Table Of Content

Yahoo Finance Fundamental Analysis Tools And Options

Yahoo Finance offers a range of analysis tools through its free and premium plans (Bronze, Silver, and Gold).

For those who are considering a Yahoo Finance subscription, here's a summary:

- The Free Plan provides basic features like stock tracking, news, earnings reports, and simple stock screeners. Upgrading to

- Bronze adds portfolio tracking, volatility analysis, and market sentiment insights.

- Silver ($24.95/month) offers expert-backed stock ratings, access to premium research, and advanced stock screeners.

- The Gold Plan provides personalized trade ideas, in-depth financial data, technical charting, and tracking of institutional investors' holdings for a comprehensive analysis experience.

Plan | Monthly Subscription |

|---|---|

Yahoo Finance – Bronze | $9.95

$95.40 ($7.95 / month) if paid annually |

Yahoo Finance – Silver | $24.95

$239.40 ($19.95 / month) if paid annually |

Yahoo Finance – Gold | $49.95

$479.40 ($39.95 / month) if paid annually |

How to Use Yahoo Finance Fundamental Analysis Tools

Yahoo Finance is one of the best free sources for fundamental analysis tools, which can help investors effectively analyze stocks, ETFs, and other financial instruments.

Below are some tips and examples to make the most of Yahoo Finance's features for stock research.

1. Leverage Earnings Reports for Company Insights

Earnings reports are key to understanding a company’s financial performance. They provide an overview of how a company performed in a given quarter or year.

Key Insights from Earnings Reports:

Earnings Surprise: Check if a company has exceeded or missed analyst expectations.

Guidance: Focus on forward guidance to understand expected revenue and profit growth.

Management Commentary: Assess how management is addressing current risks and opportunities.

-

Example

An investor interested in companies with strong future growth might look for:

Earnings Surprise: 10% higher than analyst expectations.

Positive guidance: For the upcoming quarter.

Management outlook: Focused on expansion and market share growth.

This approach helps identify companies that are poised for strong future performance and have management that is confident in navigating future challenges.

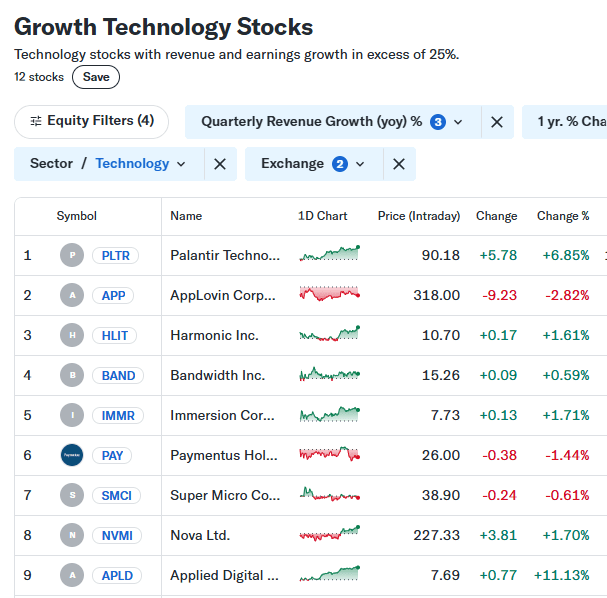

2. Use the Stock Screener for Custom Research

Yahoo Finance's stock screener is a powerful tool for filtering stocks based on various fundamental and technical criteria.

Key Features of the Stock Screener:

Sector & Industry Filters: Identify stocks in specific industries like technology, healthcare, or consumer goods.

Market Cap: Filter stocks based on their market capitalization (small, mid, or large-cap).

Dividend Metrics: Screen for stocks based on dividend yield and payout ratios.

-

Example

An investor looking for growth stocks in the technology sector might apply the following filters:

Market Cap: Over $10B

Sector: Technology

P/E Ratio: Below 20

This approach allows you to zero in on established growth companies in the tech sector, helping you make informed investment decisions.

3. Review Company Profiles and Key Statistics

In-depth company profiles on Yahoo Finance provide valuable financial metrics such as earnings-per-share (EPS), revenue estimates, market capitalization, and more. These key statistics are crucial for investors focused on the fundamentals.

Key Metrics to Analyze:

Market Capitalization: Understand the size of the company.

EPS Trend: Look for growth in earnings-per-share over time.

Revenue Estimates: Check how revenue expectations are trending for the upcoming periods.

4. Track Analyst Ratings and Stock Recommendations

Yahoo Finance aggregates analyst opinions, providing stock ratings from firms like Morningstar, Argus Research, and others. These ratings help investors gauge the sentiment and outlook for a stock based on expert analysis.

Key Analyst Features:

Buy/Hold/Sell Ratings: See how analysts rate a stock, providing insight into its potential upside or downside.

Fair Value Estimates: Check if the stock is undervalued or overvalued based on professional assessments.

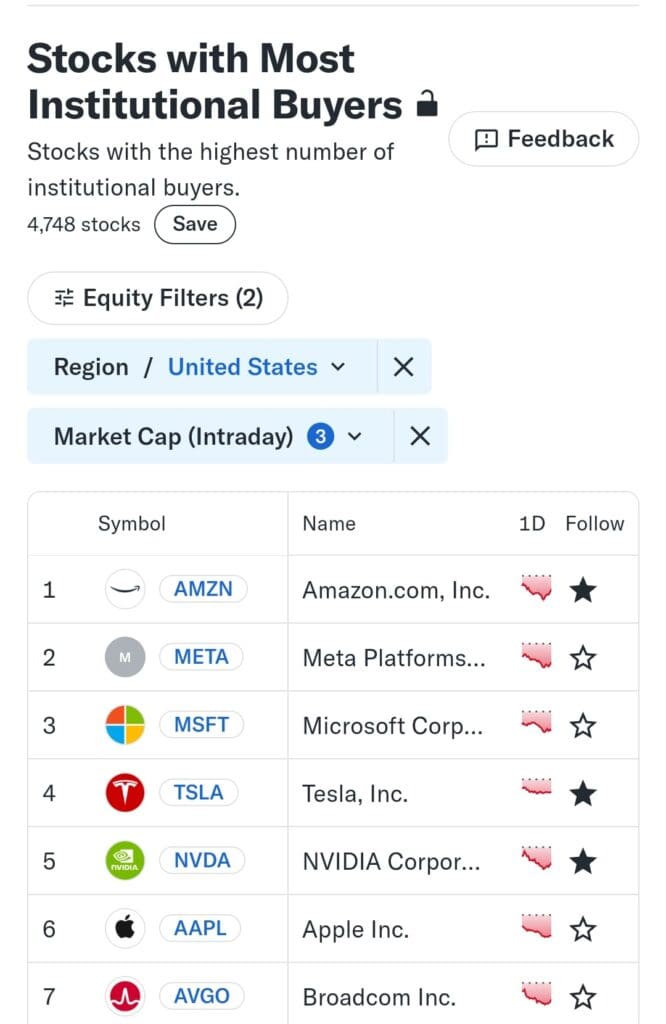

5. Use Smart Money Stock Screeners

The Smart Money Stock Screener in Yahoo Finance Gold allows users to track institutional investors' movements.

It’s a powerful tool for identifying stocks that are favored by large funds, hedge funds, and other institutional investors.

Key Features:

Institutional Holdings: Track stocks with high institutional ownership, signaling investor confidence from large money managers.

Recent Institutional Buys/Sells: See where major investors are placing their money, allowing you to align your investments with professional strategie

-

Example

If you see that Vanguard Group has recently increased its position in Tesla, this could be an indication that large, sophisticated investors are optimistic about Tesla’s future prospects.

You might decide to follow suit or further research the reasons behind this decision.

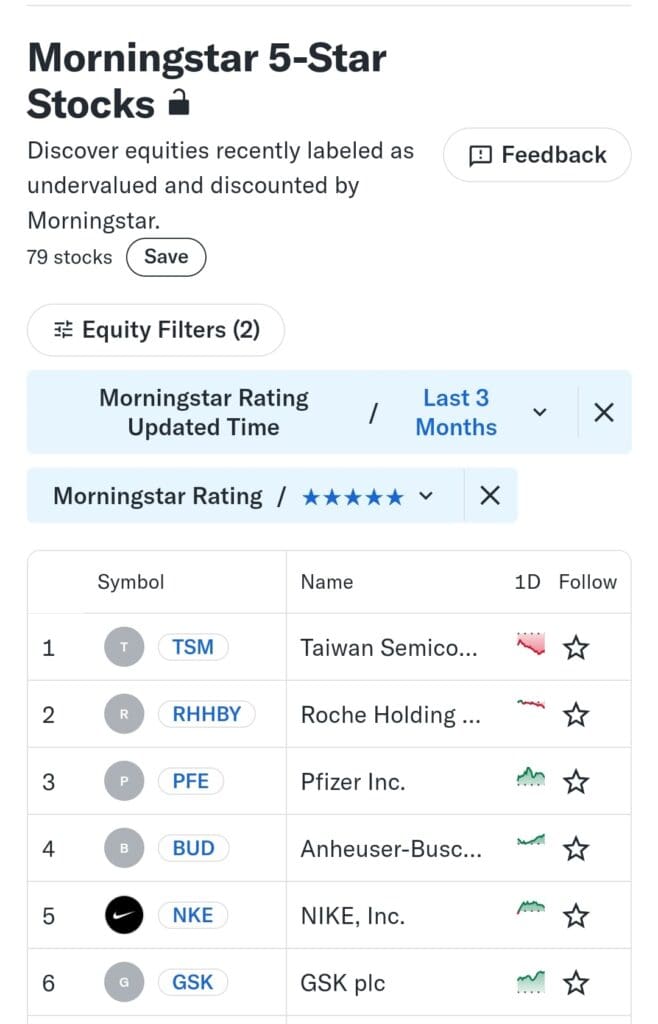

6. Analyze Fair Value Estimates with Premium Data

Yahoo Finance Premium plans provide access to fair value estimates and in-depth financial data that help investors assess whether a stock is trading at a fair, over, or undervalued price.

These estimates are supported by detailed calculations based on fundamental analysis.

Key Features:

Fair Value Estimates: Access expert valuation estimates from reputable firms like Morningstar and Argus to assess if a stock is undervalued.

P/E and P/B Ratios: Review the Price-to-Earnings (P/E) and Price-to-Book (P/B) ratios, helping you compare a stock’s market price to its earnings and book value.

7. Advanced Technical Charting Tools in Yahoo Finance Gold

For investors who focus on technical analy1sis, Yahoo Finance Gold offers 50+ technical chart patterns, advanced indicators, and annotations to help spot market trends and trade setups.

Key Features:

Technical Chart Patterns: Identify classic patterns like head-and-shoulders, double-bottom, and breakout formations to predict future price movements.

Real-Time Alerts: Set alerts based on specific technical events, such as when a stock breaks through key resistance levels.

Overall, Yahoo Finance is one of the top charting tools available.

8. Access Morningstar & Argus Stock Ratings

Yahoo Finance Premium plans (Silver & Gold) provide access to Morningstar and Argus stock ratings, which are crucial for investors who rely on expert research for making investment decisions.

Key Features:

Morningstar Ratings: Provides a star rating system for stocks, helping investors determine if a stock is overvalued, fairly valued, or undervalued based on comprehensive analysis.

Argus Research Picks: Detailed stock picks from Argus, offering buy, hold, or sell recommendations based on financial health, earnings potential, and market conditions.

9. Utilize Stock Comparison Tool

The stock comparison tool allows you to analyze multiple stocks side-by-side, making it easier to compare their fundamental metrics, financials, and growth prospects.

Key Metrics to Compare:

P/E Ratio: Helps assess whether a stock is undervalued or overvalued compared to its earnings.

EPS Growth: Compare the earnings growth of different companies to see which ones have stronger growth potential.

Dividend Yield: Compare dividend-paying stocks to assess which ones offer better income opportunities.

10. Track Earnings Calls & Event Annotations in Gold Plan

Yahoo Finance Gold provides advanced tracking for earnings calls and market events like earnings reports, dividend payouts, and stock splits. This feature allows investors to stay on top of critical financial events that can influence stock prices.

Key Features:

Earnings Call Annotations: Access detailed earnings call transcripts and events that can provide insight into a company’s future.

Event Markers: Place event markers on charts to track significant dates like earnings releases or stock splits that could affect stock movements.

FAQ

You can use Yahoo Finance’s stock screener to filter stocks based on criteria like market cap, price-to-earnings ratio, and growth potential. Additionally, company profiles provide key financial metrics such as EPS and revenue estimates to assess performance.

Yes, Yahoo Finance allows users to track dividend-paying stocks by filtering for dividend yield, payout ratio, and dividend history in its stock screener, helping you find income-generating investments.

Yahoo Finance aggregates stock ratings from multiple sources, including Morningstar and Argus Research. While they offer valuable insights, they should be combined with other research methods for a well-rounded view of a stock's potential.

To analyze a company’s financial health, review key metrics in the company profile section on Yahoo Finance, including the balance sheet, income statement, cash flow, and key ratios like return on equity (ROE) and debt-to-equity.

The earnings calendar on Yahoo Finance helps you track upcoming earnings reports. By analyzing the data, you can anticipate stock price movements based on the company's quarterly performance.

You can track market trends using Yahoo Finance’s stock market heat maps, top movers, and sector performance tools. These tools provide a visual representation of sector and stock performance to identify market trends.

Yahoo Finance offers basic charting tools with technical indicators like moving averages, RSI, and MACD, which can help investors spot trends and price movements for making trading decisions.

Yes, Yahoo Finance offers a stock comparison tool, allowing you to compare financial metrics, earnings data, and valuation ratios across multiple stocks, helping you identify the most promising investment opportunities.