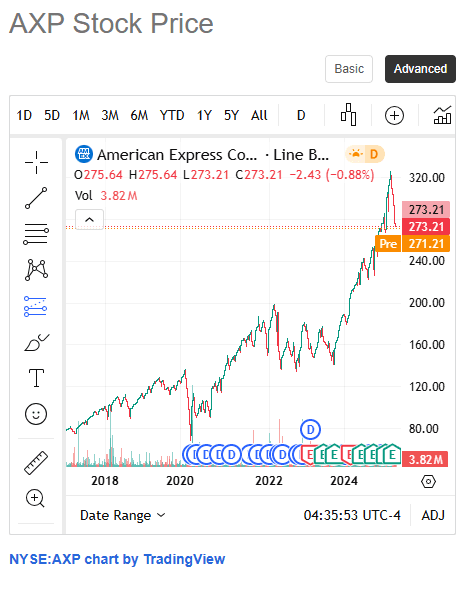

Technical Analysis Options

Seeking Alpha Premium provides basic charting focused on fundamental trends, without technical indicators, overlays, or trading signals.

TipRanks Premium includes more chart types (candlestick, scatterplot) and some technical filters (moving averages, RSI, MACD) in its stock and technical screeners.

However, it still lacks advanced charting options or scripting tools like TradingView.

-

ETF, Bonds & Fund Analysis Tools

Seeking Alpha Premium includes top ETF rankings and quant-based ETF screeners, but doesn’t cover mutual funds or bonds. It’s useful for comparing ETF performance, sector exposure, and dividend yield.

TipRanks Premium allows ETF screening by smart score but lacks deep ETF breakdowns or bond/mutual fund research. It’s limited to surface-level ETF insights, and bond analysis is not supported.

Who Should Consider Seeking Alpha Premium?

Investors who value fundamental research, portfolio health tools, and expert insights may prefer a Seeking Alpha Premium subscription.

DIY investors who enjoy deep company analysis and unlimited stock research articles.

Dividend investors tracking payout safety and high-yield stock opportunities.

Long-term investors who want detailed earnings data, transcripts, and valuation models.

ETF investors seeking curated top-rated fund lists with quant-based rankings.

Plan | Annual Subscription | Promotion |

|---|---|---|

Seeking Alpha Premium | $299 ($24.90 / month)

No monthly subscription | $4.95 for 1 month |

Seeking Alpha Pro | $2,400 ($200 / month)

No monthly subscription | $99 for 1 month |

Seeking Alpha – Alpha Picks | $499 ($41.58 / month)

No monthly subscription | N/A |

Which Investors May Prefer TipRanks Premium?

TipRanks Premium subscription is ideal for investors who prioritize analyst-driven stock ideas and sentiment-based research from multiple expert sources.

Long-term investors following top analysts, insiders, and hedge funds.

Users who like quant-backed tools like Smart Score and analyst success rankings.

Investors focused on portfolio-level insights, allocation tracking, and expert alerts.

Sector-specific investors looking for recommendations grouped by themes or sentiment.

Plan | Annual Subscription | Promotion |

|---|---|---|

TipRanks Premium | $359 ($30 / month)

No monthly plan | 30 day money-back guarantee |

TipRanks Ultimate | $599 ($50 / month)

No monthly plan | 30 day money-back guarantee |

Bottom Line

Seeking Alpha Premium shines in deep stock research, Quant Ratings, and unlimited expert analysis for long-term investors. It’s perfect for those who want to dig into fundamentals, earnings data, and portfolio health.

TipRanks Premium, on the other hand, stands out with expert-driven stock picks, Smart Score rankings, insider activity tracking, and sentiment data.

It’s a better choice for investors who want to follow analyst consensus, hedge fund moves, and behavioral signals.