Looking to level up your investing game? Stock Analysis gives you solid tools even for free, but its Pro plan brings serious firepower.

Whether you're researching growth stocks, tracking ETFs, or comparing companies, this platform delivers deep data without the fluff.

The Pro upgrade is built for long-term thinkers, DIY analysts, and anyone who wants to spot trends using 10+ years of financial history and expert rankings.

Plan | Annual Subscription | Promotion |

|---|---|---|

Stock Analysis Pro | $79 ($6.58 / month) | 60-day money back guarantee |

What You'll Get On Both Plans?

Here are 7 shared features you’ll find in both the free and premium Stock Analysis (stockanalysis.com) plans, with each offering value in its own way.

-

Stock Screener (Basic Screening Tools)

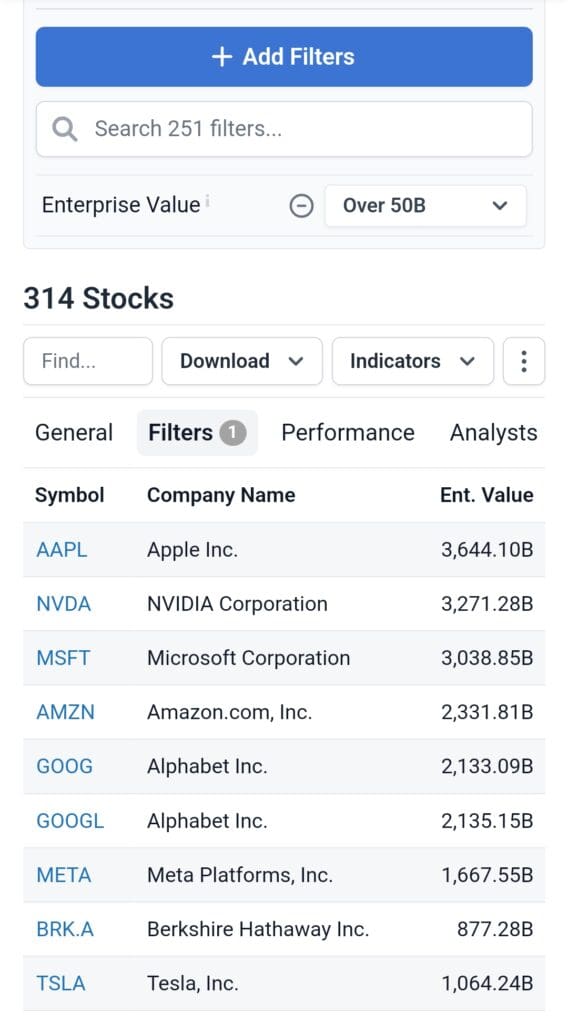

Both plans offer access to the stock screener, which lets investors filter equities based on metrics like PE ratio, market cap, dividend yield, and revenue growth.

For example, you could screen for large-cap dividend-paying stocks in the tech sector.

While Pro includes deeper analyst-based filters, the free version still covers over 250+ essential metrics, making it ideal for general stock research.

-

ETF Screener for Fund Discovery

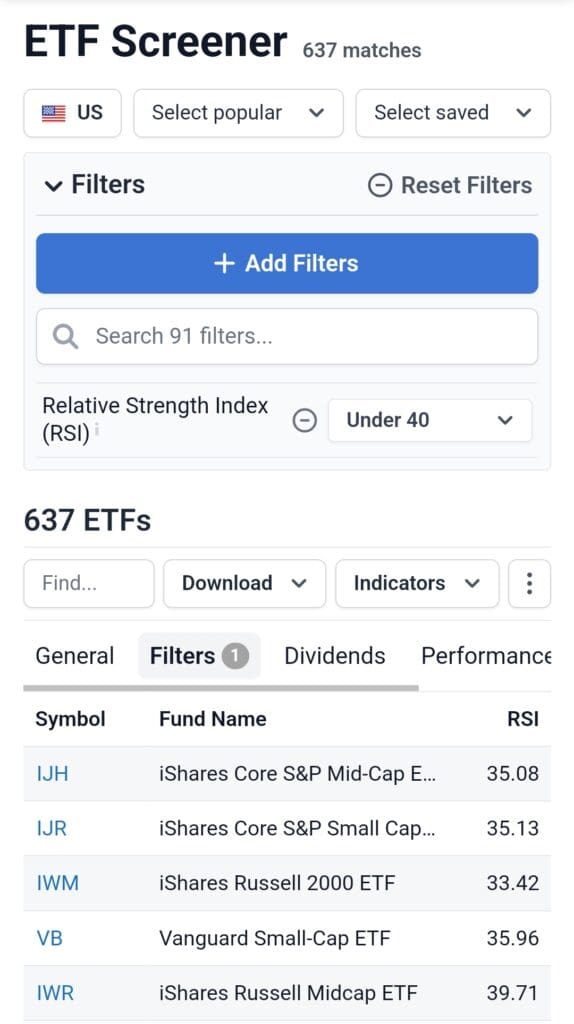

Users on both plans can use the ETF screener to explore exchange-traded funds by category, issuer, AUM, and key ratios like expense or dividend yield.

For instance, an investor comparing tech ETFs with low fees can use filters to find funds with strong yield growth or low volatility.

The Pro version adds full holdings access and more indicators, but the basic screener is still highly functional.

-

Interactive Stock Charts with Technical Indicators

Both plans include interactive charts with customizable timeframes and technical overlays.

Investors can analyze moving averages, RSI, or volume trends to spot patterns. For example, a trader may compare a stock’s price to its 200-day average before deciding to buy.

While Pro adds more indicators and export tools, the core charting functions are accessible to all users.

-

Stock Research Pages with Financials & Valuation Metrics

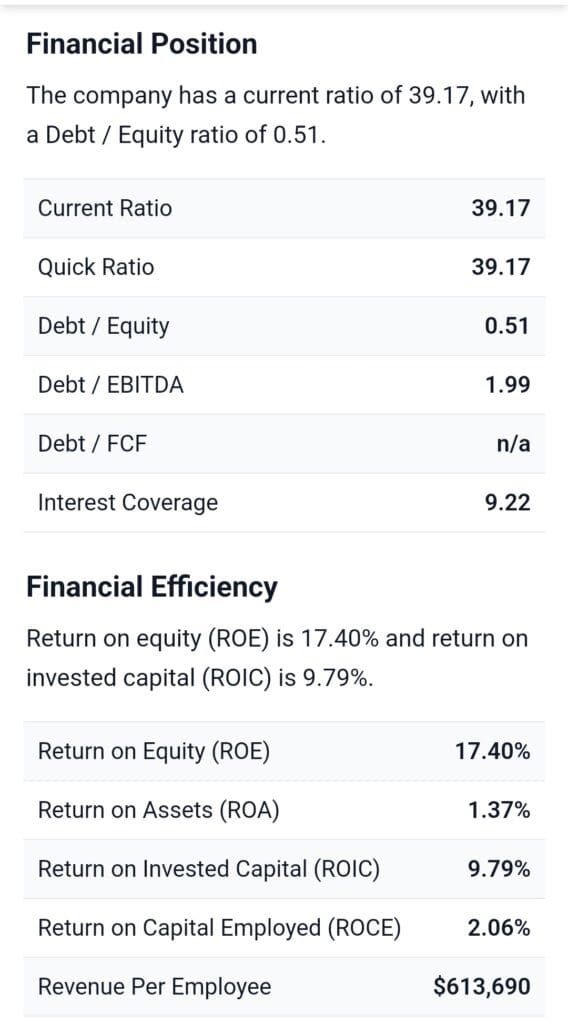

Users on both plans can research individual stocks through structured pages that display income statements, balance sheets, valuation ratios, and dividend history.

If you're evaluating a dividend stock like Johnson & Johnson, you’ll see payout ratios, earnings growth, and debt-to-equity data clearly laid out.

Pro adds deeper history, but the free plan covers the most relevant metrics for most investors.

-

Stock Comparison Tool for Side-by-Side Analysis

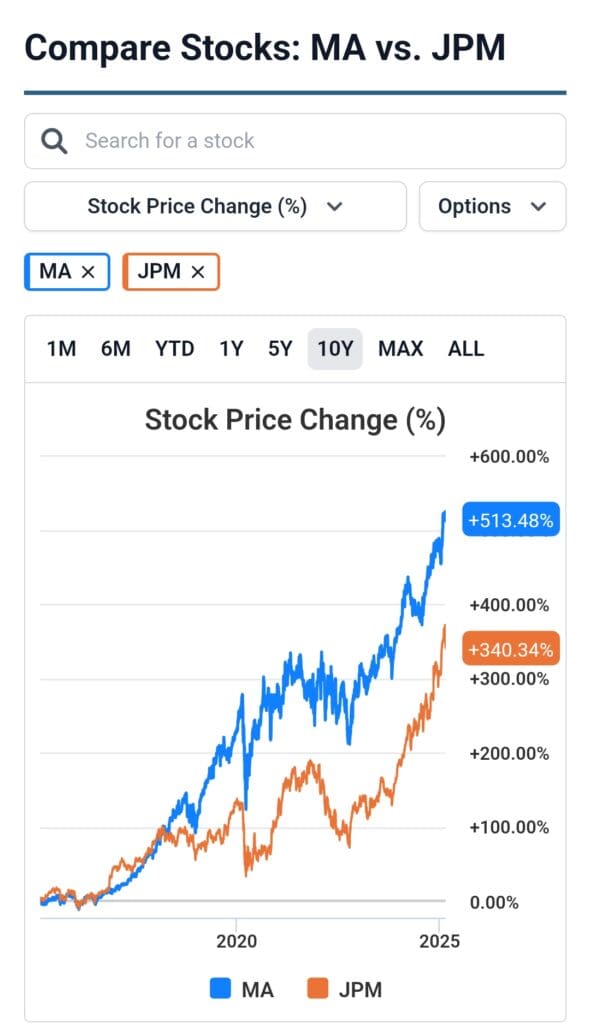

Investors using either plan can compare two or more stocks or ETFs across metrics like PE ratio, dividend yield, and historical returns.

This helps when deciding between similar companies—such as comparing Coca-Cola vs. Pepsi by revenue growth and return on equity.

-

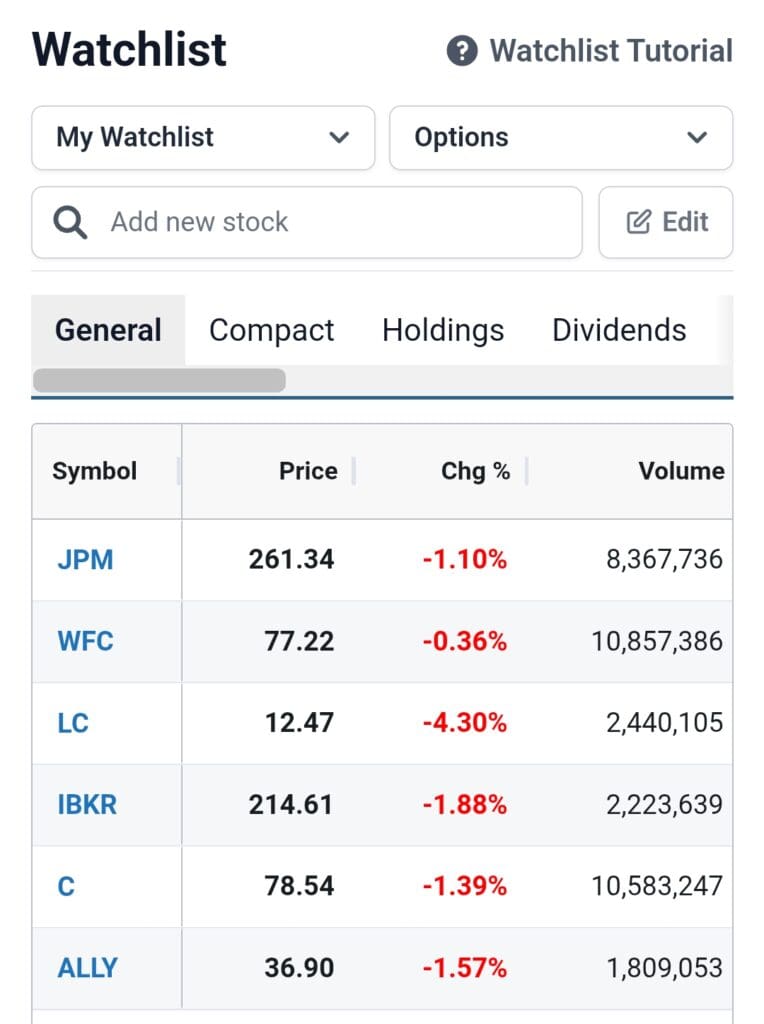

Watchlist with Performance Tracking

Both versions offer watchlists where investors can track stocks and ETFs. Users can view performance, add notes, and organize by custom columns.

For instance, a long-term investor might track dividend-paying stocks and monitor PE ratio and payout consistency over time.

-

Additional Features You Don’t Need to Pay For

In addition to core tools, both Stock Analysis plans include several smaller yet useful features that enhance the research experience for all users:

Earnings Calendar Access: Track upcoming earnings reports by date, including analyst expectations and trends. This helps investors plan trades around key financial announcements.

Trending Today Highlights: View which stocks are most researched or discussed on the platform, giving insight into market sentiment and investor focus during the day.

ETF Provider Listings: Explore major ETF issuers and their fund lineups, making it easier to compare providers by strategy, asset class, and fee structure.

Market News Feed: Stay up to date with sector news, earnings headlines, and market developments — all linked to relevant stock or ETF pages.

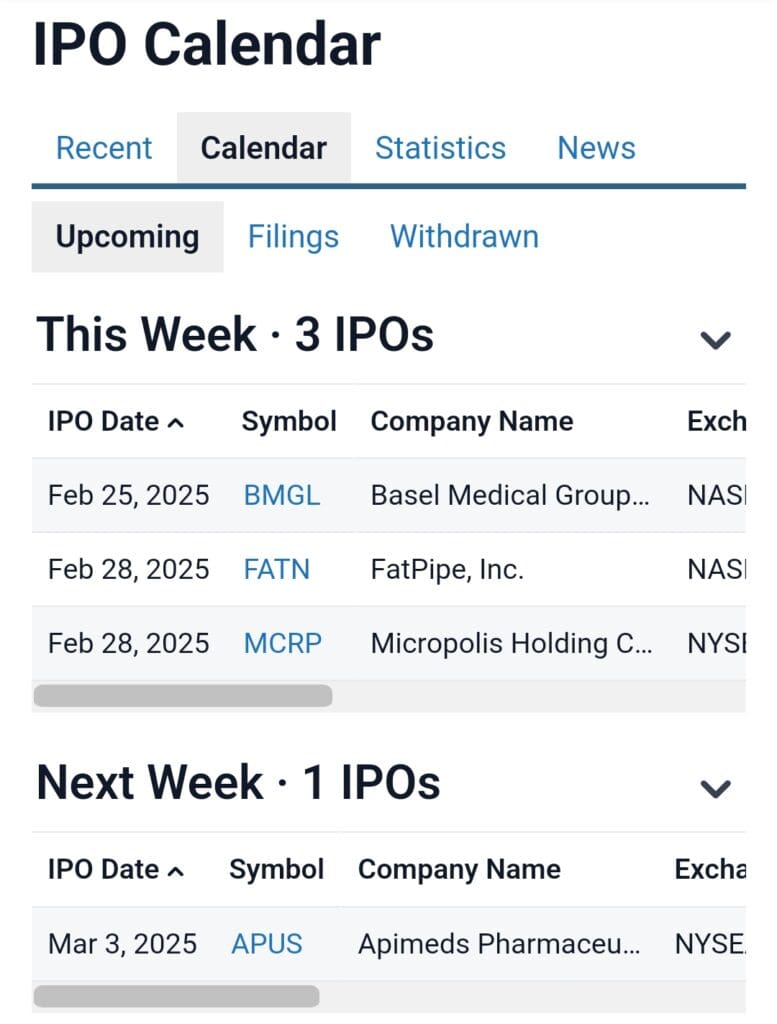

- IPO Calendar and Recent Listings Tracker: Both plans include access to the IPO section, which tracks upcoming and recent public offerings.

Easy Site Navigation: The platform’s layout is consistent in both versions, making it quick to move between financials, screeners, news, and stock comparison tools.

What You'll Get If You Upgrade To The PRO Plan?

While the Stock Analysis Pro is one of the cheapest on the market, it offers very cool options.

Here are five standout features available only with the Stock Analysis Pro plan that take the platform’s research capabilities to the next level:

-

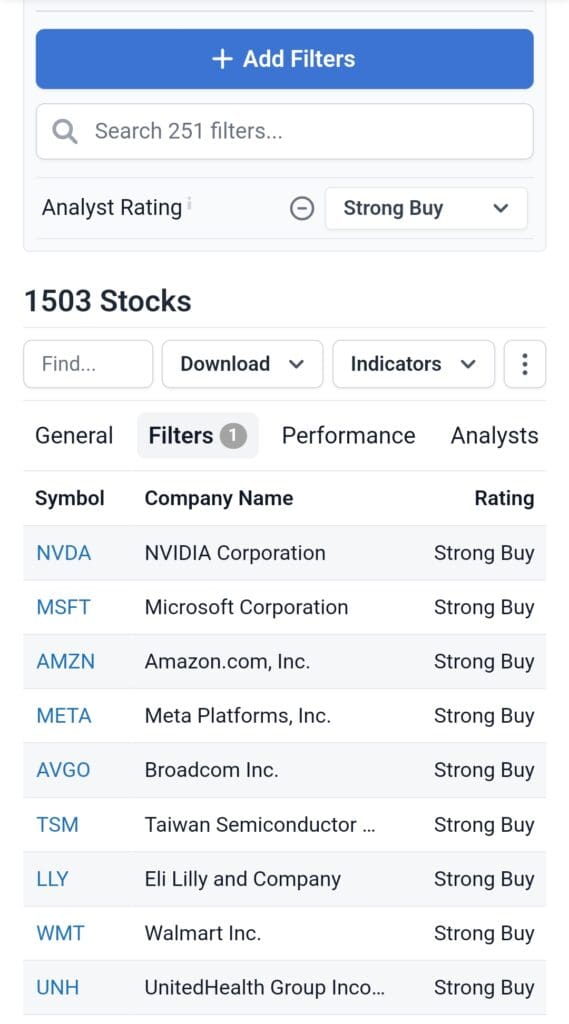

Top 50 “Strong Buy” Stocks

Pro users unlock access to a curated list of the 50 stocks with the highest “Strong Buy” ratings from top-performing Wall Street analysts.

This feature helps investors quickly find high-conviction ideas backed by expert forecasts and price target upside potential.

-

Top Wall Street Analyst Rankings

This exclusive tool ranks analysts based on accuracy, average return per rating, and sector expertise. Investors can follow analysts with proven track records, improving confidence in buy/sell decisions.

The free version offers some ratings, but lacks performance-based rankings.

-

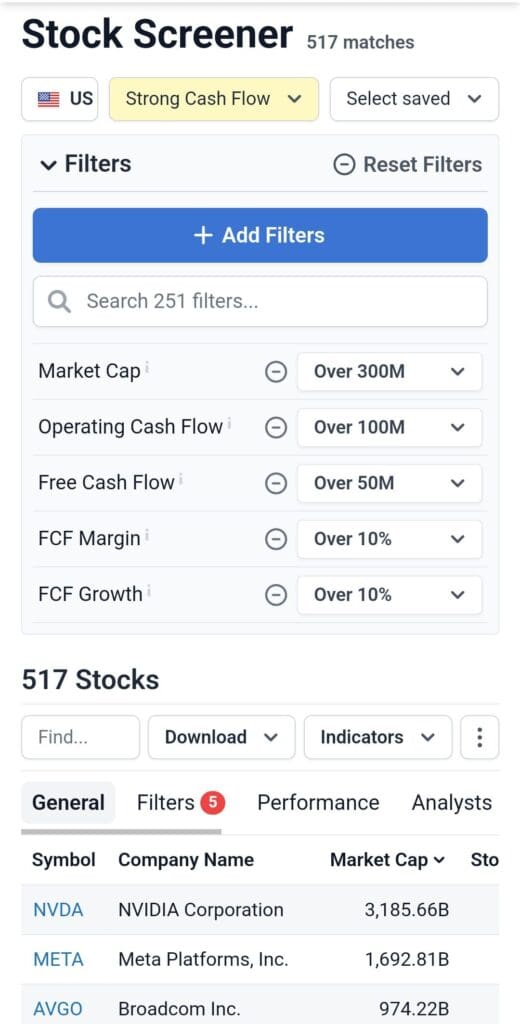

Pro Stock & ETF Screeners

Pro versions of the screeners include 200+ advanced filters, full ETF holdings, and custom screen saving. Investors can also export up to 1,000 rows of data.

Compared to the free version, this upgrade is ideal for building complex, data-driven strategies.

-

Extended Financial History (10–40 Years)

Stock Analysis Pro includes long-term financial data, allowing investors to study revenue growth, profitability, and dividend consistency across decades.

This is especially useful for long-term investors who evaluate stability across different economic cycles. The free plan only offers shorter-term views.

-

Unlimited Watchlists & CSV Exports

Pro users can build and manage unlimited watchlists and portfolios, complete with export options to Excel and CSV.

This helps track multiple strategies or sectors in one place. The free version supports a basic watchlist but limits customization and output.

Additional Features in PRO Plan

In addition to its main research tools, Stock Analysis Pro offers several smaller exclusive features that enhance customization and data depth for serious investors:

Full Corporate Actions Data: Access historical records of stock splits, dividends, mergers, and buybacks to better understand how events impact long-term performance.

Complete ETF Holdings Breakdown: Pro users can view detailed fund compositions, including top holdings, sector allocations, and exposure breakdowns—helpful when comparing ETFs.

Saved Stock Screeners: Create and save custom screeners using 200+ filters, allowing quick re-use of preferred investment criteria without starting from scratch.

Dark Mode & Ad-Free Experience: Enjoy a cleaner, distraction-free interface with full dark mode support, making extended research sessions easier on the eyes.

Financial Metrics for Top 500+ Stocks: Unlock extended historical data and business metrics for leading U.S. companies—ideal for deep-dive analysis of market movers.

Plan | Annual Subscription | Promotion |

|---|---|---|

Stock Analysis Pro | $79 ($6.58 / month) | 60-day money back guarantee |

Who May Want to Upgrade to Stock Analysis PRO?

If you’re looking for advanced screening, deeper data, and expert-driven tools, Stock Analysis PRO could be worth the upgrade.

Fundamental-Driven Long-Term Investors: Those who rely on deep financial history, dividend trends, and valuation ratios over 10–40 years to make informed decisions.

Analyst-Focused Stock Pickers: Investors who want to follow the top-rated analysts and access the “Top 50 Strong Buy” stock list for fresh ideas.

Power ETF Researchers: Ideal for ETF investors seeking full portfolio breakdowns, detailed composition data, and fund screening based on advanced criteria.

Custom Screener Builders: Great for those who frequently run and save custom filters, export results to Excel, or manage multiple stock watchlists efficiently.

Which Investor Types Prefer Stock Analysis Free Plan?

The Stock Analysis free version is a strong choice for investors who want a clean, data-rich platform without paying for extras.

Beginner Investors: New investors can explore stocks, ETFs, and financials in a simple, intuitive interface without information overload or distractions.

DIY Stock Researchers: Ideal for those who prefer analyzing company fundamentals on their own without relying on curated stock picks or expert rankings.

General ETF Trackers: Great for users comparing ETFs by sector, yield, and expense ratios using the basic but informative free ETF screener.

News and Earnings Followers: Those who follow earnings calendars and trending stocks will benefit from the organized news feed and earnings schedule included free.

Bottom Line: Is Stock Analysis Subscription Worth It?

Stock Analysis is a strong choice for DIY investors who value clarity, clean data, and powerful screening tools.

The free plan already covers financials, screeners, and watchlists, making it one of the best no-cost research tools available.

However, upgrading to Pro unlocks deeper financial history, top analyst insights, customizable screeners, and advanced ETF data at a very reasonable price.